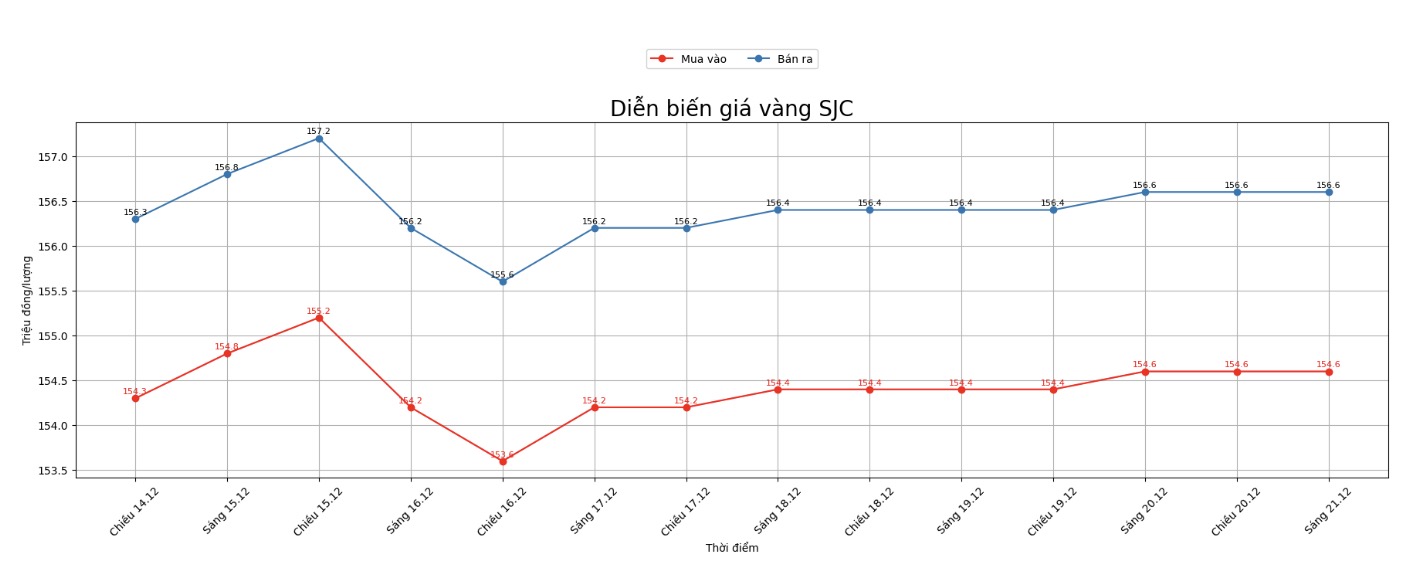

SJC gold bar price

At the end of the trading session of the week, Saigon Jewelry Company SJC listed the price of SJC gold at 154.6-156.6 million VND/tael (buy in - sell out). The difference between buying and selling is at 2 million VND/tael.

Compared to the closing price of the previous trading session (December 14, 2025), the price of SJC gold bars at Saigon Jewelry Company SJC increased by VND300,000/tael in both directions. The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 154.6-156.6 million VND/tael (buy in - sell out). The difference between buying and selling is at 2 million VND/tael.

Compared to a week ago, the price of SJC gold bars was increased by 300,000 VND/tael for both selling.

If buying SJC gold at Saigon Jewelry Company SJC and Bao Tin Minh Chau on December 14 and selling it today (December 21), buyers will lose 1.7 million VND/tael.

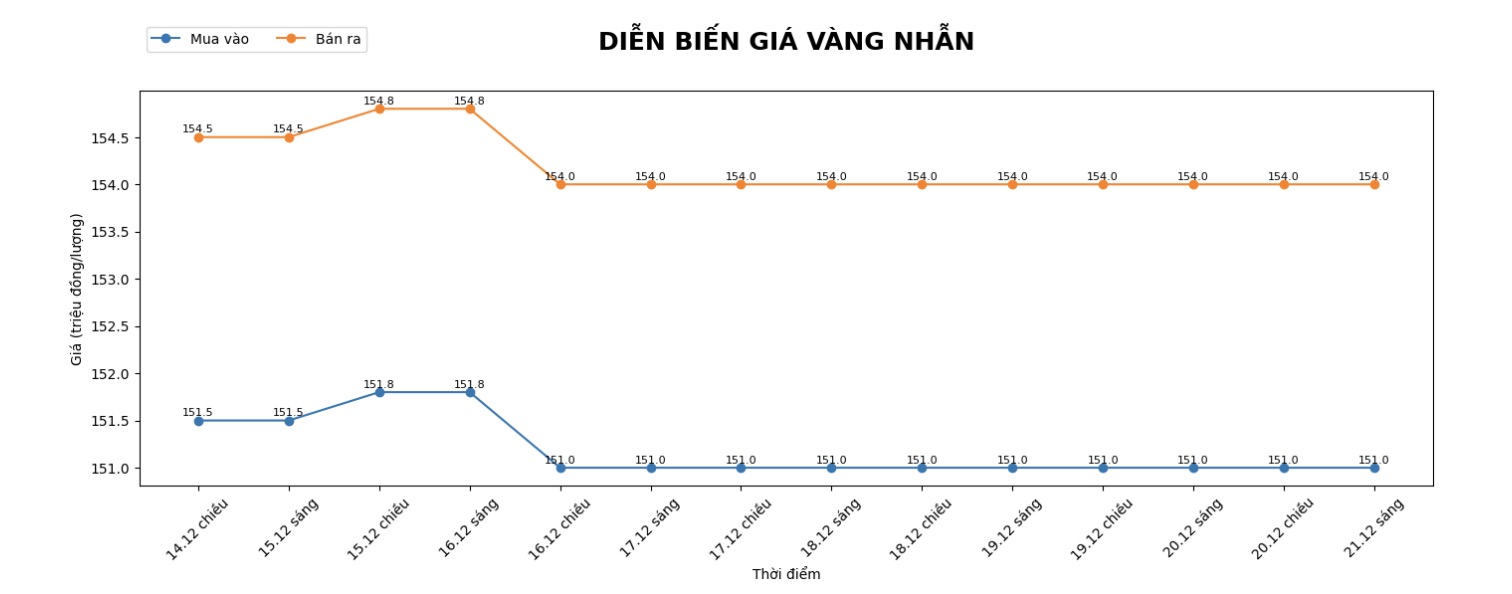

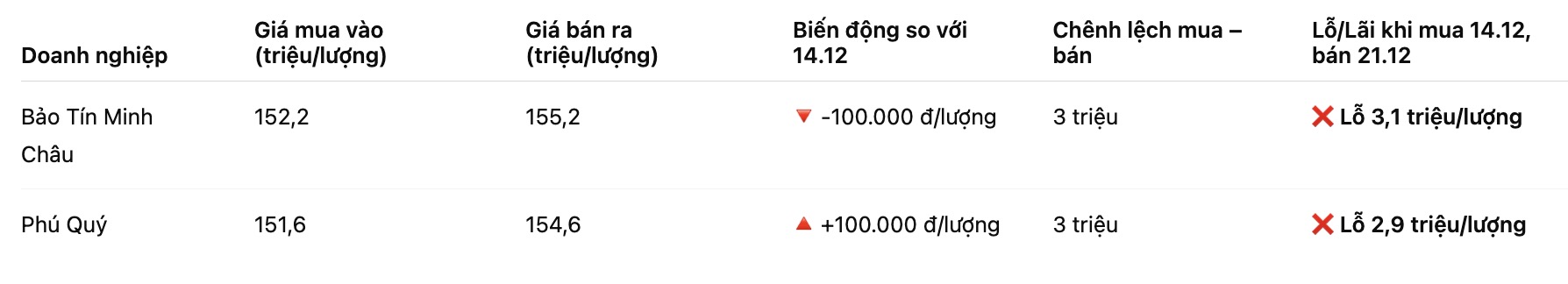

9999 gold ring price

Bao Tin Minh Chau listed the price of gold rings at 152.2-155.2 million VND/tael (buy - sell); down 100,000 VND/tael in both directions. The difference between buying and selling is at 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 151.6-154.6 million VND/tael (buy - sell), an increase of 100,000 VND/tael in both directions compared to a week ago. The difference between buying and selling is 3 million VND/tael.

If buying gold rings in the session of December 14 and selling in today's session (December 21), buyers at Bao Tin Minh Chau will lose 3.1 million VND/tael. Meanwhile, the loss when buying in Phu Quy was 2.9 million VND/tael.

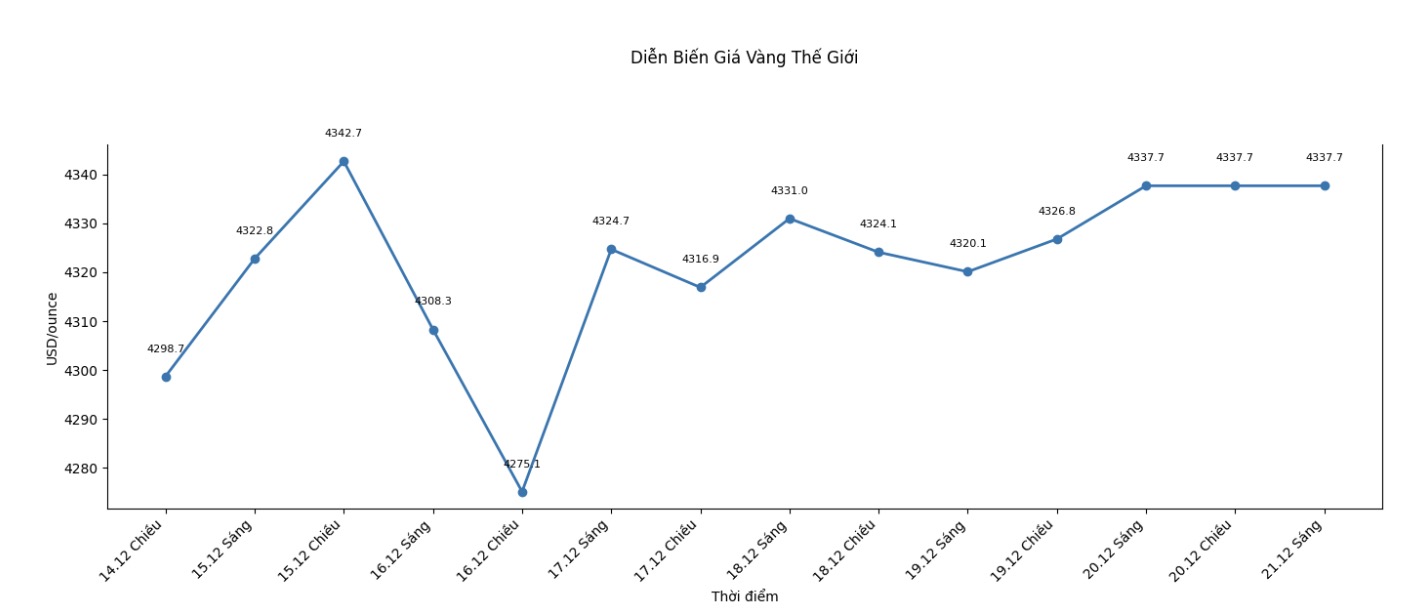

World gold price

At the end of the trading session of the week, the world gold price was listed at 4,337.7 USD/ounce, up 39 USD compared to a week ago.

Gold price forecast

Last week, data showed the highest unemployment rate in the US in 4 years and the US-Venezuela tensions caused gold to surge.

According to the US jobs report released on December 16, the economy added 64,000 jobs in November, higher than expected. However, the unemployment rate increased to 4.6%. A weakening labor market could increase the likelihood of the Federal Reserve cutting interest rates. Precious metals prices tend to increase in a low interest rate environment.

" markets are still betting on the Fed cutting interest rates twice more in the first half of 2026. This mentality could continue to support gold prices during that period," said Bas Kooijman, CEO of a trading unit DHF Capital.

In another development, the Bank of Japan (BOJ) raised operating interest rates to a three-decade high and signaled that it will continue to tighten policy in the coming time. The Japanese Yen weakened again due to investors' disappointment because the BOJ's message was not strong enough.

Russian President Vladimir Putin said the Russian military would continue to gain an advantage in Ukraine and expressed confidence that Moscow's military goals would be achieved, nearly four years after he ordered the start of a military campaign.

On Kitco News, many experts said that in 2026, gold prices may continue to increase but at a slower pace, forecast at 4,800-5,000 USD/ounce; in which RBC Capital Markets issued a 4,500-5,000 USD framework with a year-end trend.

Goldman Sachs forecasts gold to increase slightly to 4,350 - 4,370 USD/ounce thanks to stable investment capital and geopolitical factors, while maintaining a very optimistic view for the medium term when it believes that prices can reach 4,900 USD/ounce by the end of 2026 thanks to central bank demand and the possibility of the Fed cutting interest rates.

The December update report from the World Gold Council said that gold is in a "high ground" phase, with a forecast range of 4,260 - 4,500 USD/ounce in the short term and the week of December 22 - 28 alone is likely to rotate around 4,300 - 4,380 USD/ounce.

UBS continues to maintain a positive view, believing that gold prices will fluctuate in the range of 4,250 - 4,400 USD/ounce in the next 1-2 weeks, reflecting the accumulation period before the uptrend becomes more obvious in early 2026.

See more news related to gold prices HERE...