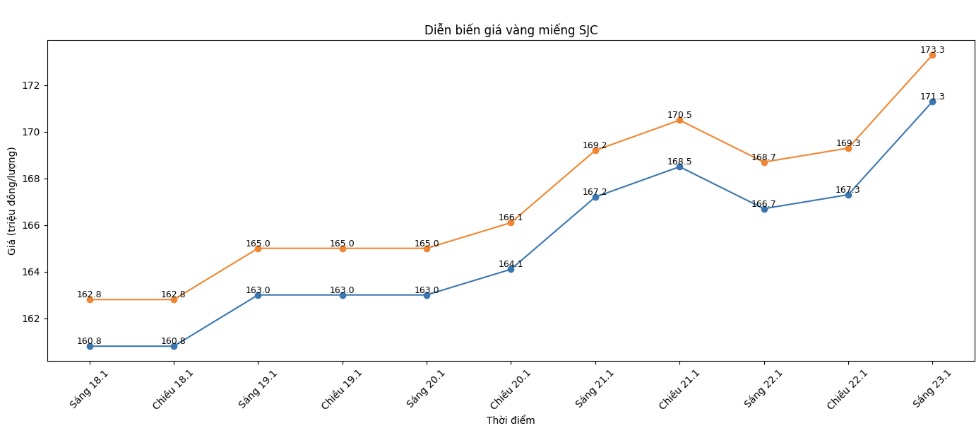

SJC gold bar price

As of 9:45 am, SJC gold bar prices were listed by DOJI Group at the threshold of 171.3-173.3 million VND/tael (buying - selling), an increase of 4.6 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at 170.3-173.3 million VND/tael (buying - selling), an increase of 4.3 million VND/tael on the buying side and an increase of 4.6 million VND/tael on the selling side. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 171.3-173.3 million VND/tael (buying - selling), an increase of 4.6 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

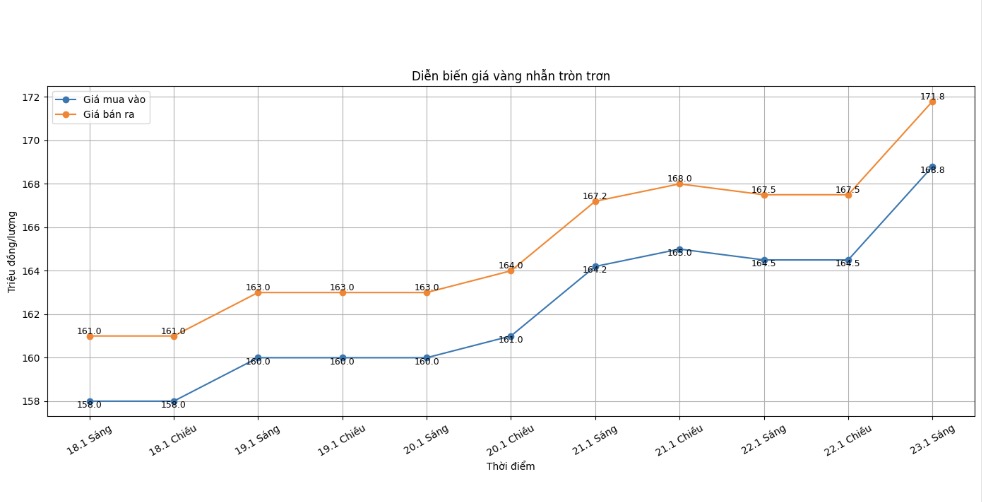

9999 gold ring price

As of 9:15 am, DOJI Group listed the price of gold rings at the threshold of 168.8-171.8 million VND/tael (buying - selling), an increase of 4.3 million VND/tael in both directions compared to the previous day. The difference between buying and selling is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 166.3-172.3 million VND/tael (buying - selling), an increase of 4.6 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 170.3-173.3 million VND/tael (buying - selling), an increase of 4.3 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Currently, the buying - selling price difference of gold is at a very high level, around 2 to 3 million VND/tael, posing a risk of losses for investors.

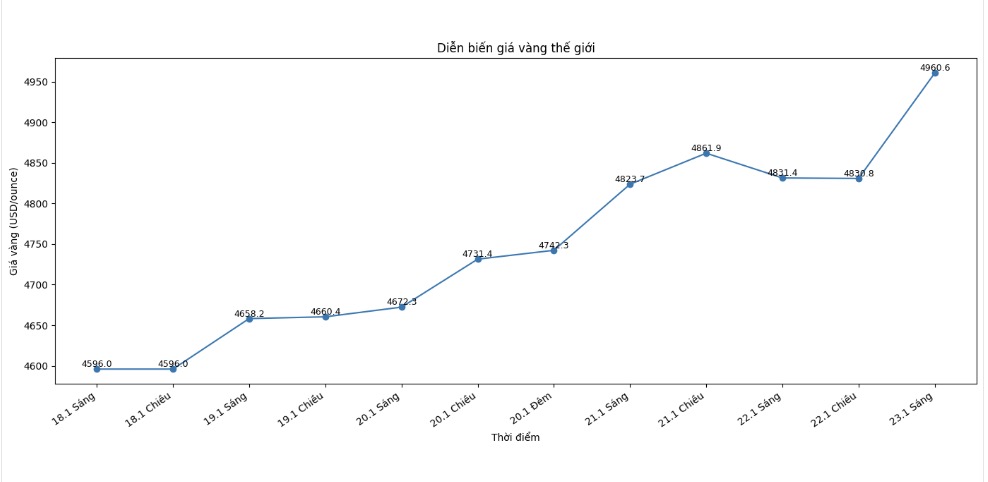

World gold price

At 10:00 AM, world gold prices were listed around the threshold of 4,960.6 USD/ounce, a shock increase of 170.2 USD compared to the previous day.

Gold price forecast

World gold prices are approaching the important psychological milestone of 5,000 USD/ounce, thereby creating a significant push for the domestic gold market. This development makes investors expect domestic gold prices to continue to adjust upwards in the coming trading sessions, although the risk of strong fluctuations is still present.

On the international market, buying power based on technical analysis is clearly dominant as price charts show that the upward trend is still maintained. Gold for February delivery continuously sets new peaks, while spot prices also maintain around historical highs.

The driving force for price increases comes from many factors, notably the weakening of the USD, the decline in US bond yields, and the need for safe havens in the context of the global financial market still facing many uncertainties.

Some international policy and economic information is also being closely monitored by investors. This week, a series of important US data such as Q3 GDP (last figures), personal consumer spending index (PCE), weekly unemployment claims and preliminary PMI may strongly impact the interest rate expectations of the US Federal Reserve (Fed). If the data shows that inflation is cooling down and growth is slowing down, gold is likely to continue to benefit.

From a technical analysis perspective, many experts believe that the buying side is still controlling the market. The closest goal of world gold prices is to conquer the resistance level of 5,000 USD/ounce. In the correction scenario, important support zones are identified around 4,800 USD/ounce and lower is the 4,700 USD/ounce area.

In the medium and long term, gold price prospects continue to be positively assessed. In its latest report, Goldman Sachs raised its gold price forecast for the end of 2026 to 5,400 USD/ounce, 500 USD higher than the previous forecast. This bank believes that the trend of diversifying reserves to gold by central banks and the private sector, especially in emerging economies, will continue to be an important driving force supporting prices.

However, experts also recommend that investors be cautious in the short term, especially when the buying-selling price difference in domestic gold is at a high level. Hot price increases can lead to strong corrections, potentially risking losses if investors chase buying at high prices.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...