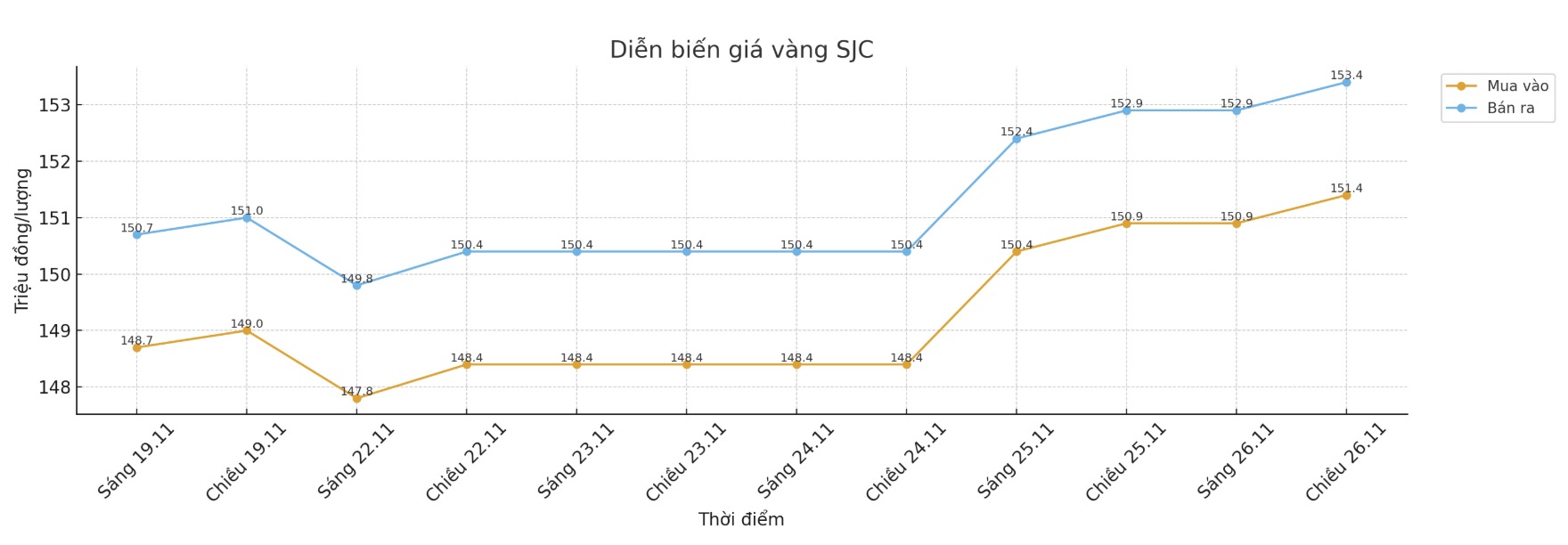

SJC gold bar price

As of 6:00 p.m., DOJI Group listed the price of SJC gold bars at VND151.4-153.4 million/tael (buy in - sell out), an increase of VND500,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 151.9-153.4 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 150.9-153.4 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

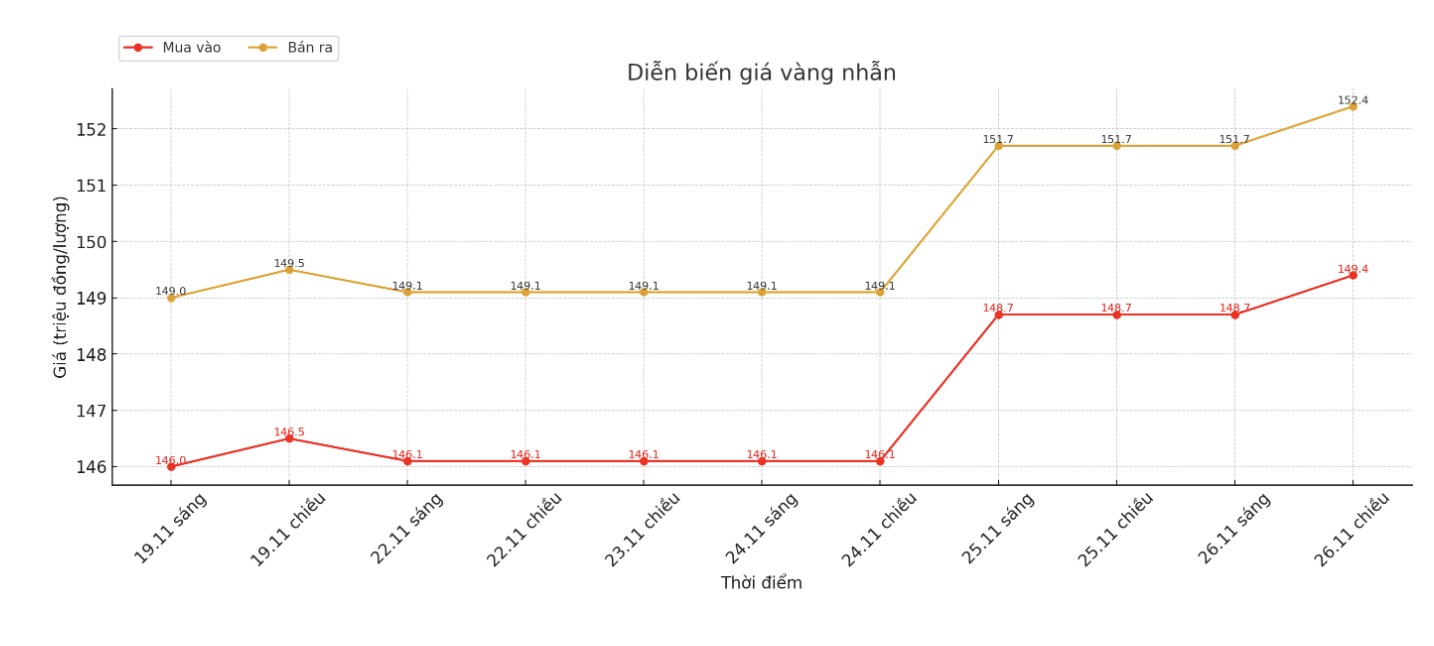

9999 gold ring price

As of 6:00 p.m., DOJI Group listed the price of gold rings at 149.4-152.4 million VND/tael (buy - sell), an increase of 700,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 150-153 million VND/tael (buy - sell), an increase of 400,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 149.7-152.7 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

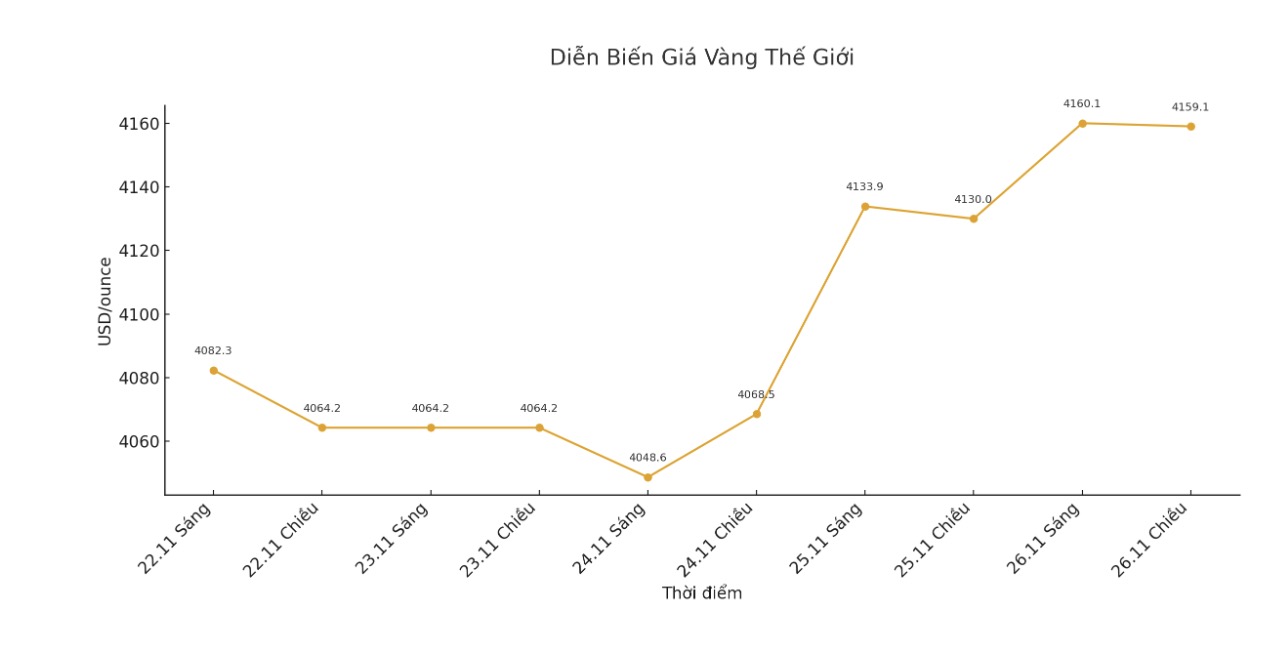

World gold price

The world gold price was listed at 6:02 p.m., at 4,159.1 USD/ounce, up 29.1 USD compared to a day ago.

Gold price forecast

Gold prices rose near a two-week high on Wednesday, after positive US economic data reinforced expectations that the Federal Reserve (Fed) will cut interest rates next month, thereby supporting the precious metal to not yield.

Investors are starting to re-evaluate the possibility of a US rate cut in December, said UBS analyst Giovanni Staunovo.

Traders now see an 83% chance of a rate cut next month, compared to just 30% a week ago, according to CME's FedWatch tool.

Notably, Deutsche Bank (DBKGn.DE) - Germany's largest bank - raised its gold price forecast for 2026 to 4,450 USD/ounce from 4,000 USD on Wednesday, citing the stabilization of investment capital flows and persistent demand from central banks.

The bank now expects gold prices next year to range between $3,950 and $4,950, with a price ceiling of about 14% higher than the current December 2026 gold contract price on the COMEX.

For other metals, spot silver rose 1.7% to $12.28 an ounce, platinum rose 0.4% to $1,559.03, while palladium fell 0.2% to $1,325.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...