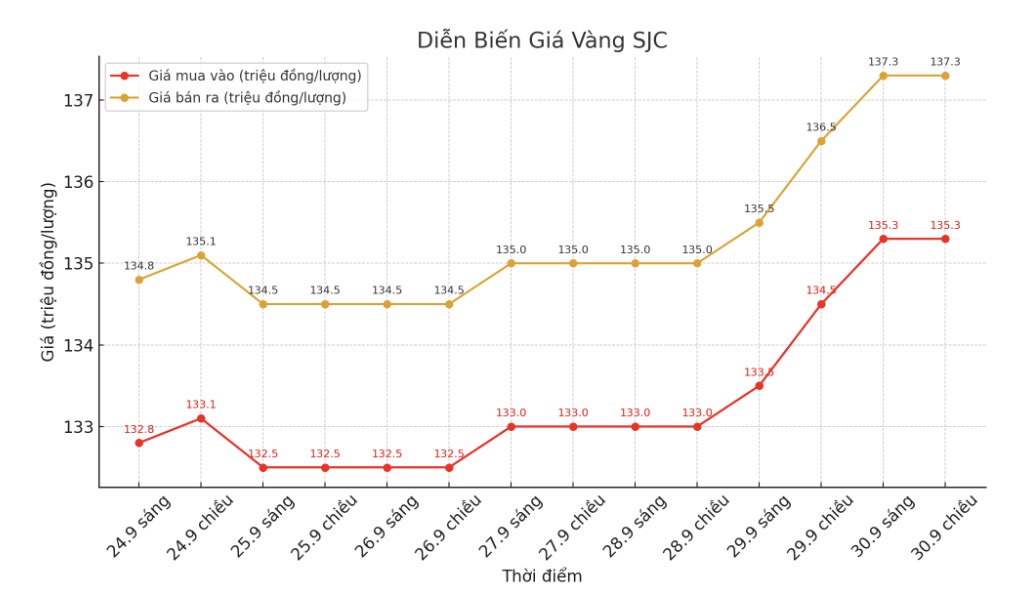

SJC gold bar price

As of 6:45 p.m., DOJI Group listed the price of SJC gold bars at VND135.3-137.3 million/tael (buy - sell), an increase of VND800,000/tael in both directions compared to a day before. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 134.8-136.8 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions compared to a day ago. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 133.3-136.8 million VND/tael (buy - sell), down 700,000 VND/tael for buying and up 300,000 VND/tael for selling compared to a day ago. The difference between buying and selling prices is at 3.5 million VND/tael.

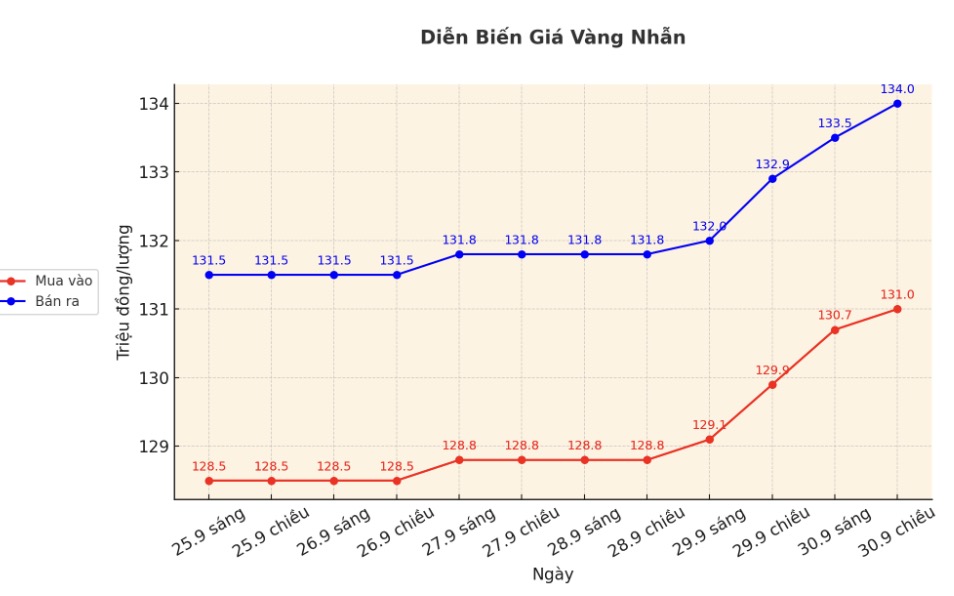

9999 gold ring price

As of 6:45 p.m., DOJI Group listed the price of gold rings at 131-134 million VND/tael (buy - sell), an increase of 1.1 million VND/tael in both directions compared to a day ago. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 131.4-134.4 million VND/tael (buy - sell), an increase of 800,000 VND/tael in both directions compared to a day ago. The difference between buying and selling is 3 million VND/tael.

Phu Quy listed the price of gold rings at 130.6-133.6 million VND/tael (buy - sell), an increase of 700,000 VND/tael in both directions compared to a day ago. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

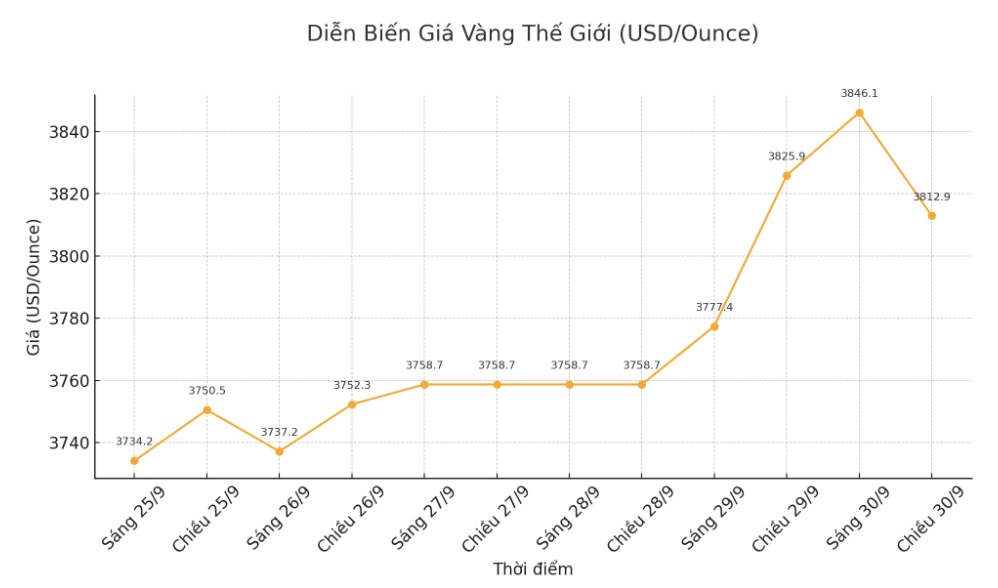

World gold price

The world gold price was listed at 6:35 p.m. at 3,812.9 USD/ounce, down 13 compared to a day ago.

Gold price forecast

As the world gold price is heading for the strongest month of increase in 16 years, the reversal plummeted on the afternoon of September 30, making investors dizzy.

This move is considered sudden as there is no economic or geopolitical factor large enough to lead to such a strong price decrease. In the US, President Donald Trump and Democratic leaders did not seem to have made much progress in the meeting at the White House to prevent the risk of the government having to close, which could disrupt a series of services as early as Wednesday.

Both sides after the meeting said that the rest would be held accountable if the National Assembly did not extend the government budget after the deadline for midnight on Tuesday (ie 4:00 GMT on Wednesday morning).

The risk of the US government's shutdown is creating an uncertain fog for the market, thereby accelerating the increase of gold. The $4,000/ounce mark is now a feasible target by the end of the year, in the context of falling interest rates and geopolitical hotspots continuing to support gold, said Mr. Tim Waterer, chief analyst at KCM Trade.

Notably, recent US economic data has reinforced expectations that the Fed will cut interest rates further this year. According to CME Group's FedWatch tool, investors are placing about 89% of the possibility of the Fed cutting 25 basis points at the October meeting. FED President of St. Petersburg Branch Louis - Alberto Musalem - also said that he is ready to consider lowering interest rates, but emphasized the need to be cautious to maintain pressure on inflation.

In a low interest rate environment, gold is further promoting its role as a safe-haven asset. The world's largest gold ETF SPDR Gold Trust said its holdings increased by 0.6% to 1,011.73 tonnes on September 29, the highest level since July 2022.

Notable economic data of the week

Tuesday: JOLTS job positions (USA), Consumer confidence index (USA).

Wednesday: ADP Private sector Employment Report (US), ISM Manufacturing PMI.

Thursday: Application for weekly unemployment benefits (US).

Friday: US Non-farm Payrolls, ISM Services PMI.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...