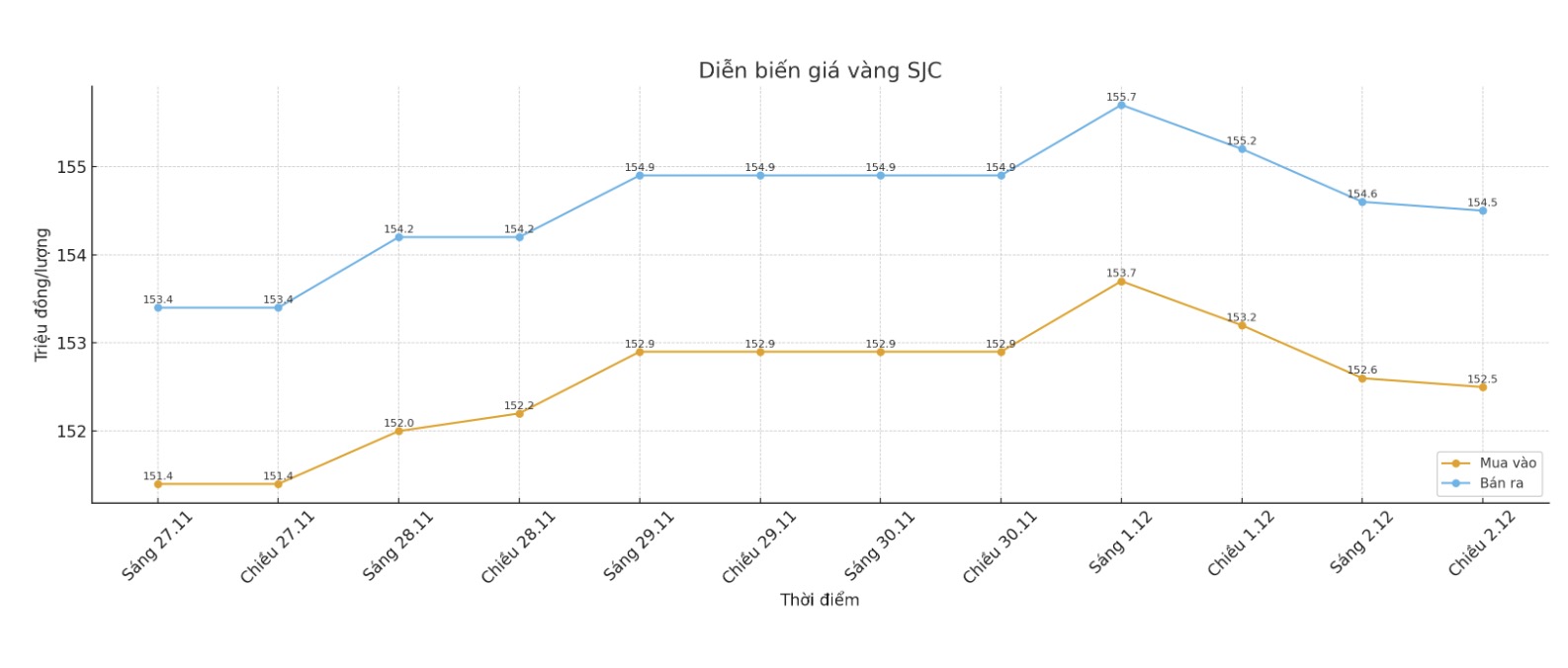

SJC gold bar price

As of 10:25 p.m., DOJI Group listed the price of SJC gold bars at VND152.5-154.5 million/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 153-154.5 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 151.5-154.5 million VND/tael (buy - sell), down 100,000 VND/tael for buying and kept the same for selling. The difference between buying and selling prices is at 2.9 million VND/tael.

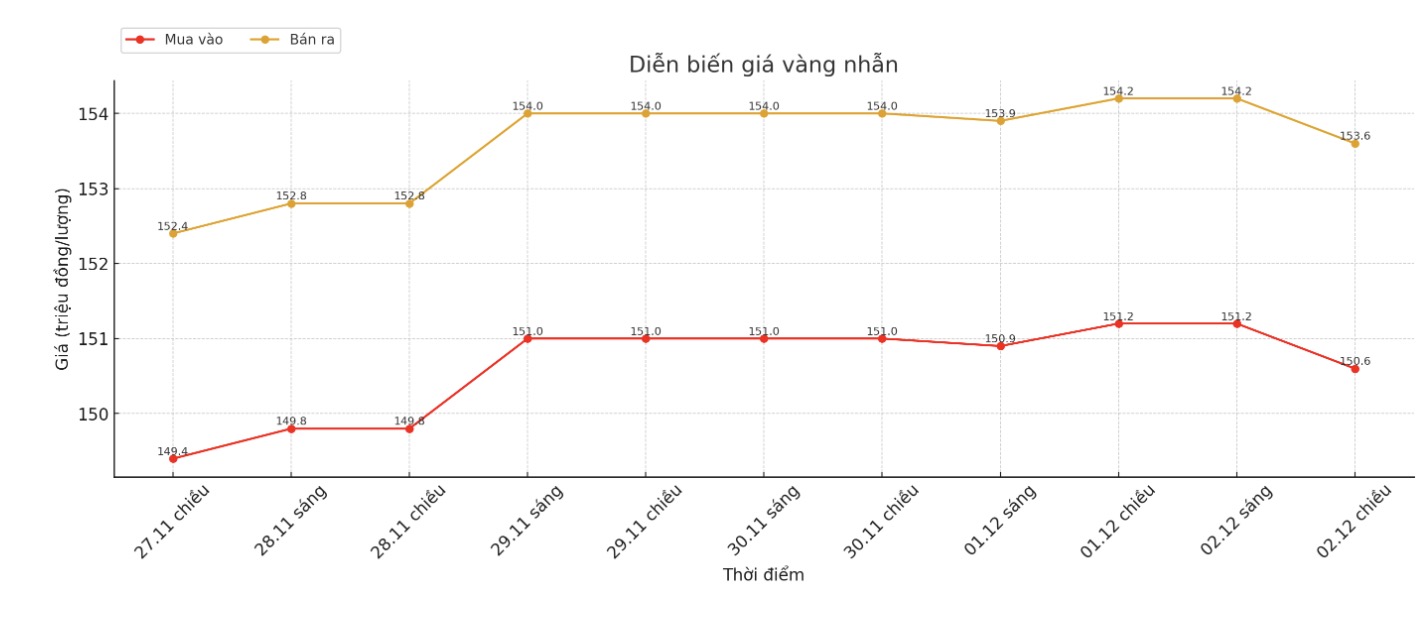

9999 gold ring price

As of 10:25 p.m., DOJI Group listed the price of gold rings at 150.6-153.6 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 150.6-153.6 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 150.8-153.8 million VND/tael (buy - sell), down 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

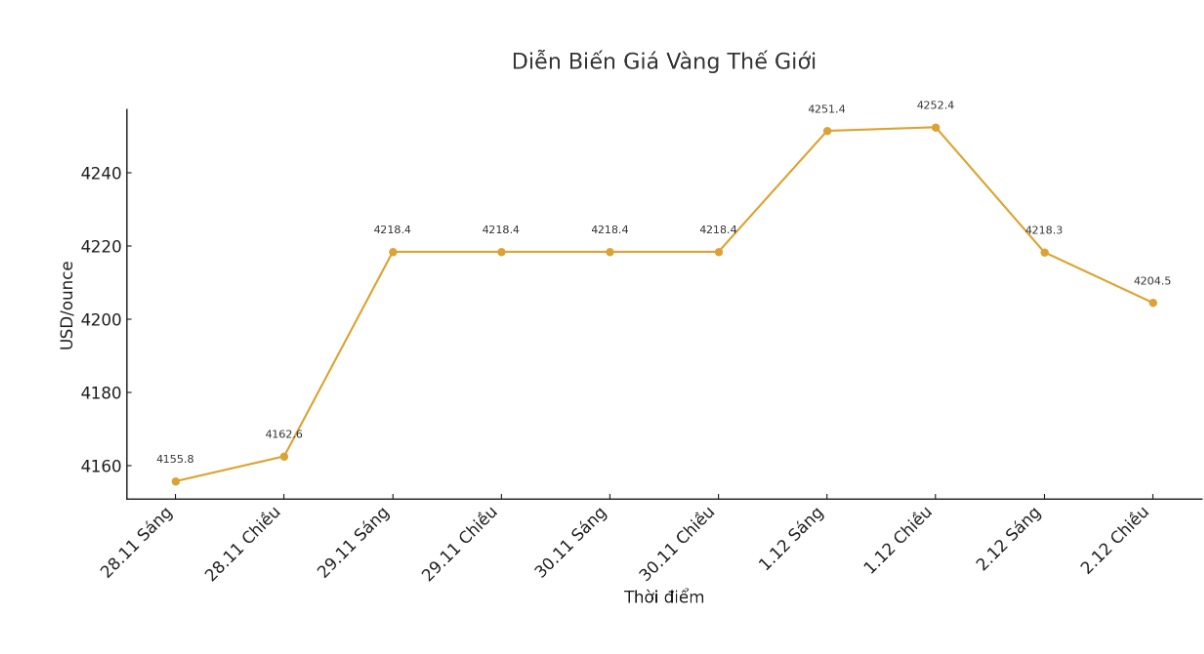

World gold price

The world gold price was listed at 6:40 p.m., at 4,200.000 USD/ounce, down 3.8 USD compared to a day ago.

Gold price forecast

Gold prices did not fluctuate much on Wednesday, as traders waited for important US economic data to predict the policy direction of the US Federal Reserve (Fed).

Ole Hansen - Head of Commodity Strategy at Saxo Bank - commented: "Gold prices moving sideways as investors focus on US economic data could boost expectations of the Fed cutting interest rates in December, which will support gold prices".

He said investors are awaiting the US ADP jobs data for November and the Personal Consumption Expenditures Index (PCE) for September, which were delayed due to the US government's closure, due to be released on Friday.

"Weak economic data and dovish signals from Fed officials have raised expectations that the central bank will cut interest rates at its meeting on December 9-10," said Ole Hansen.

Ole Hansen said that major brokerage firms such as BofA and JP Morgan predict the Fed will ease policy. According to CME's FedWatch tool, the market currently rates an 87% chance of a rate cut next week.

"Gold is not profitable, so when interest rates are low, investors often look to gold as a safe haven," said Ole Hansen.

In other precious metals, platinum rose 0.6% to $1,647.75, while palladium fell 0.5% to $1,455.34.

The global stock market was more stable on Wednesday, thanks to a recovery on Wall Street after a short-term sell-off in the bond and cryptocurrency markets cooled down.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...