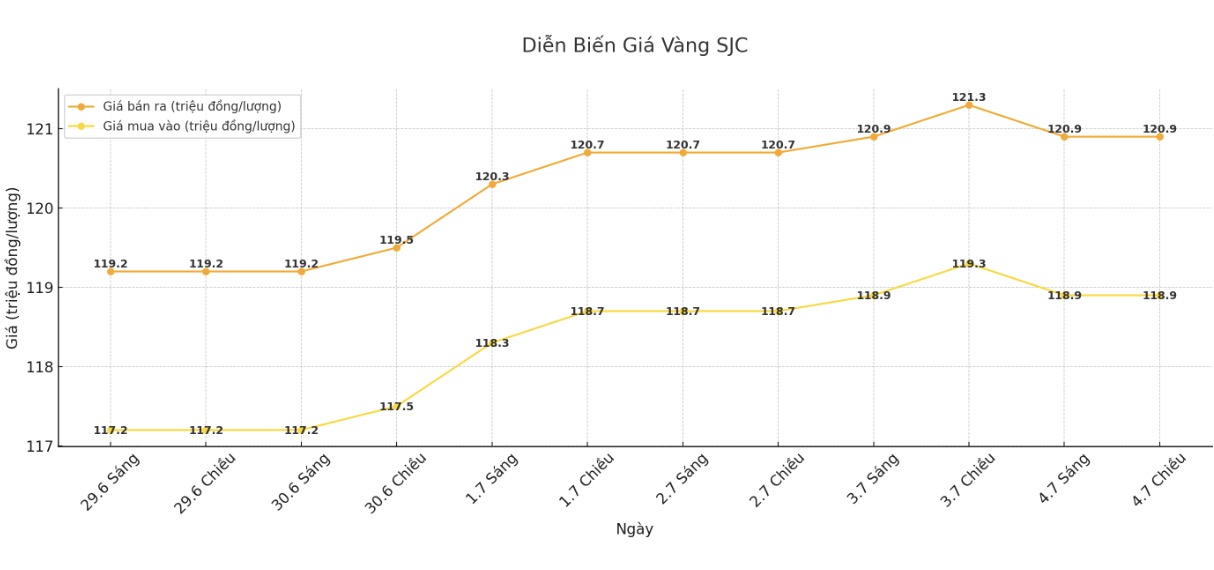

SJC gold bar price

As of 5:00 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 118.9-120.9 million/tael (buy in - sell out); down VND 400,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed at 118.9-120.9 million VND/tael (buy - sell); down 400,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 118.9-120.9 million VND/tael (buy in - sell out); down 400,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at VND 118.2-120.9 million/tael (buy in - sell out); down VND 400,000/tael in both directions. The difference between buying and selling prices is at 2.7 million VND/tael.

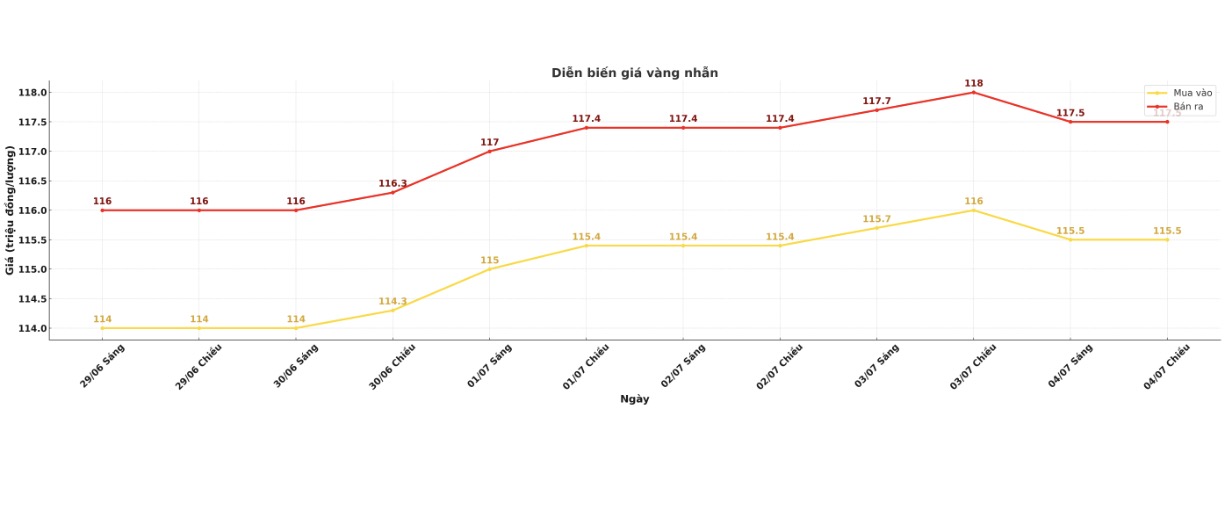

9999 gold ring price

As of 5:00 p.m., DOJI Group listed the price of gold rings at 115.5-117.5 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115.7-118.7 million VND/tael (buy - sell), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114.3-117.3 million VND/tael (buy in - sell out), down 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

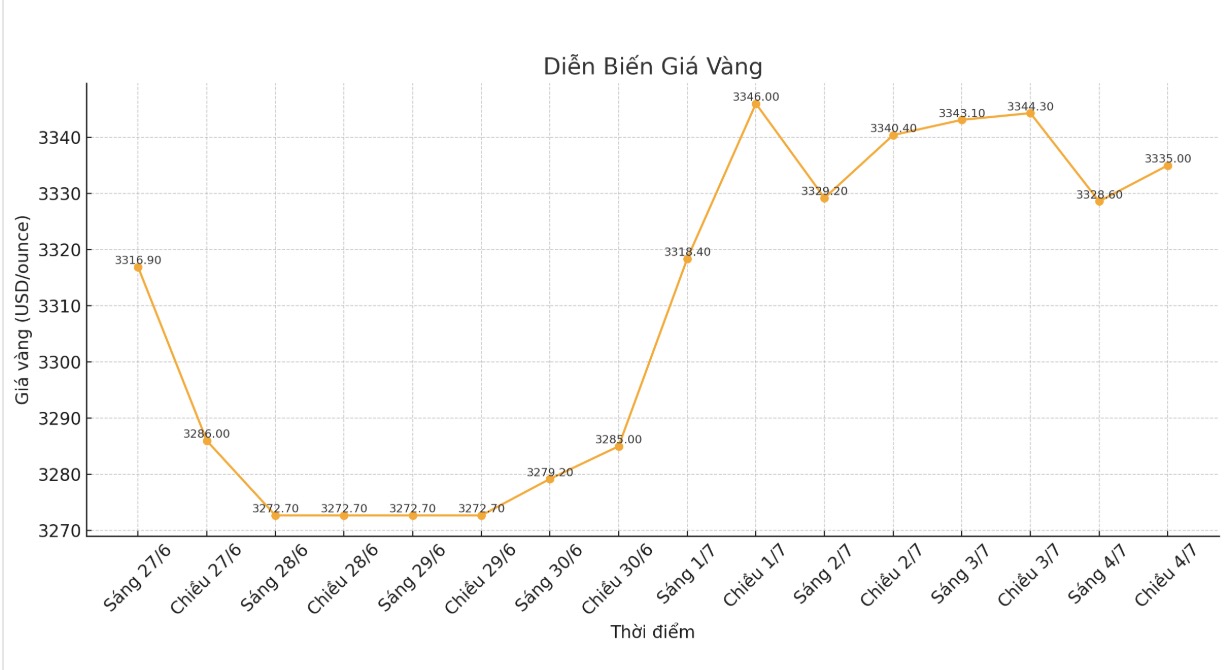

World gold price

The world gold price was listed at 5:00 p.m. at 3,335 USD/ounce, down 9.3 USD.

Gold price forecast

Mr. Ole Hansen - Head of Commodity Strategy at Saxo Bank - said that the recent gold sell-off was not a surprise, as the market adjusted interest rate expectations. Although prices are fluctuating within a narrow range, Mr. Hansen affirmed that the long-term uptrend of gold remains unchanged.

According to him, gold prices need a clear signal about cutting interest rates to regain strong momentum. In the context of low market liquidity in the coming weeks, gold prices need to remain above $3,245/ounce to avoid a deeper correction. However, he remains optimistic as the fundamentals supporting gold continue to exist.

Chris Zaccarelli, chief investment officer at Northlight Asset Management, said recent employment data showed that the US Federal Reserve (FED) could delay interest rate cuts until the end of the third quarter or into the fourth quarter. The Fed's continued high interest rates for longer will put negative pressure on gold, due to increased the cost of holding precious metals, while supporting the US dollar and US Treasury yields.

In the short term, gold prices are expected to continue to move sideways or weaken slightly, as investors wait for clearer signals from the Fed or new economic data.

Mr. Robert Minter - ETF Strategy Director at abrdn - said that US public debt has exceeded37,000 billion USD, reflecting the worrying financial situation. However, he stressed that the US is not the only country facing a budget deficit, as many European countries are also increasing spending.

According to Mr. Minter, the depreciation of currencies is reflected in the fact that gold prices remain at a record high against most major currencies. He believes that prices above $3,000/ounce are reasonable in the context of rising global debt, and it is unlikely that gold prices will fall below this threshold.

He predicted that when the FED starts cutting interest rates, gold prices could increase by about 300 USD/ounce, approaching the 3,500 USD/ounce mark. This shows that the long-term outlook for gold is still very positive, especially when the global economy still has many financial risks and inflationary pressures.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...