Updated SJC gold price

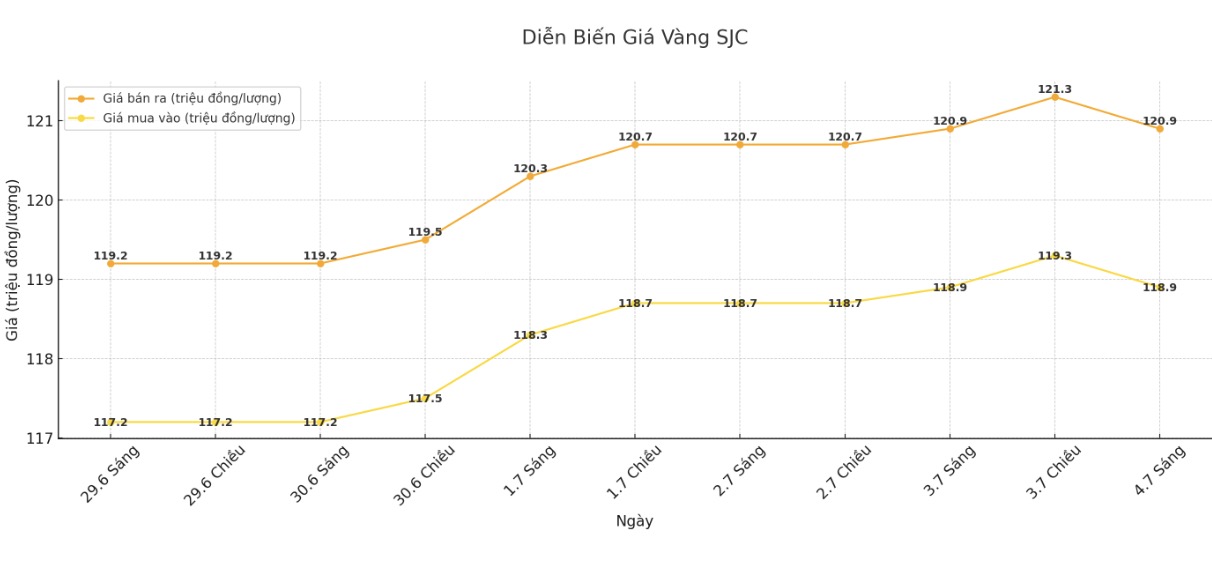

As of 9:45 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 118.9-120.9 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed SJC gold bar price at 118.9-120.9 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 118.9-120.9 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at VND 118.2-120.9 million/tael (buy - sell), down VND 200,000/tael for buying and kept the same for selling. The difference between buying and selling prices is at 2.7 million VND/tael.

9999 round gold ring price

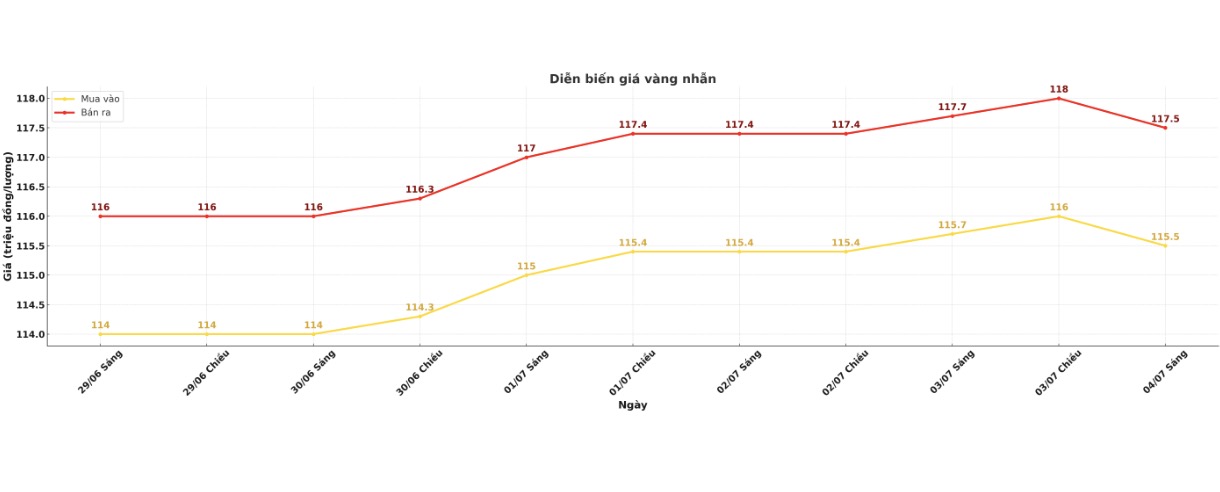

As of 9:45 a.m., DOJI Group listed the price of gold rings at 115.5-117.5 million VND/tael (buy in - sell out), down 200,000 VND/tael. The difference between buying and selling is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115.7-118.7 million VND/tael (buy - sell), down 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114.3-117.3 million VND/tael (buy in - sell out), an increase of 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

World gold price

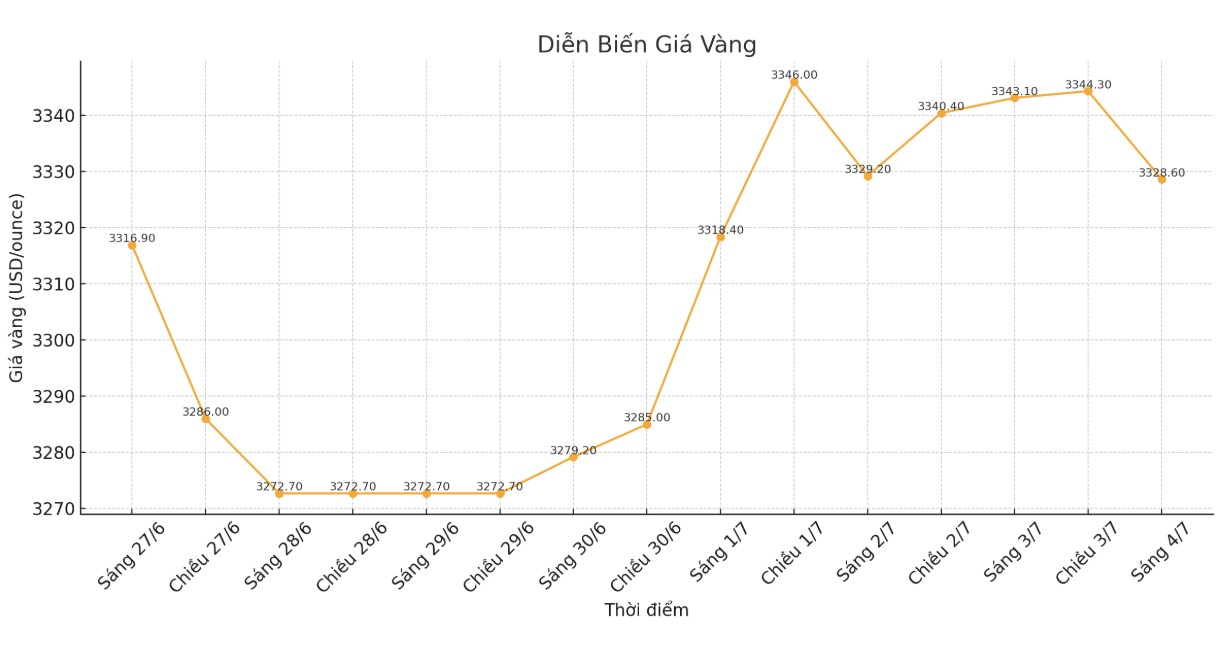

At 9:45 a.m., the world gold price was listed around 3,328.6 USD/ounce, down 14.5 USD/ounce compared to 1 day ago.

Gold price forecast

After holding the key support level around $3,250/ounce, the gold market is looking to close the short trading week with a significant increase.

However, according to some experts, this precious metal still lacks strong upward momentum to escape the current accumulation phase.

Mr. Ole Hansen - Head of Commodity Strategy at Saxo Bank - said that the gold sell-off is not a surprise, as the market has adjusted expectations about interest rates. However, he emphasized that the long-term upward trend of gold is still intact, although prices are fluctuating sideways.

Gold probably needs a rate cut to break out, which means it is still stuck. In the coming weeks of low liquidity, gold needs to hold $3,245/ounce and silver at $35.3 to avoid further technical adjustments. I remain optimistic, as the key factors supporting gold have not disappeared and will not disappear in the near term, he said.

Mr. Chris Zaccarelli - Investment Director at Northlight Asset Management, commented that due to employment data, the US Federal Reserve (FED) may wait until the end of this quarter or even the fourth quarter before cutting interest rates.

If this happens, it could put negative pressure on gold prices. Maintaining higher interest rates for longer will increase the cost of holding gold and support the USD and US Treasury bond yields. The gold market is therefore at risk of weakening or stagnating in the short term, due to investors lacking new buying motivation and waiting for clearer signals from the FED or further economic data.

Robert Minter - Director of ETF Strategy at Abrdn - said US debt has surpassed37,000 billion USD, marking a worrying financial milestone. However, he emphasized that the US is not a lone country, as many European countries have also increased deficit spending in recent times, reflecting the global trend.

Robert Minter affirmed that the currency's depreciation is clearly demonstrated through gold prices, as this precious metal remains near a record peak compared to most major currencies. Gold prices above $3,000 are reasonable for the current debt level. There is no chance that gold will fall below this level, he said.

This expert predicts that gold could increase by $300/ounce when the FED begins to lower interest rates, pushing prices closer to $3,700/ounce.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...