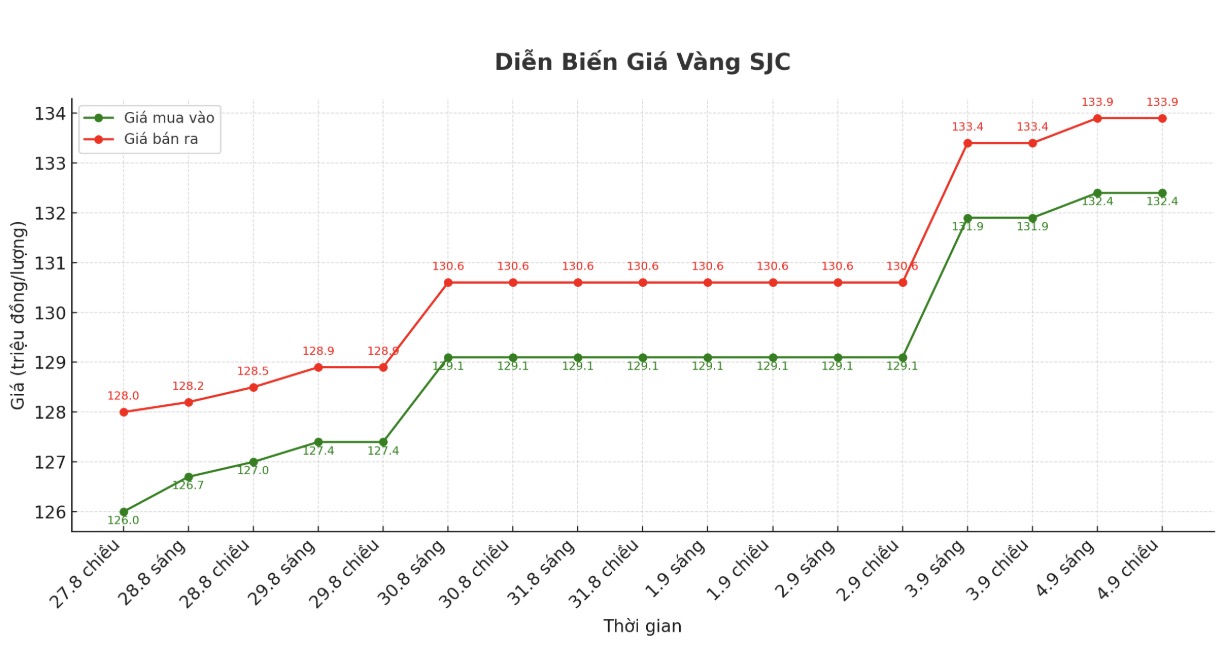

SJC gold bar price

As of 5:15 p.m., DOJI Group listed the price of SJC gold bars at VND132.4-133.9 million/tael (buy in - sell out), an increase of VND500,000/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 132.4-133.9 million VND/tael (buy - sell), an increase of 1 million VND/tael for buying and an increase of 500,000 VND/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 131.5-133.9 million VND/tael (buy in - sell out), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2.4 million VND/tael.

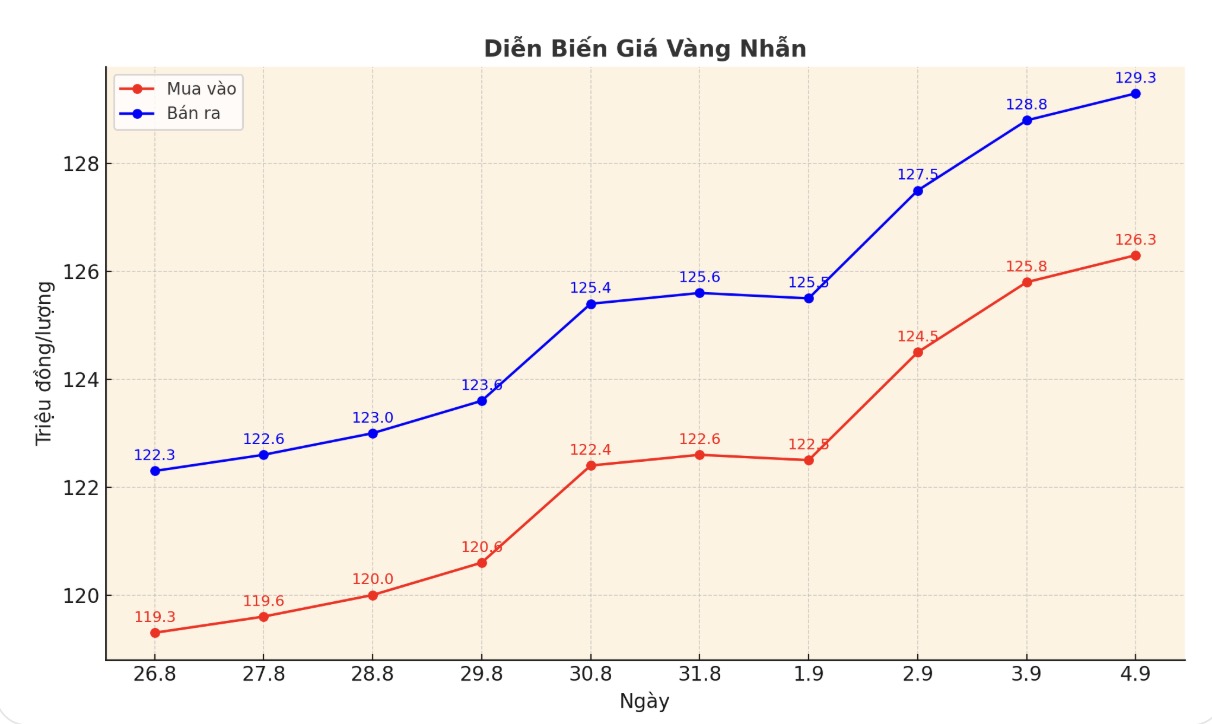

9999 gold ring price

As of 5:15 p.m., DOJI Group listed the price of gold rings at 126.3-129.3 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 126.5-129.5 million VND/tael (buy - sell), an increase of 800,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 126.1-129.1 million VND/tael (buy in - sell out), an increase of 900,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Currently, the difference between buying and selling gold rings is at a very high level, around 3 million VND/tael, posing a potential risk of loss for investors.

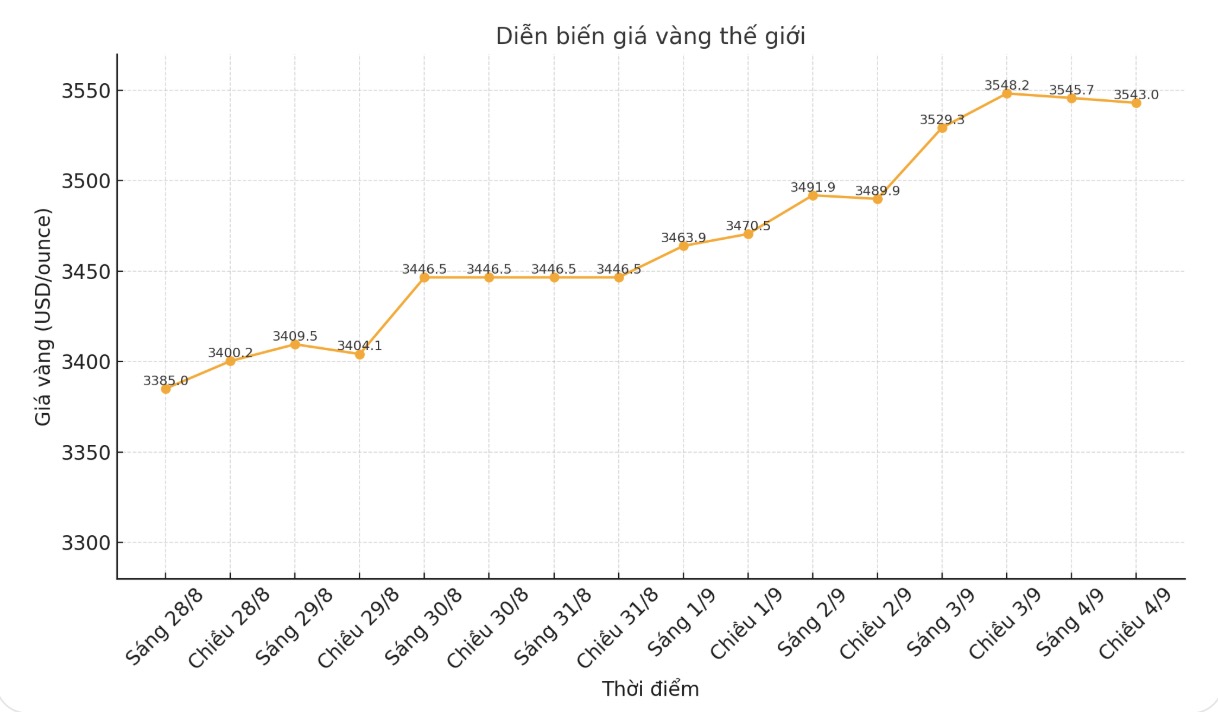

World gold price

The world gold price was listed at 5:15 p.m. at 3,543 USD/ounce, down 5.2 USD.

Gold price forecast

World gold prices fell as investors took profits before the historical peak. The market is paying attention to the US jobs report on Friday.

Mr. Brian Lan - Director of Gold Silver Central - commented: "We are witnessing a profit-taking, but gold is still in an uptrend. Expectations of interest rate cuts and concerns about the independence of the US Federal Reserve (FED) will continue to boost safe-haven demand."

The US Department of Labor said on Wednesday that the number of jobs vacant in July fell more than expected to 7.181 million.

Many Fed officials believe that concerns about the labor market further consolidating the view of interest rate cuts are inevitable. FED Governor Christopher Waller said he believes the central bank should cut interest rates at its meeting next month.

The market is currently focusing on US non-farm payroll data, which could provide a clearer signal about the Fed's monetary policy. Gold - which is not yielding - often benefits in a low interest rate environment.

In the case of private investors sharply increasing their diversification into gold, we see the potential for gold prices to surpass the $4,000/ounce base by mid-2026, said Goldman Sachs. Therefore, gold is still our most reliable long-term buying recommendation."

Increasing market anxiety, US President Donald Trump said that the US could have to cancel trade agreements signed with the European Union, Japan, South Korea and other countries if the country loses a lawsuit in the Supreme Court over tariffs.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...