The US labor market signals a "low temperature"

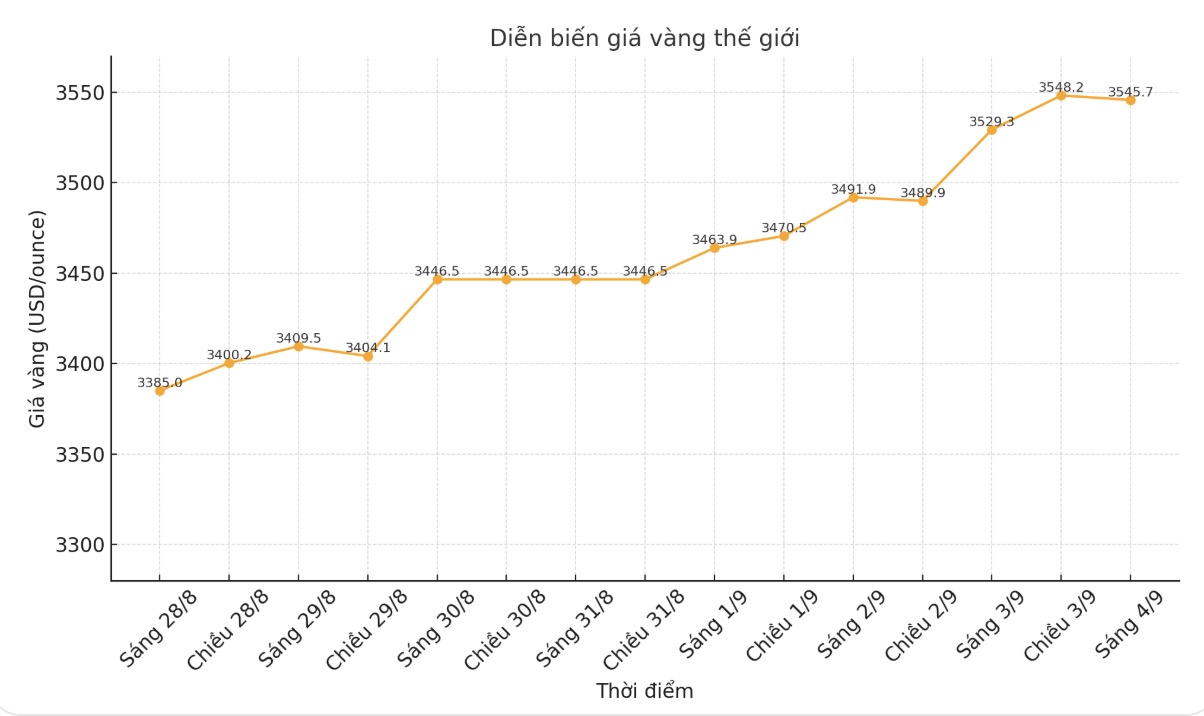

Gold prices increased after the US announced employment data, raising concerns about the health of the labor market.

The latest JOLTS report shows that the number of unemployed jobs decreased more strongly than expected. For the first time in more than 4 years, the number of recruitment positions is lower than the number of job seekers - a sign showing a clear cooling of the already scarce labor market.

This follows the July jobs report, which was concerned by the low increase in new jobs, to the point that US President Donald Trump removed him from the position of head of the Department of Labor Statistics, with an accusation of lack of basis that the data was distorted.

However, newly released data shows that the July gloom is not an isolated one but reflects a general weakening trend.

Expectations of the FED cutting interest rates boost gold demand

The weak labor outlook has prompted expectations that the US Federal Reserve (FED) will soon ease monetary policy to increase sharply.

The market is currently pricing in a 98% chance that the Fed will cut 25 basis points at its September meeting. The prospect of low interest rates helps gold benefit, as it reduces the opportunity cost of holding this non-yielding asset.

Investors are focusing on upcoming employment figures, including weekly jobless claims, ADP jobs reports and non-farm payrolls due on Friday.

Although there is still the possibility of fluctuations, the FED rate cut scenario in September has almost been "cked".

Political and policy instability increases shelter appeal

In addition to interest rate factors, gold is also supported by concerns about the independence of the FED as well as risks from trade policies. These uncertainties, combined with the weakening of the labor market, are creating a "favorable wind" for the precious metal.

As of 4:10 p.m. New York time (3:10 p.m. Vietnam time), December gold delivery contract increased by 20 USD, equivalent to 0.56%, to a record of 3,619 2.5 USD/ounce.

This persistent increase not only reflects immediate concerns but also shows long-term uncertainties continue to strengthen investment demand for gold by both organizations and individuals.

See more news related to gold prices HERE...