Update SJC gold price

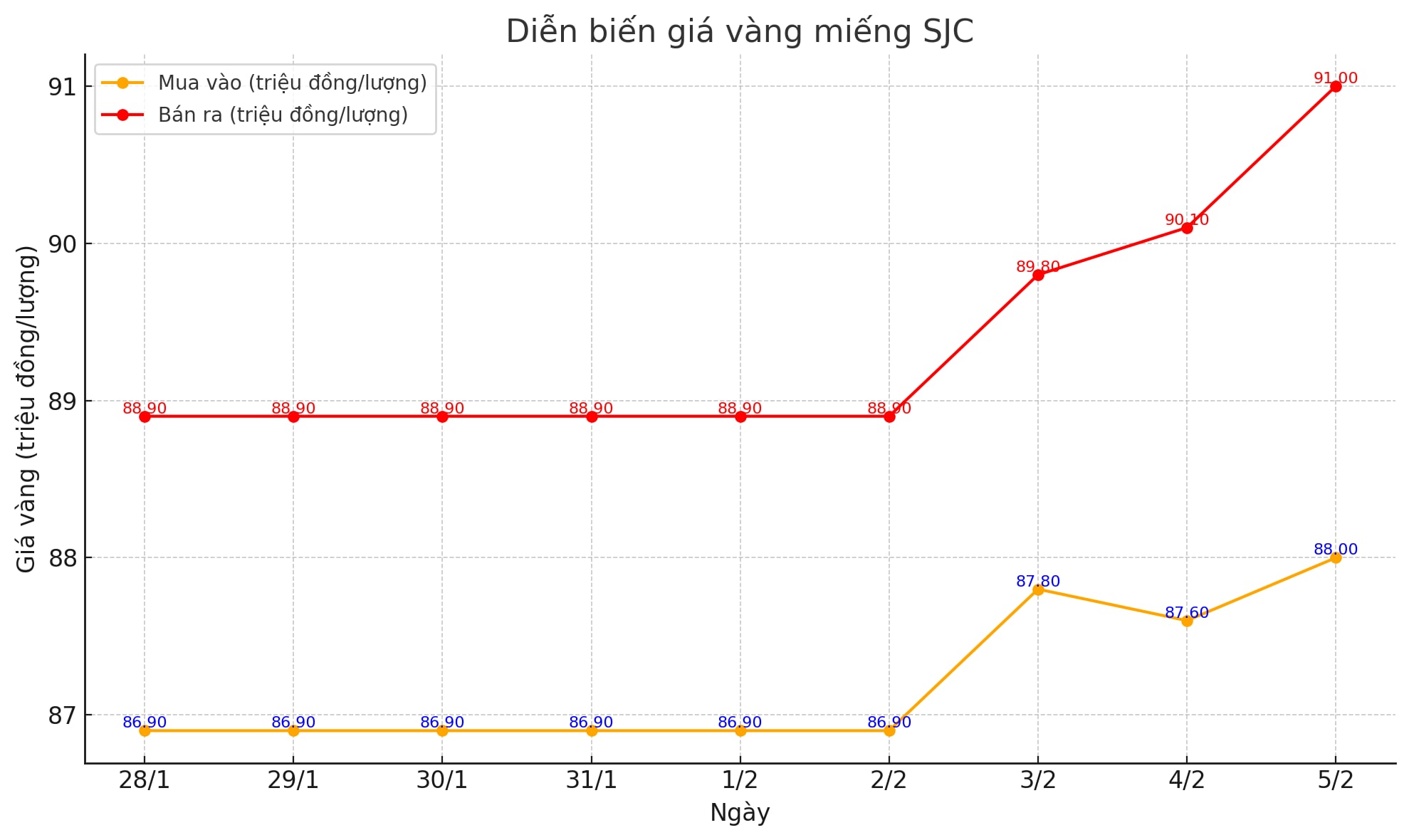

As of 6:15 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND88-91 million/tael (buy - sell); an increase of VND400,000/tael for buying and VND900,000/tael for selling compared to the close of the previous trading session.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 3 million VND/tael.

Meanwhile, the price of SJC gold bars was listed by DOJI Group at 88-91 million VND/tael (buy - sell); an increase of 400,000 VND/tael for buying and 900,000 VND/tael for selling compared to the previous trading session.

The difference between buying and selling prices of SJC gold at DOJI Group is at 3 million VND/tael.

Price of round gold ring 9999

As of 6:00 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 88.2-91 million VND/tael (buy - sell); an increase of 200,000 VND/tael for buying and an increase of 1 million VND/tael for selling compared to the closing price of yesterday's trading session.

The difference between buying and selling price of 9999 Hung Thinh Vuong round gold ring at DOJI is 2.8 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 88.2-90.95 million VND/tael (buy - sell), an increase of 100,000 VND/tael for buying and 900,000 VND/tael for selling compared to the closing price of yesterday's trading session. The difference between buying and selling is at 2.75 million VND/tael.

World gold price

As of 6:15 p.m., the world gold price continued to break records, listed on Kitco at 2,866.8 USD/ounce, an increase of 50.9 USD/ounce compared to the same time of the previous session.

Gold Price Forecast

World gold prices increased sharply in the context of a sharp decline in the USD index. Recorded at 5:25 p.m. on February 5, the US Dollar Index, which measures the fluctuations of the greenback against 6 major currencies, was at 107.325 points (down 0.46%).

Gold's rally continued to gain strength as the US labor market weakened with the number of available jobs falling more than expected in December.

According to the US Department of Labor's Job Openings and Labor Turnover Survey (JOLTS) report, the number of job vacancies in December - a measure of labor demand - fell to 7.6 million from 8.16 million in November. The figure was lower than economists' forecasts, who expected the figure to be largely unchanged.

Gold prices were also supported by safe-haven flows after US President Donald Trump's moves to impose tariffs. Donald Trump agreed to delay by a month the imposition of trade tariffs on Mexico and Canada after talks with Mexican President Sheinbaum and Canadian Prime Minister Trudeau. However, the US still officially imposed new tariffs on China on Tuesday.

In response, China imposed tariffs on many US goods immediately after the US tariffs on Chinese goods took effect on February 4. At the same time, the country also announced an investigation into Google.

Despite the recent rise in the US dollar and interest rates, gold prices still show potential to rise to $3,000 an ounce, according to Ronald-Peter Stoeferle, CEO at Incrementum AG.

This expert believes that the gold price increase has only gone halfway, as there is still a large amount of capital from Western financial investors that has not participated in this increase.

“Any small dip is immediately bought,” he stressed, reinforcing his belief in the upcoming growth momentum. In addition, according to Incrementum AG’s forecasting model, gold prices could approach $3,000 an ounce this year.

Important economic data this week

Wednesday: ADP jobs report, US ISM services PMI.

Thursday: Bank of England monetary policy decision, US weekly jobless claims.

Friday: US nonfarm payrolls report, University of Michigan preliminary index of consumer sentiment.

See more news related to gold prices HERE...