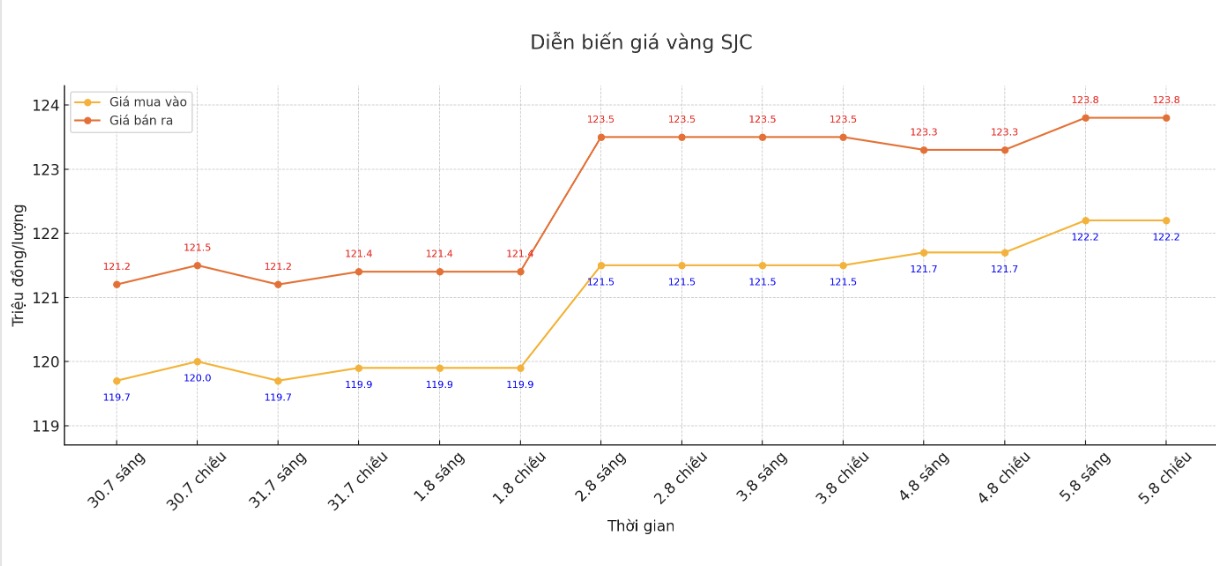

SJC gold bar price

As of 7:00 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND122.2-123.8 million/tael (buy in - sell out), an increase of VND500,000/tael in both directions. The difference between buying and selling prices is at 1.6 million VND/tael.

DOJI Group listed at 122.2-123.8 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 1.6 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 122.2-123.8 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 1.6 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 121.2-123.8 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2.6 million VND/tael.

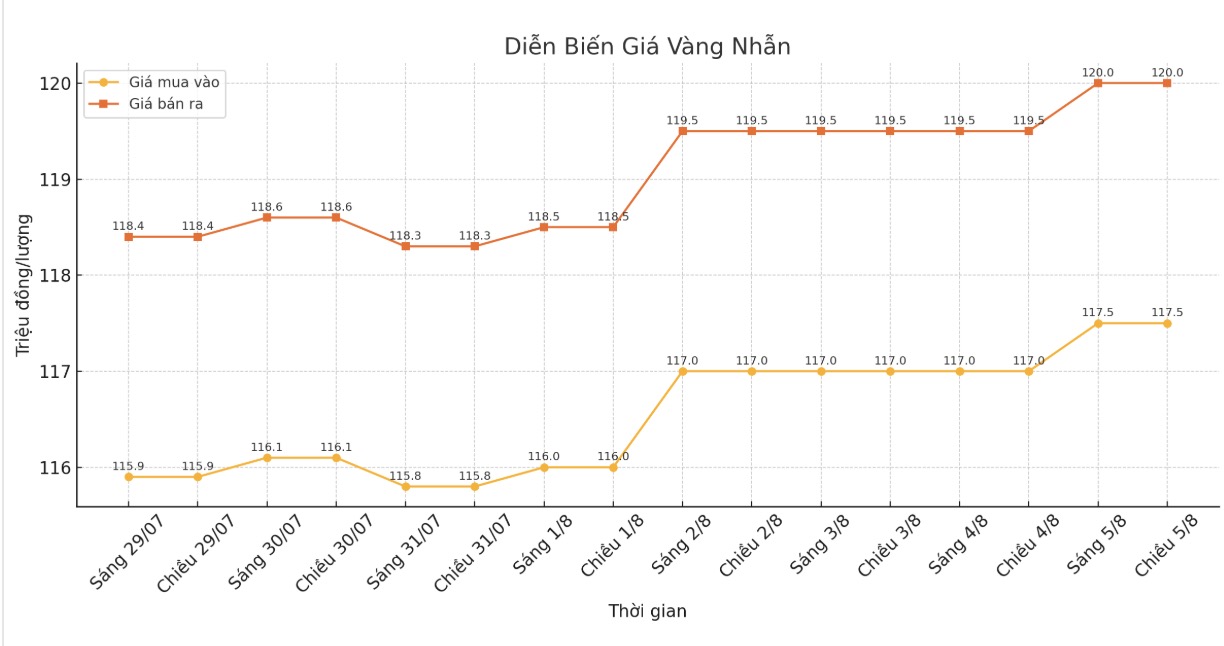

9999 gold ring price

As of 7:00 p.m., DOJI Group listed the price of gold rings at 117.5-120 million VND/tael (buy in - sell out), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 117.8-120.8 million VND/tael (buy - sell), an increase of 600,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 116.5-119 seven million VND/tael (buy in - sell out), an increase of 700,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

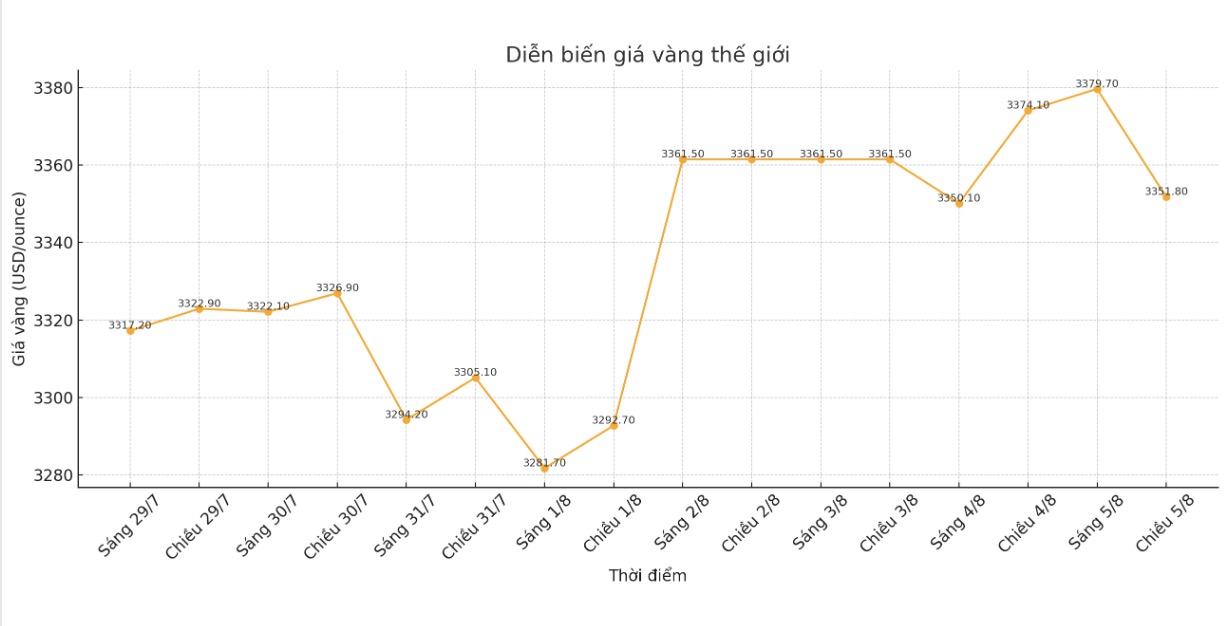

World gold price

The world gold price was listed at 7:00 p.m. at 3,351.8 USD/ounce, down 22.3 USD compared to 1 day ago.

Gold price forecast

World gold prices on August 5 are struggling around a two-week peak due to weak US employment data raising expectations of the Fed cutting interest rates in September.

Weaker-than-expected US jobs data has further strengthened hopes that the US Federal Reserve (FED) will cut interest rates in September, while putting pressure on the USD and government bond yields, supporting gold prices.

The yield on the benchmark 10-year US Treasury note has also fallen to its lowest level in a month.

Sromatic momentum has improved positively for buyers... Basically, the story of supporting gold prices is the fact that the Fed is still leaning towards the possibility of cutting interest rates in September Kelvin Wong - senior market analyst at OANDA commented.

US job growth in July weakened compared to expectations, while the May and June non-farm payrolls were also adjusted down sharply to 258,000 jobs, showing the labor market situation is deteriorating.

According to the CME FedWatch tool, traders are now predicting a 90% chance of a Fed rate cut in September.

Gold which is considered a safe haven asset in the context of political and economic instability often benefits in a low interest rate environment.

Meanwhile, US President Donald Trump has threatened to increase tariffs on imports from India because New Delhi buys Russian oil. The Indian government called the statement "unreasonable" and said it would protect its economic interests, escalating trade tensions between the two countries.

However, gold is still facing some technical resistance levels.

I have not seen traders push prices up strongly beyond $3,450/ounce, unless there is a clear enough catalyst to push gold prices above this level, Wong added.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...