Updated SJC gold price

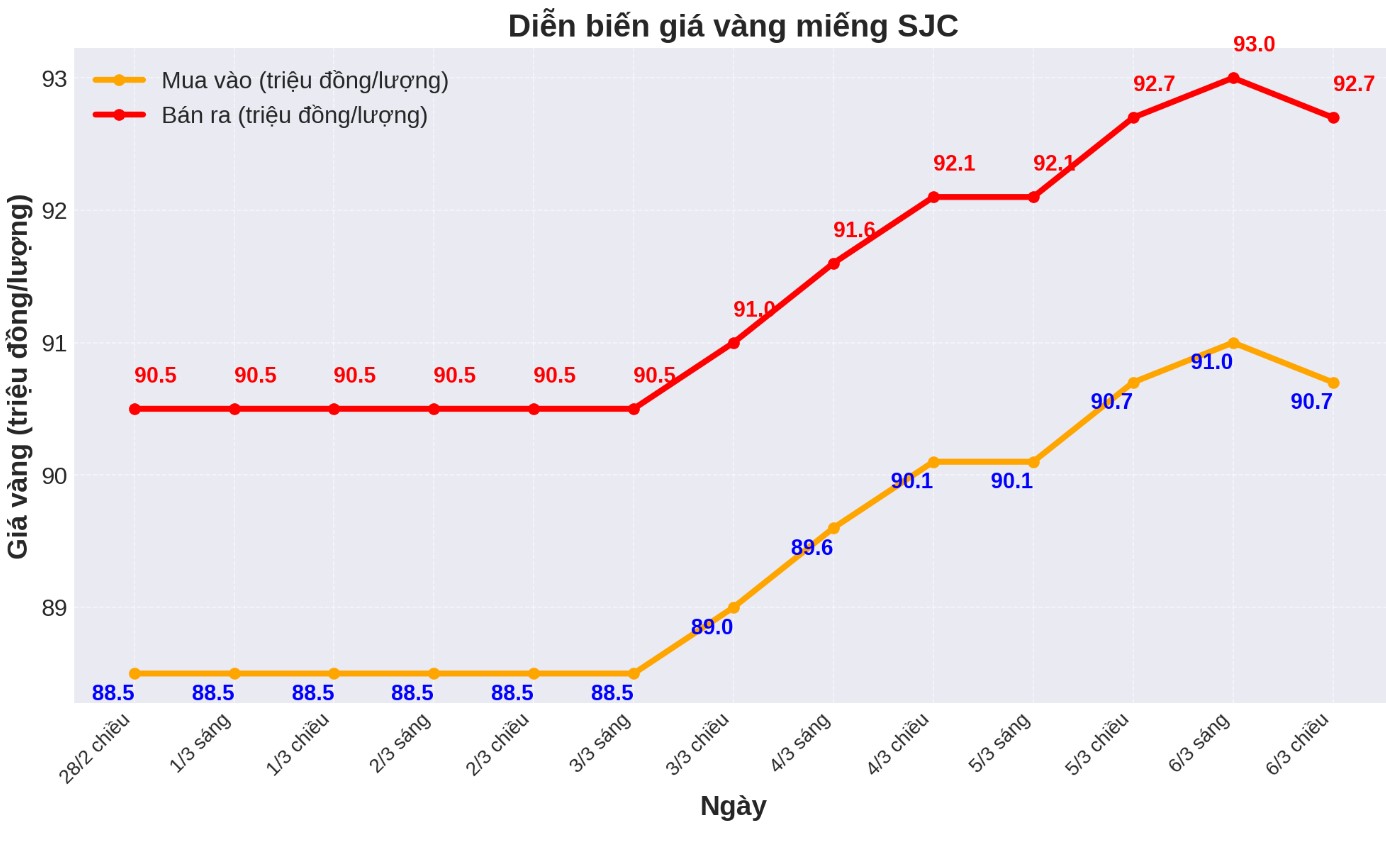

As of 5:30 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 90.7-92.7 million VND/tael (buy in - sell out), unchanged in both buying and selling directions. The difference between the buying and selling prices of SJC gold was listed by Saigon Jewelry Company at VND2 million/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 90.7-92.7 million VND/tael (buy - sell), unchanged in both buying and selling directions. The difference between the buying and selling prices of SJC gold was listed by DOJI at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 90.7-92.7 million VND/tael (buy - sell), down 200,000 VND/tael for buying and kept the same for selling. The difference between the buying and selling prices of SJC gold was listed by Bao Tin Minh Chau at 2 million VND/tael.

9999 round gold ring price

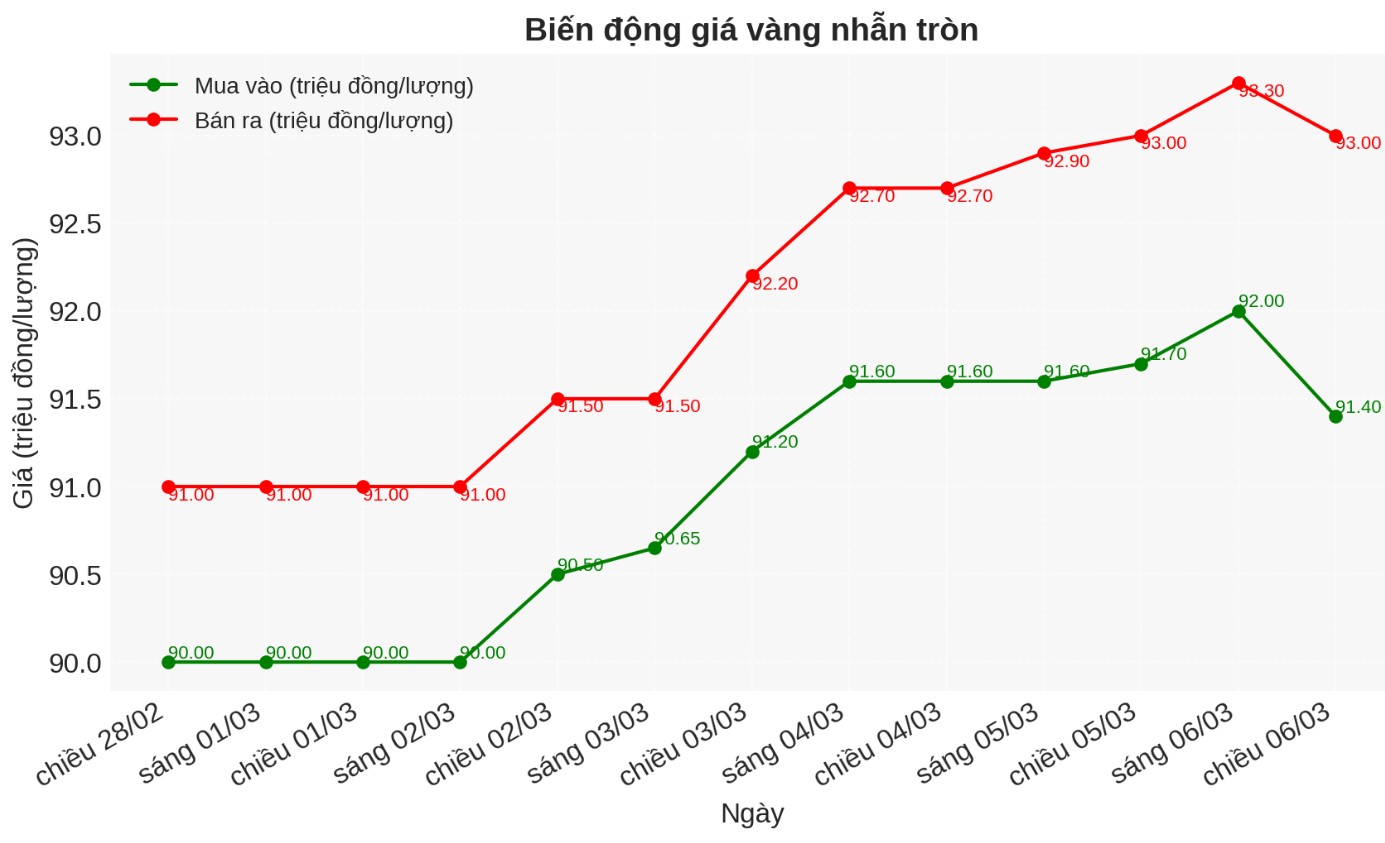

As of 5:30 p.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND91.4-93 million/tael (buy - sell); down VND300,000/tael for buying and kept the same for selling. The difference between buying and selling is listed at 1.6 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 91.6-93.1 million VND/tael (buy - sell); down 400,000 VND/tael for buying and down 100,000 VND/tael for selling. The difference between buying and selling is 1.5 million VND/tael.

World gold price

As of 5:20 p.m., the world gold price listed on Kitco was at 2,899.2 USD/ounce, down more than 18 USD/ounce compared to the same time of the previous session.

Gold price forecast

World gold prices fell despite the decline of the USD. Recorded at 5:20 p.m. on March 6, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 104.165 points (down 0.07%).

According to Reuters, gold prices fell about 1% on Thursday as investors took profits after three consecutive days of increase.

Currently, the market is paying attention to the US employment report released on Friday to find clues about the interest rate path of the US Federal Reserve (FED) in the context of growing concerns about global trade tensions.

Lukman Otunuga - senior analyst at FXTM - commented: "Gold is under profit-taking pressure as investors closely monitor thuetical developments, with trading prices around 2,900 USD/ounce ahead of the non-farm payroll report.

Without a new catalyst, the current price trend could take gold lower. If prices fall below $2,900/ounce, this could open up a deeper downtrend to $2,880/ounce, Otunuga predicted.

Speaking on CNBC, Peter Grant - Vice President and senior metals strategist at Zaner Metals - said that there is still demand for gold but it will be at a certain level of caution before the US non-farm payroll data is released tomorrow. However, the basic trend is still favorable for gold.

Currently, the market is waiting for the US non-farm payroll report, which is expected to show that the country's economy will create 160,000 more jobs in February, according to a Reuters survey.

Note: The article data compares with the same time of the previous trading session.

See more news related to gold prices HERE...