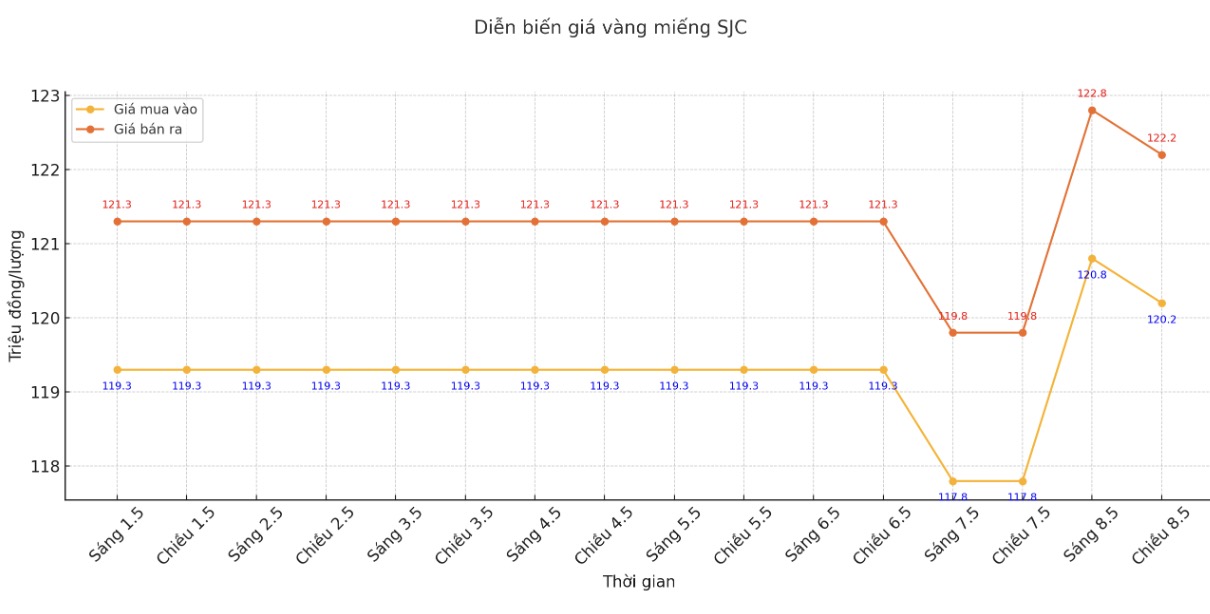

Updated SJC gold price

As of 5:45 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 118.5-120.5 million/tael (buy in - sell out), down VND 1.7 million/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 118.5-120.5 million VND/tael (buy in - sell out), down 1.7 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 118.3-120.5 million VND/tael (buy - sell), down 1.9 million VND/tael for buying and down 1.7 million VND. The difference between buying and selling prices is at 2.2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 117.5-120.5 million VND/tael (buy - sell), down 1.2 million VND/tael for both buying and selling. The difference between buying and selling prices is at 3 million VND/tael.

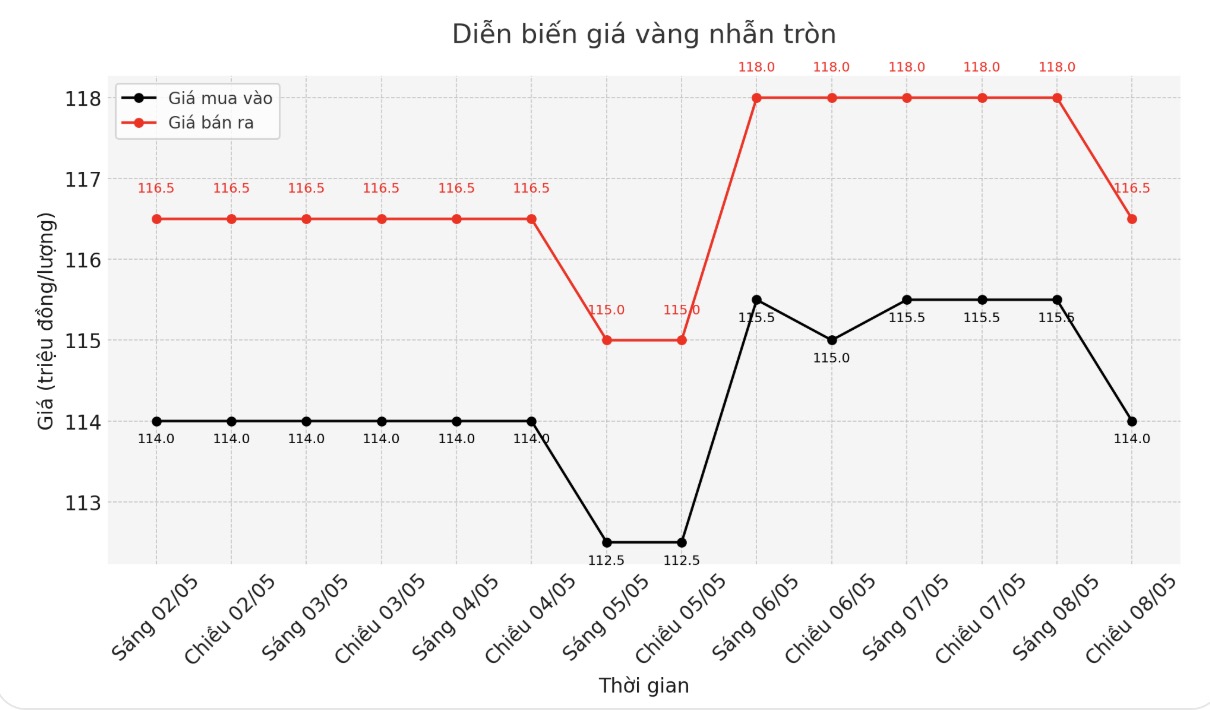

9999 round gold ring price

As of 5:45 p.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 114-116.5 million VND/tael (buy - sell), down 1.5 million VND/tael for both buying and selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116.5-1195 million VND/tael (buy - sell), down 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114.5-117.5 million VND/tael (buy in - sell out), down 1 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

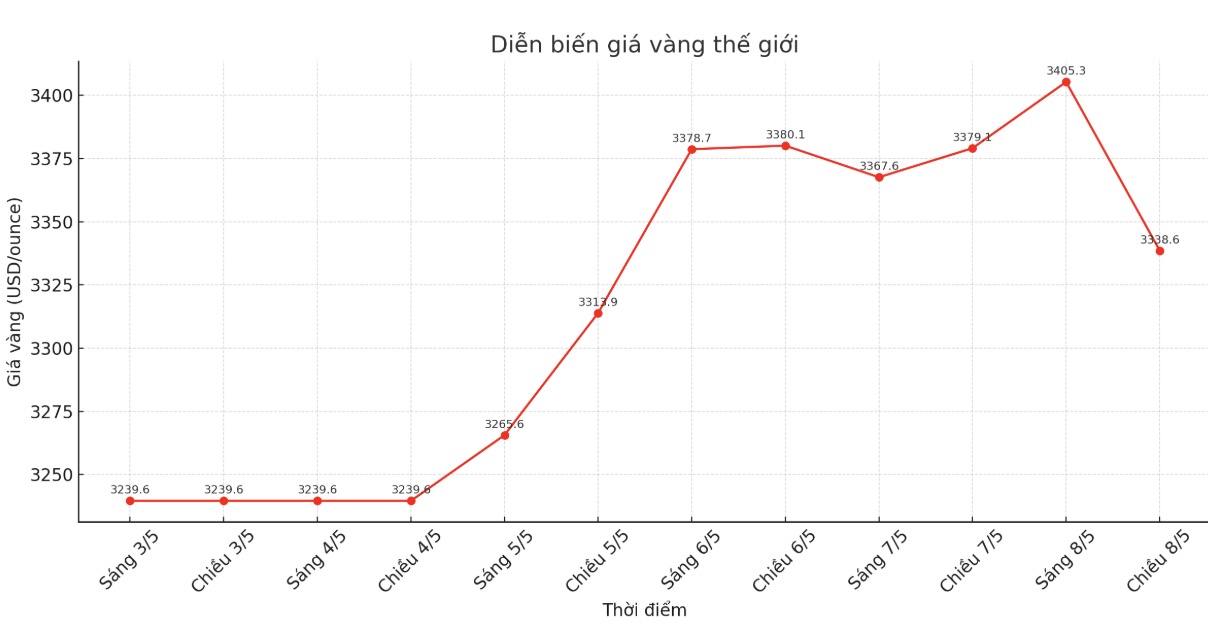

World gold price

At 6:00 p.m., the world gold price listed on Kitco was around 3,338.6 USD/ounce, down sharply by 40.5 USD.

Gold price forecast

This morning (May 8), world gold prices continued to increase sharply, at many times exceeding the 3,400 USD/ounce mark.

According to Reuters, this move comes after the US Federal Reserve (FED) warned of the risk of rising inflation and a weakening labor market, raising concerns about economic prospects.

However, in the afternoon, gold prices suddenly fell sharply when US President Donald Trump signaled a potential trade deal with the UK. This development eases trade tensions, thereby reducing the appeal of gold as a safe haven channel.

The gold market is focusing on the Feds statement, as the central bank kept interest rates unchanged but warned of rising inflation and unemployment risks, said Jigar Trivedi, senior commodity analyst at Reliance Securities.

The Fed kept interest rates unchanged on Wednesday, but warned of rising inflation and unemployment risks due to the impact of US President Donald Trump's tax measures.

Mr. Trump has said China is the initiator of upcoming trade negotiations, and affirmed that the US will not cut taxes to put Beijing at the negotiating table.

Kyle Rodda - market analyst at Capital.com - commented: "Mr. Trump's tough statements about trade negotiations with China also contribute to improving market sentiment. This is related to two major issues: slowing US growth and the trend of de-dollarization.

The New York Times reported that Mr. Trump is expected to announce a trade deal with the UK on Thursday.

See more news related to gold prices HERE...