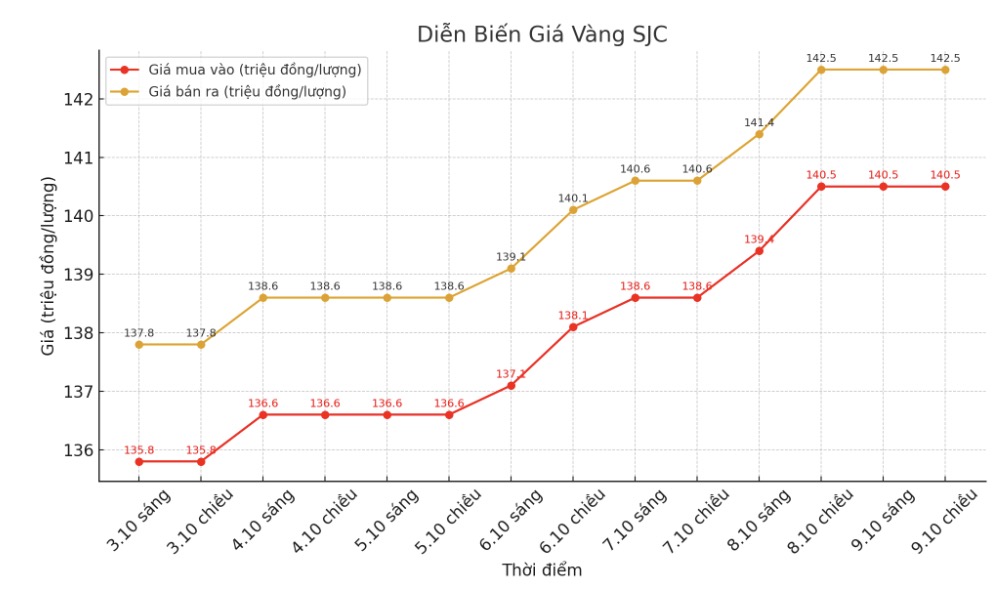

SJC gold bar price

As of 5:45 p.m., the price of SJC gold bars was listed by DOJI Group and Bao Tin Minh Chau at 140.5-142.5 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 140-142.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2.5 million VND/tael.

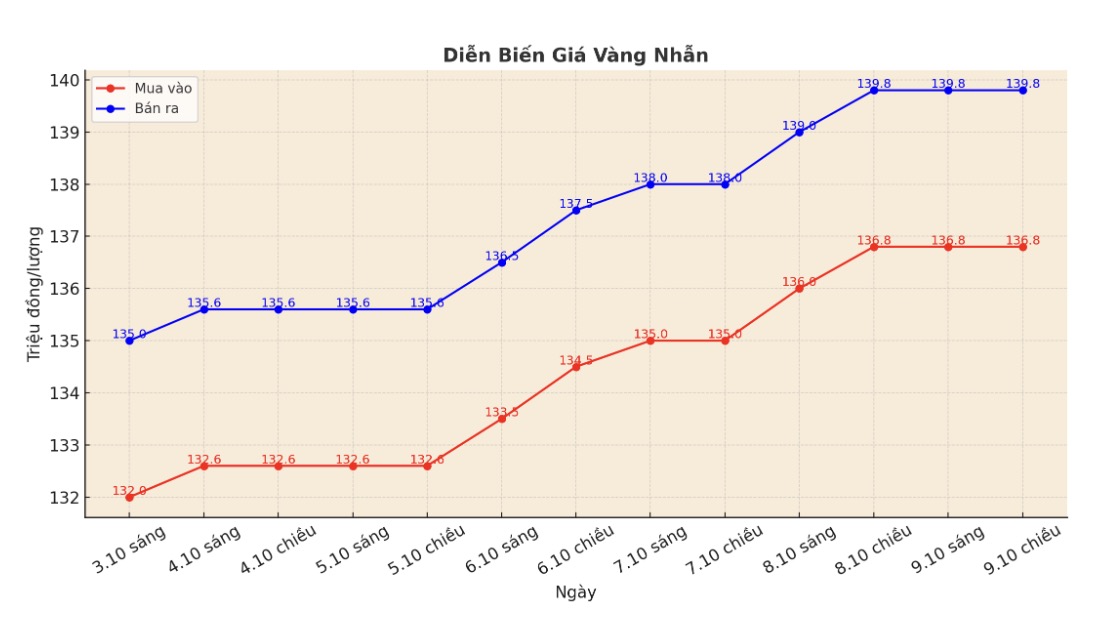

9999 gold ring price

As of 5:45 p.m., DOJI Group listed the price of gold rings at 136.8-139.8 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 138.2-141.2 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 137.5-140.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

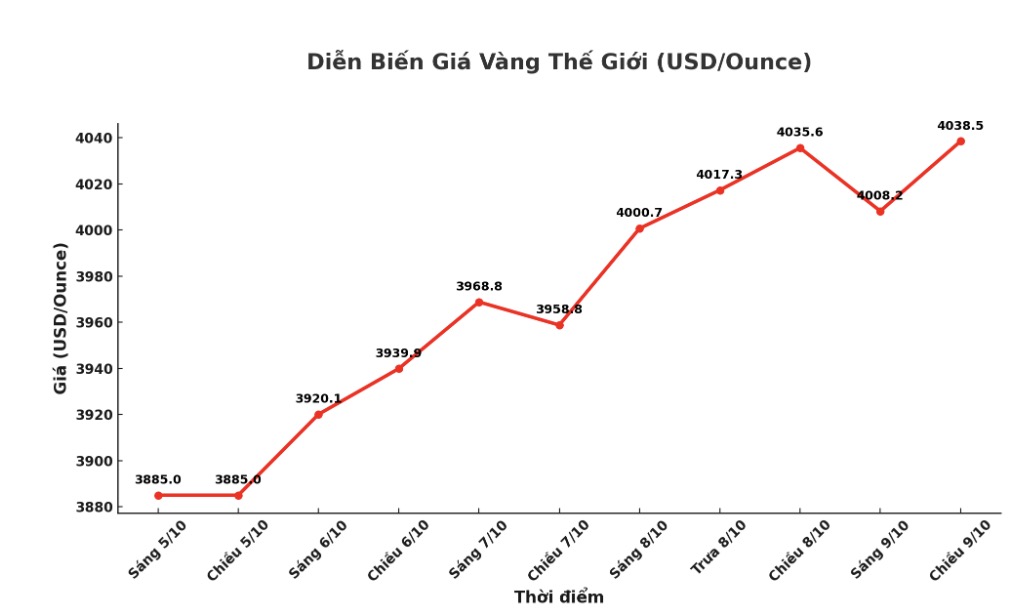

World gold price

The world gold price was listed at 5:45 p.m. at 4,038.5 USD/ounce, up 2.9 USD compared to a day ago.

Gold price forecast

The world is paying attention to the historic milestone when gold prices surpassed the threshold of 4,000 USD/ounce. Expert Bernard Dahdah - one of the first to predict this milestone, said that although gold is showing impressive upward momentum, the market could still fluctuate strongly as investor sentiment changes.

Dahdah believes there will be a period of adjustment in the short term, but the medium-term outlook to 2026 is still positive. Gold prices may be at risk of falling in the coming months, but there will be many factors supporting price increases in 2026, he said.

According to Dahdah, selling pressure may appear when the exchange increases its deposit, forcing investors to use leverage to sell off, along with profit-taking activities. This situation has happened many times in the past, causing a 5-10% decline in just a few days, such as the US public debt period in 2011, the COVID-19 pandemic in 2020 or the Ukrainian conflict in 2022.

Meanwhile, Taylor McKenna from Kopernik Global Investors Fund (Florida) predicted that gold prices will continue to increase, but the pace could slow down as high prices encourage new mining, increasing supply. We still like gold but not as much as we used to like, he told Reuters.

According to the European Central Bank (ECB), in 2024, gold surpassed the euro to become the world's second largest reserve asset, after the USD. IMF data shows that the share of gold in total global reserve assets reached a record of 24% in the second quarter, up from 23.3% in the previous quarter.

BCA Research Chief Strategist Marko Papic said: Investors should not sell US bonds or stocks for the actions of President Donald Trump. Instead, hold tangible assets - currently, palladium is our favorite choice.

HSBC expert James Steel said: "The increase in silver is closely linked to gold prices reaching a historical peak". He raised his forecast for the average silver price this year to 38.56 USD/ounce and in 2026 to 44.5 USD/ounce. Gold has a strong attraction for silver. When gold increases, cash flow often spreads to silver - especially from investors who missed out on the previous gold wave.

McKenna of Kopernik believes that platinum will break out even more as prices are still deeply discounted against gold - although the two metals are closely related. This difference could stimulate investment in new gold mining, thereby making platinum supply scarcer and giving prices a chance to increase further.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...