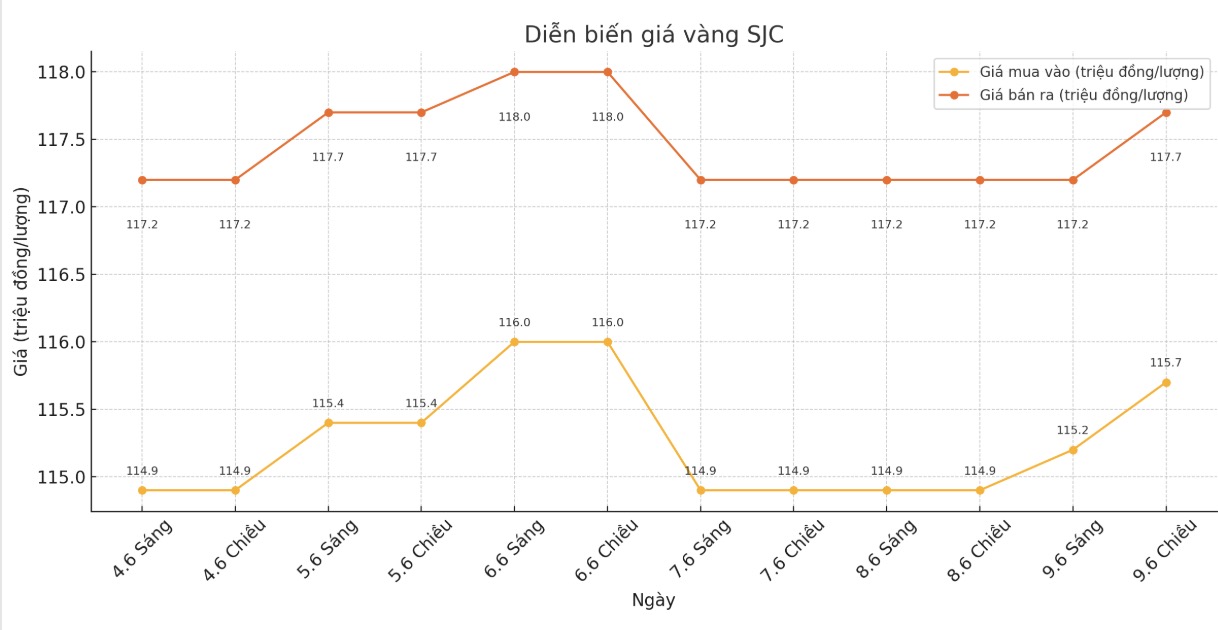

SJC gold bar price

As of 5:30 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 115.7/17.7 million/tael (buy - sell); increased by VND 800,000/tael for buying and increased by VND 500,000/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 115.7-117.7 million VND/tael (buy - sell); increased by 800,000 VND/tael for buying and increased by 500,000 VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 115.7-117.7 million VND/tael (buy - sell); increased by 800,000 VND/tael for buying and increased by 500,000 VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 115-117.7 million VND/tael (buy in - sell out); increased by 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2.7 million VND/tael.

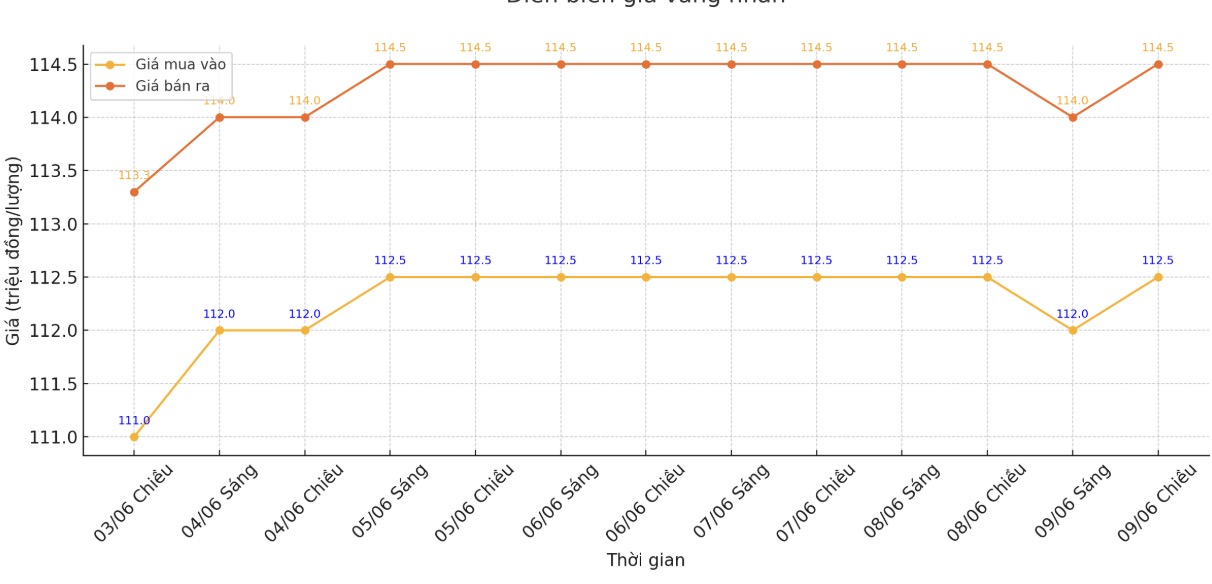

9999 gold ring price

As of 5:30 p.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 112.5-124.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 113.3-116.3 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 111.3-114.3 million VND/tael (buy in - sell out), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

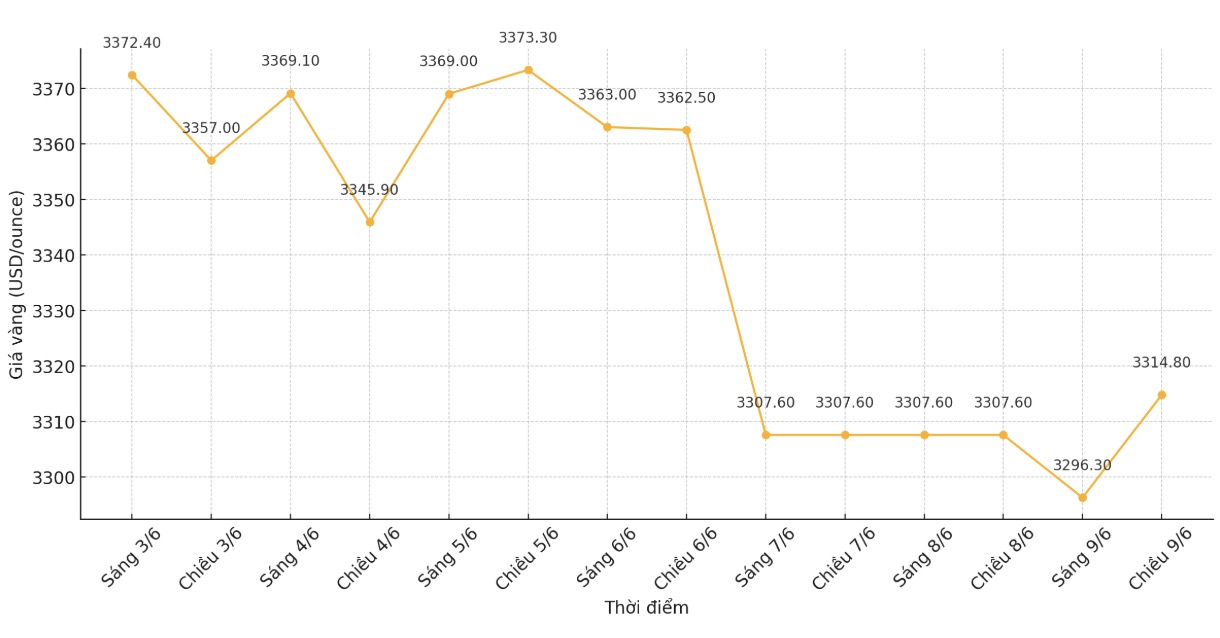

World gold price

The world gold price was listed at 5:35 p.m. at 3,314.8 USD/ounce, up 7.2 USD.

Gold price forecast

Gold prices rose on Monday, supported by a weakening US dollar as US-China trade talks prepare to address tensions. platinum prices continued their increase for the sixth consecutive session, reaching their highest peak in four years.

Spot gold prices increased by 0.3% to 3,318.76 USD/ounce (as of 5:07 p.m. Vietnam time), after falling to 3,293.29 USD/ounce - the lowest level since June 2.

US gold futures fell 0.2% to $3,339.70 an ounce.

The USD (.DXY) fell 0.3% against a basket of major currencies, making gold cheaper for investors holding other currencies.

UBS analyst Giovanni Staunovo commented: "Investors see that factors driving gold prices such as trade - geopolitical tensions, concerns about public debt and weak economic growth still exist and will continue to support the price of this precious metal in the coming months".

US and Chinese officials will meet in London on Monday for talks, in hopes of cooling down the trade war between the world's two largest economies.

The better-than-expected US non-farm payrolls data has prompted investors to adjust their expectations for the US Federal Reserve (FED) to cut interest rates, from twice this year to just once in October.

The market is now shifting its attention to US CPI data, due out on Wednesday, to find more clues on the Fed's monetary policy orientation.

Gold is considered a safe haven asset in the context of political and economic instability, often benefiting from a low interest rate environment.

Meanwhile, the Chinese Central Bank continued to buy more gold in May, marking the 7th consecutive month of increasing reserves for this precious metal.

Spot platinum prices rose 3.1% to $1,201.75 an ounce the highest level since May 2021.

Alexander Zumpfe - precious metals trading expert at Heraeus Metals (Germany) - said: "The increase in platinum is supported by expectations of tight supply, improved industrial psychology and technical factors from the general increase of the precious metals market".

Spot silver prices rose 1% to 36.30 USD/ounce, while paladi rose 2.7% to 1,074.76 USD/ounce.

See more news related to gold prices HERE...