Updated SJC gold price

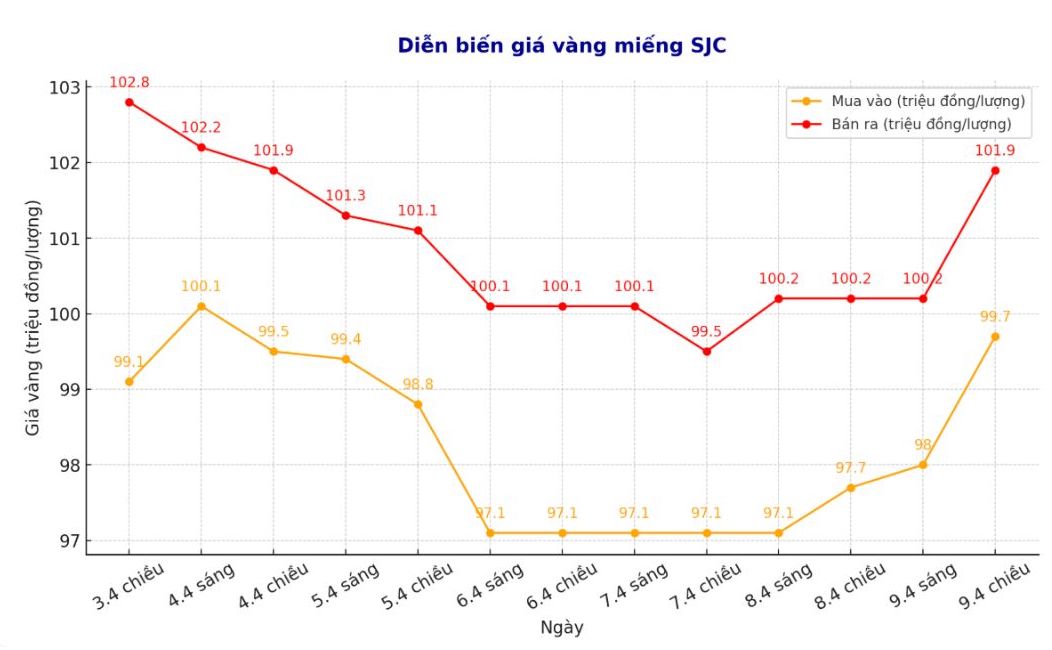

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 99.7-101.9 million/tael (buy - sell); an increase of VND 2 million/tael for buying and an increase of VND 1.7 million/tael for selling compared to early in the morning. The difference between buying and selling prices is at 2.2 million VND/tael.

At the same time, DOJI Group listed the price of SJC gold bars at 99.7-101.9 million VND/tael (buy - sell); an increase of 2 million VND/tael for buying and an increase of 1.7 million VND/tael for selling compared to early in the morning. The difference between buying and selling prices is at 2.2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 99.8-101.9 million VND/tael (buy - sell); an increase of 2 million VND/tael for buying and an increase of 1.7 million VND/tael for selling compared to early in the morning. The difference between buying and selling prices is at 2.1 million VND/tael.

9999 round gold ring price

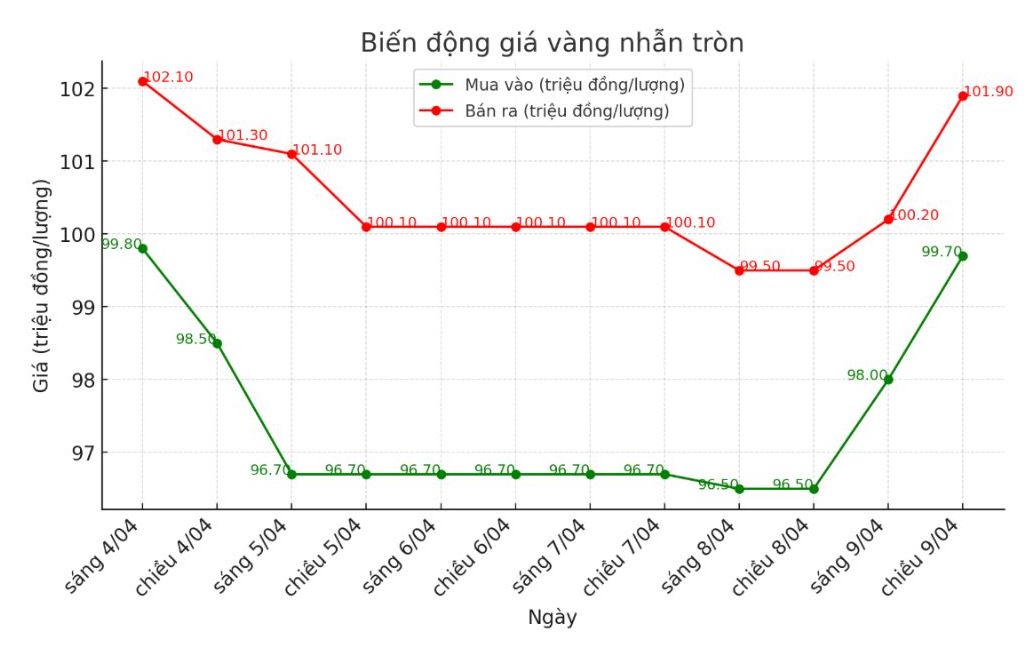

As of 6:00 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 99.7-101.9 million VND/tael (buy - sell); an increase of 2 million VND/tael for buying and an increase of 1.7 million VND/tael for selling compared to early in the morning. The difference between buying and selling prices is at 2.2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 99.9-102 million VND/tael (buy - sell); an increase of 1.9 million VND/tael for buying and an increase of 1.7 million VND/tael for selling compared to early in the morning. The difference between buying and selling prices is at 2.1 million VND/tael.

As world gold prices fluctuate strongly, the gap between domestic and domestic prices is widening, showing very clear risks. If gold prices turn down, buyers will face a huge loss. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

World gold price

As of 0:34 on April 10, the world gold price was listed at 3,049.4 USD/ounce, up more than 60 USD compared to early this morning.

Gold price forecast

According to Kitco, the need for safe havens is boosting gold prices as US bond interest rates increased due to concerns about the stability of the US bond market.

Gold for June futures has now risen $115.9, reaching $3,106.1 an ounce. The price of silver futures for May increased by 0.699 USD, to 30.4 USD/ounce.

With the ongoing US-China trade tensions and the possible participation of other countries, concerns about the stability of the US bond market are increasing.

The market is discussing that major hedge funds are having to deal with large interest rate swap positions, including buying US bonds, partly due to predictions that the Trump administration will loosen US banking regulations on holding US bonds, but this has not happened yet.

SP Angel - a brokerage company said in an email newsletter: "Gold is benefiting from China's buying.

Gold and US bonds often compete for a safe haven role, bonds often dominate when interest rates are high. However, if investors are concerned about the stability of the US government bond market, gold could become a clear replacement. When the US Federal Reserve (FED) intervened in March 2020 with an emergency interest rate cut of 100 basis points, gold prices then increased by about 30% for the rest of the year" - SP Angel emphasized.

In addition, China and Japan may be selling off US bonds due to trade tensions with the US. A title from Barron's today reads: "Trump's tariffs shake the bond market".

Overseas markets saw the USD index fall sharply due to concerns about US bonds. Nymex crude oil prices fell sharply, reaching a 4-year low, trading at about 57 USD/barrel. The interest rate on the 10-year US government bond is currently at 4.38%.

Technically, June gold investors are having a clear near-term technical advantage. The price reaction this week shows that the sellers are tired after the recent sale.

The next target for buyers is to close above the resistance level of $3,201/ounce. The next downside target for the sellers is to bring the price below 2,970.4 USD/ounce. The first resistance level was 3,125 USD/ounce, then 3,150 USD/ounce. The first support level was 3,050 USD/ounce, then 3,025 USD/ounce.

See more news related to gold prices HERE...