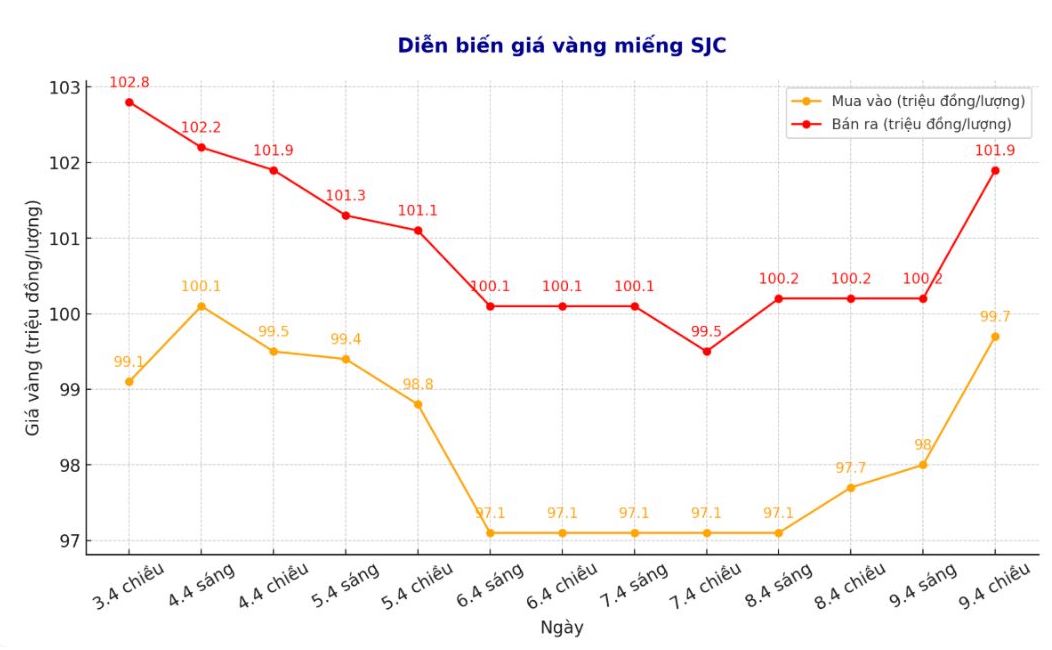

Updated SJC gold price

As of 5:50 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 99.7-101.9 million/tael (buy - sell); an increase of VND 2 million/tael for buying and an increase of VND 1.7 million/tael for selling compared to early in the morning. The difference between buying and selling prices is at 2.2 million VND/tael.

At the same time, DOJI Group listed the price of SJC gold bars at 99.7-101.9 million VND/tael (buy - sell); an increase of 2 million VND/tael for buying and an increase of 1.7 million VND/tael for selling compared to early in the morning. The difference between buying and selling prices is at 2.2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 99.8-101.9 million VND/tael (buy - sell); an increase of 2 million VND/tael for buying and an increase of 1.7 million VND/tael for selling compared to early in the morning. The difference between buying and selling prices is at 2.1 million VND/tael.

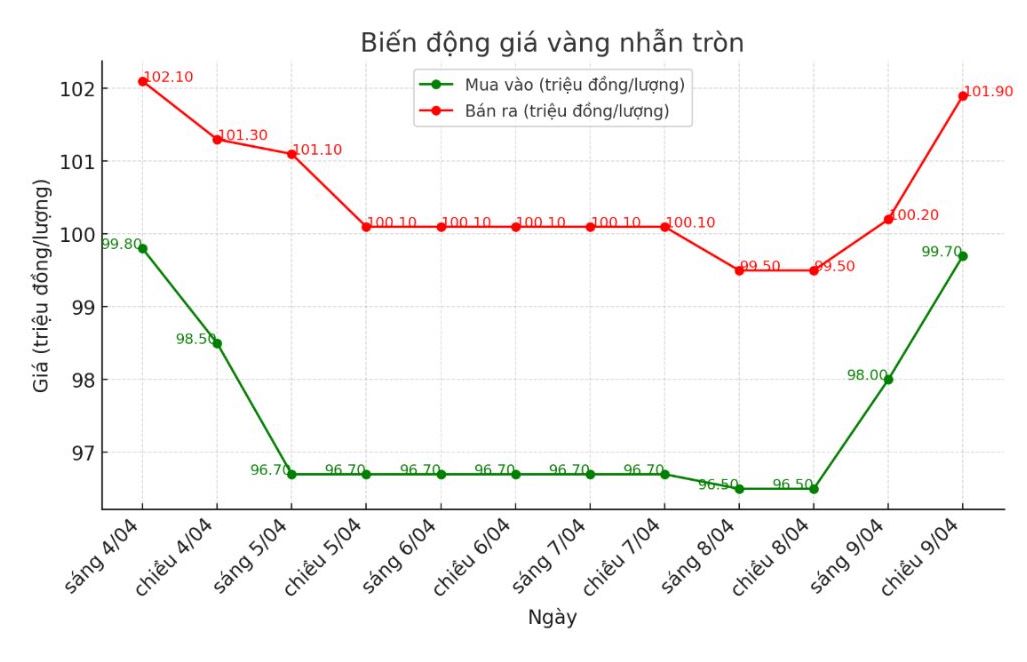

9999 round gold ring price

As of 5:50 p.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 99.7-101.9 million VND/tael (buy - sell); an increase of 2 million VND/tael for buying and an increase of 1.7 million VND/tael for selling compared to early in the morning. The difference between buying and selling prices is at 2.2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 99.9-102 million VND/tael (buy - sell); an increase of 1.9 million VND/tael for buying and an increase of 1.7 million VND/tael for selling compared to early in the morning. The difference between buying and selling prices is at 2.1 million VND/tael.

World gold price

As of 5:55 p.m., the world gold price was listed at 3,043.9 USD/ounce, up 37 USD.

Gold price forecast

According to Reuters, gold prices increased on Wednesday as traders sought safe-haven assets after US President Donald Trump's "responsive" tax rate took effect. The weakening of the US dollar and the possibility of a US interest rate cut also supported gold prices. US gold futures rose 2.5%, reaching $3,066.20 an ounce.

US President Donald Trump's 104% tax rate on Chinese goods has come into effect, raising concerns about the possibility of escalating global trade tensions and negatively affecting the economy. China is expected to hold a high-level meeting to discuss its response to these tariffs, while the Chinese central bank has asked state-owned banks to limit their purchases of USD.

"Certainties about a trade war are affecting the outlook for the US economy," said UBS analyst Giovanni Staunovo. Investors are starting to predict that the US Federal Reserve (FED) will cut interest rates this year. We expect gold prices to continue to rise to $3,200/ounce in the coming months.

Nearly 60% of traders expect the Fed to start cutting interest rates as early as May. Non-yielding precious metals such as gold are often favored in low-interest-rate environments.

Meanwhile, the market is waiting for the minutes of the latest FED policy meeting along with the US consumer price index on Thursday.

CPI will reduce its importance, as the focus will shift to the impact of tariffs on inflation. With the FED's dual task, if the US economy weakens, interest rates may be cut this year," said analyst Giovanni Staunovo.

See more news related to gold prices HERE...