On Thursday, ECB announced that it will keep interest rates unchanged for three main tools: deposit interest rate at 2.00%, principal refinancing interest rate at 2.15% and frontier lending interest rate at 2.40%. This decision is completely in line with market forecasts.

According to the central bank's monetary policy statement, the board is taking time to assess the current economic situation.

The economy continues to grow despite many challenges in the global environment. A strong labor market, a healthy financial balance sheet of the private sector and previous interest rate cuts by the Board of Directors continue to be important factors helping the economy maintain resilience.

However, the outlook remains uncertain, especially due to global trade disputes and geopolitical tensions," the ECB said in a statement.

The central bank has said it will ensure stable inflation around the 2% target in the medium term, and will monitor data and make decisions at each meeting.

The ECB stressed that interest rate decisions will be based on assessments of inflationary prospects, surrounding risks, the latest economic and financial data, as well as developments in core inflation and the effectiveness of monetary policy. The Board of Directors did not make any prior commitments on a specific interest rate roadmap.

The gold market has barely reacted significantly to the new decision by the ECB. The increase in gold against the euro is still in line with the general trend of the global currency market.

Spot gold prices against the euro are currently at 3,437 euros an ounce, up nearly 1.5% on the day.

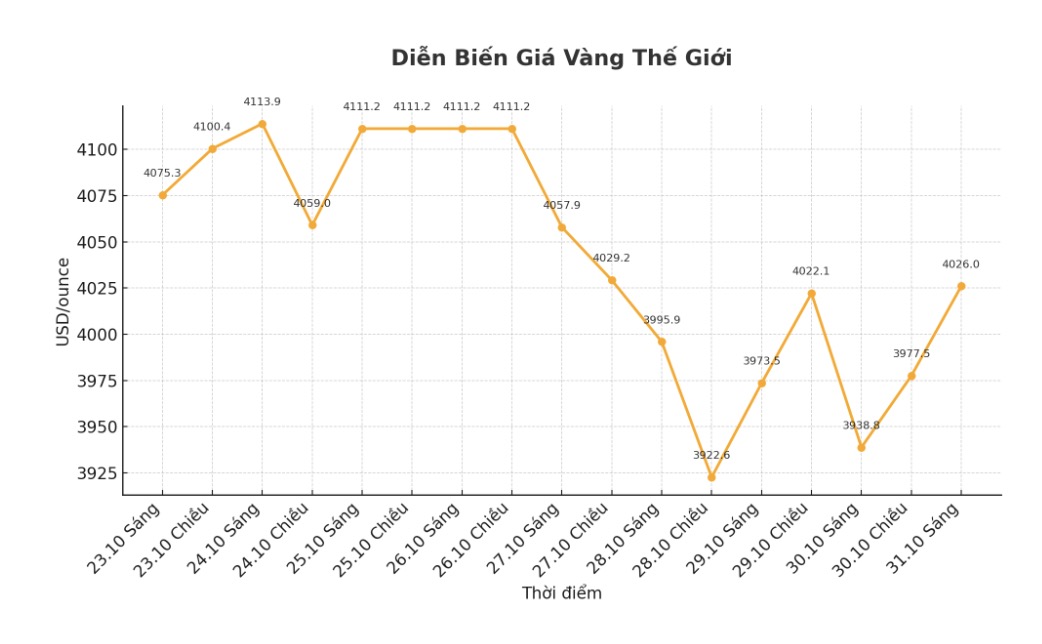

Technically, the upward trend of December gold futures remains neutral - slightly leaning towards buyers. After the recovery in today's session, investors following the bulls are aiming to close gold prices above the strong resistance level at 4,100 USD/ounce - a level that could pave the way for a new rally if completely conquered.

On the other hand, bears aim to pull prices below the solid support zone at $3,800/ounce, thereby breaking the current balance structure and expanding the decline.

In the short term, the first resistance zone was determined to be 4,028.30 USD/ounce, corresponding to the highest peak in today's session, followed by 4,050 USD/ounce. The closest support zone is at $3,925.10 an ounce - the bottom overnight, and the next support level is $3,900 an ounce.

Note, the gold market operates mainly through two pricing mechanisms: spot market - where prices are reported for trading and immediately delivered; andfutures market - where prices are established for future delivery. Due to liquidity factors and year-end position, the December gold contract is currently the most actively traded contract on the CME exchange.

See more news related to gold prices HERE...