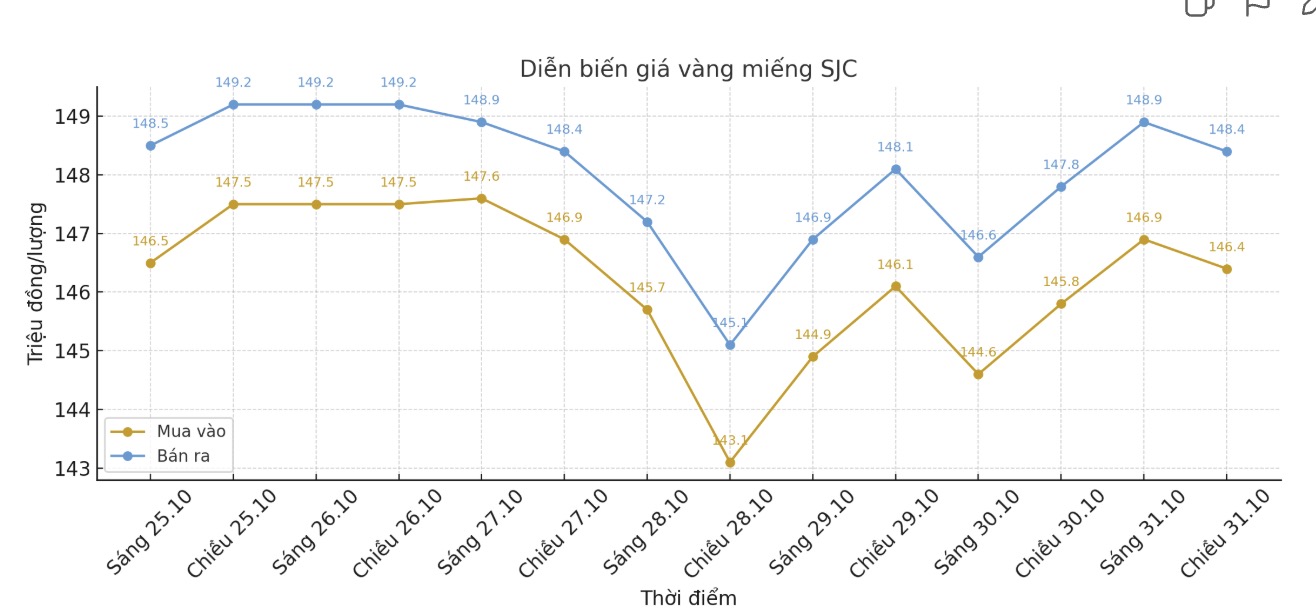

SJC gold bar price

As of 8:30 p.m., DOJI Group listed the price of SJC gold bars at 146.4-148.4 million VND/tael (buy in - sell out), an increase of 600,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 146.9-148.4 million VND/tael (buy - sell), an increase of 400,000 VND/tael for buying and an increase of 600,000 VND/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 145.9-148.4 million VND/tael (buy - sell), an increase of 600,000 VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

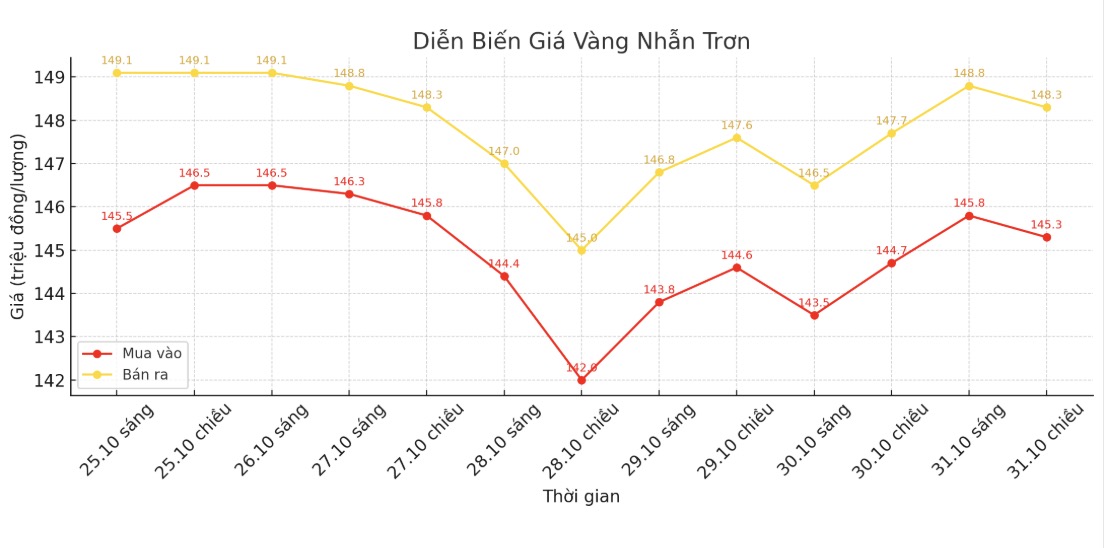

9999 gold ring price

As of 8:30 p.m., DOJI Group listed the price of gold rings at 145.3-148.3 million VND/tael (buy - sell), an increase of 600,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 146.2-149.2 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 145.4-148.4 million VND/tael (buy - sell), an increase of 600,000 VND/tael for both buying and selling. The difference between buying and selling is 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

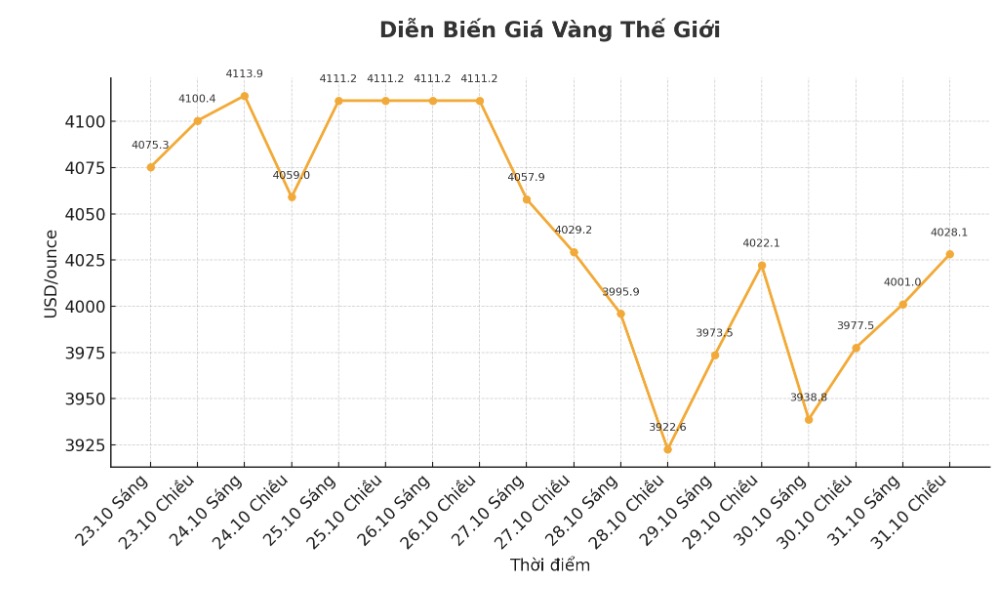

World gold price

The world gold price was listed at 20:30 at 4,028.1 USD/ounce, up 50.6 USD compared to a day ago.

Gold price forecast

Gold prices recovered after the US Federal Reserve (FED) cut the federal funds rate by 0.25 percentage points, in line with market expectations.

However, FED Chairman Jerome Powell warned investors to curb expectations of a further rate cut in December, as the Fed's internal division between job market concerns and inflation concerns.

According to Bloomberg, although Mr. Powell emphasized the main concern is the stagnant job market, some other members of the FED warned that persistent inflation will limit policy easing space.

The temporary suspension of the release of official economic data due to the US Government's closure has further increased this division.

Mr. Tim Waterer - Head of Market Analysis at KCM Trade, commented: "The FED Chairman this week clearly demonstrated the hawkish stance, and that is completely unfavorable for gold prices".

The possibility of the Fed cutting interest rates in December is now much more fragile than previously forecast, which has helped the USD strengthen, while making the outlook for gold more complicated from a yield perspective, he added.

According to CME Group's FedWatch tool, the market currently rates a 74.8% chance that the Fed will cut interest rates by another 25 basis points in December, down significantly from 91.1% last week.

In another development, US President Donald Trump said on Thursday that he had reached an agreement with Chinese President Xi Jinping on reducing tariffs on Chinese goods, in return, Beijing would take strong measures to suppress illegal fentanyl trading, resume soybean imports from the US, and maintain stable exports of rare earths to the US.

Meanwhile, in India, gold is being sold at a discount this week - for the first time in seven weeks, due to slowing domestic demand. In contrast, the decline in global gold prices has stimulated more active buying and selling activities in other Asian markets.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...