Gold benefits from "safe haven" demand

From June to September, the SNB earned a VND 14.33 billion in exchange rate from gold holdings - much higher than the VND 4.41 billion in the same period last year. According to UBS calculations, this profit is far exceeding the average of the past 10 quarters of the SNB from gold, which was less than 2 billion francs.

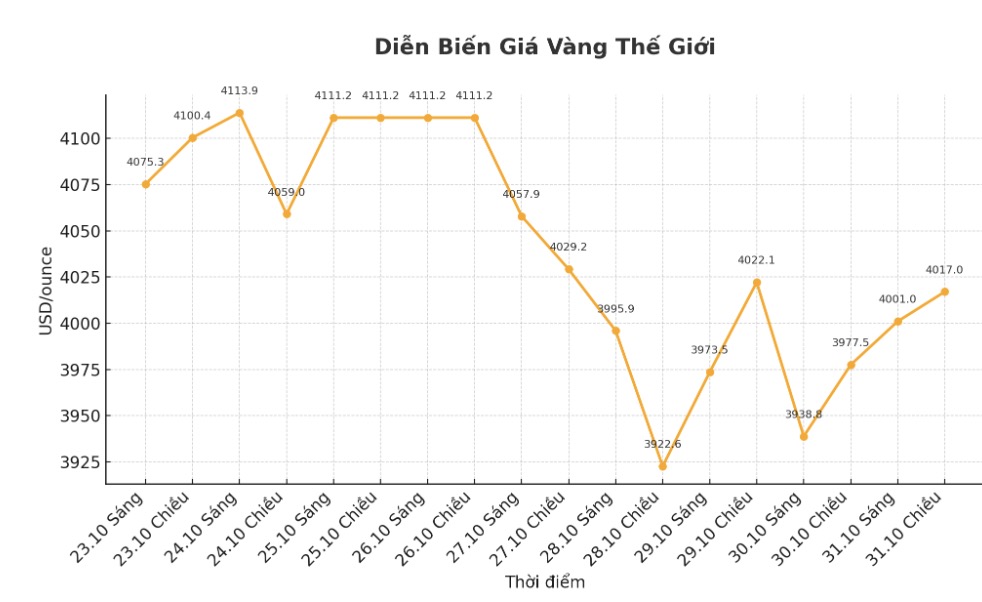

The SNB is currently holding gold reserves at 1,040 tons, and benefits as gold prices have risen to 53% since the beginning of this year. Investors are looking to gold as a channel to preserve value against escalating political and geopolitical risks.

The weakening of the US dollar also makes gold cheaper for holders of other currencies, increasing demand. In addition, the US Federal Reserve's (FED) interest rate cut has caused the yields of other safe-haven assets, such as US Treasury bonds, to decline, making gold more attractive.

Foreign currency profits and overall results in the third quarter

In addition, in the third quarter, the SNB also recorded a profit of 13.63 billion francs from foreign currency investments - including bonds and stocks purchased in foreign currency that the bank had accumulated.

As a result, SNB's overall profit in the quarter reached 27.93 billion francs, up sharply from only 5.67 million francs in the same period last year.

It is rare for the SNB to make such a large profit from gold, but this reflects golds strong rally this year, said UBS economist Florian Germanier.

This profit is essentially just an easy side effect of holding assets that are considered a last resort, the SNB is forced to maintain to diversify its portfolio and implement monetary policy, he added.

Note: convert rate: 1 USD = 0.7931 Swiss francs.

See more news related to gold prices HERE...