Update SJC gold price

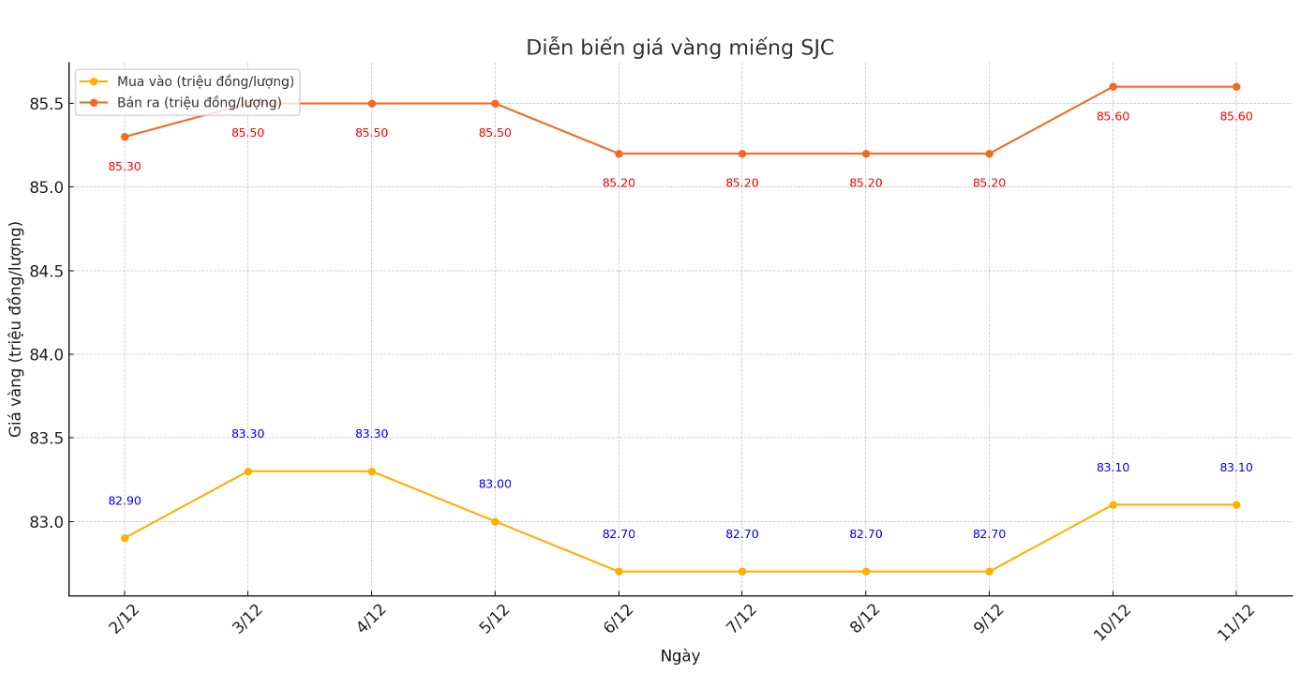

As of 6:00 a.m., the price of SJC gold bars listed by DOJI Group was at 83.1-85.6 million VND/tael (buy - sell), an increase of 400,000 VND/tael in both directions.

The difference between buying and selling price of SJC gold at DOJI Group is at 2.5 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 83.6-85.6 million VND/tael (buy - sell), an increase of 900,000 VND/tael for buying and 400,000 VND/tael for selling compared to early this morning.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of SJC gold at 83.6-85.6 million VND/tael (buy - sell), an increase of 900,000 VND/tael for buying and 400,000 VND/tael for selling compared to early this morning.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

The difference between the buying and selling price of gold is listed at around 2-2.5 million VND/tael. This difference is very high, causing investors to face the risk of losing money when buying in the short term.

This price difference is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make profits, especially in the short term.

Price of round gold ring 9999

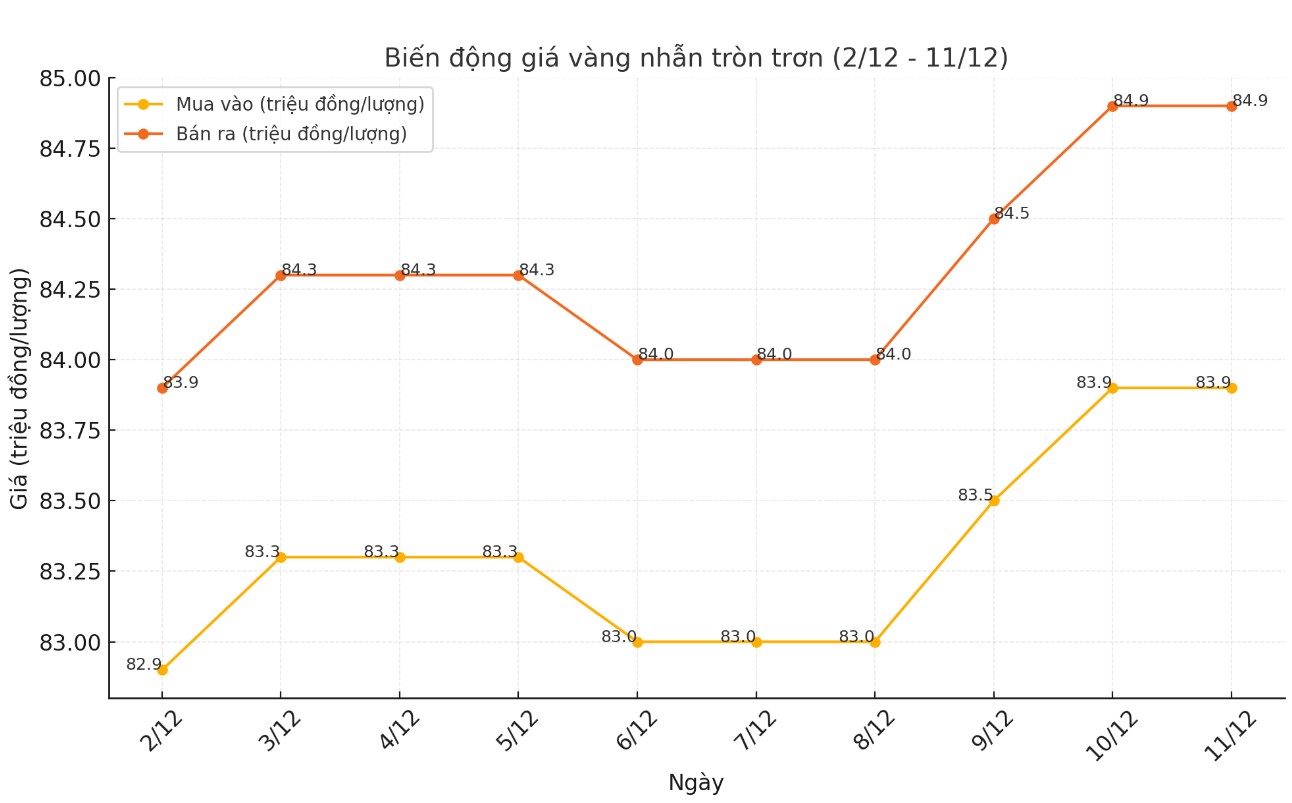

As of 6:00 a.m. today, the price of Hung Thinh Vuong 9999 gold rings at DOJI is listed at 83.9-84.9 million VND/tael (buy - sell); an increase of 400,000 VND/tael for both buying and selling compared to the close of the previous trading session.

Bao Tin Minh Chau listed the price of gold rings at 83.43-84.93 million VND/tael (buy - sell); increased by 50,000 VND/tael for buying and increased by 450,000 VND/tael for selling.

World gold price

As of 0:15 on December 11 (Vietnam time), the world gold price listed on Kitco was at 2,693.3 USD/ounce, up 27 USD/ounce compared to the opening of the previous trading session.

Gold Price Forecast

World gold prices fluctuated amid the rising USD index. Recorded at 0:20 on December 11, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 106.225 points (up 0.38%).

Gold's recent rally began on Monday as traders reacted to news that the People's Bank of China bought 5 tonnes of gold in November.

According to data from the People's Bank of China, the agency bought an additional 5 tons of gold in November, bringing its total official gold reserves to 2,269 tons, according to Krishan Gopaul, senior analyst for EMEA at the World Gold Council.

In a recent interview with Kitco News, Christopher Vecchio, head of Futures & Forex at Tastylive.com, said that February gold futures need to break above $2,725 to maintain their near-term upside.

Gold’s rally since Monday has taken it above its 20-day and 50-day moving averages, said David Morrison, senior market analyst at Trade Nation. While technical momentum remains slightly negative, Morrison said it is showing signs of improvement.

“Bulls will be hoping that this momentum continues to build, helping push prices back above $2,700 an ounce quickly,” he said. “If that happens, it would be an impressive recovery from the lows of less than a month ago. However, bulls will also need gold to hold support at $2,600 an ounce during downside corrections.”

Ricardo Evangelista, senior analyst at ActivTrades, said gold continued to benefit from geopolitical uncertainty as well as expectations that the US Federal Reserve (FED) will cut interest rates after its monetary policy meeting next week.

However, Mr. Evangelista also highlighted a major challenge for gold this week as investors focus on persistently high inflation.

“The US dollar has regained strength following better-than-expected non-farm payrolls data last Friday, creating a challenge for gold prices due to the inverse relationship between the two assets,” he said. “Analysts expect consumer prices to rise, which could add to the dollar recovery narrative and put pressure on gold. Conversely, if inflation is lower than expected, gold prices could be supported.”

According to Kitco - gold prices are still forecast to reach $3,000/ounce next year. However, investors need to be patient, as the current adjustment period could last until the first half of 2025, according to Bank of America (BoA).

See more news related to gold prices HERE...