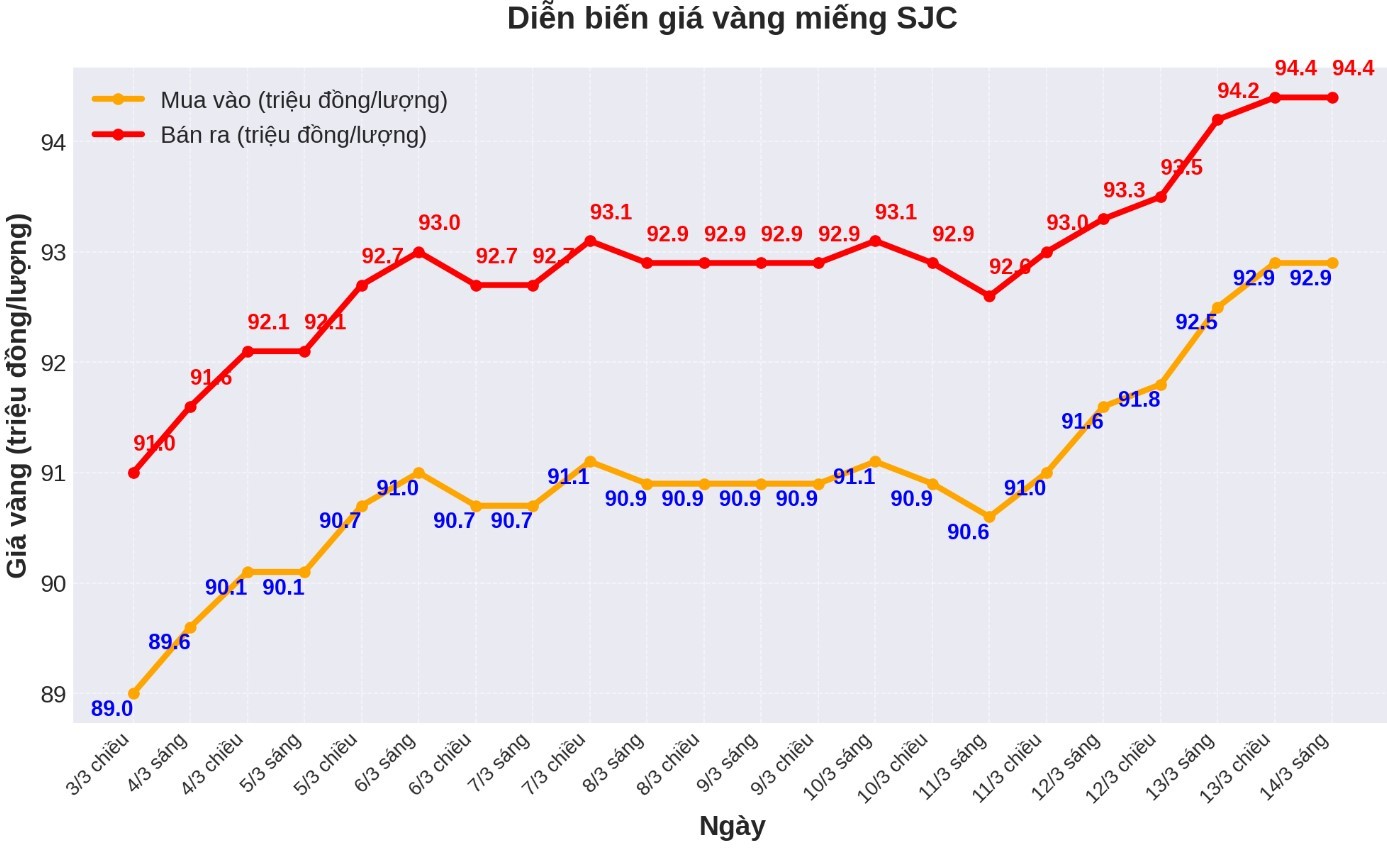

Updated SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND92.9-94.4 million/tael (buy - sell), an increase of VND1.1 million/tael for buying and VND900,000/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at VND92.9-94.4 million/tael (buy - sell), an increase of VND1.1 million/tael for buying and an increase of VND900,000/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 93-94.4 million VND/tael (buy - sell), an increase of 1 million VND/tael for buying and an increase of 900,000 VND/tael for selling. The difference between the buying and selling prices of SJC gold is listed at 1.4 million VND/tael.

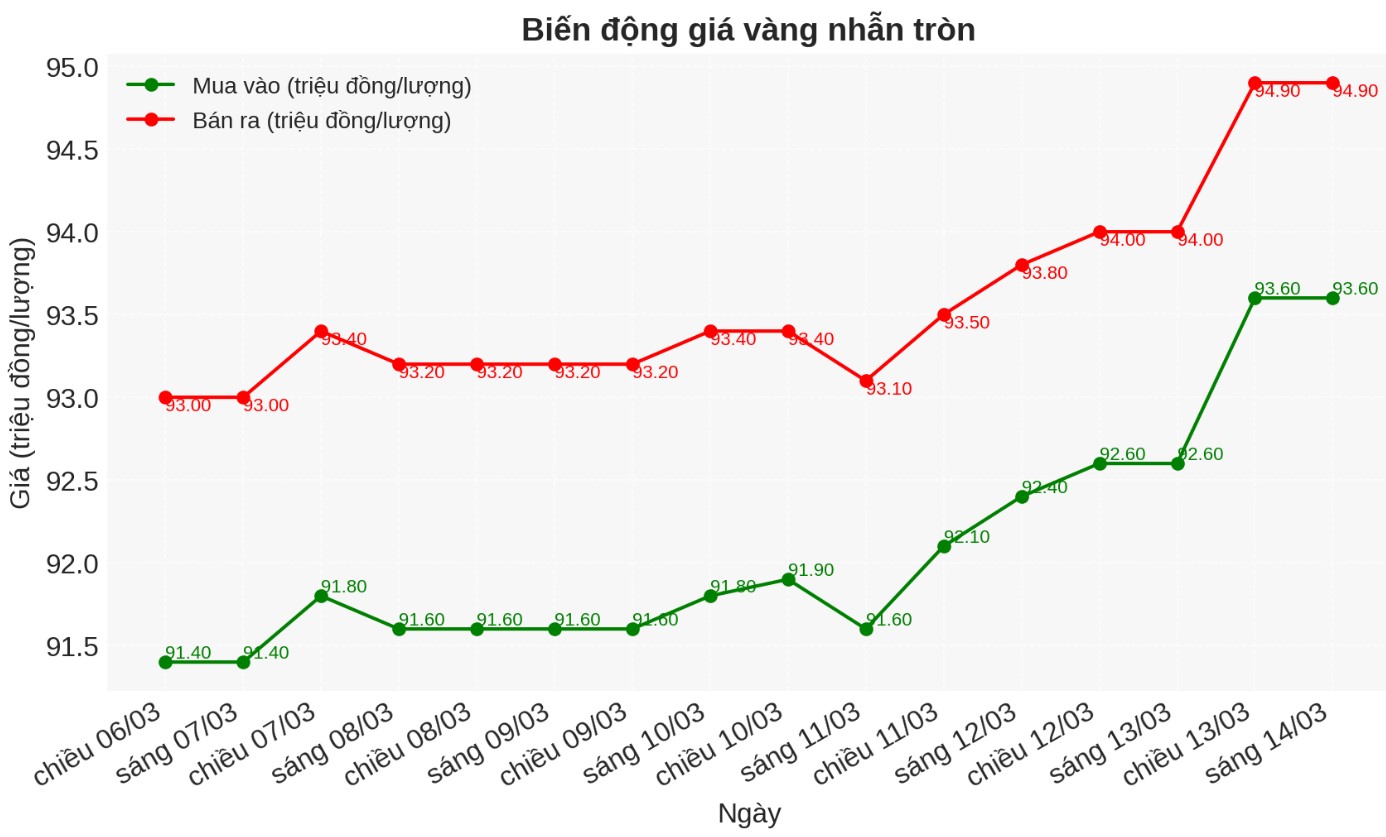

9999 round gold ring price

As of 6:00 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND93.6-94.9 million/tael (buy - sell); increased by VND1 million/tael for buying and increased by VND900,000/tael for selling. The difference between buying and selling is listed at 1.3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 93.4-95 million VND/tael (buy - sell); increased by 850,000 VND/tael for buying and increased by 900,000 VND/tael for selling. The difference between buying and selling is 1.6 million VND/tael.

In the context of high world gold prices, domestic gold rings may increase when the market opens a new trading session.

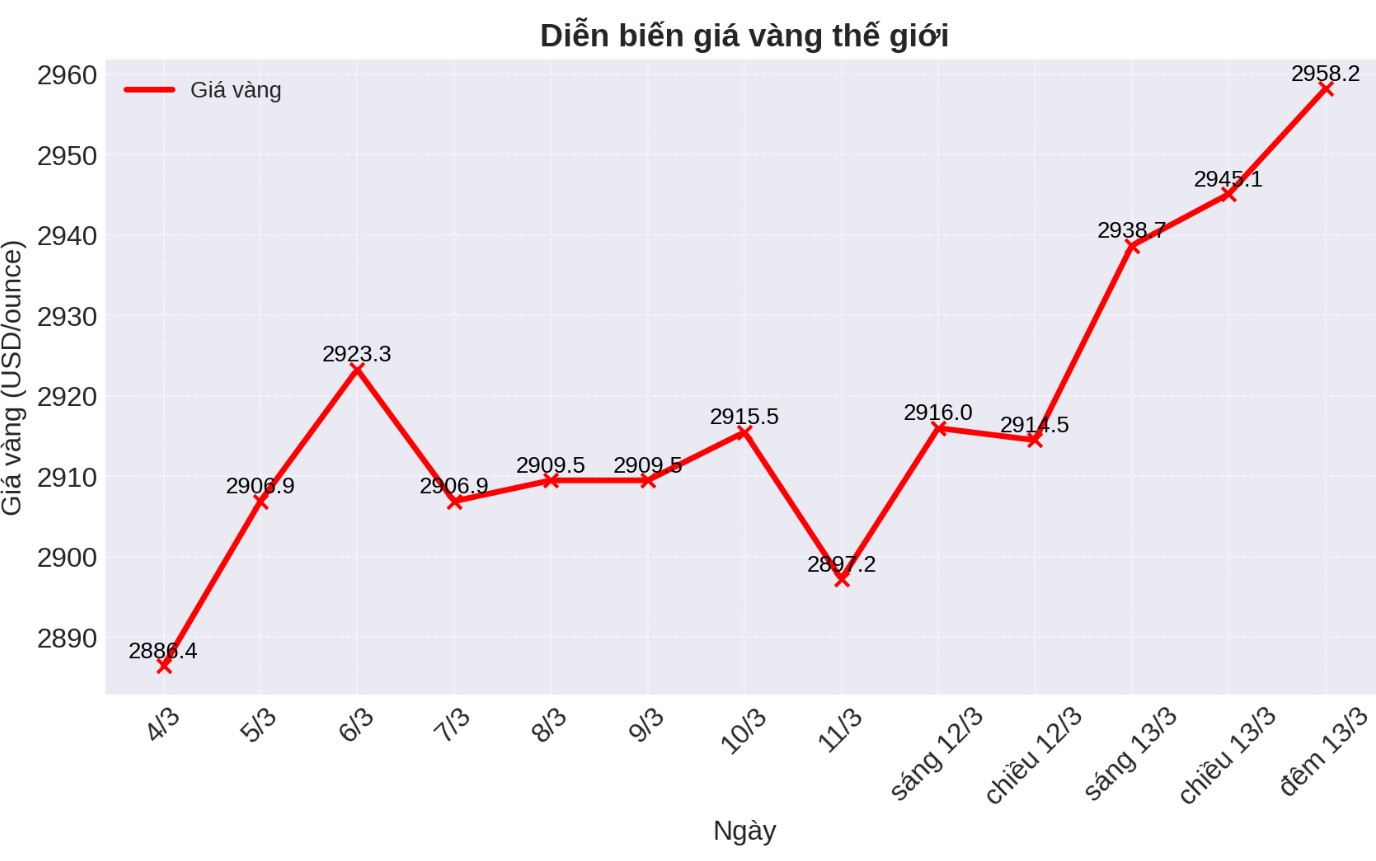

World gold price

As of 9:40 p.m., the world gold price listed on Kitco was at 2,958.2 USD/ounce, up 22.5 USD/ounce compared to the same time of the previous session.

Gold price forecast

World gold prices increased despite the high USD. Recorded at 9:40 p.m. on March 13, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 103.780 points (up 0.22%).

Gold prices increased as buyers continued to be supported by a weaker-than-expected inflation report. Meanwhile, silver prices fell slightly due to pressure to adjust after a strong increase earlier in the week.

Gold futures for April increased by 9.5 USD to 2,955.3 USD/ounce. The May silver contract fell by 0.083 USD to 33.66 USD/ounce.

The US producer price index (PPI) report for February showed unchanged levels compared to the previous month, while it was forecast to increase by 0.3% per month. Compared to the 0.4% increase in the January report, this figure shows reduced inflationary pressure. The core PPI (excluding food and energy) even fell 0.1% from the expectation of a 0.3% increase.

Previously, the US consumer price index (CPI) report on Wednesday was also lower than expected. However, today's PPI report did not have a strong impact on the market.

Asian and European stocks traded in opposite directions overnight, while US stocks tended to decrease when entering the trading session in New York. Risk avocation sentiment remains strong this week due to concerns about trade tensions between the US and major partners that could lead the global economy into recession.

The US government is at risk of closing for the first time since December 2018 when Democratic Senators announced they do not support the Republican-pushed temporary spending bill.

According to SP Angel's report, the recovery of the Japanese yen against the USD is disrupting the exchange rate differential in yen, causing selling pressure on the US stock market.

The US economic data due today includes the weekly jobless claims report.

Technically, bulls are still in the short term for April gold. The next target for buyers is to push prices above the resistance level at the contract peak of 2,974 USD/ounce.

On the contrary, the seller aims to pull prices below the important support zone at the low of 2,844.1 USD/ounce last week.

The most recent resistance level: 2,958.9 USD/ounce (peak in the overnight session), followed by 2,974 USD/ounce.

The most recent support level: $2,942.2/ounce (nying in the overnight session), followed by $2,911/ounce (Wednesday's day).

Major outside markets saw Nymex crude oil futures slightly lower, trading around $67.50/barrel. The yield on the 10-year US Treasury note is currently at 4.341%.

Note: The article data compares with the same time of the previous trading session.

See more news related to gold prices HERE...