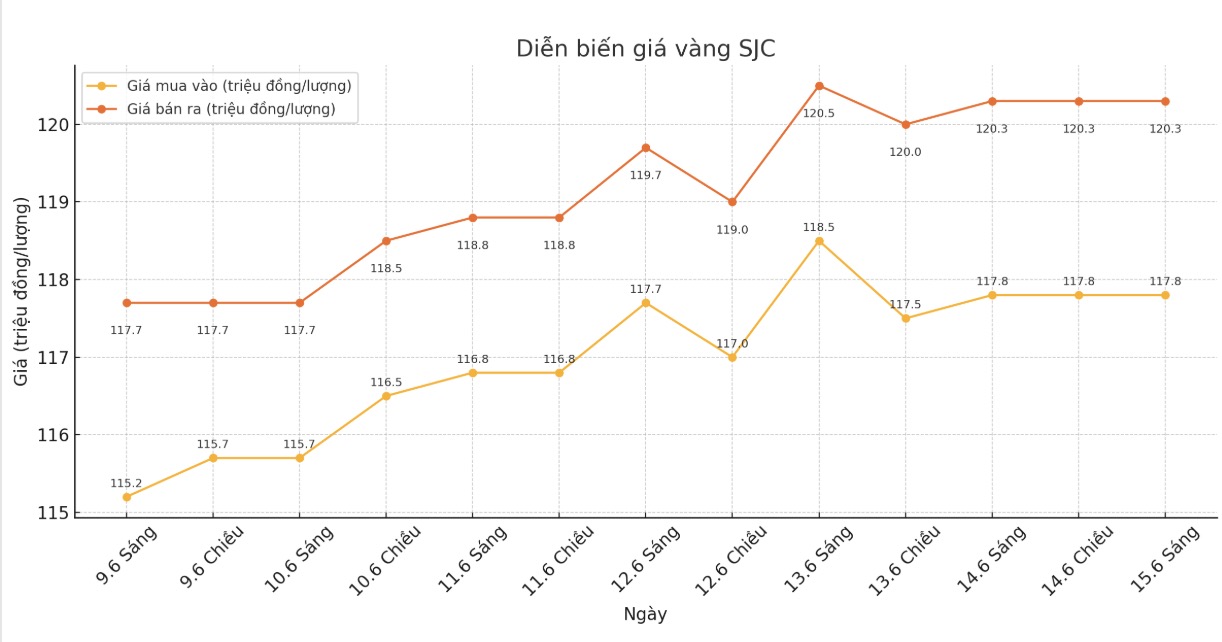

SJC gold bar price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 117.8-120.3 million VND/tael (buy in - sell out); increased by 300,000 VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 117.8-120.3 million VND/tael (buy in - sell out); increased by 300,000 VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 117.8-120.3 million VND/tael (buy in - sell out); increased by 300,000 VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 117-120 million VND/tael (buy - sell); unchanged, the difference between buying and selling prices is at 3 million VND/tael.

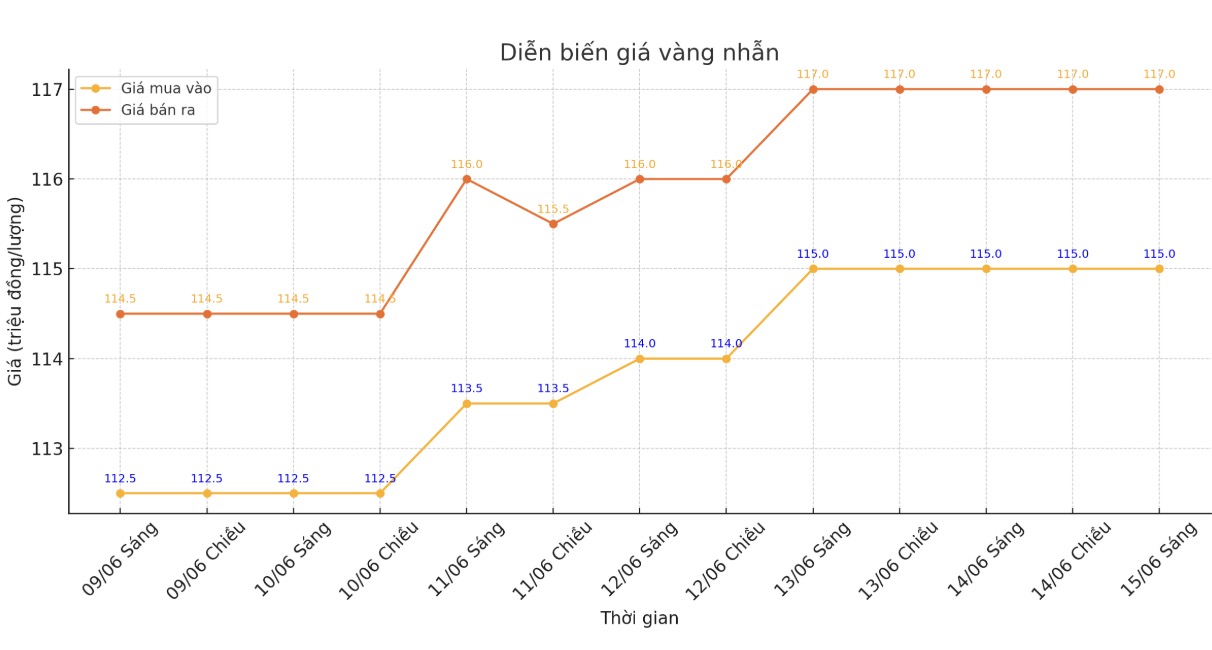

9999 gold ring price

As of 6:00 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 115-117 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116-119 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114-117 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

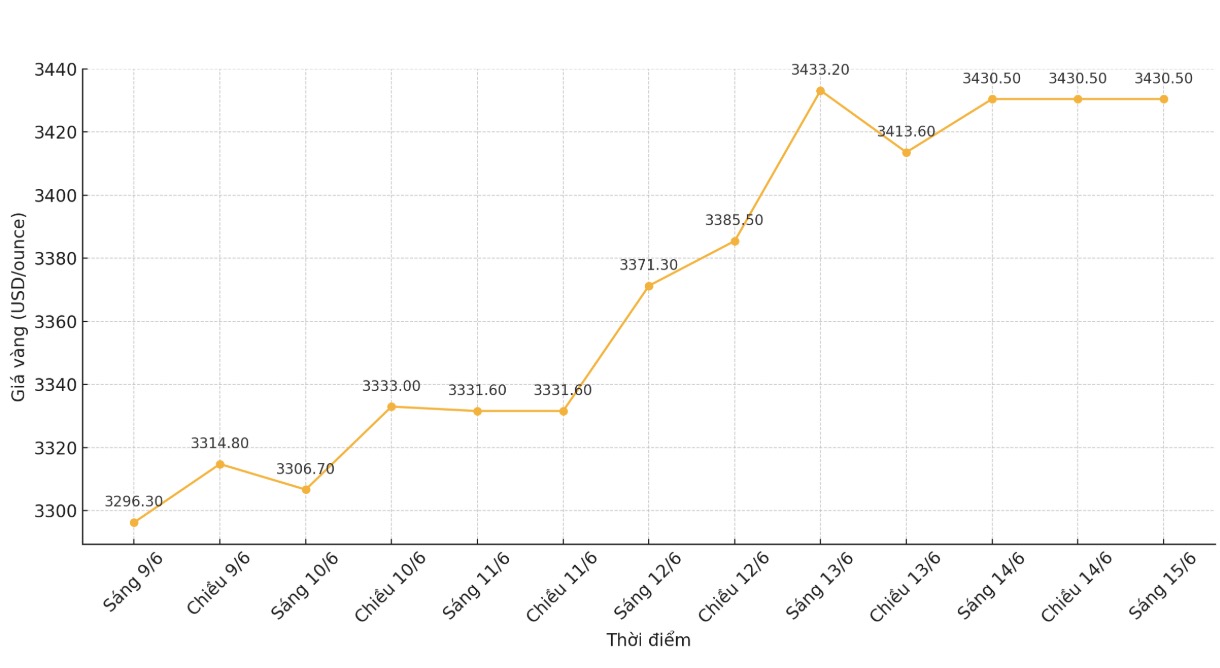

World gold price

The world gold price was listed at 6:00 a.m. at 3,430.5 USD/ounce.

Gold price forecast

Gold prices have had a strong increase in recent days, supported by the weakening of the USD and tense geopolitical factors.

Analysts say that gold is a safe haven in the context of increased instability in global financial markets.

This increase was driven by a sharp decline in the USD amid concerns about economic recession and unstable political factors. The weakness of the US dollar makes gold more attractive to investors, leading to a strong buying wave. At the same time, investors are also looking to gold to protect their assets in the context of high US interest rates, creating more pressure on the USD.

One of the key factors pushing gold prices up is uncertainty about the global economic and political situation. Experts say that the instability in the US economy, along with the decision of the US Federal Reserve (FED) to keep interest rates unchanged, has further attracted investors to gold.

Neil Welsh, head of metals at Britannia Global Markets, also gave a positive view on gold: In general, the current gold rally shows no signs of weakening.

In fact, if someone bet on gold going down at this time, it would be a rather risky decision. Basic market factors still support gold, and there is no change in the momentum to boost gold prices in the near future. In particular, factors such as the Fed's monetary policy, global political instability, and trade negotiations are all factors that favor gold as a safe asset.

In addition to the weakening of the US dollar, one of the reasons why gold prices cannot decrease in the coming time is that fundamental market factors are still supporting gold. Experts say that with the unstable geopolitical situation and no signs of strong changes in monetary policies, gold prices will maintain a steady increase in the coming time.

Another factor that has driven gold prices in recent times is the price increase of other precious metals such as silver and platinum. Investors have shifted to gold as a primary investment asset in this context. However, despite a strong increase, gold has not yet reached the historical peak of 3,500 USD/ounce it reached in April. This proves that despite the recovery of the US dollar, gold prices have maintained their upward momentum.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...