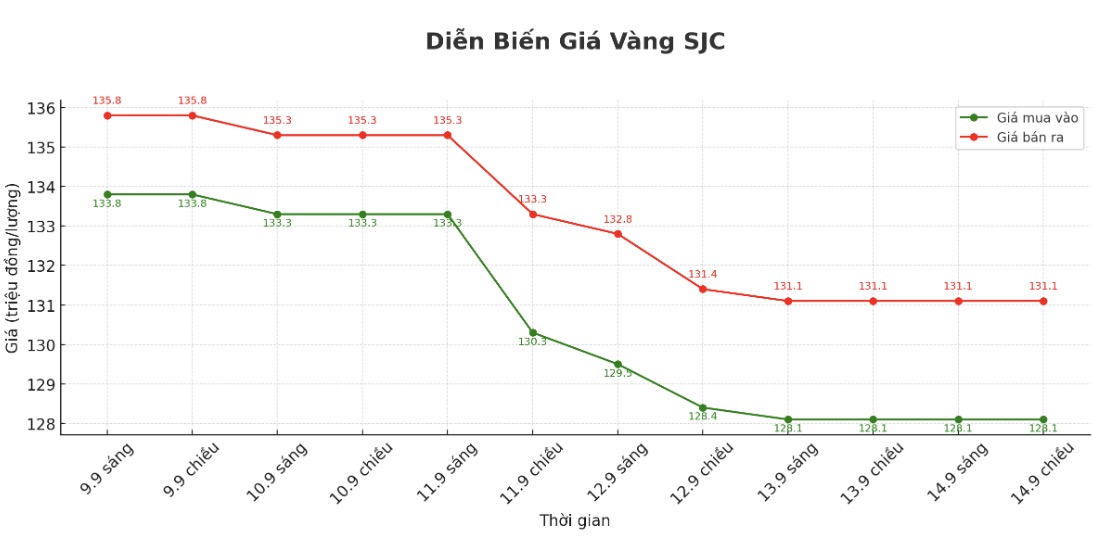

SJC gold bar price

As of 6:00 a.m., the price of SJC gold bars was listed by DOJI Group at 128.1-131.1 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 128.1-131.1 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 127.5-131.1 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 3.6 million VND/tael.

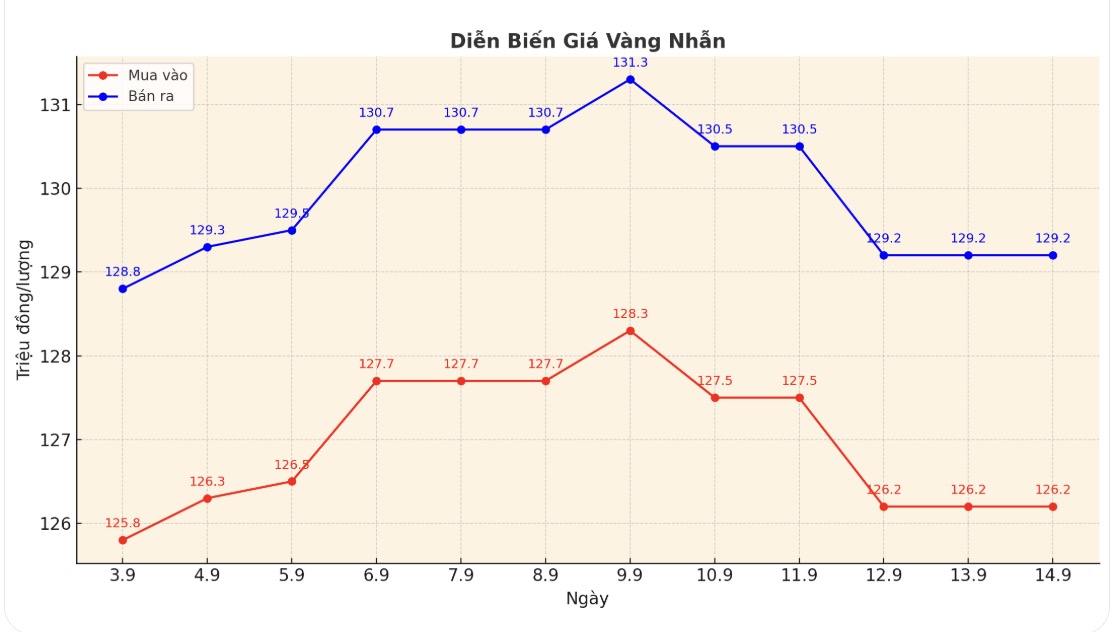

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 126.2-129.2 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 127-130 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 125.5-128.5 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Currently, the difference between buying and selling gold rings is at a very high level, around 3 million VND/tael, posing a potential risk of loss for investors.

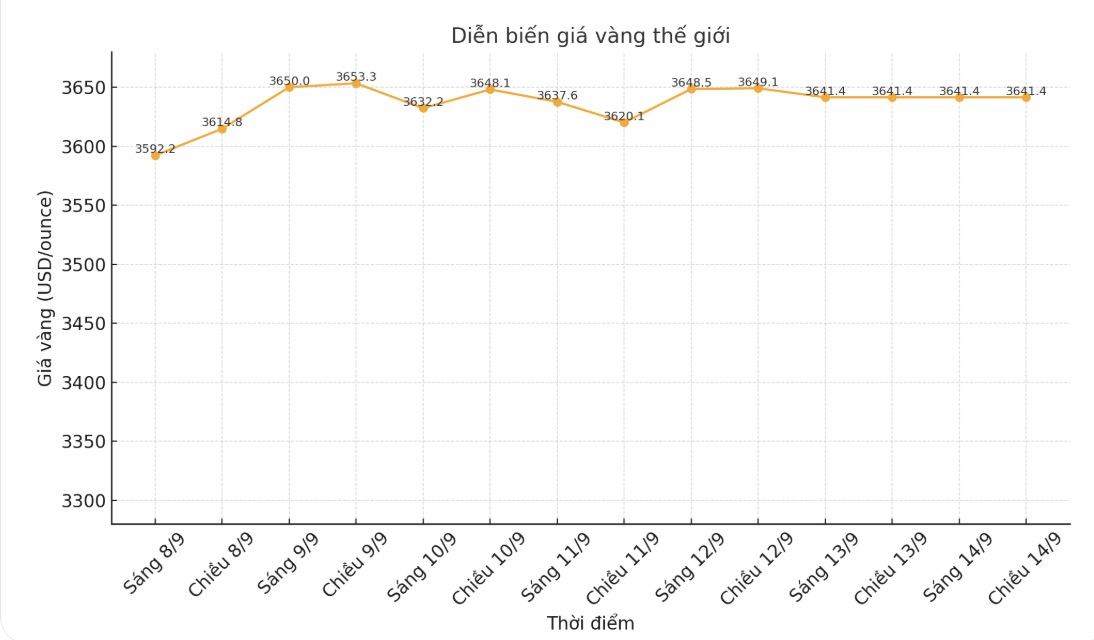

World gold price

The world gold price was listed at 6:00 a.m. at 3,641.4 USD/ounce.

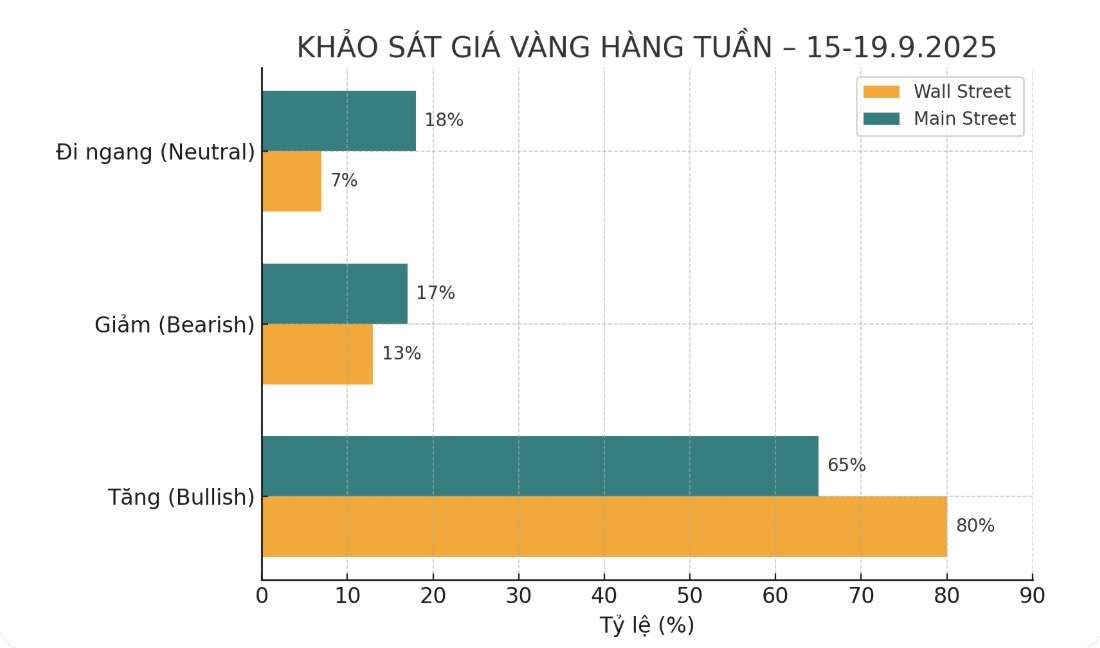

Gold price forecast

The latest weekly gold survey with Wall Street experts shows that the majority are still overwhelmingly optimistic despite gold prices anchored around their all-time highs.

Of the 15 analysts, 12 experts (equivalent to 80%) predict gold prices will increase this week. Only 2 people (accounting for 13%) predict prices will decrease. The remaining expert (accounting for 7%), said that gold prices will move sideways.

Darin Newsom, senior market analyst at Barchart, said that the current global landscape has not changed much, and policy uncertainty continues to drive demand for shelter. Gold prices will increase, he said.

Meanwhile, Rich Checkan - Chairman and CEO of Asset Strategies International said that if the expectation of the US Federal Reserve (FED) cutting interest rates at the next meeting becomes a reality, gold will certainly benefit. Higher prices are inevitable. However, if the Federal Open Market Committee (FOMC) unexpectedly keeps interest rates unchanged, the market could see a sell-off due to profit-taking.

James Stanley, senior market strategist at Forex, said there was no sign that the rally was over. The continued strength of gold prices despite persistent inflation is a signal of market confidence in the possibility of the Fed soon shifting monetary policy.

In this context, gold continues to be considered a safe haven, with the prospect of maintaining a high price zone in the short term.

Notable economic data this week

This week will be an important week with a series of major economic information, including many interest rate decisions by central banks - including the FED - and many data that can strongly impact the market.

Empire State manufacturing survey will be released on Monday, followed by the US Retail Sales report for August on Tuesday morning.

By Wednesday, the market will receive data on Construction Starting Houses and Construction Permits for August. Then there is the monetary policy decision of the Bank of Canada (BoC), before all eyes were on Washington for the FED's interest rate announcement and Chairman Jerome Powell's press conference in the afternoon.

There will be a monetary policy decision by the Bank of England (BoE) on Thursday morning, followed by a US weekly jobless claims report and a Philly Fed manufacturing survey.

The economic week ended with the monetary policy decision of the Bank of Japan (BoJ) on Thursday evening.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...