Updated SJC gold price

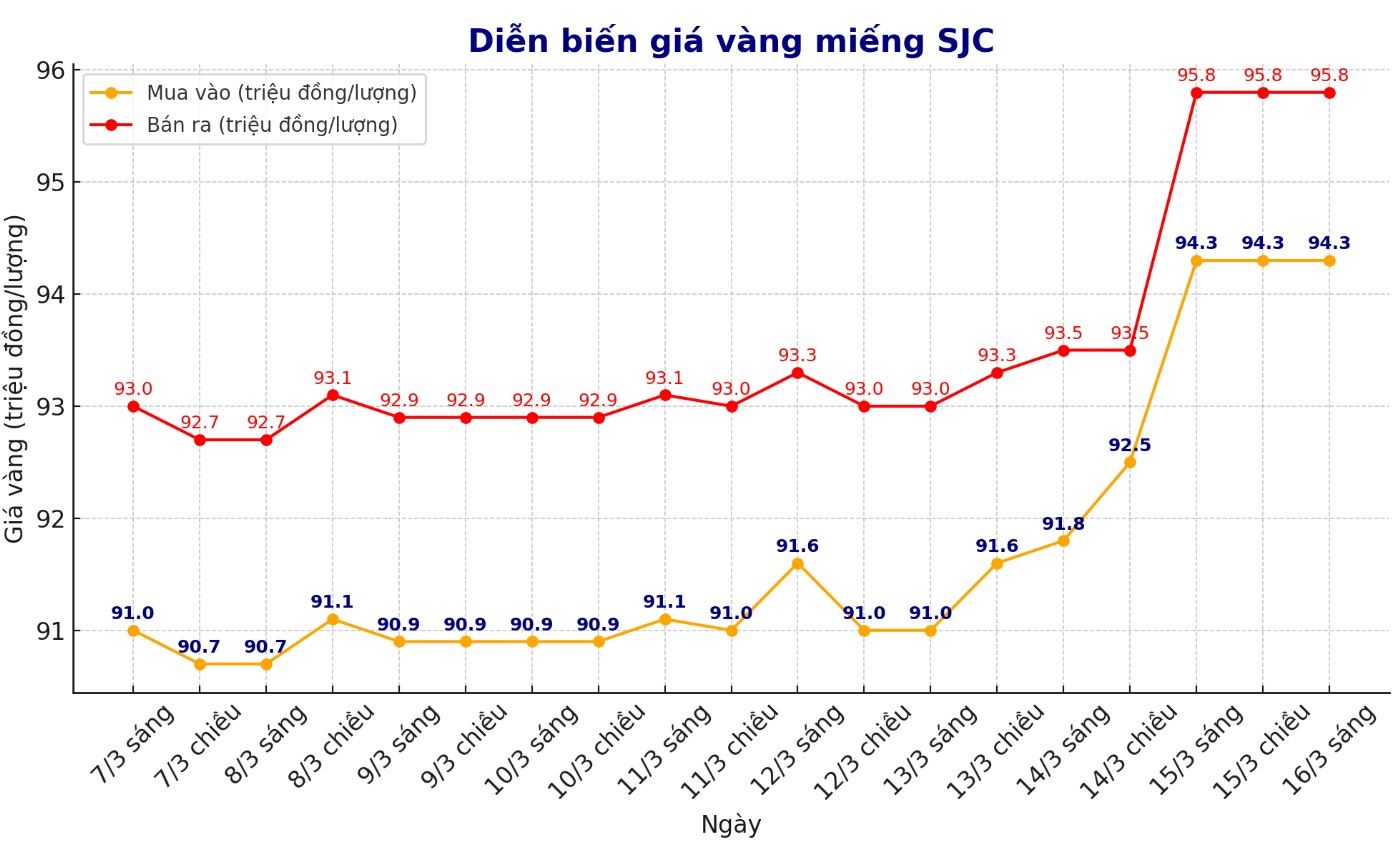

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND94.3-95.8 million/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at VND94.3-95.8 million/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at VND94.5-95.8 million/tael (buy - sell), an increase of VND100,000/tael for buying and kept the same for selling. The difference between the buying and selling prices of SJC gold is listed at 1.3 million VND/tael.

9999 round gold ring price

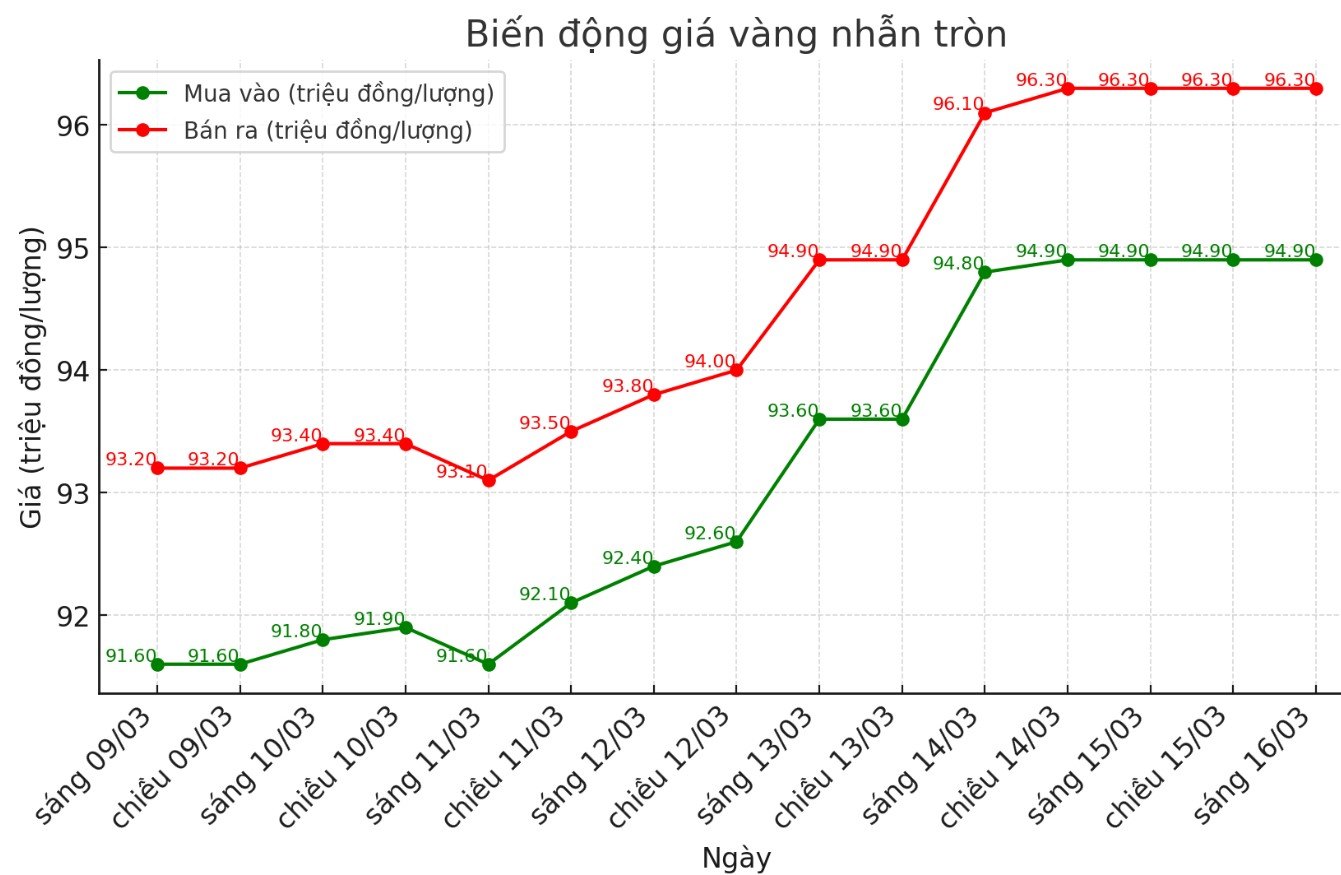

As of 6:00 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI is listed at VND94.9-96.3 million/tael (buy in - sell out); both buying and selling prices remain unchanged. The difference between buying and selling is listed at 1.4 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 95-96.6 million VND/tael (buy - sell); increased by 50,000 VND/tael for buying and increased by 100,000 VND/tael for selling. The difference between buying and selling is 1.6 million VND/tael.

World gold price

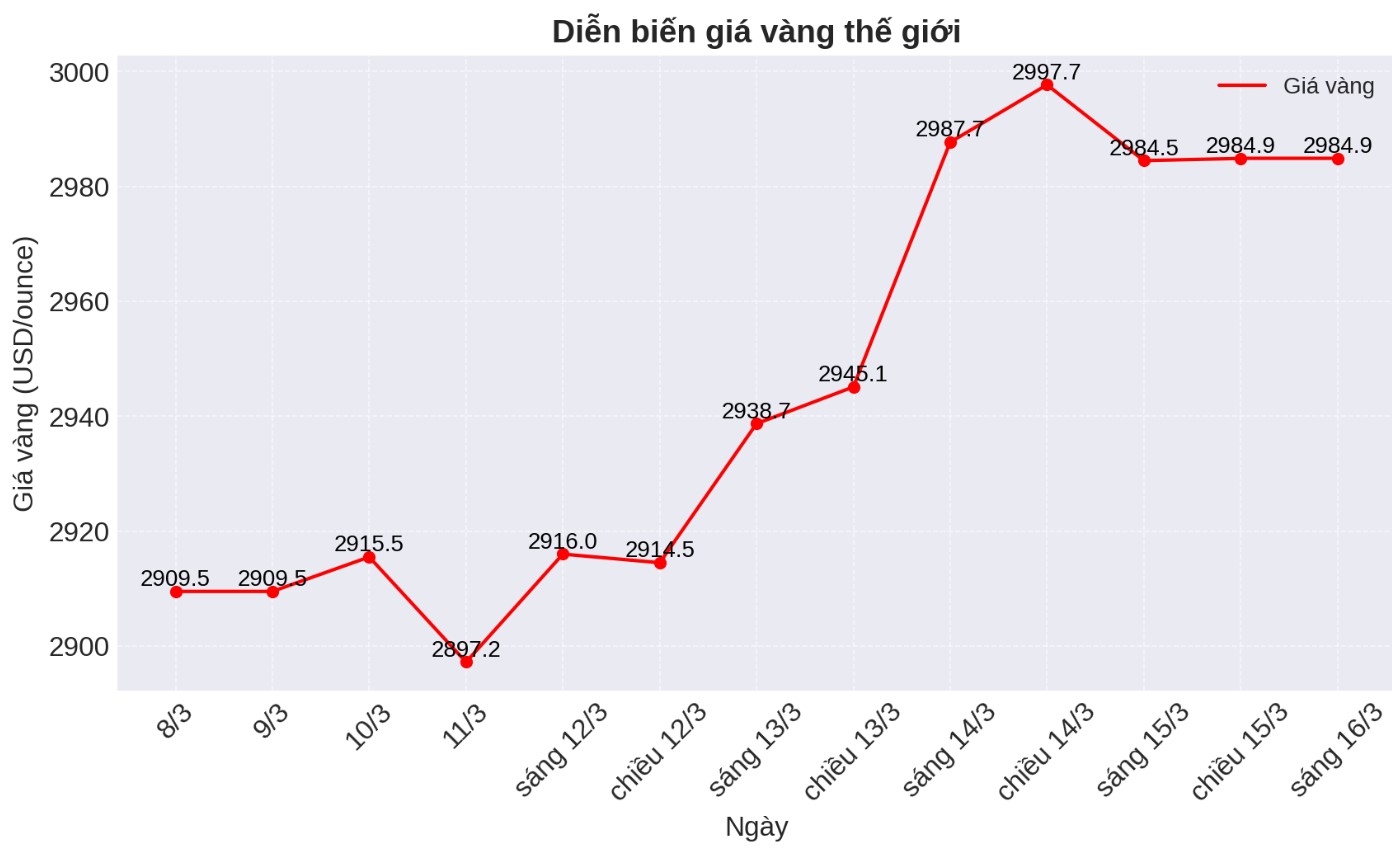

As of 6:00 a.m., the world gold price listed on Kitco was at 2,984.9 USD/ounce.

Gold price forecast

World gold prices fell in the trading session on Friday despite the decline of the USD. Recorded at 6:00 a.m. on March 16, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 103.710 points (down 0.13%).

According to Kitco, world gold prices fell after reaching a record of 3,005 USD/ounce due to profit-taking waves. However, gold prices still receive strong support thanks to weak consumer sentiment and expectations of rising inflation, highlighting concerns about a prolonged recession environment.

The University of Michigan released preliminary results of its consumer psychology survey on Friday, showing that the index fell to 57.9 in March, below the February adjustment of 64.7. The data was well below forecasts, with economists predicting the index will be at 63.1.

According to the survey, consumer sentiment has now declined to its lowest level since November 2022.

Adrian Day, chairman of Adrian Day Asset Management, commented: "Gold prices will increase. The central bank continues to buy strongly, and gold will surpass the $3,000/ounce mark. This round figure is not a barrier for foreign central banks or those who buy gold in their own currency.

Although US President Donald Trump may try to ease trade tensions and come up with a more concrete plan, concerns abroad remain. In addition, North American buyers are finally taking part in the gold buying trend, adding a source of demand that has been absent for the past two years," Day added.

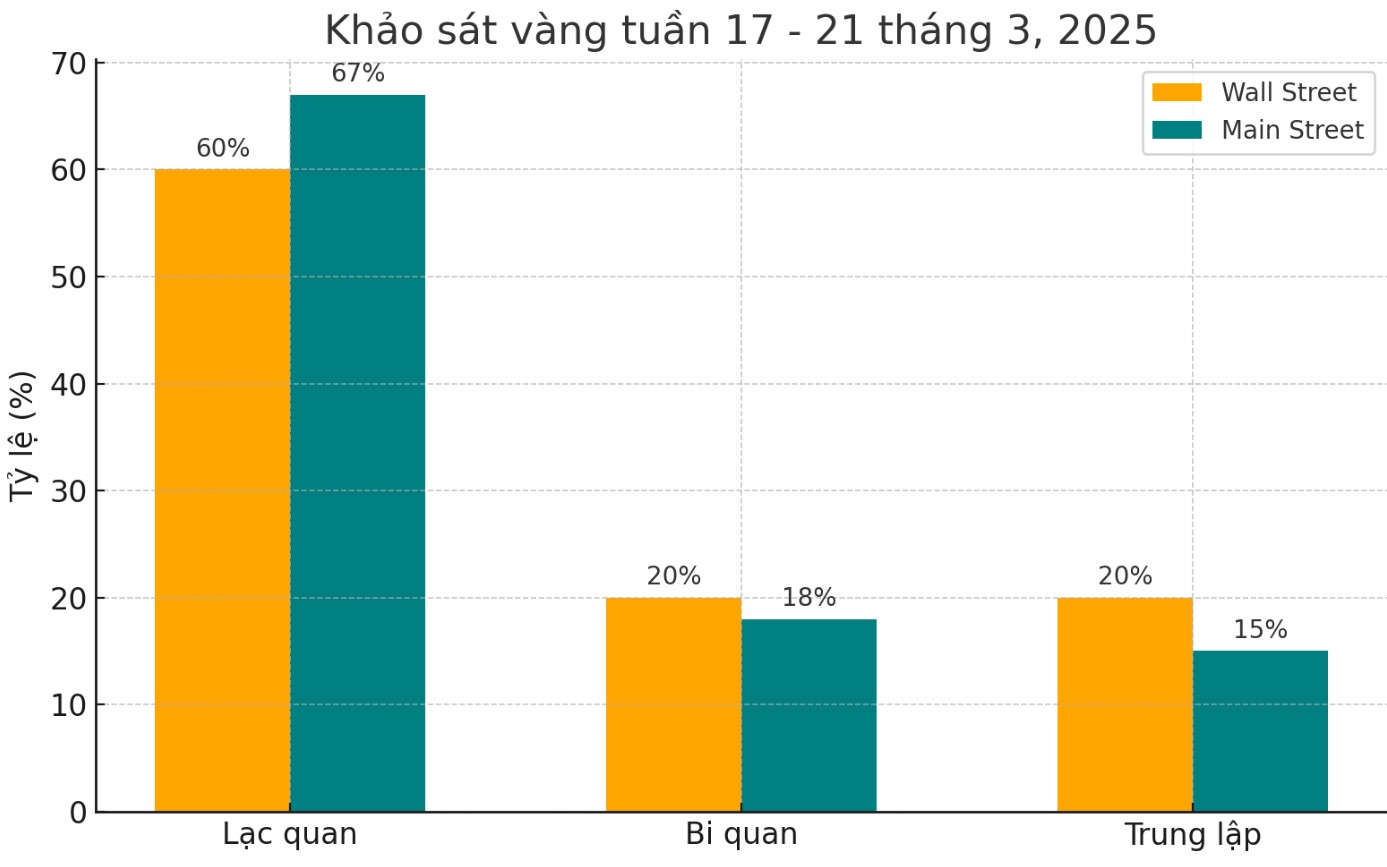

This week, 15 analysts participated in the Kitco News gold survey, with Wall Street reducing optimism compared to last week, although only a little.

Nine experts, or 60%, predict gold prices will continue to rise next week, while three analysts, or 20%, predict gold prices will fall, and the remaining three experts believe that gold prices will fluctuate within a stable range after the important milestone.

Meanwhile, 262 votes participated in Kitco's online survey, with retail investor sentiment almost unchanged from last week.

175 retail traders, or 67%, expect gold prices to surpass $3,000 next week, while another 47 - 18%, predict gold prices will fall. The remaining 40 investors, accounting for 15% of the total, predict gold prices will move sideways in the coming days.

Note: The article data compares with the same time of the previous trading session.

See more news related to gold prices HERE...