Updated SJC gold price

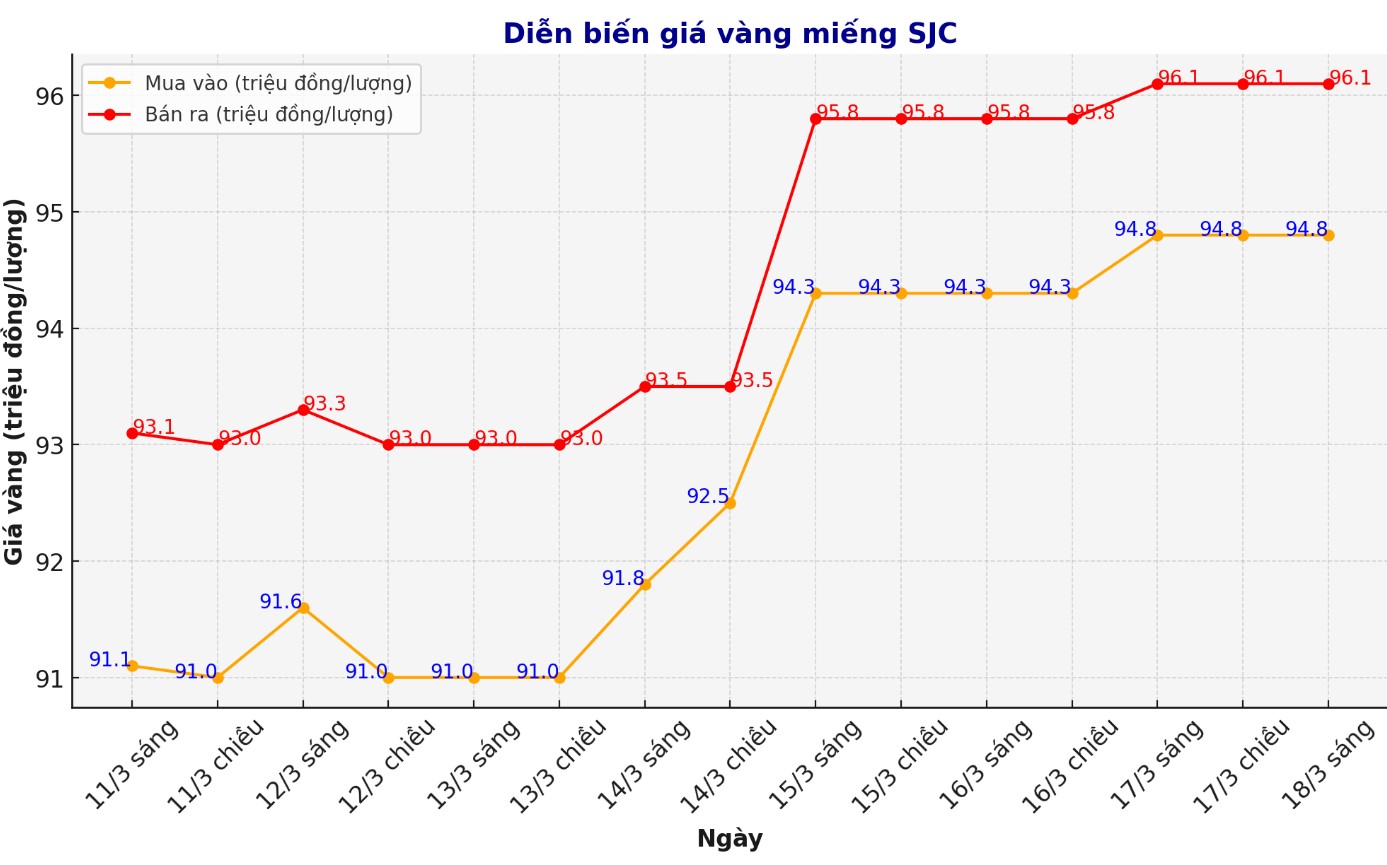

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND94.8-96.1 million/tael (buy - sell), an increase of VND500,000/tael for buying and an increase of VND300,000/tael for selling. The difference between buying and selling prices is at 1.3 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at VND94.8-96.1 million/tael (buy - sell), an increase of VND500,000/tael for buying and an increase of VND300,000/tael for selling. The difference between buying and selling prices is at 1.3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at VND94.8-96.1 million/tael (buy - sell), an increase of VND400,000/tael for buying and an increase of VND300,000/tael for selling. The difference between the buying and selling prices of SJC gold is listed at 1.3 million VND/tael.

9999 round gold ring price

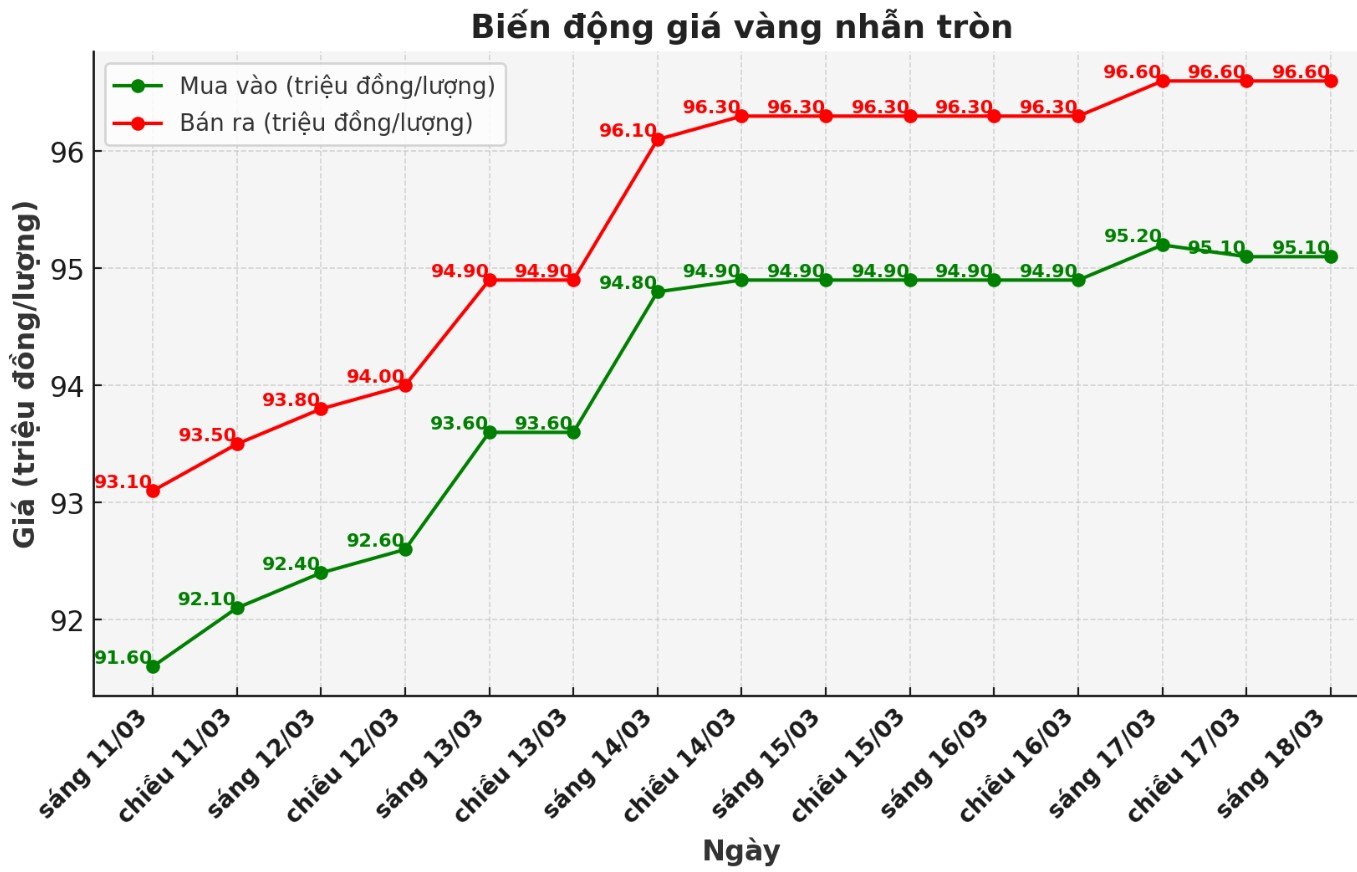

As of 6:00 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND95.1-96.6 million/tael (buy - sell); increased by VND200,000/tael for buying and increased by VND300,000/tael for selling. The difference between buying and selling is listed at 1.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 95.2-96.8 million VND/tael (buy - sell); increased by 250,000 VND/tael for buying and increased by 300,000 VND/tael for selling. The difference between buying and selling is 1.6 million VND/tael.

World gold price

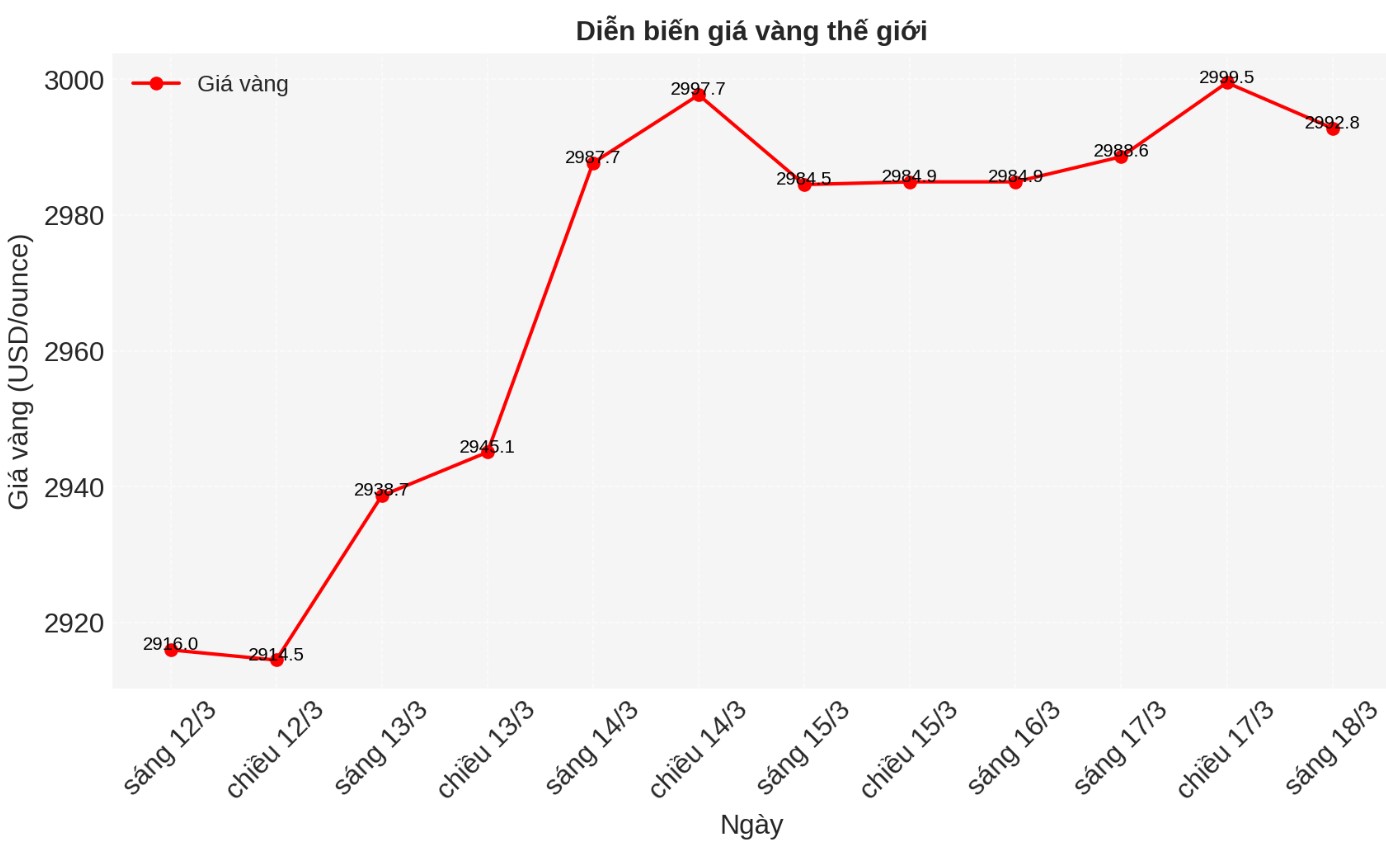

As of 0:00, the world gold price listed on Kitco was at 2,992.8 USD/ounce. Although there is a downward trend, compared to early this morning, prices have increased slightly.

Gold price forecast

World gold prices increased slightly in the context of the USD decreasing. Recorded at 0:00 on March 18, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 102.995 points (down 0.36%).

Gold prices edged up in the US midday trading session and remained near last week's record high. Meanwhile, silver futures fell slightly.

Safe-haven demand continues to be high due to concerns about the risk of a global trade war, along with signals from optimistic technical charts and expectations of a looser monetary policy from the US Federal Reserve (FED), helping to keep precious metal prices stable.

Gold futures for April increased by $3.5 to $3,004.8/ounce. The price of silver futures for May fell by 0.208 USD, down to 34.23 USD/ounce.

The focus of this week's market is the Federal Open Market Committee (FOMC) meeting, which began on Tuesday morning and ended on Wednesday afternoon with an official announcement and a press conference by Fed Chairman Jerome Powell.

Investors do not expect the Fed to change interest rates at this meeting but will closely monitor every word in the FOMC statement as well as Mr. Powell's statement.

Technically, April gold buyers still dominated in the short term. The next target for buyers is to get prices above a solid resistance level at $3,100/ounce.

On the contrary, the sellers need to push prices below the important support level at 2,900 USD/ounce to regain control.

The first resistance level is 3,017.1 USD/ounce, followed by 3,025 USD/ounce. The first support level is 2,988.6 USD/ounce, followed by 2,974 USD/ounce.

Major outside markets saw US light crude oil (WTI) prices increase, trading around 67.75 USD/barrel. The yield on the 10-year US Treasury note is currently at 4.266%.

Note: The article data compares with the same time of the previous trading session.

See more news related to gold prices HERE...