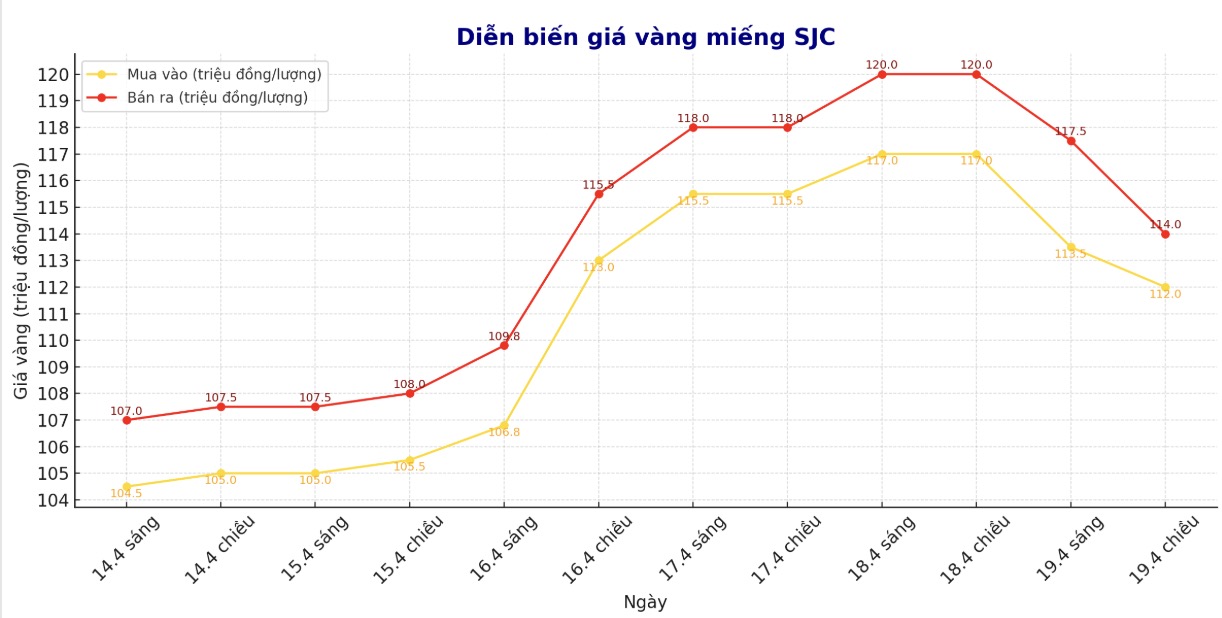

Updated SJC gold price

As of 6:00 a.m., the price of SJC gold bars was VND112-114 million/tael (buy - sell); down VND5 million/tael for buying and down VND6 million/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, DOJI Group listed the price of SJC gold bars at VND112-114 million/tael (buy - sell); down VND5 million/tael for buying and down VND6 million/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 112-114 million VND/tael (buy - sell); down 5 million VND/tael for buying and down 6 million VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

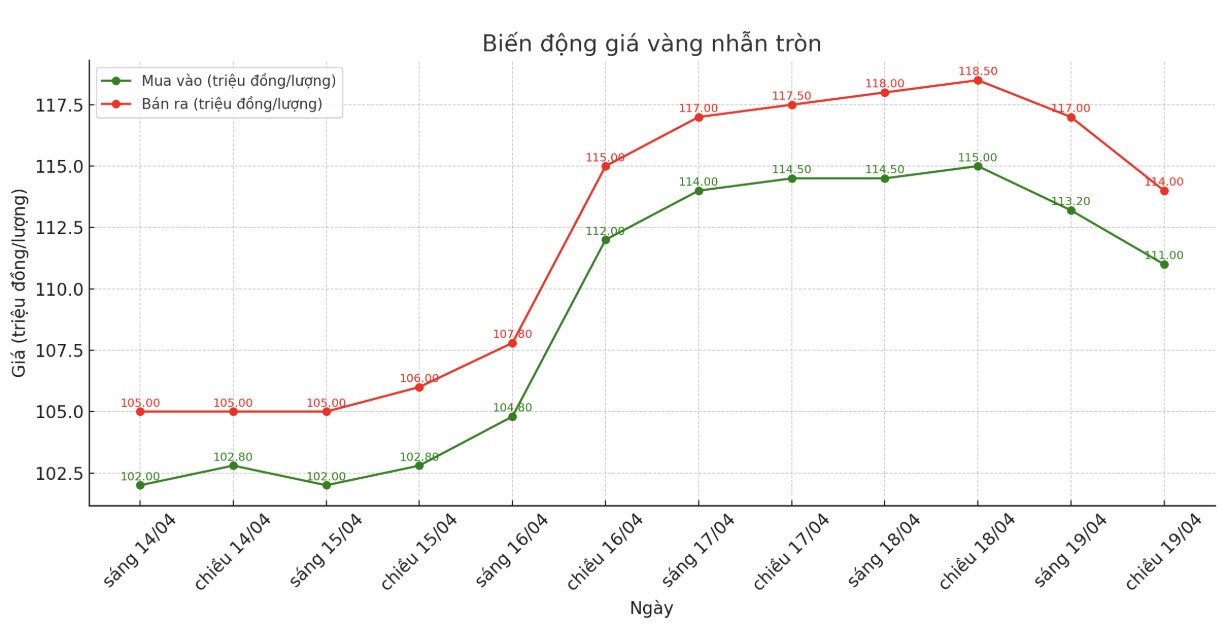

9999 round gold ring price

As of 6:00 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 109.5-113.5 million VND/tael (buy - sell); down 5.5 million VND/tael for buying and down 5 million VND/tael for selling. The difference between buying and selling prices is at 4 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 111-114 million VND/tael (buy - sell); down 5.5 million VND/tael for both buying and selling compared to early in the morning. The difference between buying and selling prices is at 3 million VND/tael.

Domestic gold prices fell sharply after the Deputy Prime Minister requested to strengthen inspection, examination and strict handling of violations, preventing speculation and manipulation of gold prices.

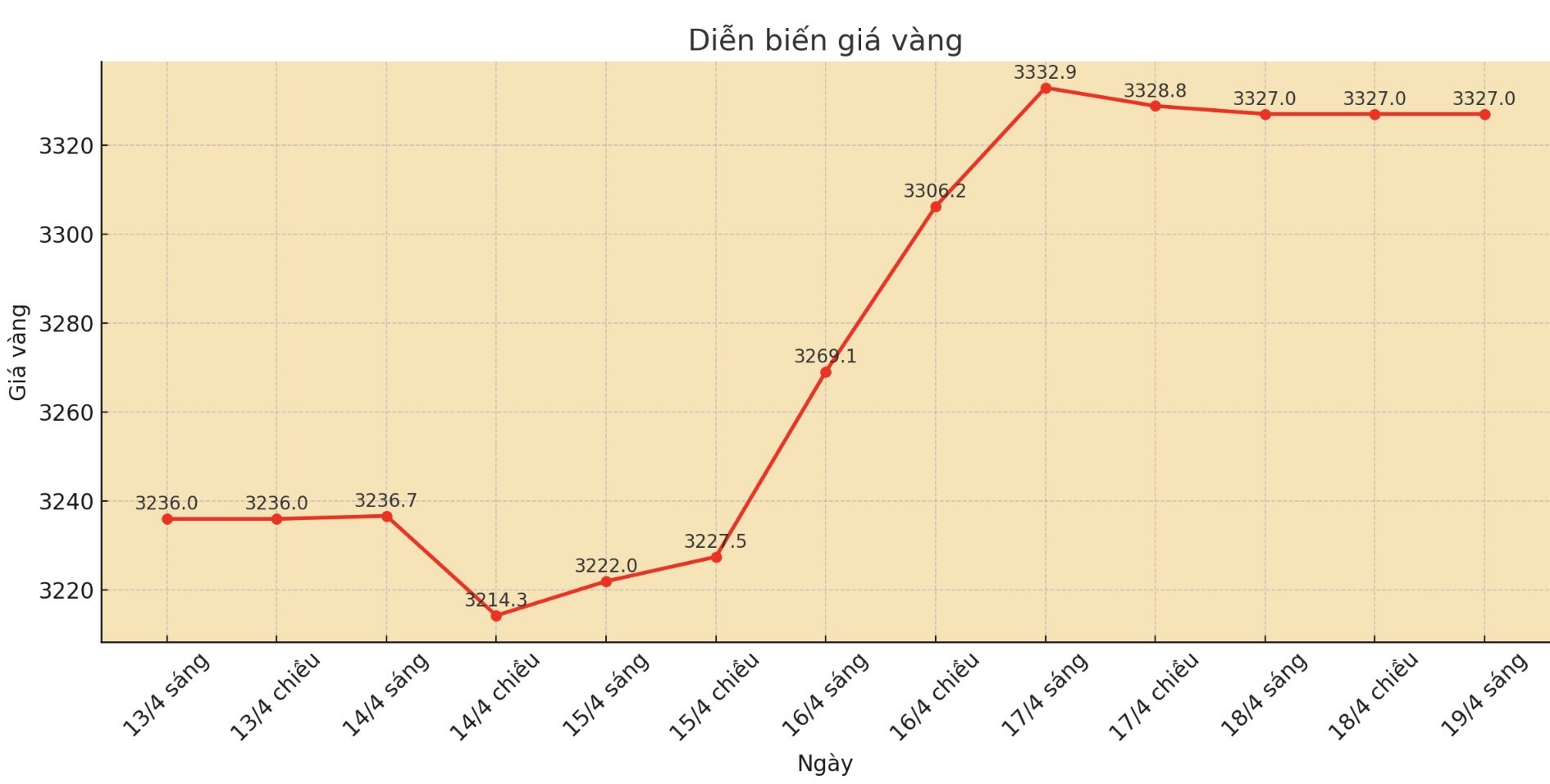

World gold price

As of 6:00 a.m. on April 19, the world gold price was listed at 3,327 USD/ounce.

Gold price forecast

The latest weekly gold survey from Kitco News shows that both Wall Street experts and individual investors are being more cautious as gold prices surpass the $3,300/ounce mark a price zone considered view-high.

This week, 16 analysts participated in the Kitco News survey. Compared to last week when most were optimistic, Wall Street analysts this week have eased their excitement, although most still expect gold prices to continue to rise.

10 people (63%) predict gold prices will increase next week. Meanwhile, four (25%) see prices falling. The remaining two (12%) see gold prices moving sideways around the new peak.

Kitco's online survey also recorded 312 participants from the group of individual investors. Of these, 195 people (63%) see gold prices continuing to rise next week, 57 people (18%) see prices falling, and the remaining 60 people (19%) see prices moving sideways.

Mr. Christopher Vecchio - Director of futures and foreign exchange contracts at Tastylive.com - said that gold will continue to benefit if the USD continues to weaken. This expert believes that although the USD has not lost its position as a global reserve currency, the unstable trade policy of US President Donald Trump has weakened the US position.

Expert David Morrison - Senior Analyst at Trade Nation - said that the strong increase of 100 USD on Wednesday was the "peak of the current price increase".

He commented: In just one week, gold has increased by 13% (ie 360 USD). Therefore, it is not surprising if prices adjust slightly. The MacD index is also in the same overbought range as its peak in 2011. Although that does not mean that prices cannot continue to increase, investors should be cautious.

Economic data to watch next week

Wednesday: Preliminary manufacturing and service PMI, new home sales in the US

Thursday: Long-term goods orders, weekly jobless claims, US home sales

See more news related to gold prices HERE...