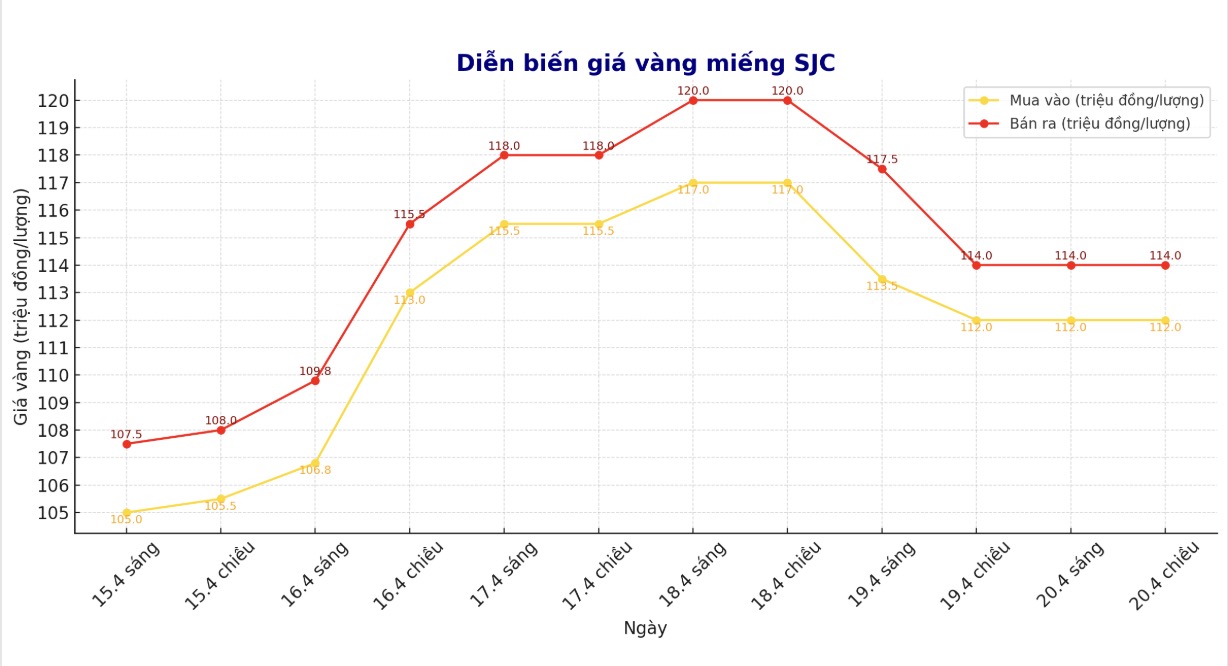

Updated SJC gold price

As of 6:00 a.m., the price of SJC gold bars was VND112-114 million/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 112-114 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 112-114 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

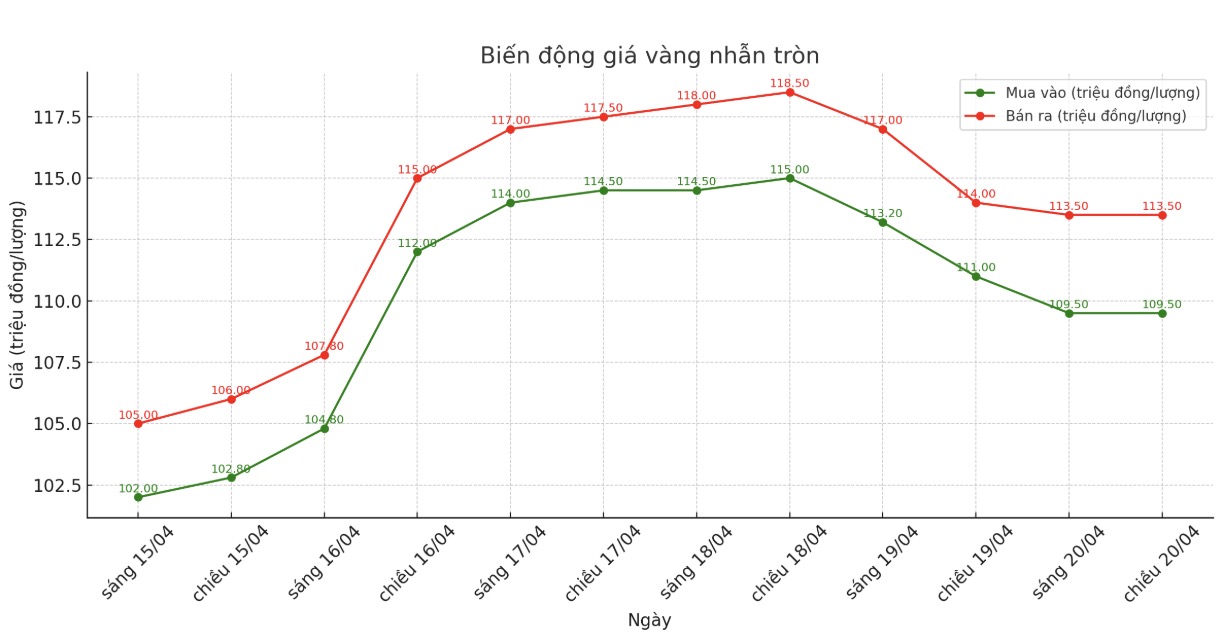

9999 round gold ring price

As of 6:00 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 109.5-113.5 million VND/tael (buy in - sell out).

Bao Tin Minh Chau listed the price of gold rings at 110.8-114 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 3.2 million VND/tael.

Domestic gold prices fell sharply last weekend after the Deputy Prime Minister requested to strengthen inspection, examination and strict handling of violations, preventing speculation and manipulation of gold prices.

The Government Office issued Document No. 3332/VPCP-KTTH dated April 18, 2025, conveying the direction of Central Party Committee member and Deputy Prime Minister Ho Duc Phoc on the domestic gold price developments.

Considering the quick report of the Government Office on the domestic gold price developments on April 18, 2025, Deputy Prime Minister Ho Duc Phoc gave instructions:

The State Bank of Vietnam shall preside over and coordinate with agencies to closely monitor the situation and developments of the financial, monetary, foreign exchange markets, and domestic and international gold markets to urgently implement solutions according to regulations to stabilize the gold market.

Further strengthen inspection, examination and strictly handle violations according to regulations, do not let profiteering, manipulation, price manipulation, speculation... occur in the gold market in accordance with the direction of the Government leader in document No. 1483/VPCP-KTTH dated April 4, 2025.

The Deputy Prime Minister also requested proactive implementation of communication and communication measures immediately to stabilize social psychology.

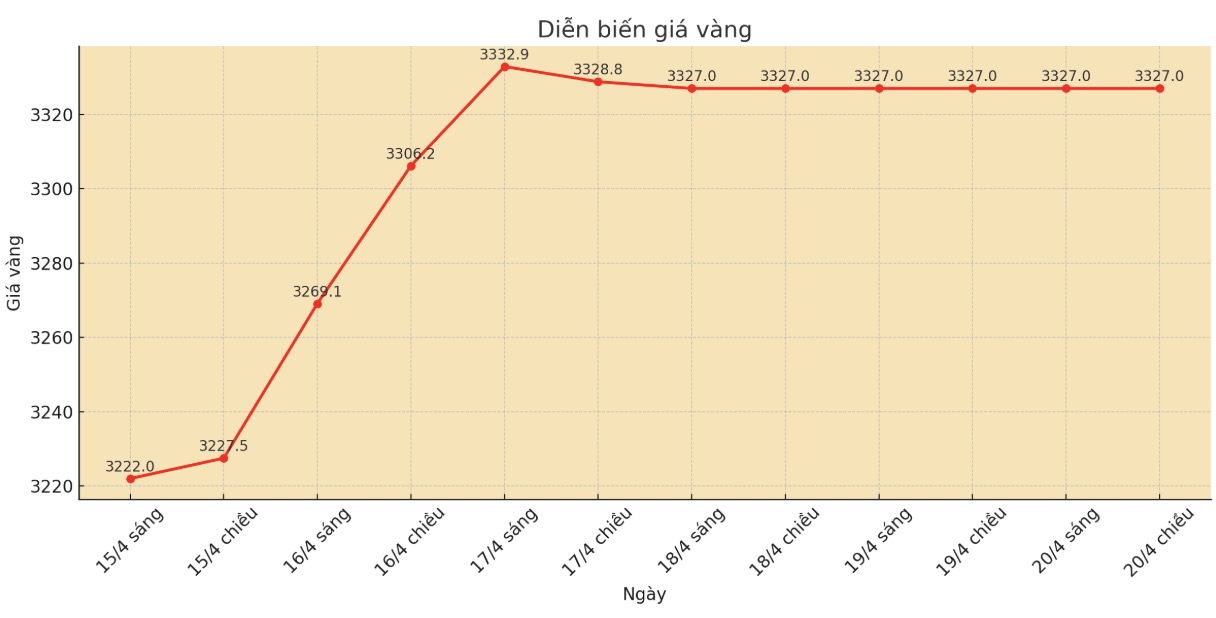

World gold price

As of 6:00 a.m. on April 21, the world gold price was listed at 3,327 USD/ounce.

Gold price forecast

This week, 16 analysts participated in the Kitco News survey. Compared to last week when most were optimistic, Wall Street analysts this week have eased their excitement, although most still expect gold prices to continue to rise.

10 people (63%) predict gold prices will increase this week. Meanwhile, four (25%) see prices falling. The remaining two (12%) see gold prices moving sideways around the new peak.

Kitco's online survey also recorded 312 participants from the group of individual investors. Of these, 195 people (63%) see gold prices continuing to rise this week, 57 people (18%) see prices falling, and the remaining 60 people (19%) see prices moving sideways.

Alex Kuptsikevich - Senior Analyst at FxPro - commented that gold has regained its upward momentum since hitting the 50-day moving average early last week. He assessed this as a signal to end the adjustment period that has lasted since the end of December 2024.

We expect gold to surpass $3,500/ounce in the short term. Currently, the price is about 60% higher than the 200-week moving average. If it reaches $3,540 an ounce, the difference would be 70% equivalent to the peak in 2011 before entering the market, he said.

With the same optimism, Jim Wyckoff - an expert at Kitco, said that there is no factor hindering the current uptrend, as the technical chart maintains a positive signal and the demand for gold as a safe haven is still very strong.

Marc Chandler - CEO at Bannockburn Global Forex - commented: "Gold has reached a record high of nearly 3,358 USD and seems to be accumulating at a time when the market has few transactions due to the holiday season".

Meanwhile, Rich Checkan - President and COO of Asset Strategies International - predicted: " Prices will decrease. I fully expect a profit-taking after gold surpassed $3,300/ounce on Wednesday. This is the time to adjust and build a support zone around this new high.

Economic data to watch

Wednesday: Preliminary manufacturing and service PMI, new home sales in the US

Thursday: Long-term goods orders, weekly jobless claims, US home sales

See more news related to gold prices HERE...