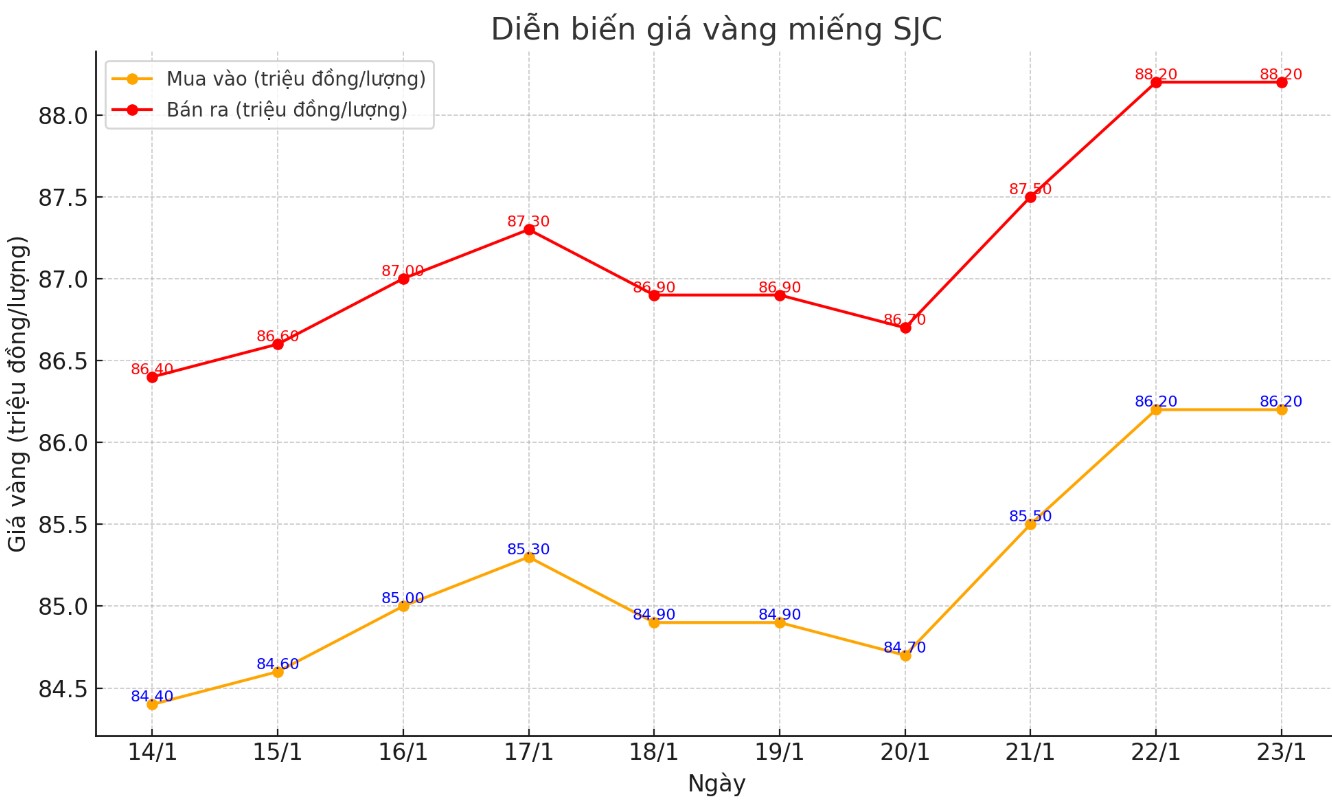

Update SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND86.2-88.2 million/tael (buy - sell); an increase of VND700,000/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 86.2-88.2 million VND/tael (buy - sell); an increase of 700,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 86.2-88.2 million VND/tael (buy - sell); increased by 700,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

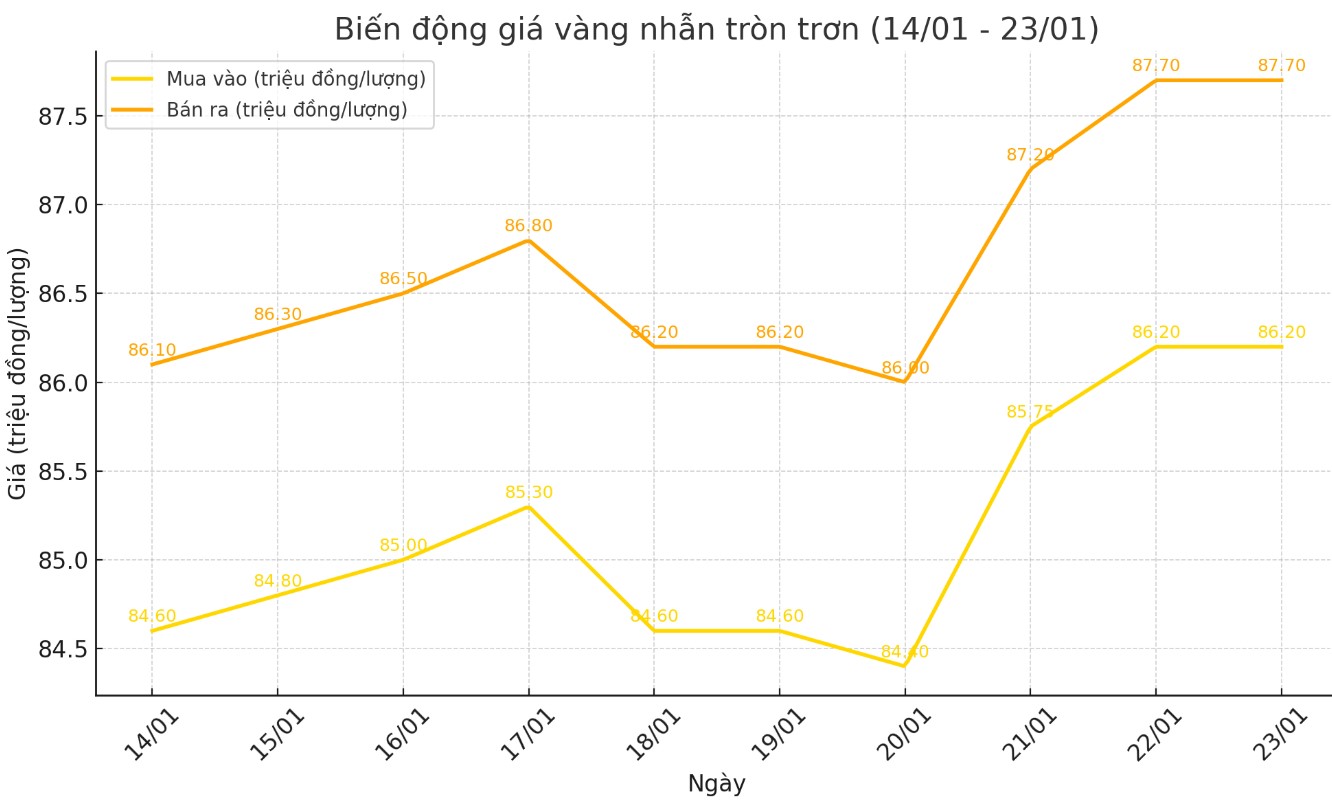

Price of round gold ring 9999

As of 6:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 86.2-87.7 million VND/tael (buy - sell); an increase of 450,000 VND/tael for buying and 500,000 VND/tael for selling compared to the beginning of the trading session yesterday morning.

Bao Tin Minh Chau listed the price of gold rings at 86.2-88.15 million VND/tael (buy - sell), an increase of 700,000 VND/tael for both buying and selling compared to early this morning.

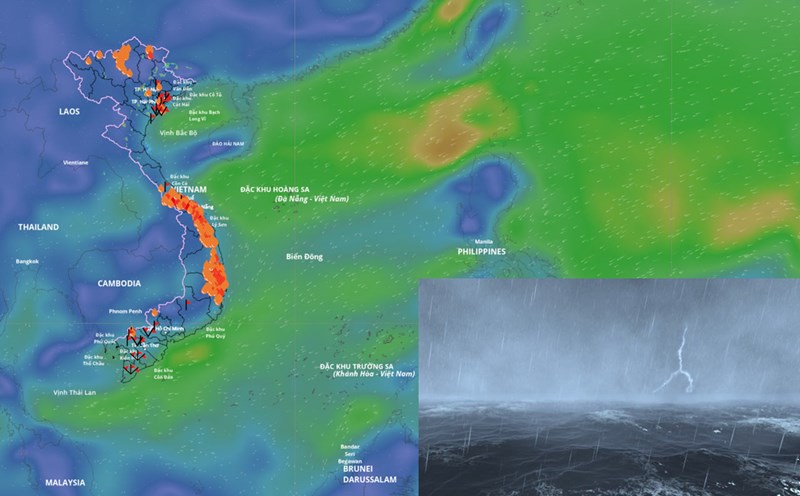

World gold price

As of 1:00 a.m. on January 23, the world gold price listed on Kitco was at 2,756.6 USD/ounce, up 15.5 USD/ounce compared to early this morning.

Gold Price Forecast

World gold prices skyrocketed despite the increase in the USD index. Recorded at 1:00 a.m. on January 23, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 108,010 points (up 0.14%).

According to Kitco, gold prices rose sharply to a 2.5-month high thanks to safe-haven buying in the face of new moves from US President Donald Trump. Gold prices are now approaching a record high. Not only spot gold, the February gold futures contract increased by $10 to $2,769.2 an ounce.

Asian stock markets have been under pressure since Donald Trump threatened to impose a 10% tariff on all imports from China starting on February 1. Meanwhile, European stock indexes such as the Euro Stoxx 50, Germany’s DAX and the UK’s FTSE 100 all hit new record highs. So far, Europe and the UK have not been mentioned by Trump as targets of the new tariffs.

Major overseas markets today saw the US dollar index rise slightly as it recovered from recent losses. Nymex crude oil futures were little changed, trading around $76 a barrel. The yield on the 10-year US Treasury note was at 4.57%.

The February gold futures contract is currently tilted in favor of the bulls, with a clear advantage in the short term. Gold continues to show a steady uptrend on the daily trading chart. In the coming period, if gold can break above the strong resistance at the high of $2,826.30/oz and maintain there, the upward momentum will continue. Conversely, if the bears gain the upper hand, they will try to push the price below the important support at $2,675/oz.

Currently, the first resistance level for gold to overcome is $2,775, followed by $2,800. Meanwhile, the nearest support level is at $2,756.2 (recorded overnight), followed by $2,750.

In his 2025 outlook report, Eric Strand, founder of precious metals company AuAg Funds, predicted that gold prices will surpass $3,000/ounce this year.

“We expect gold to break $3,000 an ounce during the year and could end higher, with a realistic target of $3,300 an ounce,” he said.

Mr. Strand’s bullish price represents a 20% increase from current levels. Mr. Strand believes that the new administration of Donald Trump could usher in a new era of economic stimulus and loose monetary policy.

See more news related to gold prices HERE...