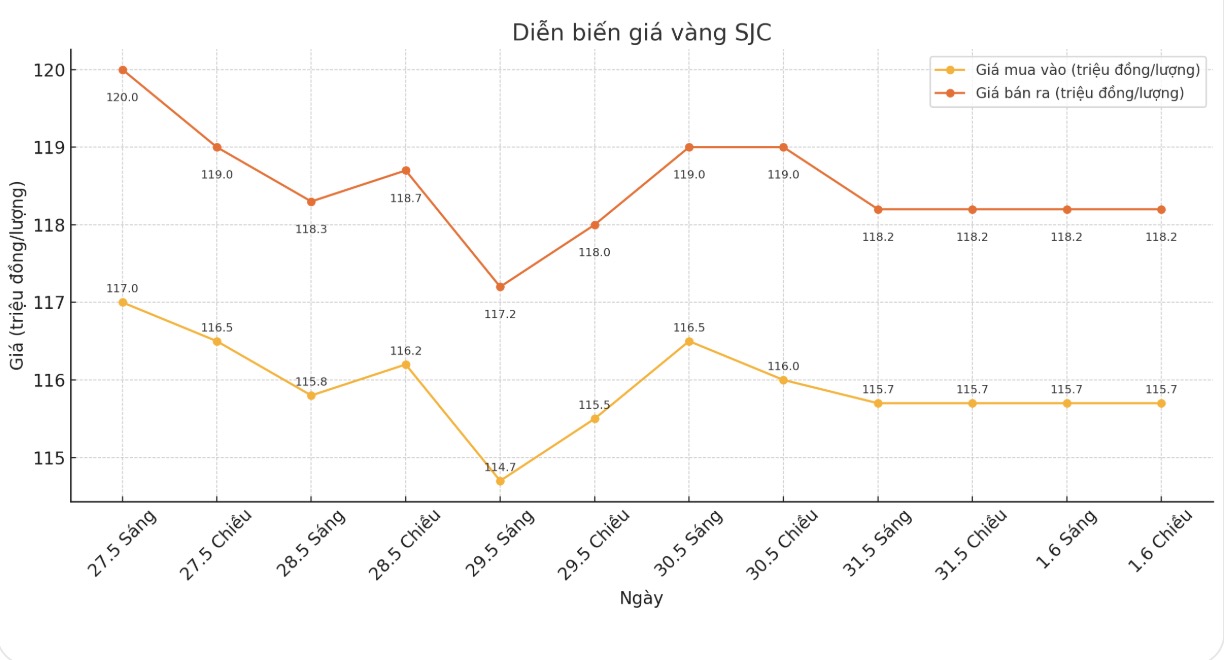

Updated SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND115.7/18.2 million/tael (buy in - sell out). The difference between buying and selling prices is at 2.5 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 115.7-118.2 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 115.7-118.2 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 115-118.2 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 3.2 million VND/tael.

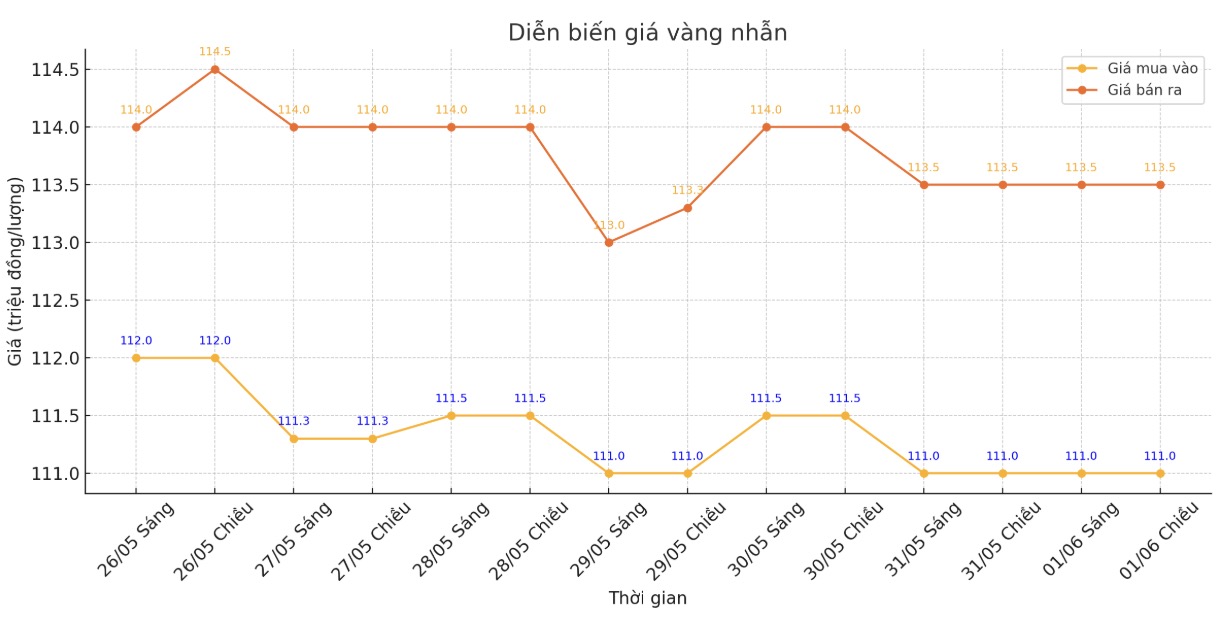

9999 round gold ring price

As of 6:00 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 111-113.5 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 113-116 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 110.5-113.5 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

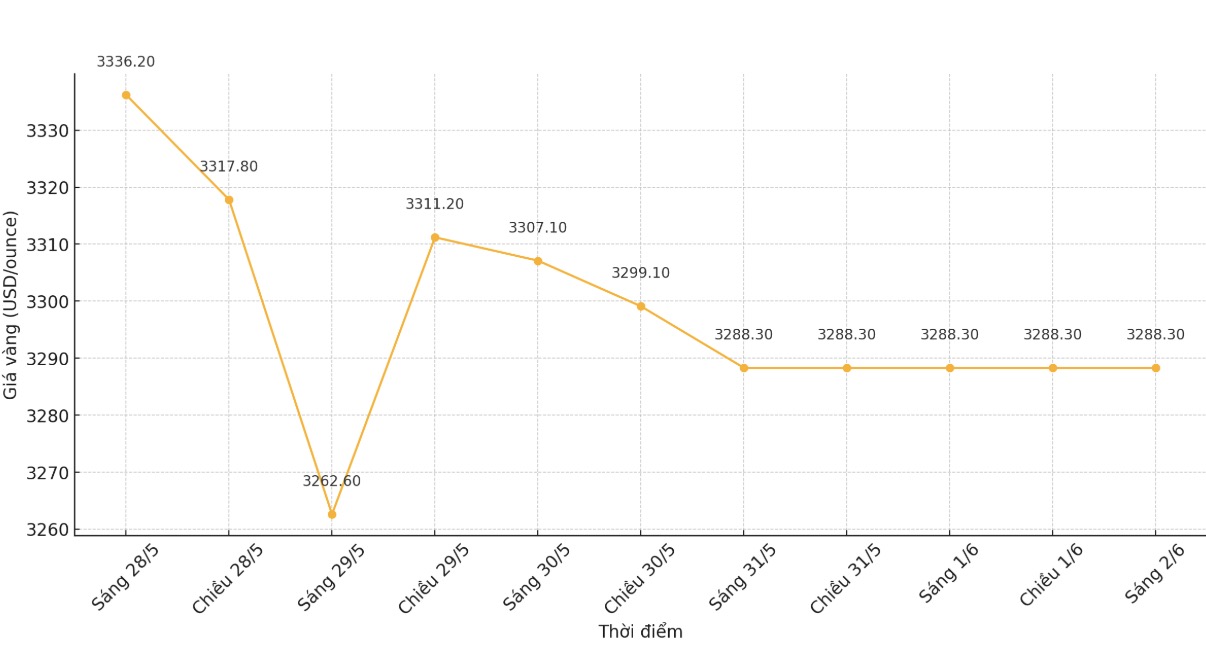

World gold price

At 6:00 a.m., the world gold price was listed at 3,288.3 USD/ounce.

Gold price forecast

Gold prices have eased slightly over the past week as conflicting statements and legal judgments regarding tariffs have made many investors no longer interested in thrilling news, but have turned to chart and data analysis.

Ricardo Evangelista - Senior Analyst at ActivTrades commented: The downward pressure on gold is limited by tax-related instability, rising geopolitical tensions, and growing concerns about global economic prospects. In addition, fiscal risks from the US government's tax cut are cautious for investors. In the context of many uncertainties, gold's safe-haven role will still be maintained around the $3,300/ounce mark.

Meanwhile, Adam Button, head of foreign exchange strategy at Forexlive.com, said gold will move up. According to him, new political and trade moves from US President Donald Trump continue to make the market worried, causing gold prices to increase.

Mr. Adrian Day - Chairman of Adrian Day Asset Management - said that gold prices will fluctuate strongly but it is difficult to decrease deeply because there is always buying pressure when prices decrease.

Gold drivers have been around before Trump, before the war in Ukraine, and they are still in place, he stressed. Central banks have been diversifying their US dollar reserves for years.

Mr. Day said that even if economic data such as employment has slight changes, they will no longer have a big impact because the US Federal Reserve (FED) is temporarily suspending policy adjustments. Only when the data is too bad that forces the Fed to cut interest rates early will gold bounce strongly, he said.

Economic data schedule next week

Next week, the market will pay attention to a series of employment data including: JOLTS (Tuesday), ADP (Tuesday), unemployment claims (Thursday), and the May non-farm payrolls report (Friday).

There are also the ISM manufacturing PMI (Monday), ISM services (Wednesday), and the interest rate decision of the Bank of Canada and the European Central Bank (ECB) in midweek.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...