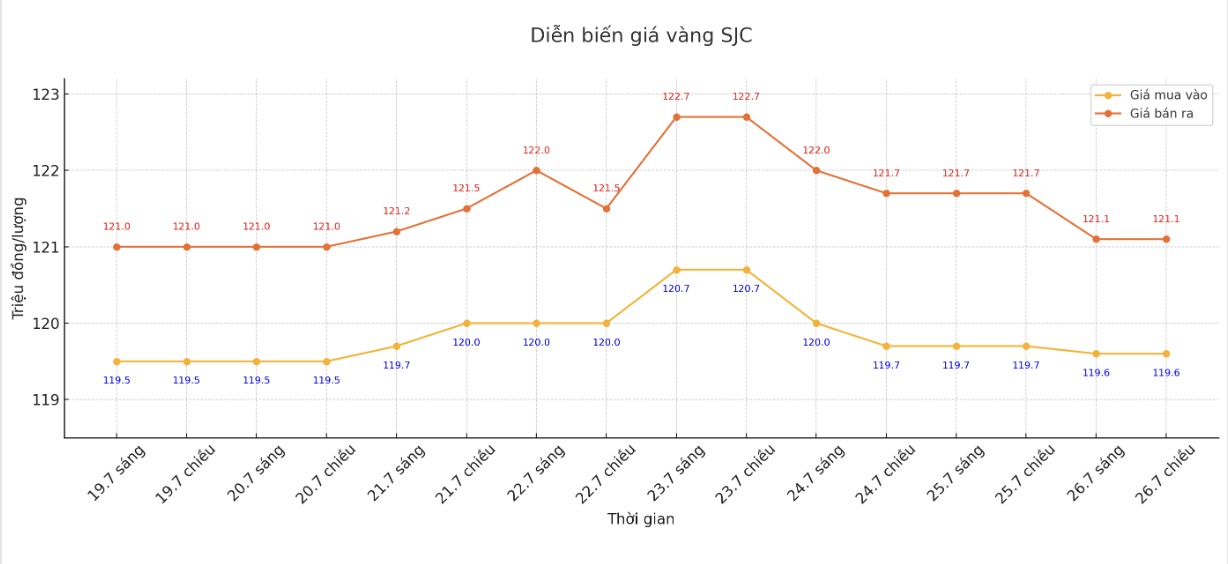

SJC gold bar price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 119.6-121.1 million/tael (buy - sell); down VND 100,000/tael for buying and down VND 600,000/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

DOJI Group listed at 119.6-121.1 million VND/tael (buy - sell); down 100,000 VND/tael for buying and down 600,000 VND/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 119.6-121.1 million VND/tael (buy - sell); down 100,000 VND/tael for buying and down 600,000 VND/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 118.8-121.1 million VND/tael (buy - sell); down 400,000 VND/tael for buying and down 600,000 VND/tael for selling. The difference between buying and selling prices is at 2.3 million VND/tael.

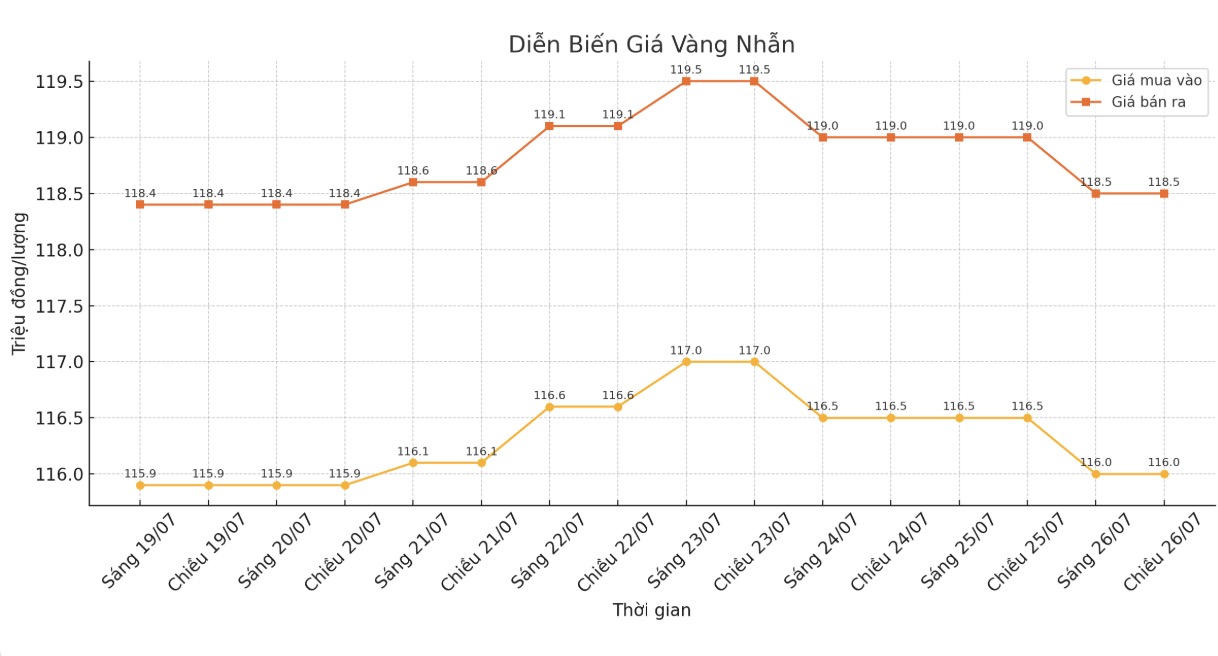

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 116-118.5 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116.2-119.2 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 115.1-118.1 million VND/tael (buy in - sell out), down 400,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

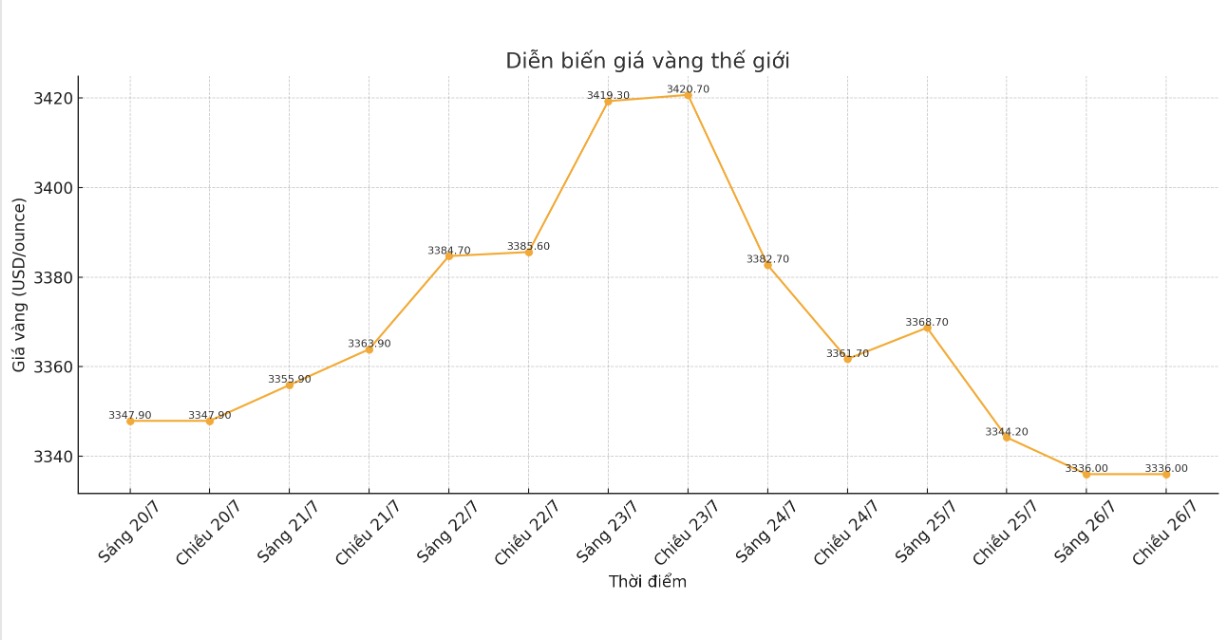

World gold price

The world gold price was listed at 6:00 a.m. at 3,336 USD/ounce, down 8.2 USD compared to 1 day ago.

Gold price forecast

The developments in the gold market last week showed the sensitivity of this precious metal in the context of the lack of clear economic data. The surge above $3,400/ounce earlier in the week reflects expectations that a stable economy will create conditions for the US Federal Reserve (FED) to start a rate cut cycle, as worries about recession gradually cool down.

However, after the US and Japan reached a trade deal on Tuesday an event seen by investors as a positive signal for progress in negotiations between the US and other major partners such as the EU the gold market reversed. Optimism has boosted risk appetite, causing cash flow to shift to higher-yielding assets such as stocks.

Mr. Carsten Fritsch - an expert at Commerzbank - commented that when trade tensions cool down, gold will be less attractive as a safe haven. Mr. Kelvin Wong - senior expert at OANDA - also said that profit-taking activities of short-term speculators are taking place after a period of strong gold growth thanks to geopolitical expectations.

However, some experts still believe that gold prices will be supported in the medium and long term. Mr. Ahmad Assiri from Pepperstone warned that the issue of the Fed's independence is still a worrying factor. President Donald Trump's repeated criticism of Chairman Jerome Powell for not speeding up the pace of interest rate cuts has raised concerns about the possibility of Mr. Powell being replaced by a more "compromising" figure. This could put pressure on the USD and unintentionally create an advantage for gold.

Mr. Brian MacHaney - an expert at Raymond James - said that structural risks such as prolonged budget deficits, inflation and geopolitical instability are still factors supporting gold prices in the long term.

The next trading week also the last week of July is expected to be full of fluctuations as the market turns its attention to a series of important data: the GDP report for the second quarter of 2025, the non-farm payroll for July and especially the Fed's monetary policy decision on July 30.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...