Gold prices fell in the trading session on Monday, as the US dollar increased in price and signals of cooling down trade tensions between the US and China put pressure on the precious metal - which is considered a safe asset. Investors are waiting for important central bank meetings this week to find clues on monetary policy.

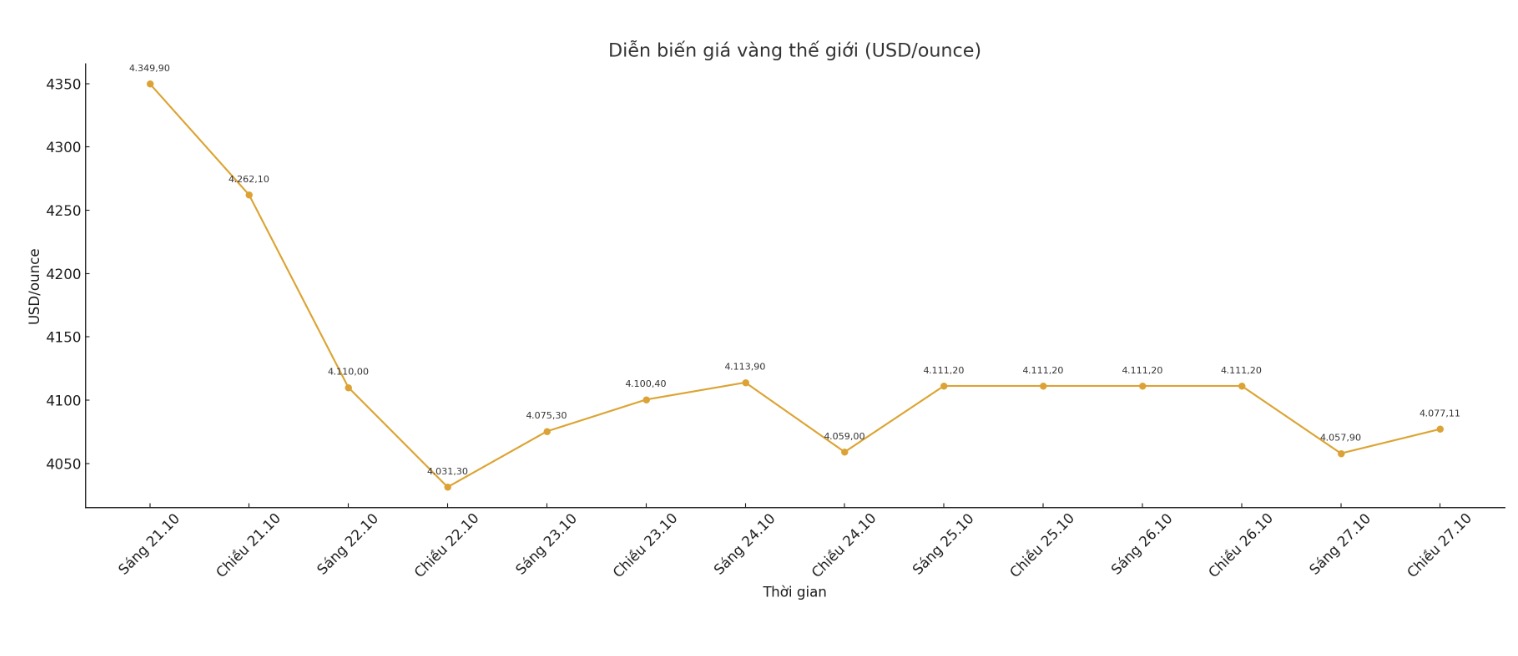

At 1:55 p.m. (Vietnam time), spot gold prices fell 0.8%, down to $4,077.11/ounce. US December gold futures fell 1.1%, to $4,090.9/ounce.

The US dollar rose to a two-week high against the Yen, making gold more expensive for holders of other currencies.

Previously, top US and Chinese economic officials agreed on a trade deal framework for US President Donald Trump and Chinese President Xi Jinping to consider and decide on this week.

"The surprise appearance of the possibility of reaching a US-China trade agreement is a positive factor for the market in general. Of course, that puts downward pressure on gold prices, said Kyle Rodda, an analyst at Capital.com.

"Currently, the market temperature has decreased and the sentiment is becoming more neutral. The reason gold still maintains its support is the expectation of loose fiscal and monetary policies in the coming time. If this continues, the upward trend in gold could still be maintained.

The US Federal Reserve (FED) is widely expected to cut interest rates by 0.25 percentage points at its meeting on Wednesday, after a weaker inflation report than expected released last Friday.

However, because this interest rate cut was predicted by the market, investors will focus on future policy signals from FED Chairman Jerome Powell.

Gold - an un interest-bearing asset - often benefits in a low-interest-rate environment.

SPDR Gold Trust - the world's largest gold ETF - said its gold holdings fell 0.52%, down to 1,046.93 tons on Friday, from 1,052.37 tons the previous day.

In other precious metals markets, spot silver fell 0.6% to $48.31 an ounce; platinum rose 0.7%, to $1,616.30 an ounce; and palladium rose 0.5%, to $1,435.75 an ounce.

See more news related to gold prices HERE...