The London Gold Market Association (LBMA) said that from 2027, gold refiners on the list of approved for trading in London will have to provide data to a new digital platform to increase transparency in the precious metals industry.

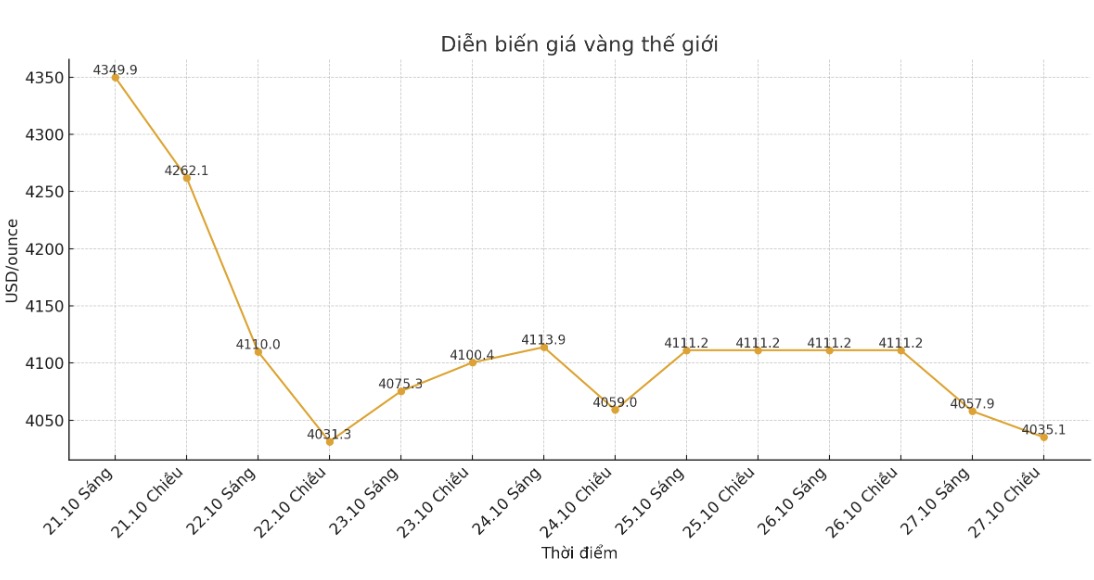

LBMA - the world's largest decentralized gold exchange monitoring body in London - is pushing for more transparency in the market as gold prices have increased by 55% since the beginning of the year and set a record of $4,381/ounce on October 20, as concerns about US tariffs increased volatility.

From January next year, we will apply a voluntary periodic reporting mechanism and switch to mandatory from 2027, said Ruth Crowell, CEO of LBMA, at the associations precious metals conference in Kyoto (Japan).

Since January this year, LBMA has deployed the Gold Bar Integrity Database to accelerate the collection and processing of data from refineries on the "Good Delivery list".

Being on this list allows access to the London market and requires refining units to ensure a responsible supply of exploited metals. Currently, data on the national origin of gold is only reported to the LBMA once a year.

We want to maintain more regular dialogue, and at the same time coordinate with refineries to ensure feasibility, not creating unnecessary burdens for them, Crowell told reporters.

The LBMA's "good dealers" list currently has 66 gold refiners and 83 silver refiners worldwide.

The monthly public data source on the amount of gold held in London by the LBMA - updated since 2016, played an important role earlier this year, when concerns about US tariffs caused gold to flow strongly into the US market, raising concerns about remaining liquidity in London.

Those are sets of data that need further development, and the infrastructure of the Golden transparency Program is an important foundation for that, said Crowell.

The market is getting more complex. We need to dialogue with refiners as they expand their supply to new areas. We all need to have faith in the quality and origin of gold as a guarantee for this market.

See more news related to gold prices HERE...