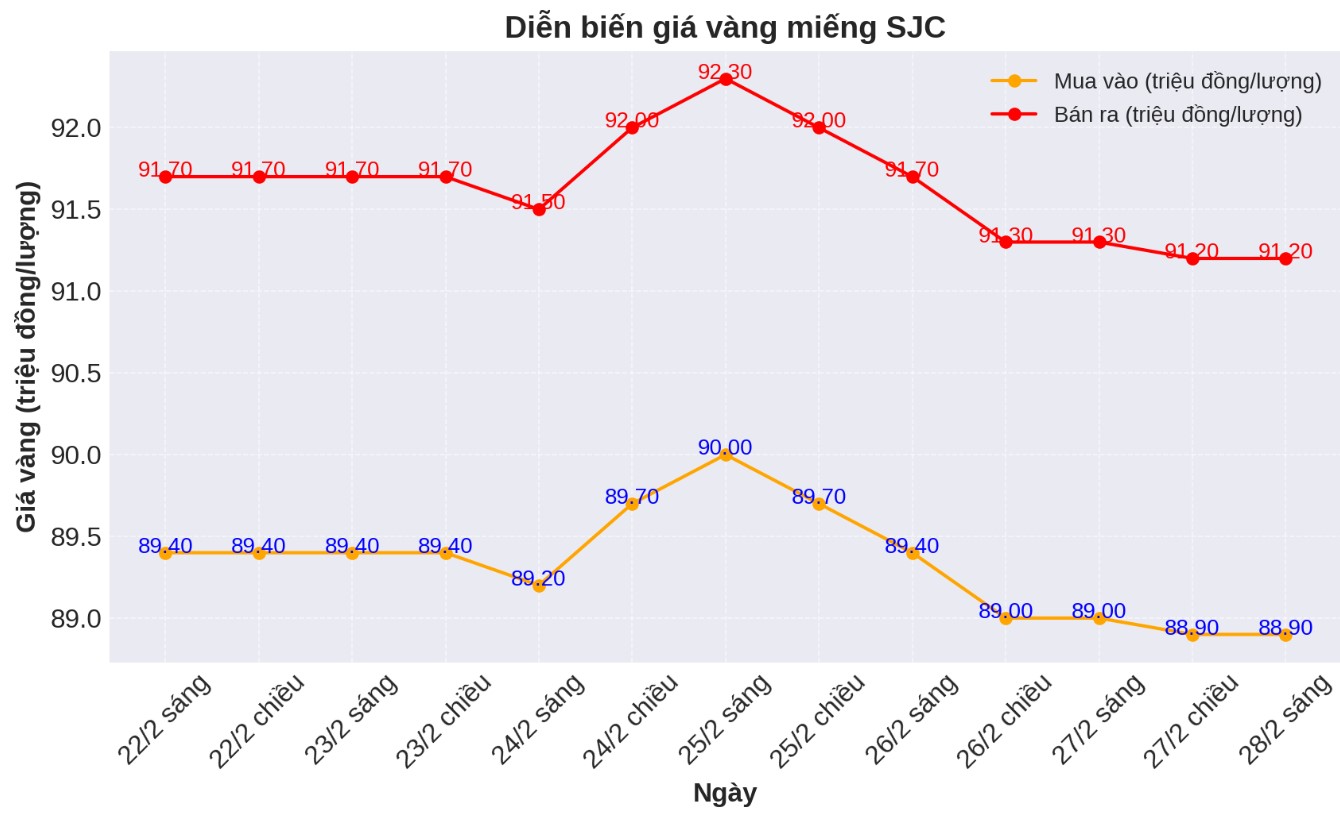

Updated SJC gold price

As of 6:00 a.m., DOJI Group listed the price of SJC gold bars at 88.9-91.2 million VND/tael (buy in - sell out), down 100,000 VND/tael in both directions. The difference between the buying and selling prices of SJC gold was listed by DOJI at 2.3 million VND/tael.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company at 88.9-91.2 million VND/tael (buy in - sell out), down 100,000 VND/tael in both directions. The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 2.3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at VND89.2-91.2 million/tael (buy - sell), down VND100,000/tael for both buying and selling. The difference between the buying and selling prices of SJC gold was listed by Bao Tin Minh Chau at 2 million VND/tael.

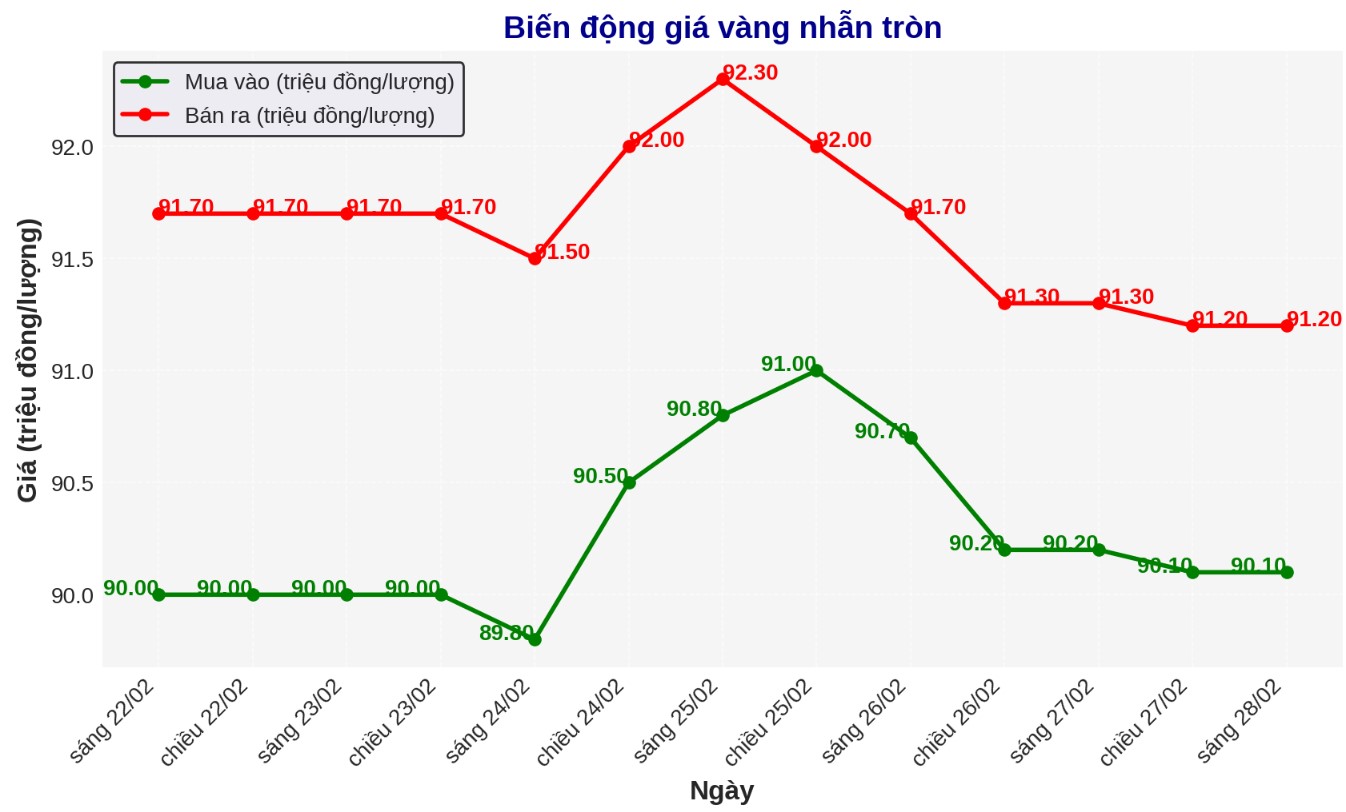

9999 round gold ring price

As of 6:00 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 90.1-91.2 million VND/tael (buy - sell); down 100,000 VND/tael for both buying and selling. The difference between buying and selling is listed at 1.1 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 90.15-91.7 million VND/tael (buy - sell); down 50,000 VND/tael for buying and down 100,000 VND/tael for selling. The difference between buying and selling is 1.55 million VND/tael.

World gold price

As of 23:20 on February 27, the world gold price listed on Kitco was at 2,875.8 USD/ounce, down 38.1 USD/ounce compared to the same time of the previous session.

Gold price forecast

World gold prices are under pressure in the context of the USD increasing. Recorded at 23:20 on February 27, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 107.180 points (up 0.8%).

According to Kitco, gold prices fell sharply to a two-week low due to profit-taking activities from short-term futures traders.

Gold prices fell as a series of data from the US economy were released. long-term commodity orders in the US unexpectedly increased by 3.1% in January. The US Commerce Department said today that long-term commodity orders increased 3.1% last month, after falling -1.8% in December. This figure far exceeded analysts' forecasts, with economists predicting an increase of only 1.3%.

Core orders, excluding transportation, fluctuated at 0.0% in January, below the forecast of 0.4% and 0.3% in December.

Meanwhile, orders for non-defense materials (excluding aircraft manufacturing) increased by 0.8% in January, significantly higher than the forecast of 0.4% and 0.2% in December.

In addition, the precious metal is also under pressure as US GDP growth in the fourth quarter remained unchanged at 2.3%, inflation increased. Gold prices have struggled to find bullish momentum after data showed the US economy continues to expand, albeit at a slower pace.

The second report on the US Gross Domestic Product (GDP) shows that the economy will grow by 2.3% in the last quarter of 2024, according to the US Bureau of Economic Analysis (BEA) today. This figure remains unchanged from the original estimate and is in line with analysts' expectations.

However, the report also shows that inflationary pressures continue to increase. The preliminary GDP price index increased by 2.4%, significantly higher than the initial estimate of 2.2%. Analysts had previously predicted that the index would not change.

At the same time, the core personal consumption expenditure price index (core PCE) in the quarter - excluding commodity and energy prices - increased by 2.7%, higher than the forecast of 2.5% by economists.

Gold contracts in April are still having a short-term advantage, but the increase on the daily chart has slowed down. The bull market aims to push prices up and maintain above $2,974/ounce - this is an important resistance level. On the contrary, the sellers want to reduce prices below the important support level of 2,800 USD/ounce.

Outside markets, Nymex crude oil prices also increased, trading around 69.25 USD/barrel. The yield on the 10-year US Treasury note is currently at 4.308% and is trending down.

Note: The article data compares with the same time of the previous trading session.

See more news related to gold prices HERE...