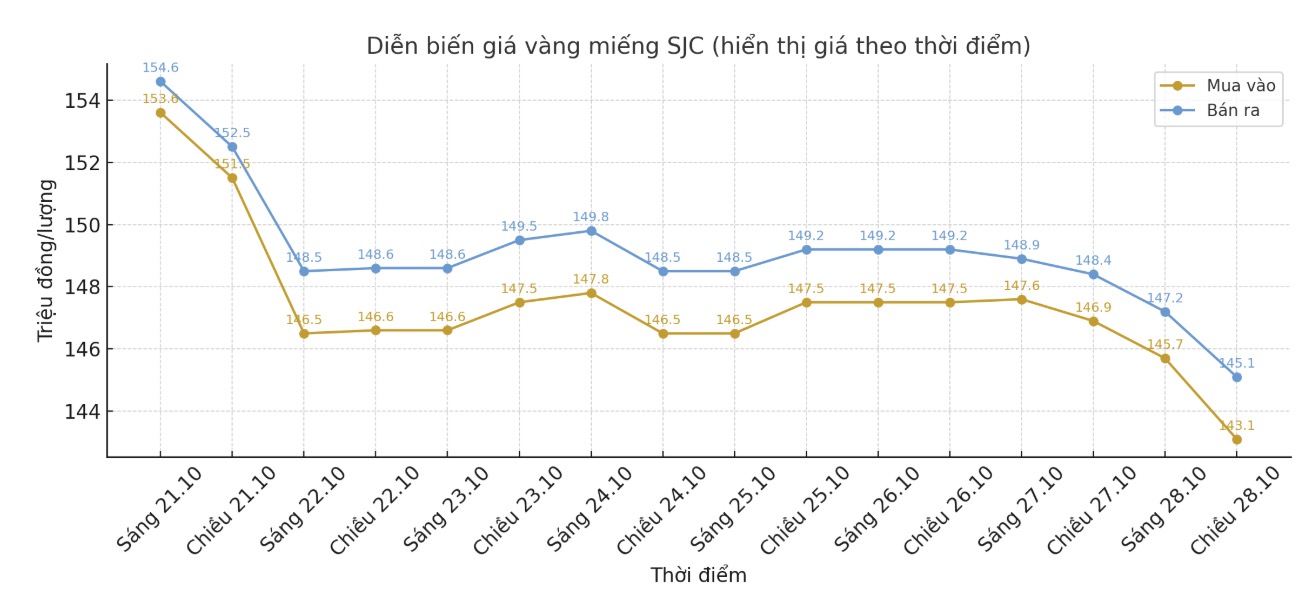

SJC gold bar price

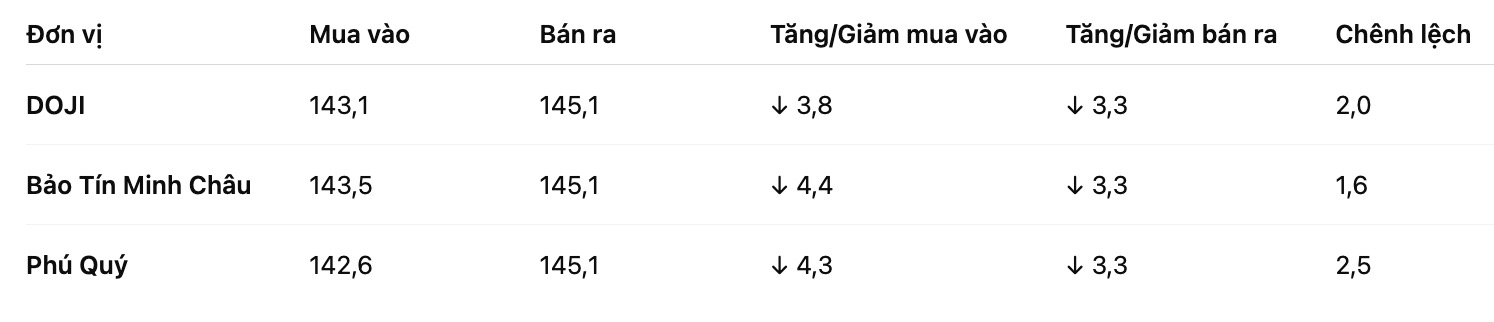

As of 6:00 a.m., DOJI Group listed the price of SJC gold bars at 143.1-145.1 million VND/tael (buy - sell), down 3.8 million VND/tael for buying and down 3.3 million VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 143.5-145.1 million VND/tael (buy - sell), down 4.4 million VND/tael for buying and down 3.3 million VND/tael for selling. The difference between buying and selling prices is at 1.6 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 142.6-145.1 million VND/tael (buy - sell), down 4.3 million VND/tael for buying and down 3.3 million VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

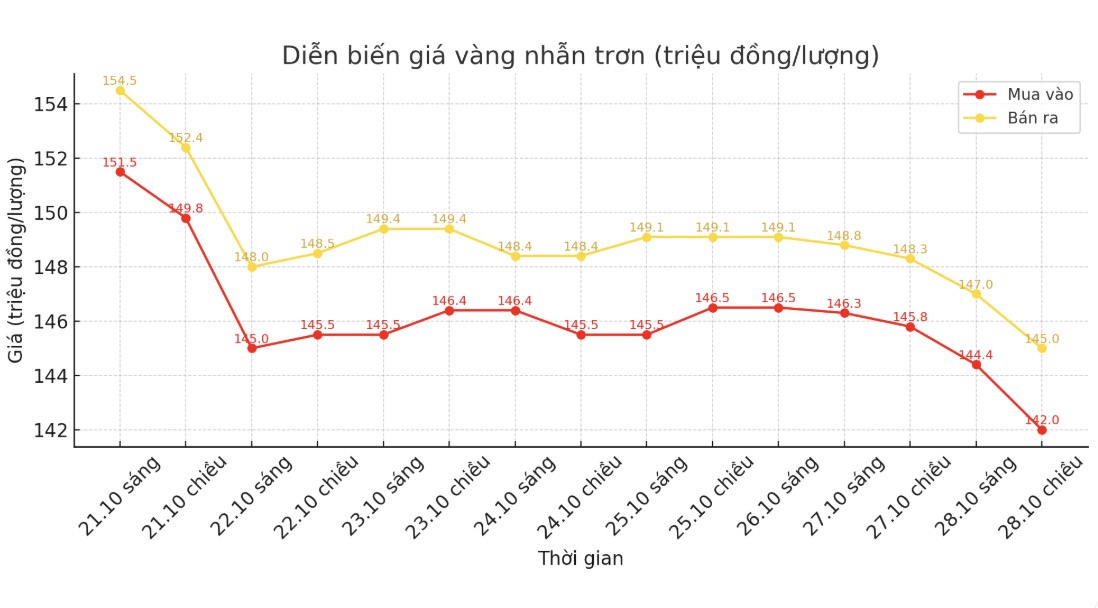

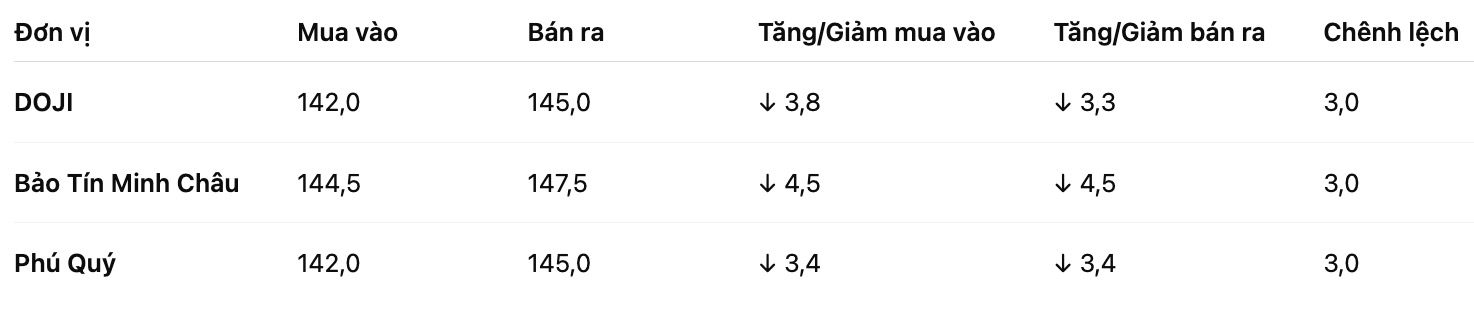

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 142-145 million VND/tael (buy - sell), down 3.8 million VND/tael for buying and down 3.3 million VND/tael for selling. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 144.5-147.5 million VND/tael (buy - sell), down 4.5 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 142-145 million VND/tael (buy - sell), down 3.4 million VND/tael for both buying and selling. The difference between buying and selling is 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

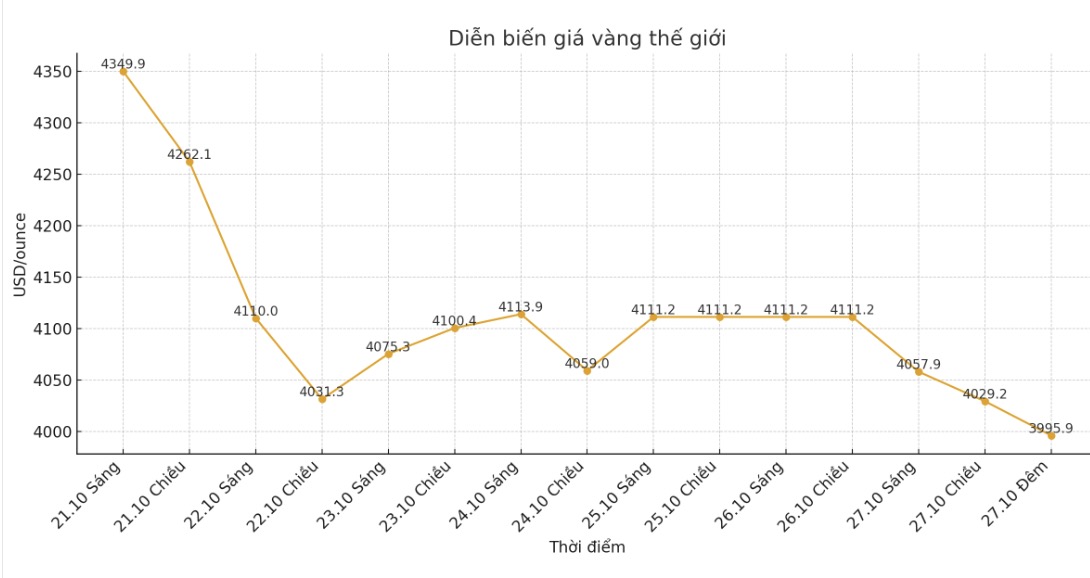

World gold price

The world gold price was listed at 0:00 at 3,995.9 USD/ounce, down 97.8 USD/ounce.

Gold price forecast

Gold prices fell to near a three-week low, as optimism about the possibility of reaching a trade deal between the US and China weakened demand for this precious metal, while investors awaited a series of policy decisions from major central banks during the week.

The frozen US-China trade relationship has partly caused gold prices to fall due to the decline in safe-haven cash flow, said Mr. Tim Waterer, chief market analyst at KCM Trade.

In another development, at the London Gold Market Association's (LBMA) Global Year-end Conference on Quarterly Metals, the Bank of Korea signaled the possibility of increasing gold reserves.

Mr. Heung-Soon Jung, Director of Reserve Investment Department of the Korea Bank for Reserve Management Group, said in his presentation that although the bank has not bought gold since 2013, it is considering buying more gold in the medium and long term.

Meanwhile, Central Bank Governor of Madagascar Aivo Andrianarivelo told Bloomberg that the country could increase its gold reserves to 4 tons, from the current level of 1 ton.

Technically, the next upside target for buyers is to close above the strong resistance zone at $4,100/ounce. On the contrary, the target for the sellers is to pull the price below the solid support level at 3,800 USD/ounce.

The nearest resistance zone was at $4,000/ounce, followed by an overnight peak of $4,034.20. The first support was at $3,900/ounce, followed by $3,850/ounce.

Notable economic data this week

Wednesday: Bank of Canada policy decision, US waitress data, FED policy decision, Bank of Japan policy decision.

Thursday: ECB policy decision.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...