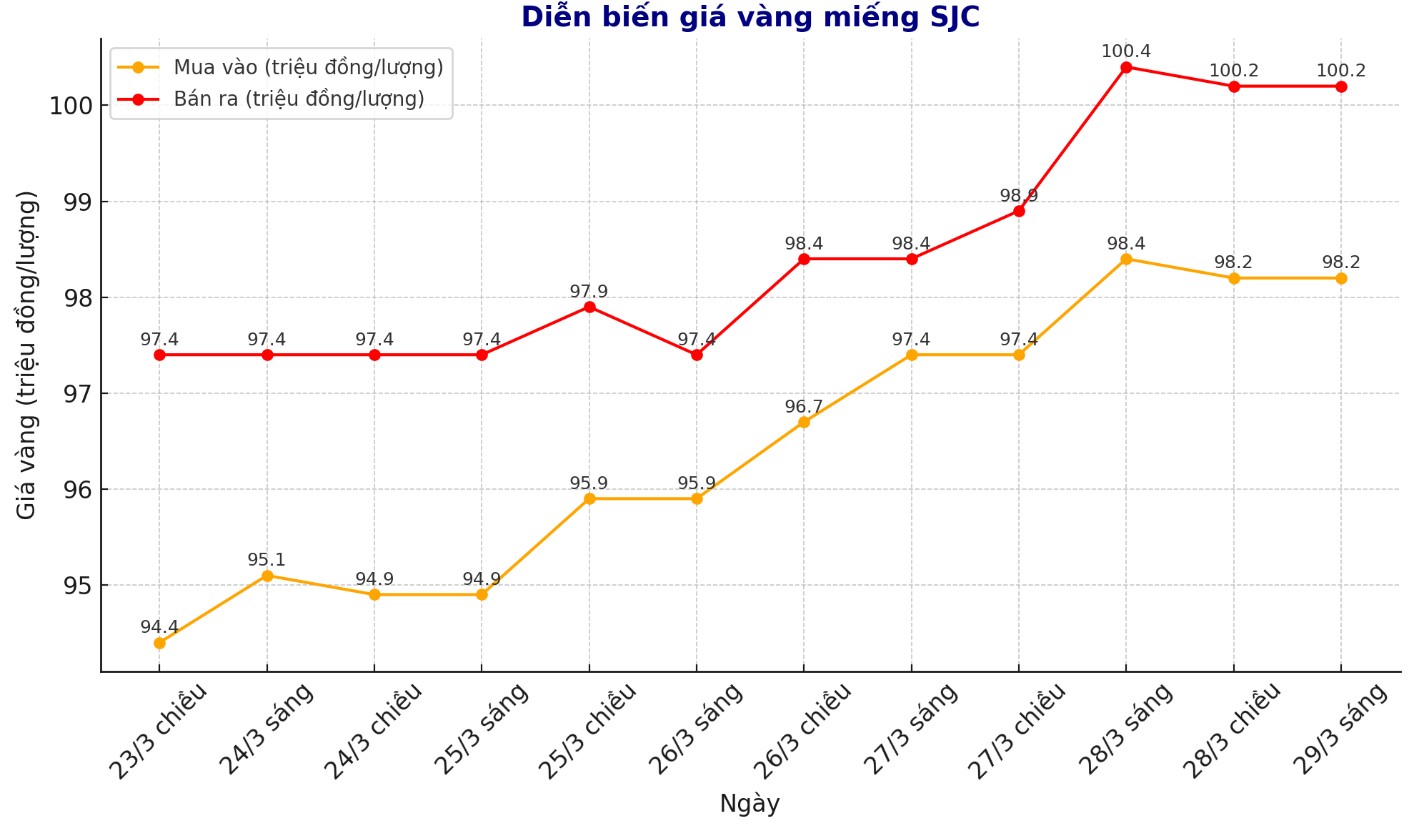

Updated SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 98.2-100.2 million VND/tael (buy - sell), an increase of 800,000 VND/tael for buying and an increase of 1.3 million VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, DOJI Group listed the price of SJC gold bars at 98.2-100 million VND/tael (buy - sell), an increase of 800,000 VND/tael for buying and an increase of 1.3 million VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 98.3-100.2 million VND/tael (buy - sell), an increase of 800,000 VND/tael for buying and an increase of 1.3 million VND/tael for selling. The difference between buying and selling prices is at 1.9 million VND/tael.

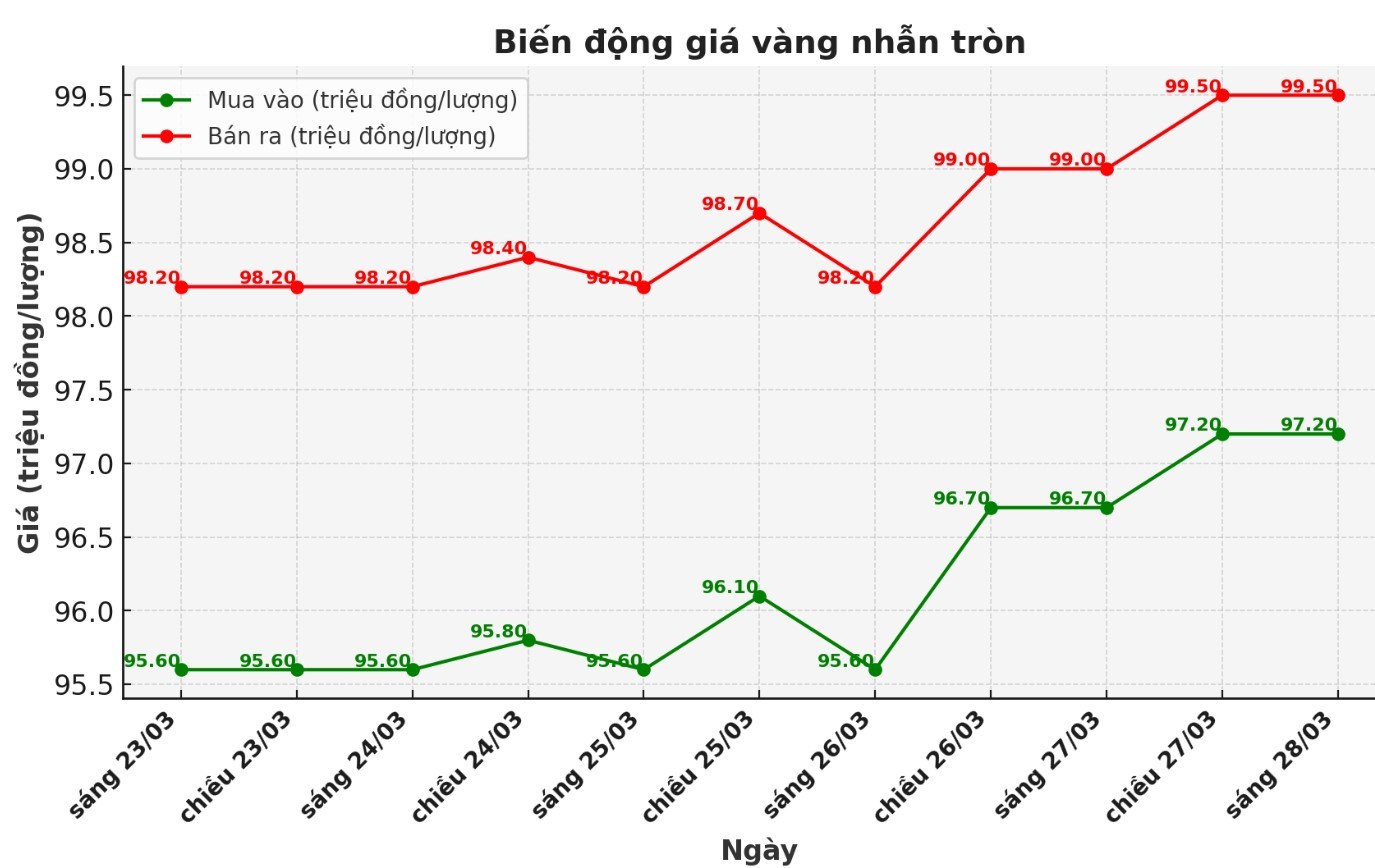

9999 round gold ring price

As of 6:00 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 98.4-100.2 million VND/tael (buy - sell); an increase of 1.2 million VND/tael for buying and an increase of 700,000 VND/tael for selling. The difference between buying and selling is listed at 1.8 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 98.6-100.6 million VND/tael (buy - sell); increased by 1 million VND/tael for buying and increased by 900,000 VND/tael for selling. The difference between buying and selling is at 2 million VND/tael.

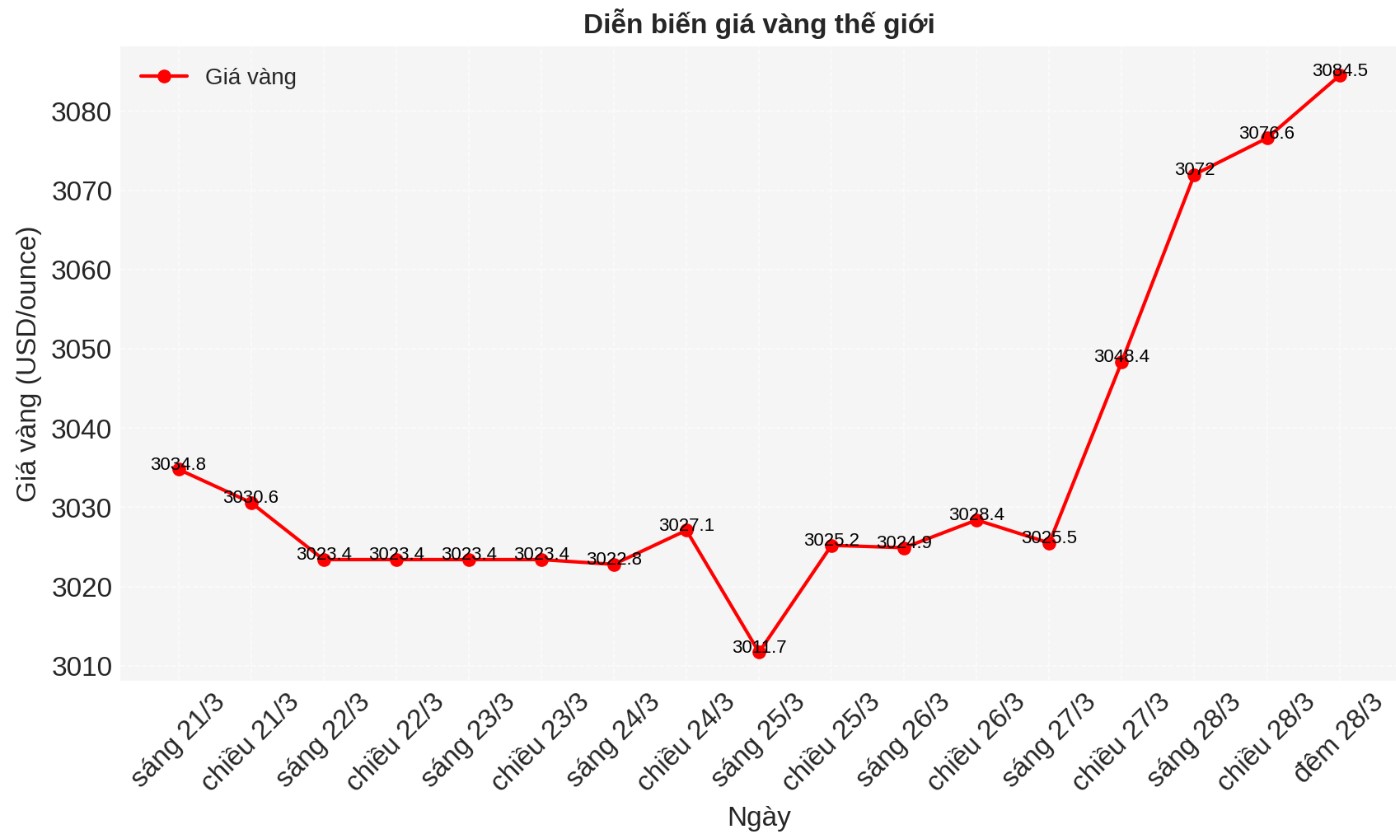

World gold price

As of 11:07 p.m. on March 28, the world gold price was listed at 3,084.5 USD/ounce, up 36.7 USD/ounce.

Gold price forecast

World gold prices increased in the context of the USD decreasing. Recorded at 11:10 p.m. on March 28, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 103.670 points (down 0.31%).

Gold prices rose sharply last night, Comex gold futures in June hit a new record high of $3,124.40/ounce. Silver prices also hit a year's high the night before.

Stable safe-haven demand is helping precious metal prices remain high. In addition, the continued purchase of gold by central banks is also a positive support for the metal. Gold prices in June are currently up $24 to $3,114.9/ounce. silver prices in May increased by 0.332 USD to 35.415 USD/ounce.

The Asian and European stock markets mostly fell in the night trading session. US stock indexes are expected to open slightly down in New York. Risk avocation increased at the end of the trading week, due to escalating global trade tensions.

Dow Jones Newswires reported, US President Donald Trumps expanding trade war is taking investors to gold as a safe haven. The company also said that strength demand from central banks continues to push gold prices up.

Technically, June gold futures bulls are dominating the short term. The next upside target is to close above the solid resistance level of $3,200/ounce.

On the contrary, the sellers are aiming to push the price below the support level of 3,031 USD/ounce. The first resistance level was the overnight contract peak of $3,124.4/ounce, followed by $3,150/ounce. The first support level was at the bottom of the overnight session at 3,096.3 USD/ounce, followed by 3,075 USD/ounce.

In the outside market, Nymex crude oil prices are almost flat, trading around 69.75 USD/barrel. The yield on the 10-year US Treasury note is currently at 4.334%.

Note: The article data compares with the same time of the previous trading session.

See more news related to gold prices HERE...