Global stocks fell for the second consecutive session and gold prices hit a new peak on Thursday after the US presidential administration Donald Trump announced a new tax rate on the auto industry, increasing trade tensions.

On Wednesday, Mr. Donald Trump announced a 25% tax on cars and auto components manufactured abroad imported into the US. This move negatively impacts Japan's Nikkei index and South Korea's KOSPI.

In the US, the stock market fluctuated between ups and downs, while automakers plummeted. However, stocks of electric vehicle manufacturers such as Tesla and Rivian increased because their production was mainly domestic.

General Motors shares fell 7.36%, Ford lost 3.88% due to concerns about the impact on the supply chain. Stellantis' US-listed stock also fell 1.25%.

Investors are really cautious and concerned about Mr. Trump and his policies. Not only policy, but also continuous erratic changes" - Jed Ellerbroek, portfolio manager at Argent Capital in St. Petersburg. Louis, Missouri, commented.

That makes people worried when making long-term investment decisions, whether it is for companies or investors, the expert said.

The Dow Jones index fell 155.09 points (0.37%) to 42,299.70 points, the S&P 500 fell 18.89 points (0.33%) to 5,693.31 points, Nasdaq fell 94.98 points (0.53%) to 17,804.03 points.

US key metrics are on track to record two consecutive months of decline for the first time since October 2023.

European stocks also ended the session in red, with the group of auto stocks heavily affected. Volkswagen shares fell 1.26%, BMW lost 2.55% and Mercedes-Benz fell 2.69%. The global MSCI index fell 0.33% to 843.19 points, while the European STOXX 600 index fell 0.44% to a two-week low.

Concerns about the impact of tariffs on the global economy, along with the possibility of delaying the US Federal Reserve's (FED) interest rate cut plan, have put pressure on the stock market in recent weeks, despite signs of gradually stabilizing.

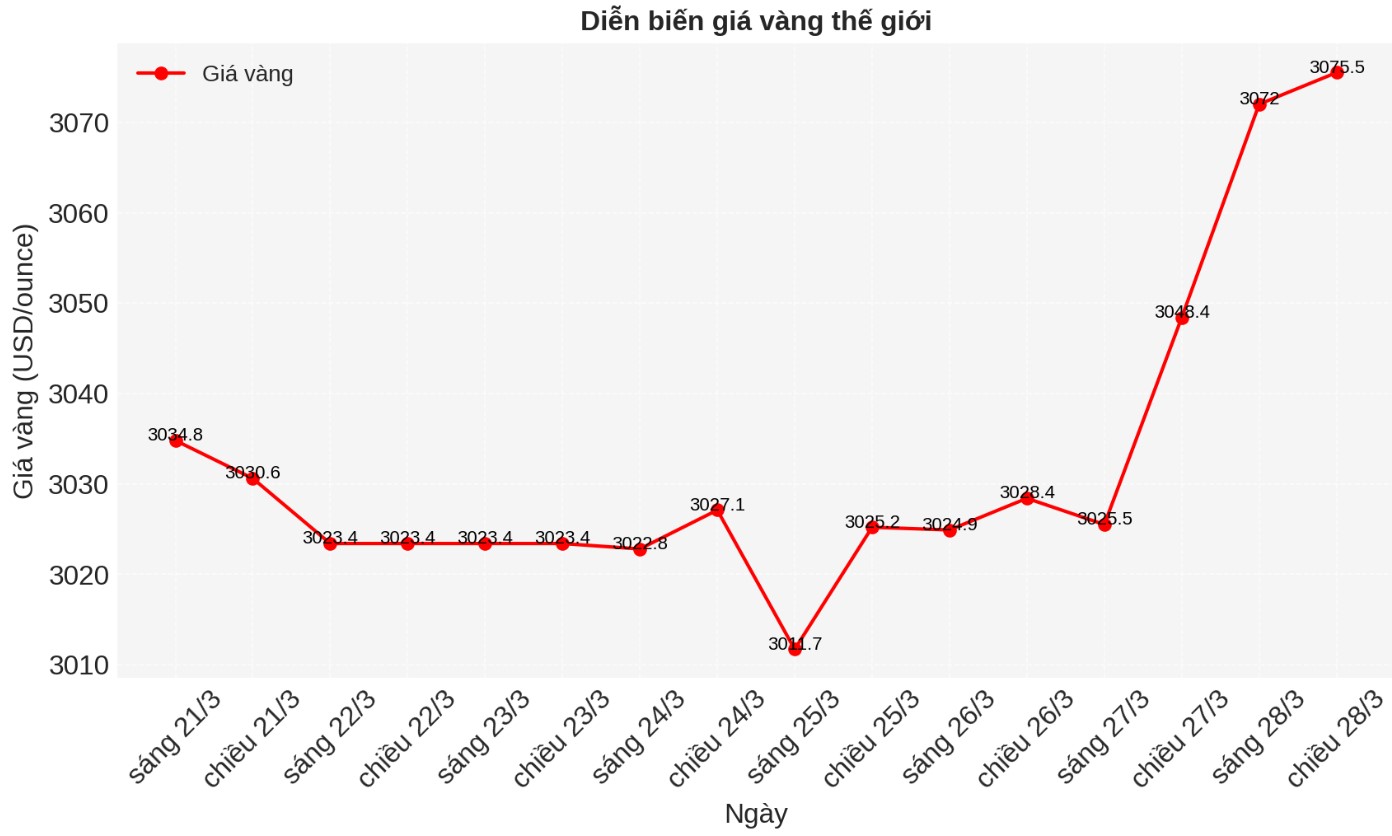

Reflecting investors' cautious sentiment, spot gold prices skyrocketed to $3.075.5 an ounce at 13:20 on March 28 (Vietnam time).

Goldman Sachs has raised its gold price forecast to $3,300/ounce due to stronger-than-expected inflows into gold ETFs and continued high demand from central banks.

The USD index fell 0.33% to 104.29 points, while the euro rose 0.4% to 1.0795 USD. The Mexico peso fell 0.86% to 20.295 MXN/USD and the CAD lost 0.29% to 1.43 CAD/USD, as both countries are expected to be strongly affected by auto import tariffs.

Donald Trump announced that he would impose counterpart tariffs on all countries on April 2. Canadian Prime Minister Mark Carney said the country would take trade retaliatory measures if the US implemented a new tax policy.

US economic data shows that the labor market remains strong, although the impact of Donald Trump's tax policies and billionaire Elon Musk's sharp cut in federal personnel has not yet been clearly shown.

Other figures also showed that the US economy grew slightly better in the fourth quarter than initially estimated.

The yield on the 10-year US Treasury note rose 2.7 basis points to 4.365%. 7-year bond yields also increased after an unfavorable $44 billion auction.

US crude oil prices rose 0.39% to 69.92 USD/barrel, while Brent oil increased 0.33% to 74.03 USD/barrel, as investors assessed the impact of escalating trade tensions.