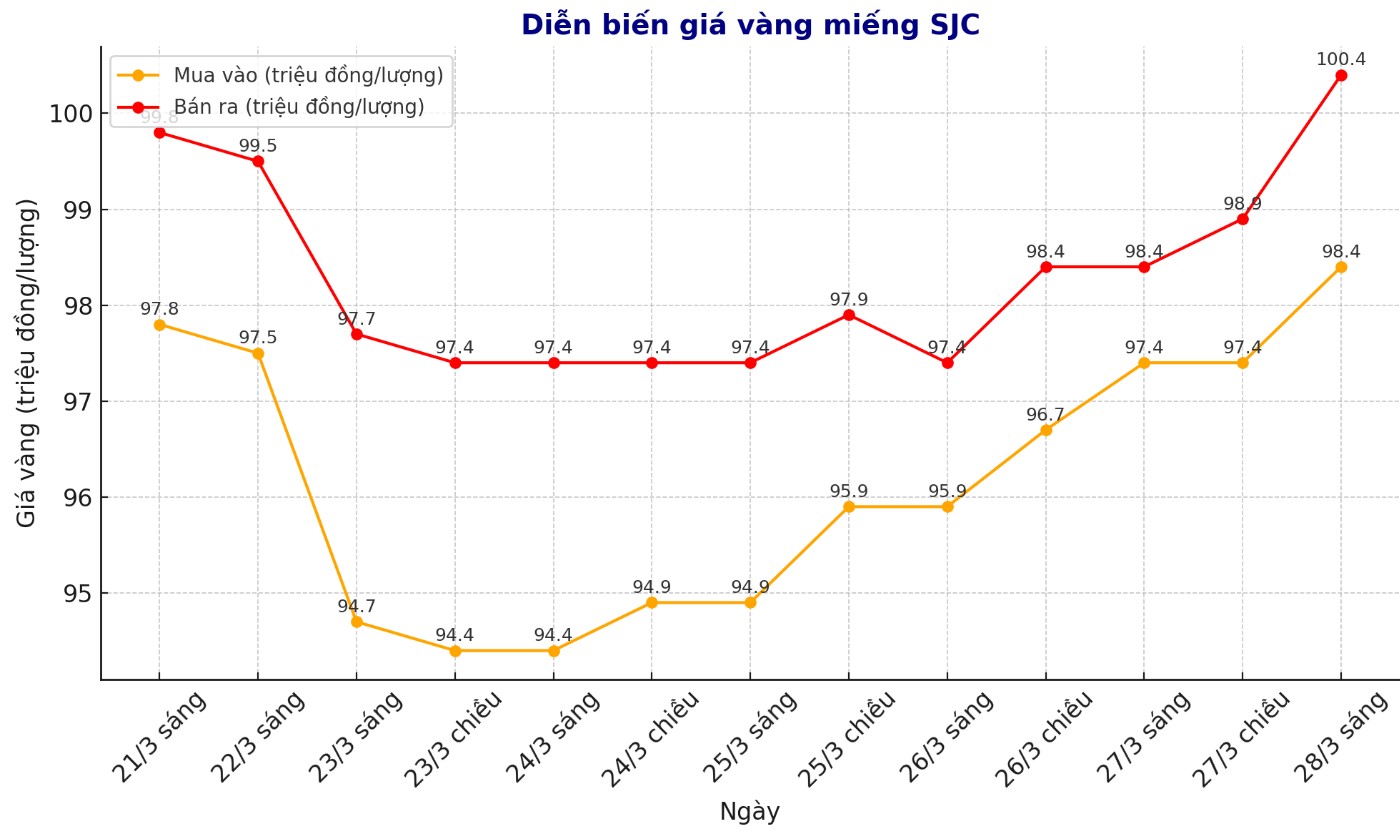

Updated SJC gold price

As of 11:30, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 98.4-100.4 million VND/tael (buy - sell), an increase of 1.7 million VND/tael for buying and an increase of 2 million VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, DOJI Group listed the price of SJC gold bars at 98.4-100.4 million VND/tael (buy - sell), an increase of 1.7 million VND/tael for buying and an increase of 2 million VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 98.6-100.6 million VND/tael (buy - sell), an increase of 1.8 million VND/tael for buying and an increase of 2.2 million VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

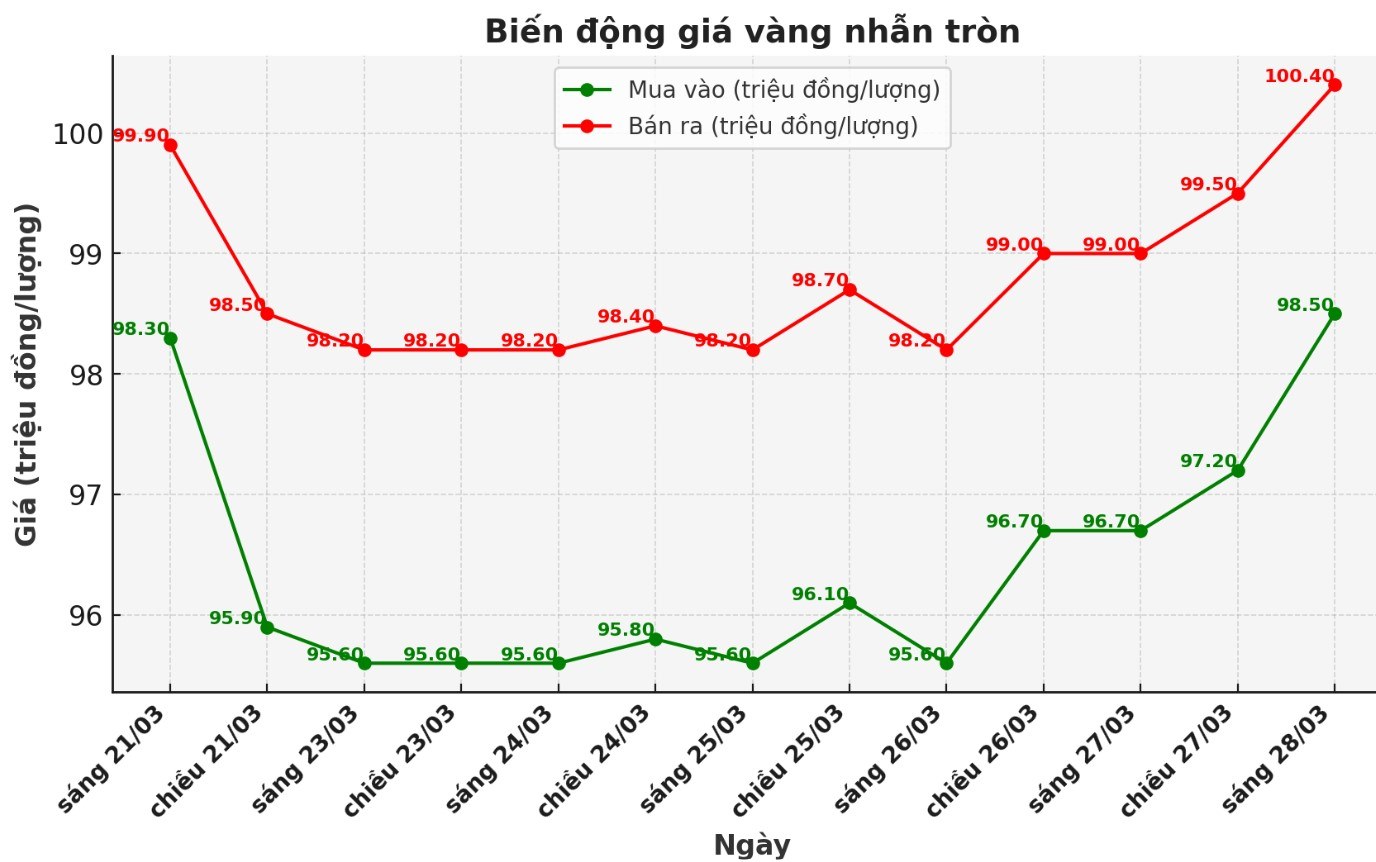

9999 round gold ring price

As of 11:30 today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 98.5-100.4 million VND/tael (buy - sell), an increase of 1.8 million VND/tael for buying and an increase of 1.4 million VND/tael for selling. The difference between buying and selling is listed at 1.9 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 98.6-100.6 million VND/tael (buy - sell), an increase of 1.8 million VND/tael for buying and an increase of 1.5 million VND/tael for selling. The difference between buying and selling is at 2 million VND/tael.

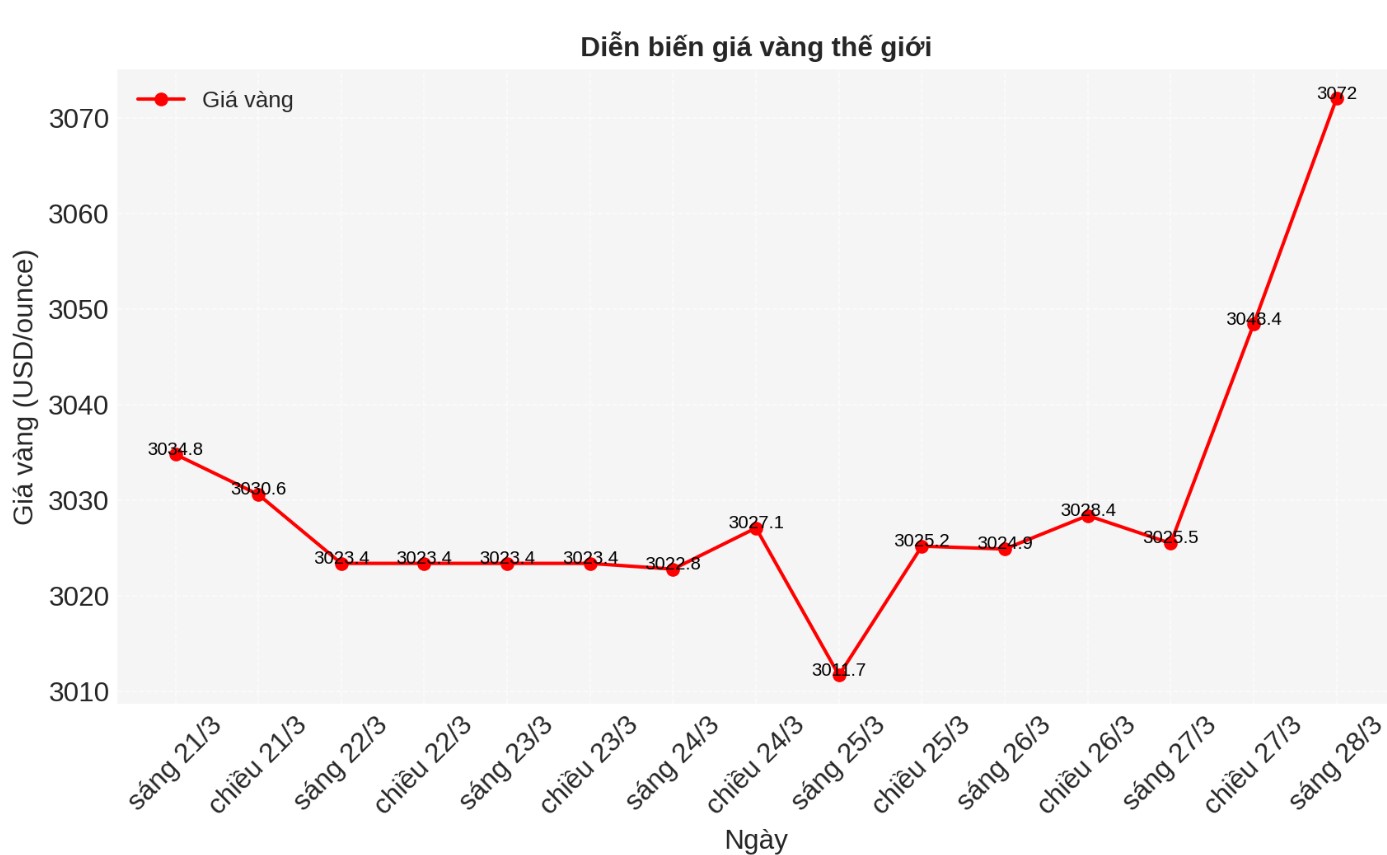

World gold price

At 11:30 on March 28, the world gold price listed on Kitco was around 3,072 USD/ounce, up 46.5 USD/ounce compared to the beginning of the trading session yesterday morning.

Gold price forecast

World gold prices increased to an all-time high despite the high USD. Recorded at 11:30 on March 28, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 104.015 points (up 0.03%).

The market is rising as investors seek shelter amid escalating global trade tensions and a decline in stocks. On March 27, US President Donald Trump announced a 25% tax on cars imported to the US. A series of governments, from Canada to France, have vowed to retaliate.

"Gold prices in futures could soon reach $3,100. The catalyst is safe-haven demand," said Bob Haberkorn, senior market strategist at RJO Futures.

In addition, the precious metal is also supported by strong buying demand from central banks and ETFs, said Phillip Streible, market strategist at Blue Line Futures. Gold is considered a traditional tool to prevent economic and political instability, often increasing in a low interest rate environment.

Gold prices also received support when many important US economic indicators were released. The latest data from the US Department of Labor shows that the number of initial unemployment claims in the week ended March 22 fell to 224,000, lower than the forecast of 225,000.

Meanwhile, recent data from the National Association of Realtors (NAR) showed a slight recovery in the US housing market, as the number of unfinished home sales contracts increased by 2% in February, reaching 72.

This is a good sign after the index hit an all-time low of 70.6 in January. However, the housing market continues to face many difficulties due to high housing prices and high home loan interest rates, making it impossible for many buyers to access.

US GDP growth in the fourth quarter of 2024 reached 2.4%, slightly higher than experts expected, when they forecast a growth rate of 2.3%. Although economic indicators show that the US economy is still maintaining growth momentum, gold prices are not affected too much by these figures.

See more news related to gold prices HERE...