SJC gold bar price

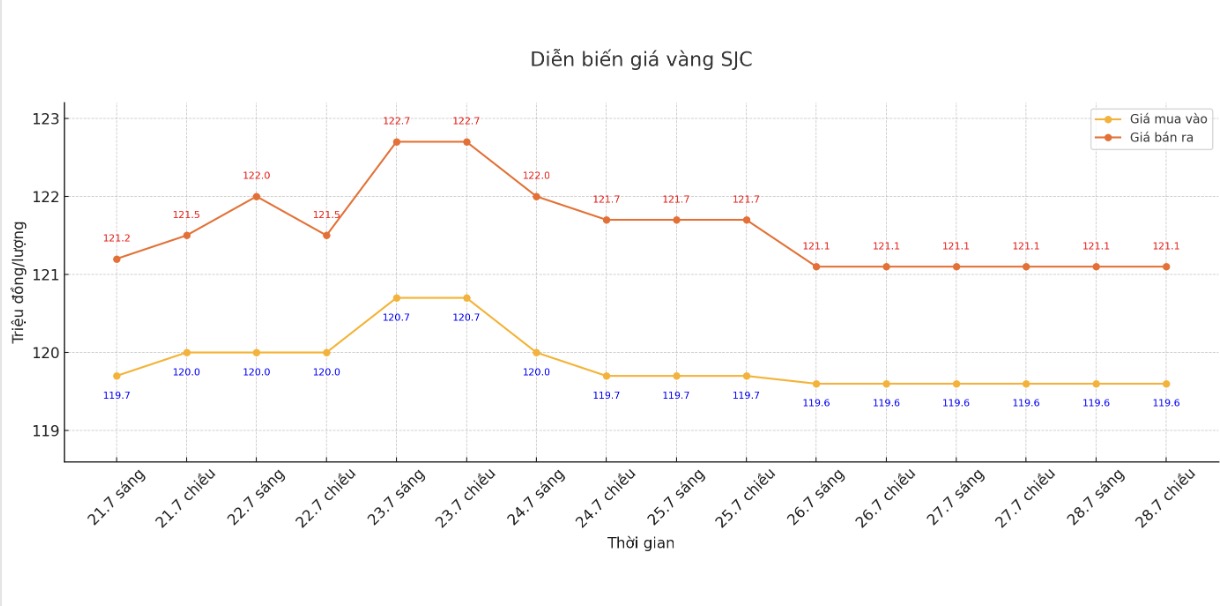

As of 6:00 a.m. on July 29, the price of SJC gold bars was listed by Saigon Jewelry Company at VND 119.6-121.1 million/tael (buy in - sell out); unchanged. The difference between buying and selling prices is at 1.5 million VND/tael.

DOJI Group listed at 119.6-121.1 million VND/tael (buy - sell); unchanged. The difference between buying and selling prices is at 1.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 119.6-121.1 million VND/tael (buy in - sell out); unchanged. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 118.8-121.1 million VND/tael (buy in - sell out); unchanged. The difference between buying and selling prices is at 2.3 million VND/tael.

9999 gold ring price

As of 6:00 a.m. on July 29, DOJI Group listed the price of gold rings at 116-118.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116.2-119.2 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 115.1-118.1 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael.

World gold price

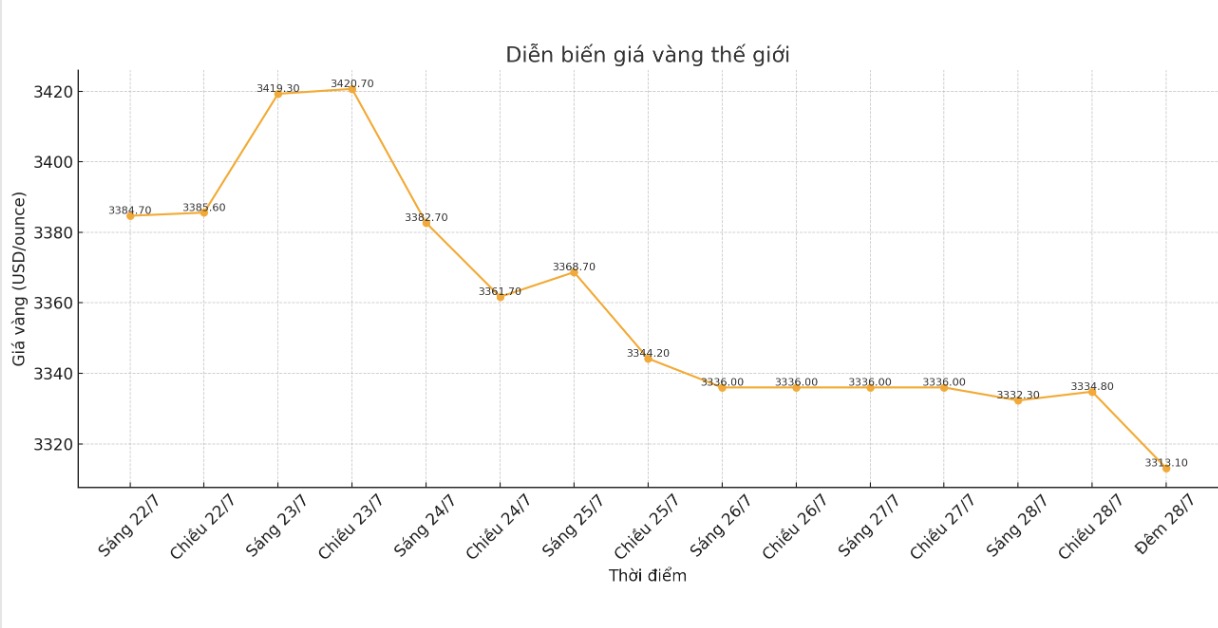

The world gold price was listed at 11:35 p.m. on July 28 at 3,313.1 USD/ounce, down 21.7 USD compared to 1 day ago.

Gold price forecast

Gold prices fell sharply and hit a two-week low at noon on Monday, while silver prices remained almost flat. Gold is under pressure from the soaring USD index and slightly increased US Treasury yields.

In addition, better risk-taking in the general market is also a negative factor for safe-haven metals. August gold contract decreased by 27.5 USD, to 3,307.9 USD/ounce.

According to overnight news, the US and the European Union reached a trade deal over the weekend, which would have put the EU under a 15% tariff on most of its exports to the US, including cars, to avoid a trade war with the US.

The strong increase in the USD index and the Euro decreased sharply today after the agreement showed that the market believes that the US is gaining more favorable conditions.

The US and China are expected to extend the tariff ceasefire by another three months, the South China Morning Post reported over the weekend. The report comes ahead of trade talks between US Treasury Secretary Scott Bessent and Chinese Vice Prime Minister He Lap Phong in Stockholm, Sweden.

The Federal Open Market Committee (FOMC) meeting began Tuesday morning and concluded Wednesday afternoon with a statement and press conference from Federal Reserve Chairman Jerome Powell.

Currently, FED officials are determined to keep interest rates unchanged, although the increasingly fierce debate could increase expectations of an interest rate cut in the fall. Mr. Powell is "under great pressure" from US President Donald Trump to lower interest rates. However, the Fed is widely expected to keep the federal rate unchanged this week.

Technically, buyers in August gold contracts still dominated in the short term but are gradually weakening. The next upside target for buyers is to close above the strong resistance level at the July peak of 3,451.7 USD/ounce. The next downside target for the bears is to push prices below the key technical support level at the bottom of June at $3,250.5/ounce.

The first resistance level recorded at today's high was 3,345.4 USD/ounce, followed by Friday's high of 3,376.6 USD/ounce. The first support is today's low of $3,300, followed by $3,275/ounce.

Another important outside market today is Nymex crude oil futures, which increased to around 66.50 USD/barrel. The yield on the 10-year US Treasury note is currently at 4.412%.

Economic data to watch this week

Tuesday: New employment numbers (JOLTS), US consumer confidence.

Wednesday: ADP employment data, US preliminary GDP, Bank of Canada monetary policy decision, pending home sales, FED interest rate decision, Bank of Japan decision.

Thursday: US PCE, weekly jobless claims.

Friday: US non-farm payrolls, ISM manufacturing PMI.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...