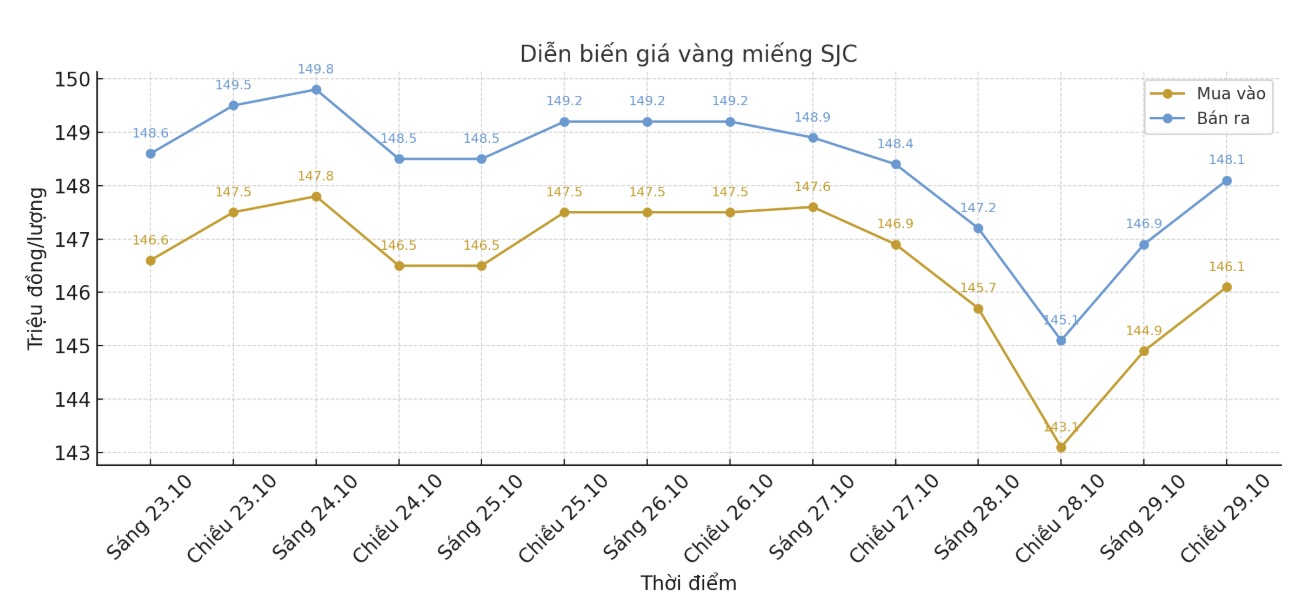

SJC gold bar price

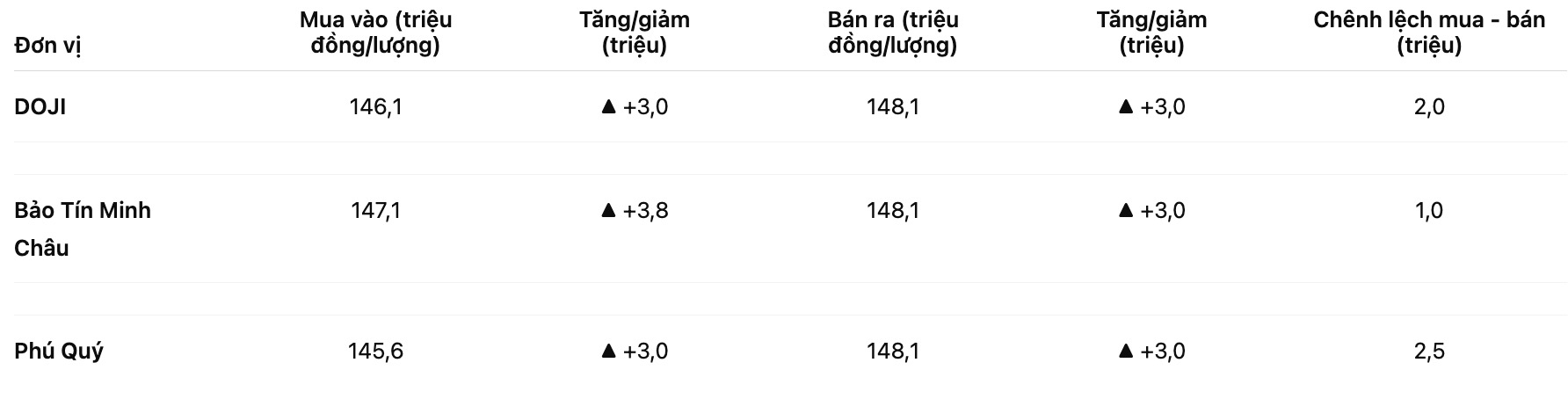

As of 6:00 a.m., DOJI Group listed the price of SJC gold bars at 146.1-148.1 million VND/tael (buy in - sell out), an increase of 3 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 147.1-148.1 million VND/tael (buy - sell), an increase of 3.8 million VND/tael for buying and an increase of 3 million VND/tael for selling. The difference between buying and selling prices is at 1 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 145.6-148.1 million VND/tael (buy - sell), an increase of 3 million VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

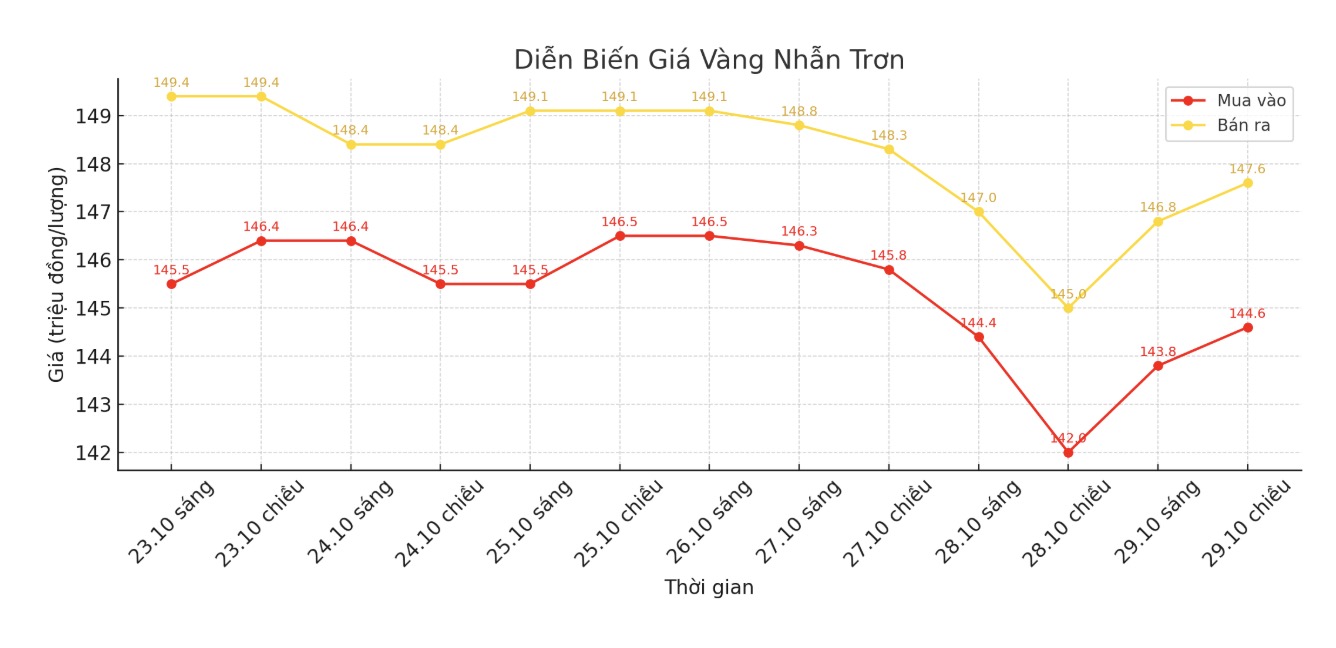

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 144.6-147.6 million VND/tael (buy - sell), an increase of 2.6 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 146.5-149.5 million VND/tael (buy - sell), an increase of 2 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 145.1-148.1 million VND/tael (buy - sell), an increase of 3.1 million VND/tael for both buying and selling. The difference between buying and selling is 3 million VND/tael.

Although it increased compared to a day ago, in the context of world gold plummeting, domestic gold is at risk of decreasing as the opening of today's trading session.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

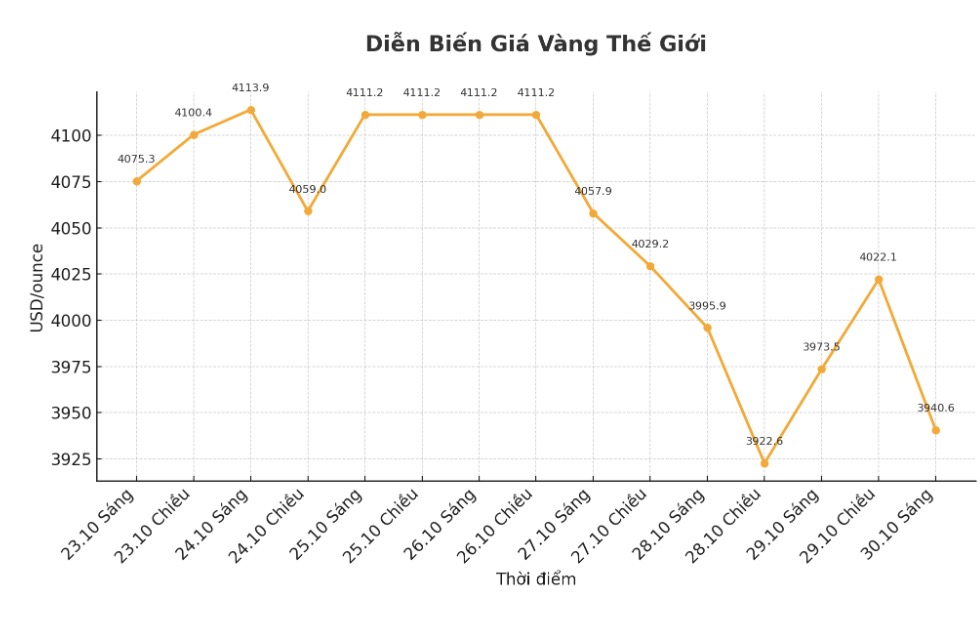

World gold price

The world gold price was listed at 6:00 at 3,940.6 USD/ounce, down 55.3 USD/ounce.

Gold price forecast

World gold prices fell as Federal Reserve Chairman Jerome Powell took a "cold drink" in expectation of a rate cut in December.

After the Fed cut interest rates by another 25 basis points in a move predicted by investors, Mr. Powell emphasized at the beginning of the press conference that continuing to cut interest rates before the end of this year is still a long way off.

Technically, the December gold contract chart shows that the bulls still maintain a slight advantage. However, the recent strong sell-off has caused significant damage to the overall technical structure, showing the possibility of setting a short-term peak in the market.

The next upside target for buyers is to close above a solid resistance level at $4,100/ounce. On the contrary, the target for the sellers is to push the price below the strong support zone at 3,800 USD/ounce.

The first resistance level was at $4,050/ounce, followed by $4,100/ounce; first support was at $4,000, then to an overnight low of $3,930/ounce.

In outside markets, the USD index increased, crude oil prices increased and fluctuated around 60.5 USD/barrel. The yield on the 10-year US Treasury note is currently at 3.99%.

Note: The gold market operates through two main pricing mechanisms: the spot market, where prices are listed for transactions and immediate delivery; and the futures market (futures), where prices are set for future delivery. Due to the year-end liquidity factor, December gold contracts are currently the most actively traded on the CME exchange.

Notable economic data this week

Wednesday: Bank of Canada policy decision, US waitress data, FED policy decision, Bank of Japan policy decision.

Thursday: ECB policy decision.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...