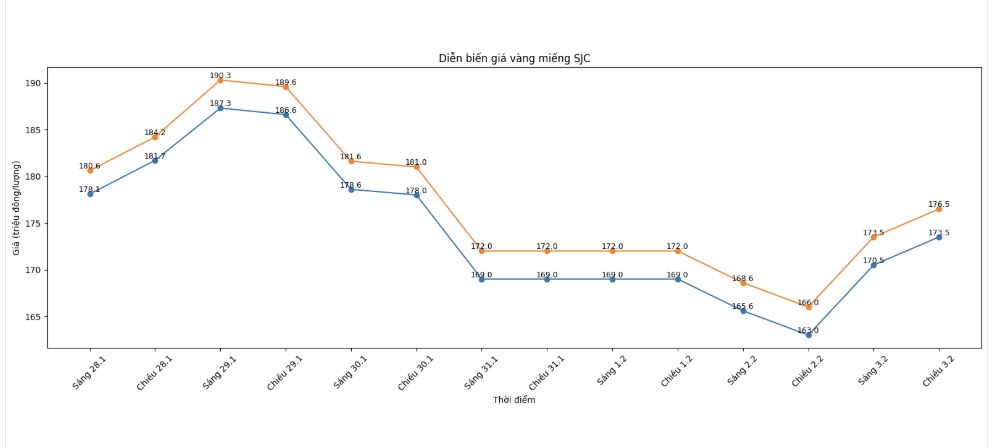

SJC gold bar price

As of 6:00 AM, SJC gold bar prices were listed by DOJI Group at the threshold of 173.5-176.5 million VND/tael (buying - selling); an increase of 10.5 million VND/tael in both buying and selling directions. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 173.5-176.5 million VND/tael (buying - selling); an increase of 10.5 million VND/tael in both buying and selling directions. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at 173.5-176.5 million VND/tael (buying - selling); an increase of 10.5 million VND/tael in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

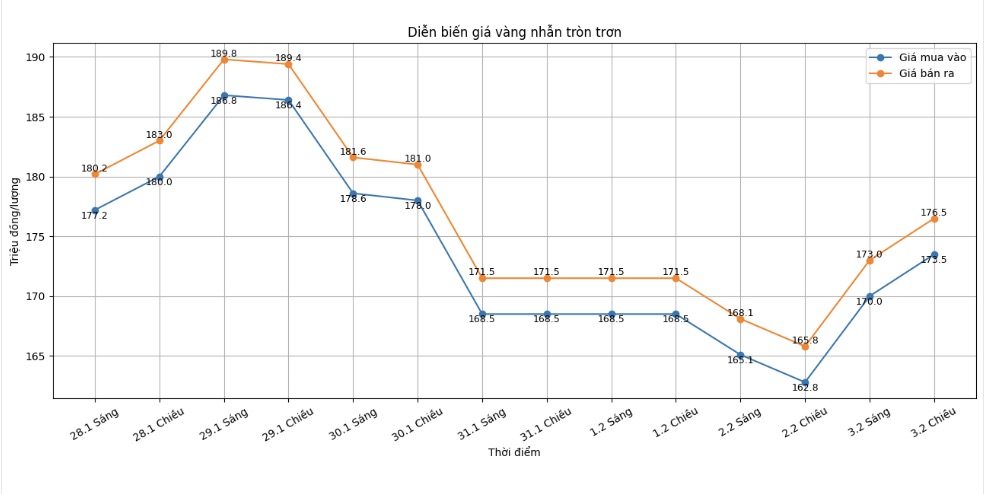

9999 gold ring price

As of 6:00 AM, DOJI Group listed the price of gold rings at 173.5-176.5 million VND/tael (buying - selling); an increase of 10.7 million VND/tael in both buying and selling directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 173.5-176.5 million VND/tael (buying - selling), an increase of 9 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Jewelry Group listed the price of gold rings at 173-176 million VND/tael (buying - selling), an increase of 10 million VND/tael in both buying and selling directions. The buying - selling difference is at 3 million VND/tael.

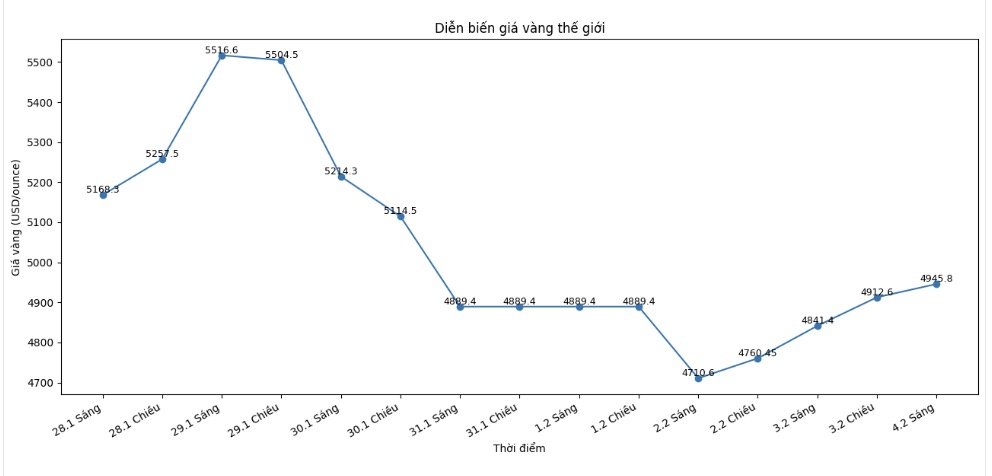

World gold price

At 5:36 am, world gold prices were listed around the threshold of 4, 945.8 USD/ounce; an increase of 239 USD compared to the previous day.

Gold price forecast

Gold and silver prices surged sharply, as buying power from investors (buyers) massively returned after a previous deep decline. The upward momentum of the two precious metals was also supported by the psychology of accepting risks in the general market weakening slightly in the US trading session compared to the previous night's session. In addition, the weakening USD index and a slight increase in crude oil prices also created support for gold and silver prices.

The US jobs report and some economic data continue to be postponed due to a partial federal government shutdown. The US Bureau of Labor Statistics (BLS) said on Monday that it would not release the January jobs report next Friday as planned due to the impact of the government shutdown.

The announcement will be postponed to the time the government is re-funded," said Emily Liddel - Deputy Commissioner in charge of publishing and special studies at BLS - in a statement. She added: "Due to partial federal government shutdowns, BLS will temporarily suspend data collection, processing and disclosure.

According to Bloomberg, many other reports expected to be released this week, including the December job vacancy and labor turnover (JOLTS) survey and the jobs – unemployment report by urban area, will also be postponed.

Technically, the diễn biến of gold futures in April last week formed a "key reversal" pattern of sharp decline on the daily chart - a technical signal showing that the market may have peaked.

The next upside target of the buying side is to close above the strong resistance level of 5,250 USD/ounce. Conversely, the short-term downside target of the selling side is to push the price below the important technical support zone at the bottom this week, 4,423.20 USD/ounce.

The nearest resistance level is determined at the daily peak of 4, 977.7 USD, followed by the psychological milestone of 5,000 USD. Meanwhile, the first support is at 4, 750 USD, followed by the night session bottom at 4, 690.2 USD.

Notable external markets show that crude oil prices increased slightly, trading around 62.75 USD/barrel. The USD index fell, while the yield on 10-year US Treasury bonds was 4.28%.

Gold price data is compared to the previous day.

The world gold market operates based on two main pricing mechanisms. The first is the spot market, reflecting spot buying and selling prices and spot delivery. The second is the futures market, determining delivery prices at a time in the future. Due to the liquidity factor at the end of the year, the December gold futures contract is currently the most actively traded contract on the CME.

See more news related to gold prices HERE...