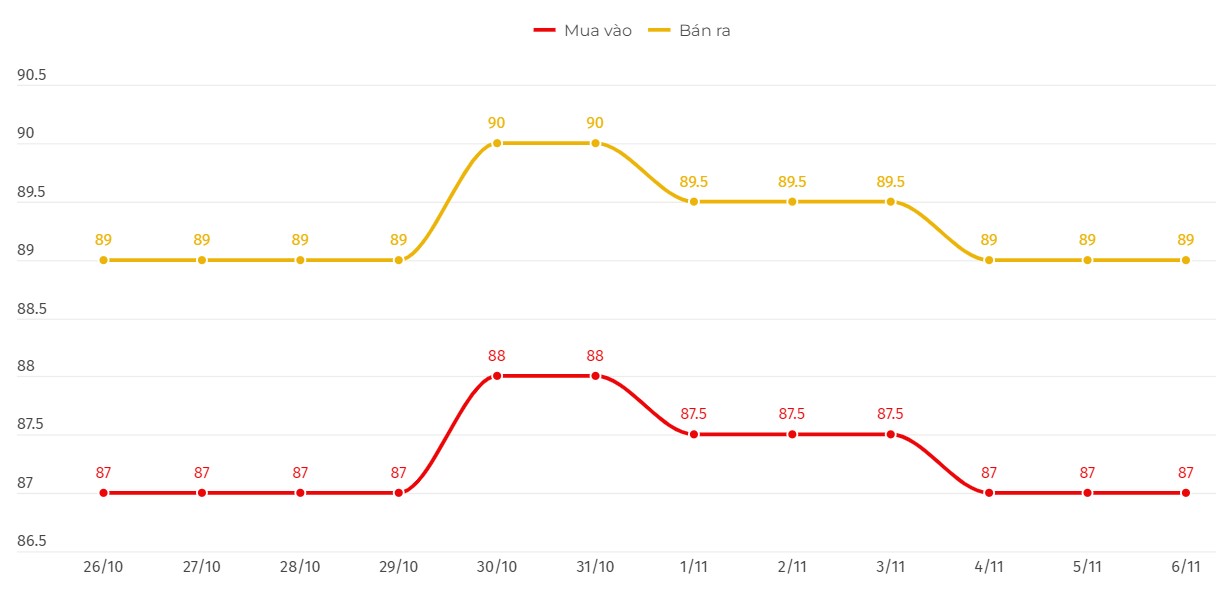

SJC gold bar price

As of 6:00 a.m. on November 6, the price of SJC gold bars listed by DOJI Group was at 87-89 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, gold prices at DOJI remained unchanged in both buying and selling directions. The difference between buying and selling prices of SJC gold at DOJI Group is at 2 million VND/tael.

Saigon Jewelry Company SJC listed the price of SJC gold at 87-89 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, the gold price at Saigon Jewelry Company SJC remained unchanged in both buying and selling directions. The difference between the buying and selling price of SJC gold at Saigon Jewelry Company SJC is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 87-89 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, the gold price at Bao Tin Minh Chau remained unchanged in both buying and selling directions. The difference between the buying and selling price of SJC gold at Bao Tin Minh Chau was at 2 million VND/tael.

Currently, the difference between the buying and selling price of gold is listed at around 2 million VND/tael. Experts say that this difference is very high, causing investors to face the risk of losing money when investing in the short term.

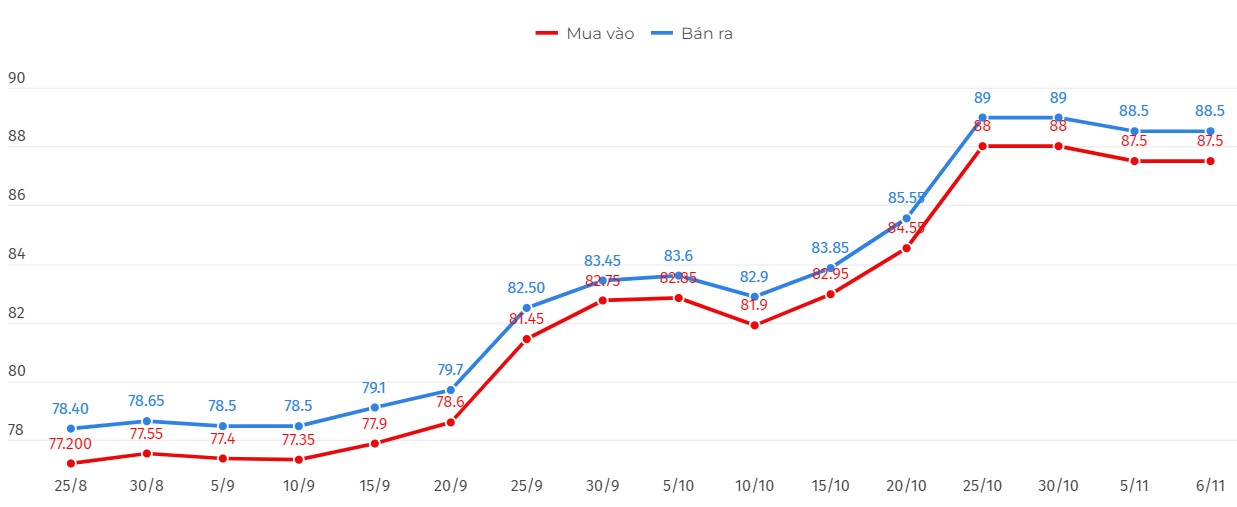

9999 gold ring price

As of 6:00 a.m. on November 6, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 87.5-88.5 million VND/tael (buy - sell), down 100,000 VND/tael for buying and down 300,000 VND/tael for selling compared to the beginning of the previous trading session.

Bao Tin Minh Chau listed the price of gold rings at 87.48-88.48 million VND/tael (buy - sell); down 300,000 VND/tael for both buying and selling compared to the beginning of the previous trading session.

In recent sessions, the price of gold rings has often fluctuated in the same direction as the world market. In the context of a sharp decline in world gold prices, domestic gold rings are facing the risk of falling as well.

World gold price

As of 9:00 p.m. on November 5, the world gold price listed on Kitco was at 2,745.5 USD/ounce, an increase of 9.1 USD/ounce compared to early morning on November 5.

Gold Price Forecast

World gold prices increased as the USD index decreased. Recorded at 9:00 p.m. on November 5, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 103.657 points (up 0.13%).

Gold recovered slightly in the context of the US presidential election on November 5 local time.

Marex analyst Edward Meir said gold prices are likely to rise regardless of who wins because both candidates appear to be reluctant to cut spending and are more likely to increase it. Gold may be volatile in the short term, but the $3,000 an ounce target by 2025 is achievable, especially with continued government spending, Meir said.

According to UBS analyst Giovanni Staunovo, the US election will be the driving force for gold prices this week. This analyst believes that the Fed's interest rate cut will hardly cause much volatility in the market, as the bank has signaled easing as expected by the market.

Bart Melek, director of commodity strategy at investment bank TD Securities, said that if Donald Trump wins, gold prices will increase because the market is concerned about inflation with the tariff barriers that the former President mentioned.

This session, investors are also focusing on the US Federal Reserve's (FED) interest rate decision after its meeting from November 6-7. According to the CME FedWatch tool, the market is predicting a 0.25 percentage point interest rate cut this week. This will be the FED's second interest rate cut this year.

Gold is seen as a hedge against economic and political instability and tends to rise sharply when interest rates are low.

See more news related to gold prices HERE...