Update SJC gold price

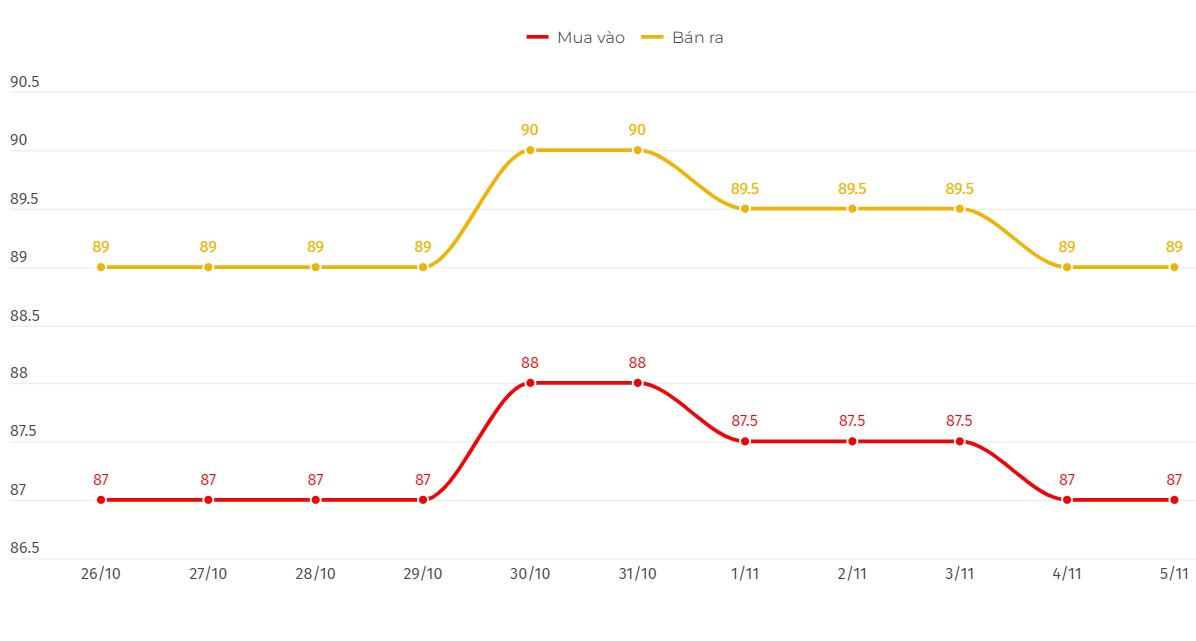

As of 5:00 p.m., the price of SJC gold bars was listed by DOJI Group at 87-89 million VND/tael (buy - sell).

Compared to the previous trading session, gold prices at DOJI remained unchanged in both buying and selling directions. The difference between buying and selling prices of SJC gold at DOJI Group is at 2 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 87-89 million VND/tael (buy - sell).

Compared to the previous trading session, the gold price at Saigon Jewelry Company SJC remained unchanged in both buying and selling directions. The difference between the buying and selling price of SJC gold at Saigon Jewelry Company SJC is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 87-89 million VND/tael (buy - sell).

Compared to the previous trading session, gold prices at Bao Tin Minh Chau remained unchanged in both buying and selling directions. The difference between buying and selling prices of SJC gold at Bao Tin Minh Chau was at 2 million VND/tael.

Currently, the difference between the buying and selling price of gold is listed at around 2 million VND/tael. Experts say that this difference is very high, causing investors to face the risk of losing money when investing in the short term.

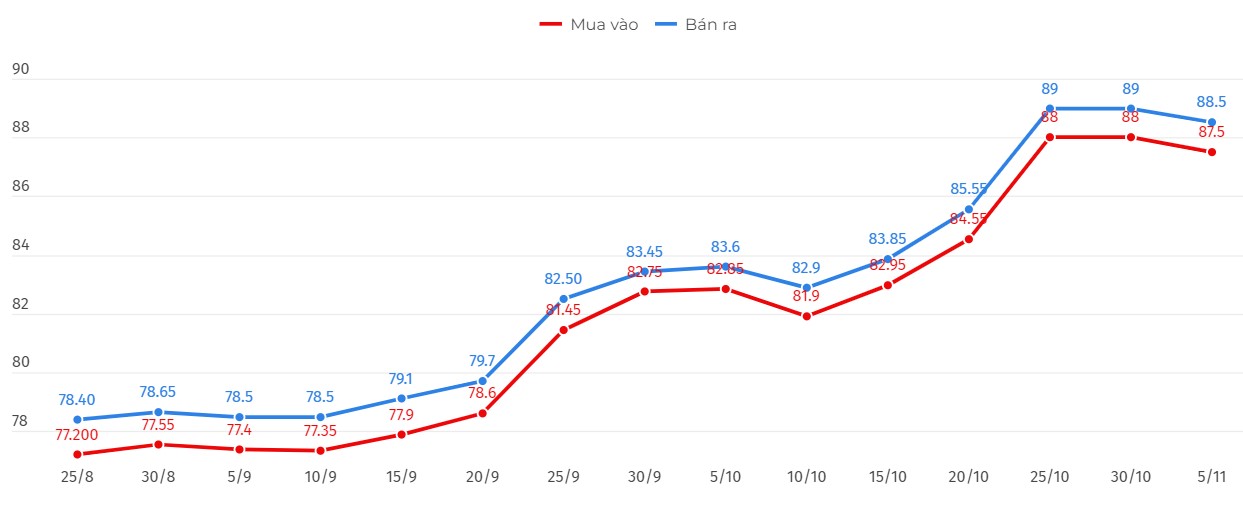

Price of round gold ring 9999

As of 5:30 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 87.5-88.5 million VND/tael (buy - sell), down 100,000 VND/tael for buying and down 300,000 VND/tael for selling compared to the close of the previous trading session.

Bao Tin Minh Chau listed the price of gold rings at 87.48-88.48 million VND/tael (buy - sell); down 300,000 VND/tael for both buying and selling compared to the close of the previous trading session.

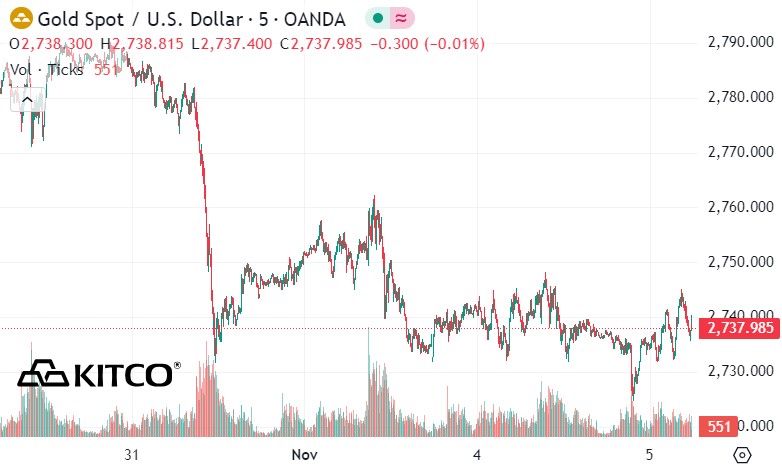

World gold price

As of 5:37 p.m., the world gold price listed on Kitco was at 2,737.9 USD/ounce, down 3.8 USD/ounce compared to the close of the previous trading session.

Gold Price Forecast

World gold prices fell despite the decline in the USD index. Recorded at 5:37 p.m. on November 5, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 103.677 points (down 0.11%).

According to CBS News, events that could impact gold prices are the 2024 US presidential election and the upcoming decision by the US Federal Reserve (FED) on interest rates.

Analysts widely expect a second rate cut of the year at the Fed's November 6-7 meeting, and historically, changes in the Fed's interest rate policy have had mixed effects on gold.

While potential investors may hope that gold prices will temporarily decline following this week's Fed rate decision, such a trend is unlikely, according to CBS News analyst Angelica Leicht. After all, gold and interest rates have historically had an inverse relationship, with lower rates typically being accompanied by higher gold prices.

So, with the Fed expected to cut interest rates this week, many investors are predicting that gold prices will rise rather than fall, or that the rate cut may not have a significant impact on gold prices in the short term.

According to Axel Rudolph - market analyst at IG Markets, the world gold price will break the threshold of 2,900 USD/ounce by the end of this year. This expert commented that the gold price will trade between 3,000 and 3,113 USD/ounce in the first quarter of 2025.

In a recent analysis, Rudolph noted that gold has been on a strong rally over the past two years, with last week's record price of $2,790 an ounce just shy of the key $2,800 an ounce level.

Rudolph said that in addition to the psychological level of $2,800 - $2,900 / ounce, it is expected to be reached by the end of 2024. He believes that the level of $3,000 / ounce will appear in the early months of next year.

Rudolph believes that gold prices will likely trade around $3,000 an ounce for several months as gold will act as a strong magnet for investors: “Physical gold purchases by some central banks, especially China, are likely to continue until this level is reached. If these bullion purchases continue, pushing gold prices above the technical $3,000 an ounce level, the precious metal could also reach $3,113 an ounce.”