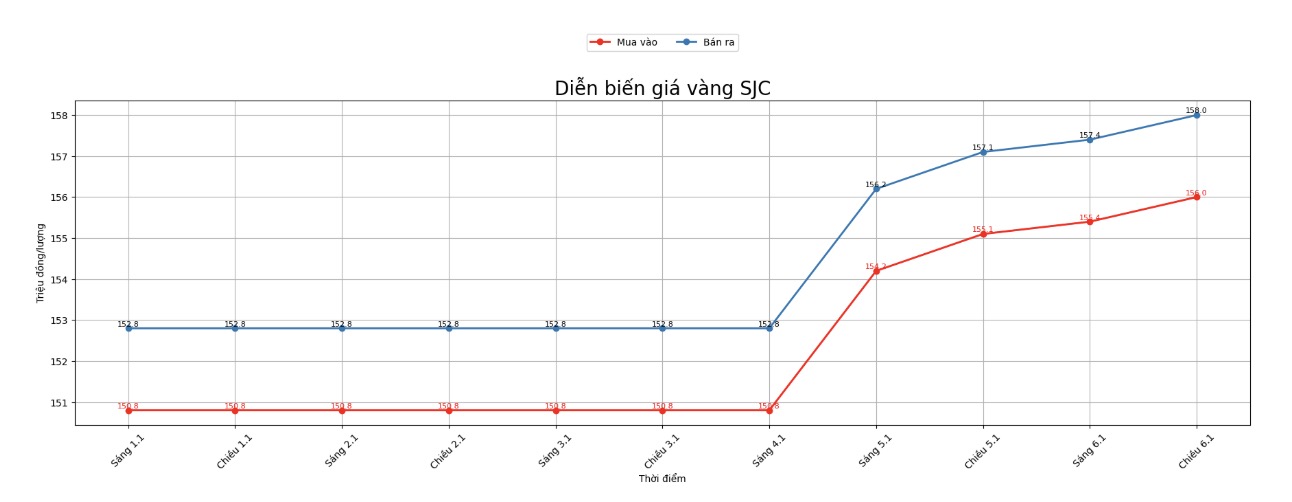

SJC gold bar price

As of 6:00 AM on January 8, SJC gold bar prices were listed by DOJI Group at the threshold of 156.1-158.1 million VND/tael (buying - selling), an increase of 100,000 VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 156.1-158.1 million VND/tael (buying - selling), an increase of 100,000 VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed SJC gold bar prices at 156.1-158.1 million VND/tael (buying - selling), an increase of 100,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

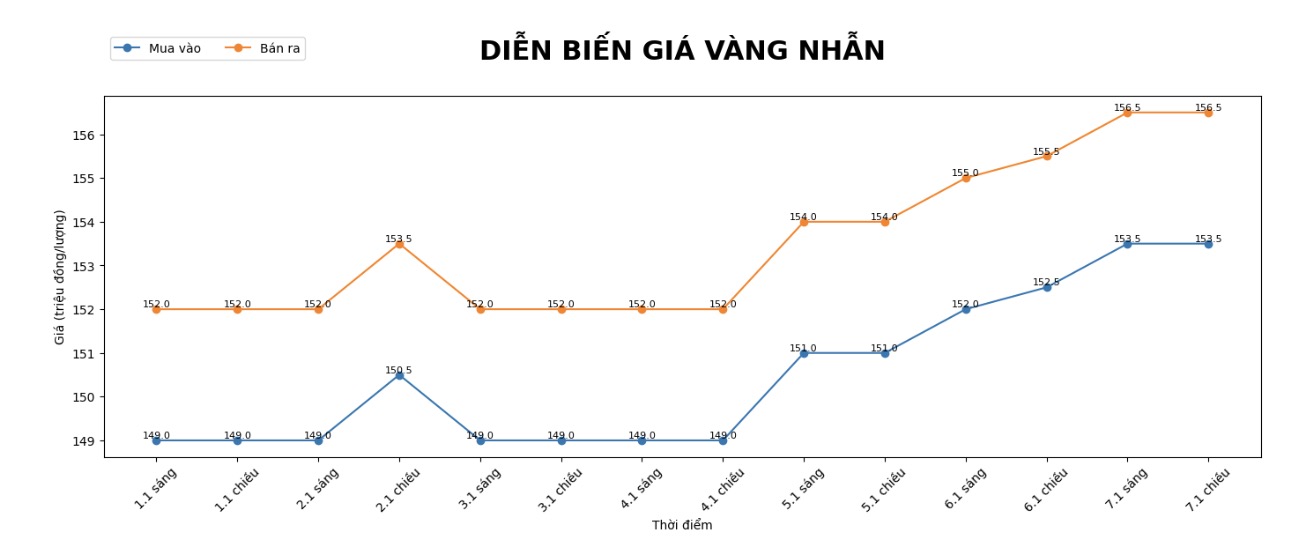

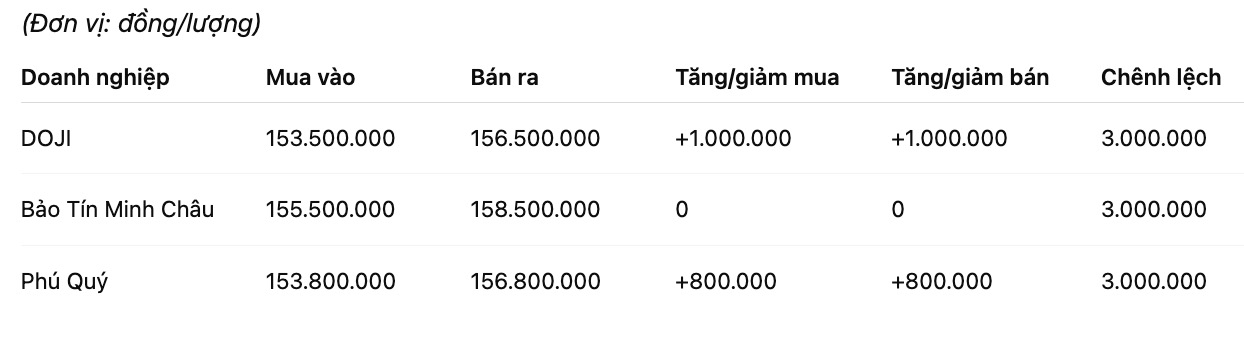

9999 gold ring price

As of 6:00 AM on January 8, DOJI Group listed the price of plain gold rings at 153.5-156.5 million VND/tael (buying - selling), an increase of 1 million VND/tael in both buying and selling directions. The difference between buying and selling is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 155.5-158.5 million VND/tael (buying - selling), going sideways in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 153.8-156.8 million VND/tael (buying - selling), an increase of 800,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

The high buying - selling gap increases the risk for individual investors. Individual investors, especially those with a "surfing" mentality, need to consider carefully before spending money.

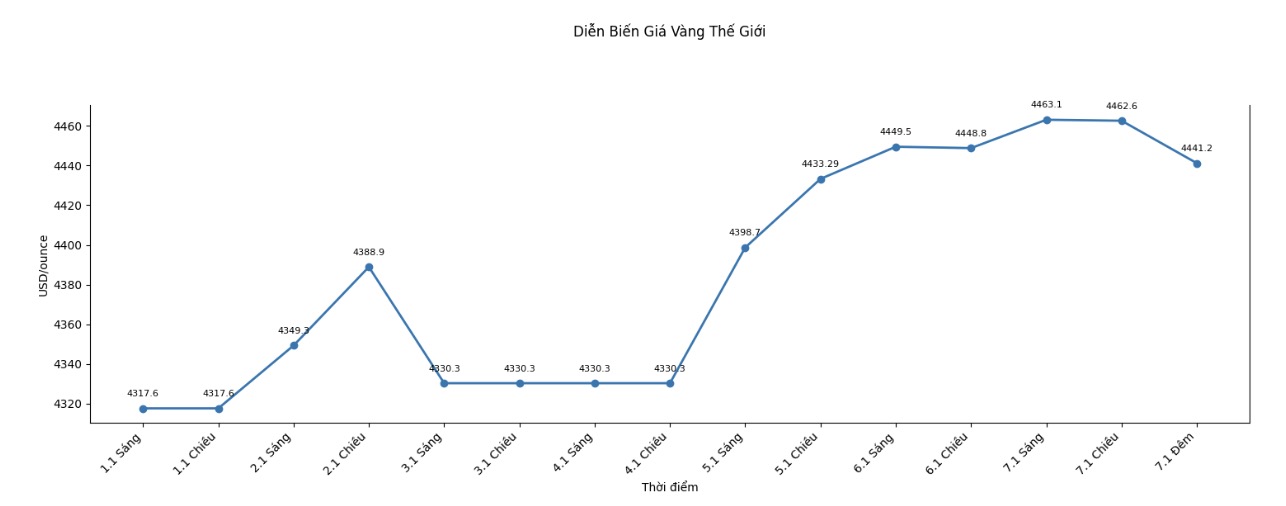

World gold price

World gold prices listed at 10:50 PM on January 7 were at the threshold of 4,441.2 USD/ounce, down 57.1 USD.

Gold price forecast

Gold and silver prices decreased mainly due to profit-taking activities of short-term investors in the futures contract market. In addition, strong technical resistance levels around the historical peak also caused buying momentum to temporarily slow down in the middle of the week.

Gold for February delivery fell $32.4, down to $4,463.70/ounce. Meanwhile, silver for March delivery fell $2.344, down to $78.695/ounce.

Notable developments in the international market: China's central bank continues to buy gold. According to the latest released data, China has extended its gold buying streak for 14 consecutive months, showing that official gold reserve demand is still maintained at a high level, despite the sharp fluctuation of precious metal prices. In the previous month alone, gold reserves increased by about 30,000 ounces, raising total purchases since the end of 2024 to about 1.35 million ounces (equivalent to 42 tons).

Analysts believe that although gold prices have fluctuated sharply in recent weeks, this precious metal still recorded the strongest increase in decades, thanks to demand from central banks, geopolitical concerns and the trend of seeking safe havens from monetary risks.

The oil market recorded new supply information, in the context of global energy trade flows undergoing many changes. Some large US energy businesses are said to be increasing oil import and export activities in Latin America, partly easing short-term supply pressure.

In Europe, inflation in the Eurozone continues to cool down. The consumer price index in December increased by 2% compared to the same period last year, in line with the European Central Bank (ECB)'s target. Core inflation and service inflation both tend to decrease, reinforcing the view that interest rates in this region are likely to remain stable in the near future, if no major economic fluctuations occur.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...