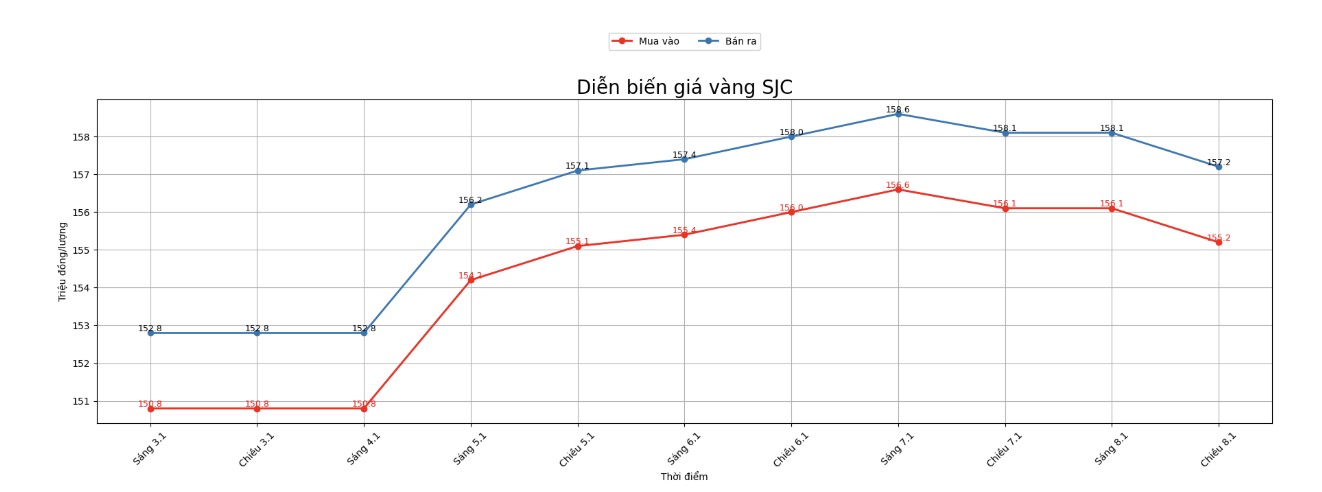

SJC gold bar price

As of 6:00 AM, SJC gold bar prices were listed by DOJI Group at the threshold of 155.2-157.2 million VND/tael (buying - selling), down 900,000 VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 155.2-157.2 million VND/tael (buying - selling), down 900,000 VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed SJC gold bar prices at the threshold of 155.2-157.2 million VND/tael (buying - selling), down 900,000 VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

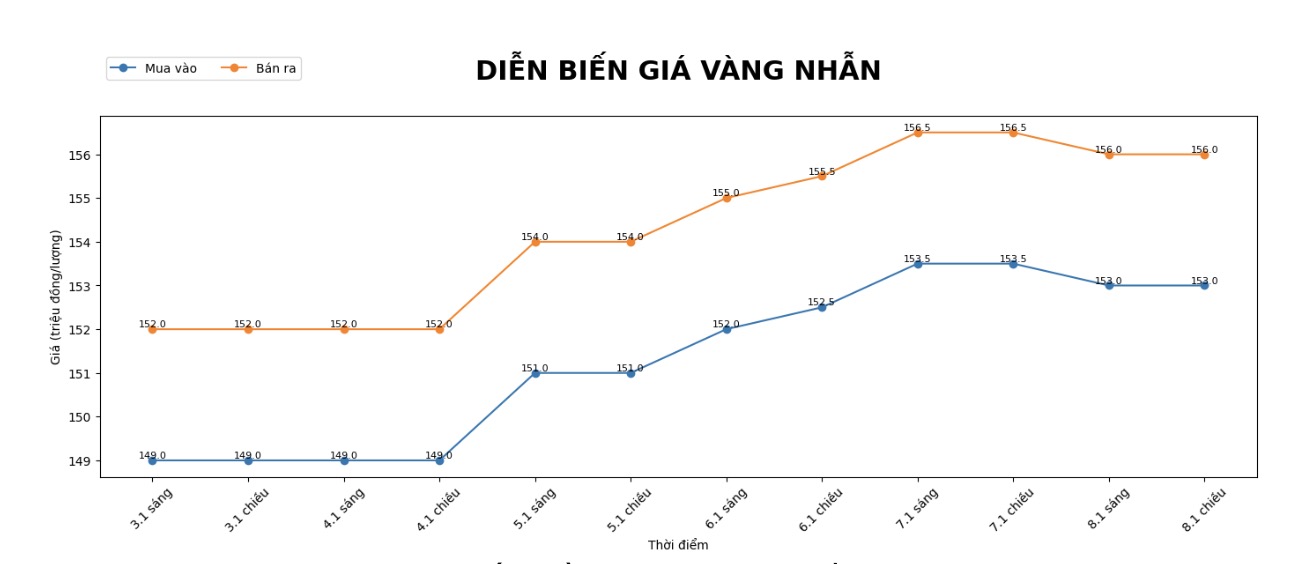

9999 gold ring price

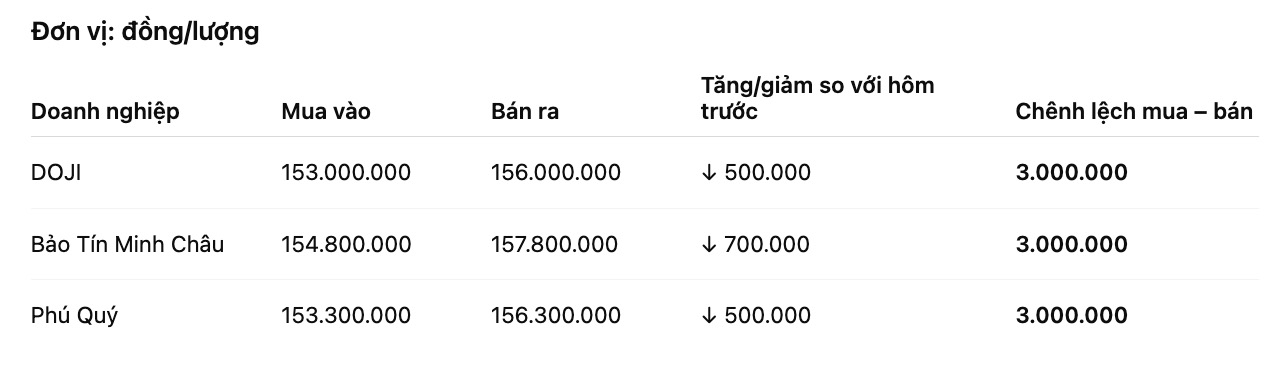

As of 6:00 AM, DOJI Group listed the price of plain gold rings at 153-156 million VND/tael (buying - selling), down 500,000 VND/tael in both buying and selling directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 154.8-157.8 million VND/tael (buying - selling), down 700,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 153.3-156.3 million VND/tael (buying - selling), down 500,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

The high buying - selling gap increases the risk for individual investors. Individual investors, especially those with a "surfing" mentality, need to consider carefully before spending money.

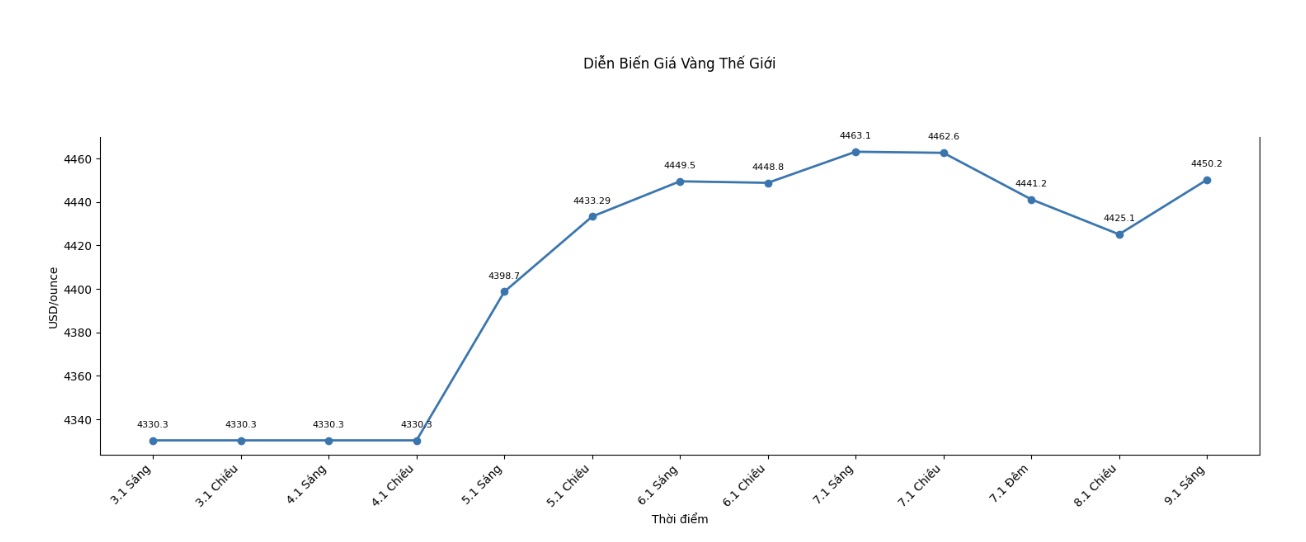

World gold price

World gold price listed at 3:00 am at the threshold of 4,450.2 USD/ounce, up 9 USD.

Gold price forecast

Gold prices rose slightly and recovered quite well from the bottom of the day, while silver prices fell sharply in Thursday afternoon trading in the US. Silver is under profit-taking pressure and liquidation of weak buying positions from short-term futures traders, in the context that this metal has formed a negative technical model.

Gold traders are still partly monitoring the developments of the silver market to determine the price trend for the day. However, the deep drop in silver is limiting buying power for gold in today's session.

Gold futures for February delivery rose 10.3 USD, to 4,473.1 USD/ounce. Meanwhile, silver futures for March delivery fell 1,598 USD, to 76.01 USD/ounce.

Investors and gold and silver traders are preparing for the annual restructuring of commodity indices, which is currently taking place and may cause billion-dollar futures contracts to be sold in the next few days. Bloomberg quoted Citigroup Inc.'s estimates as saying that about 6.8 billion USD of silver futures could be sold to meet restructuring requirements, while the amount of capital withdrawn from gold futures contracts is also about the same. Selling is necessary because the proportion of precious metals in standard commodity indices has increased sharply, according to Bloomberg.

External markets show that the US USD index is increasing. Crude oil prices are higher and trading around 57 USD/barrel. The 10-year US Treasury bond yield is currently at 4.16%.

Technically, gold futures buyers for February delivery set the next price increase target to close above the strong resistance zone at the contract's record high of 4,584 USD/ounce. The short-term price reduction target of the selling side is to push the price below the important technical support zone at 4,284.3 USD/ounce.

The immediate resistance is at a high overnight level of 4,475.2 USD/ounce, followed by 4,500.00 USD. The first support is at a low level in the day of 4,415 USD/ounce, followed by 4,400 USD/ounce.

Gold price data is compared to the previous day.

See more news related to gold prices HERE...