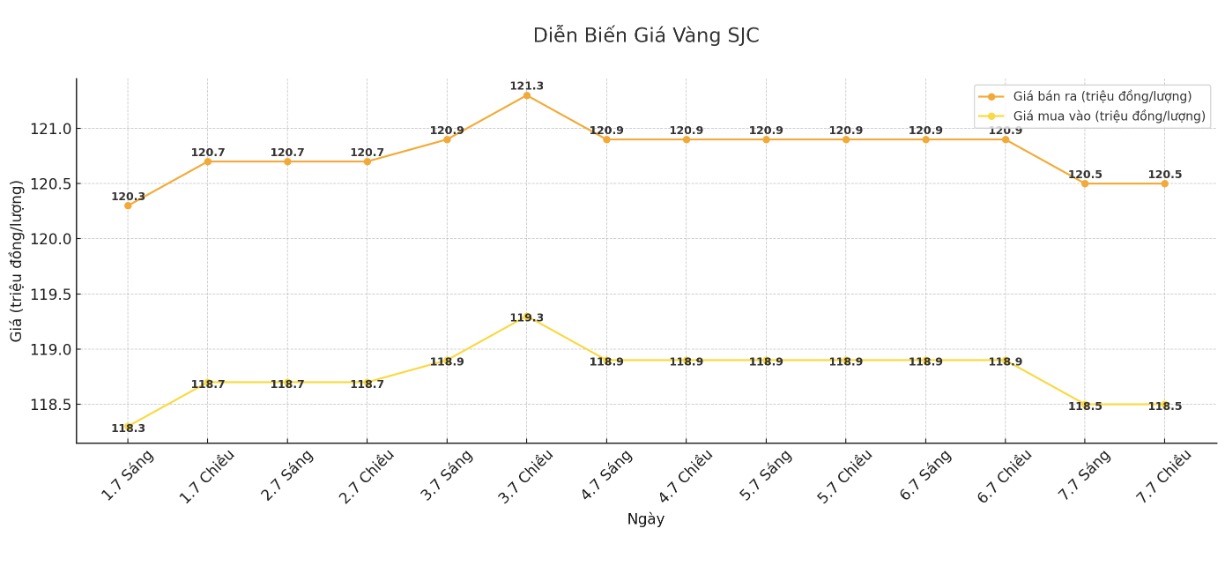

SJC gold bar price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 118.5-120.5 million/tael (buy in - sell out); down VND 400,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed at 118.5-120.5 million VND/tael (buy - sell); down 400,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 118.5-120.5 million VND/tael (buy in - sell out); down 400,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 117.8-120.5 million VND/tael (buy in - sell out); down 400,000 VND/tael in both directions. The difference between buying and selling prices is at 2.7 million VND/tael.

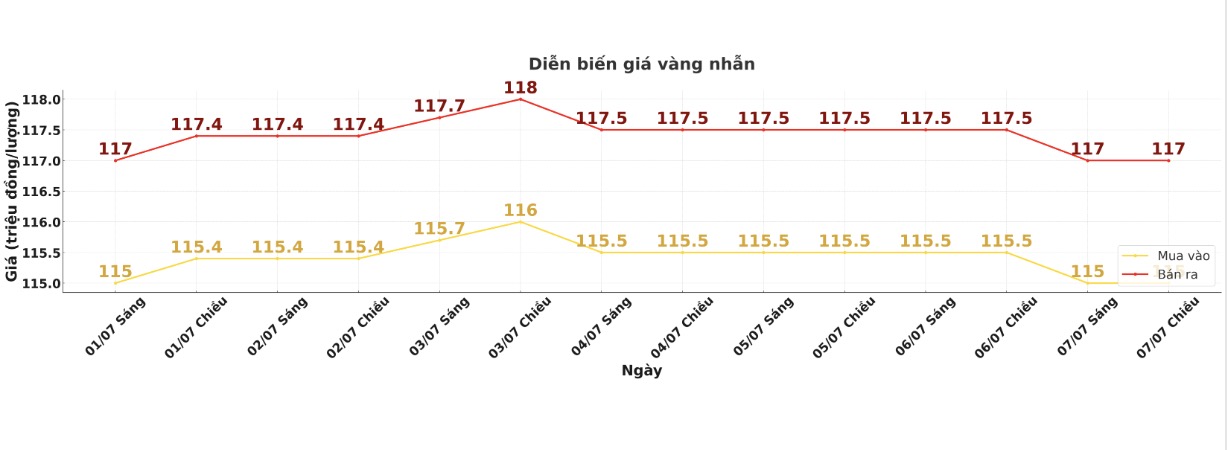

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 115-117 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115.2-118.2 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 113.9-116.9 million VND/tael (buy - sell), down 400,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

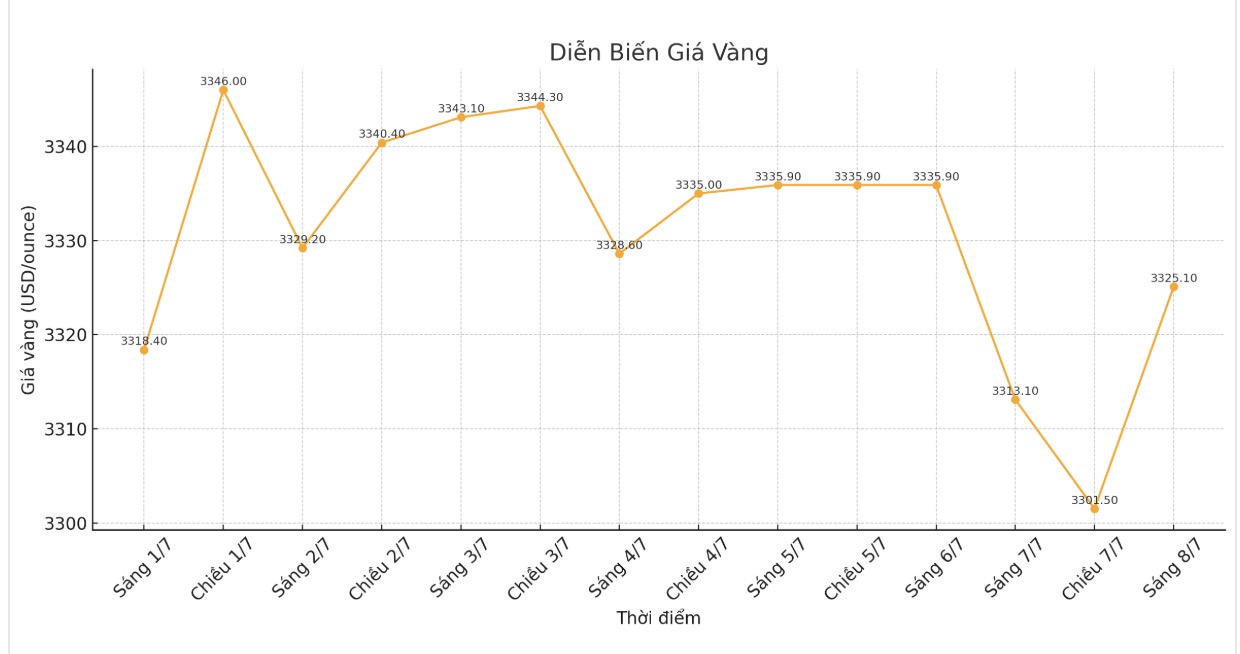

World gold price

Recorded at 0:00, spot gold was listed at 3,325.1 USD/ounce, down 10.8 USD/ounce.

Gold price forecast

Yesterday, safe-haven metals were under selling pressure due to improved investor risk sentiment, after major US stock indexes hit a record high. August gold contract decreased by 32.8 USD, to 3,310.1 USD/ounce. September delivery silver price decreased by 0.629 USD, to 36.455 USD/ounce.

However, the bearish trend of gold is being reversed due to the wave of buying as prices decrease. Early this morning (July 8 - Vietnam time), the precious metal on the world market almost regained its previous decrease.

The Asian and European stock markets fluctuated in different directions overnight. US stock indexes are heading for a weaker opening session today in New York.

The development comes as US Treasury Secretary Bessent said the deadline for US real trade talks with partners could be postponed from July 9 to August 1. White House officials say some trade deals could be reached this week.

In another development, the BRICS (Brazil, Russia, India, China and South Africa) summit will begin this week, hosted by Brazil in Rio. President Donald Trump warned that countries associated with the BRICS group may face additional tariffs.

Technically, speculators who sell gold in August still have a short-term advantage. The next upside target for buyers is to close above $3,400/ounce. The nearest downside target for the seller is to pull prices below the support level of $3,200/ounce.

The first resistance level was the overnight peak of $3,355 an ounce, followed by last week's peak of $3,376.9/ounce. First support was at the bottom of overnight at $3,304.4 an ounce, followed by $3,300 an ounce.

In key outside markets, the USD index is strengthening. Nymex crude oil prices are almost flat, trading around $67/barrel. The yield on the 10-year US Treasury note is currently at 4.356%.

Economic data to watch this week

Tuesday: Reserve Bank of Australia monetary policy meeting.

Wednesday: Minutes of the Fed's June FOMC meeting.

Thursday: US weekly jobless claims.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...