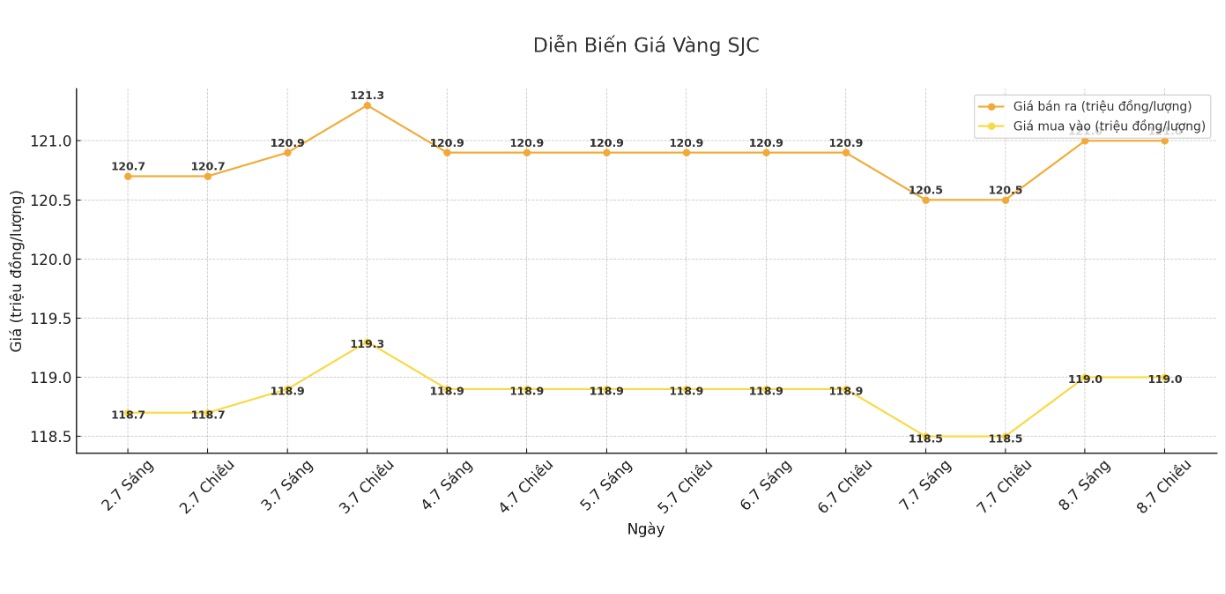

SJC gold bar price

As of 6:00 a.m. on July 9, the price of SJC gold bars was listed by Saigon Jewelry Company at VND119-121 million/tael (buy in - sell out); increased by VND500,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed at 119-121 million VND/tael (buy - sell); increased by 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 119-121 million VND/tael (buy - sell); increased by 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 118.3-121 million VND/tael (buy in - sell out); increased by 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2.7 million VND/tael.

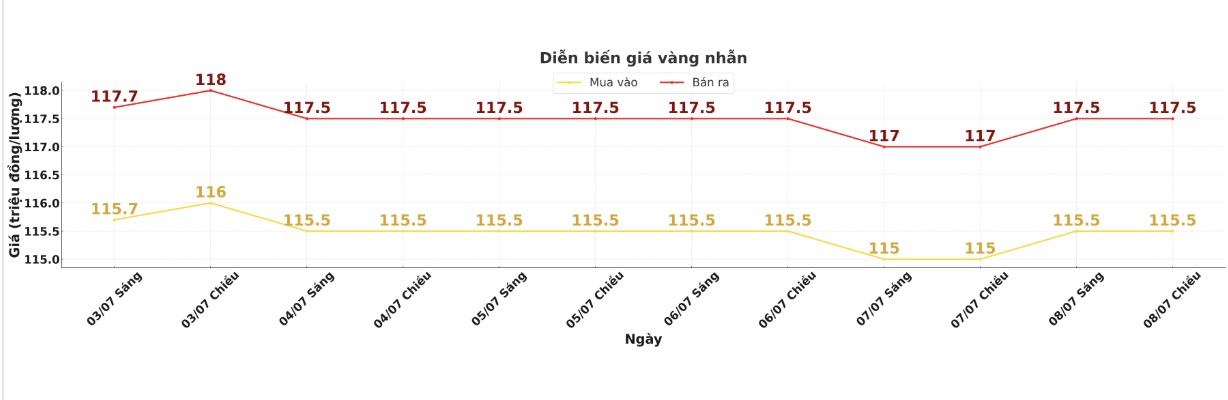

9999 gold ring price

As of 6:00 a.m. on July 9, DOJI Group listed the price of gold rings at VND 115.5-117.5 million/tael (buy in - sell out), an increase of VND 500,000/tael in both directions. The difference between buying and selling is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115.7-118.7 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114.2-117.3 million VND/tael (buy in - sell out), an increase of 400,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

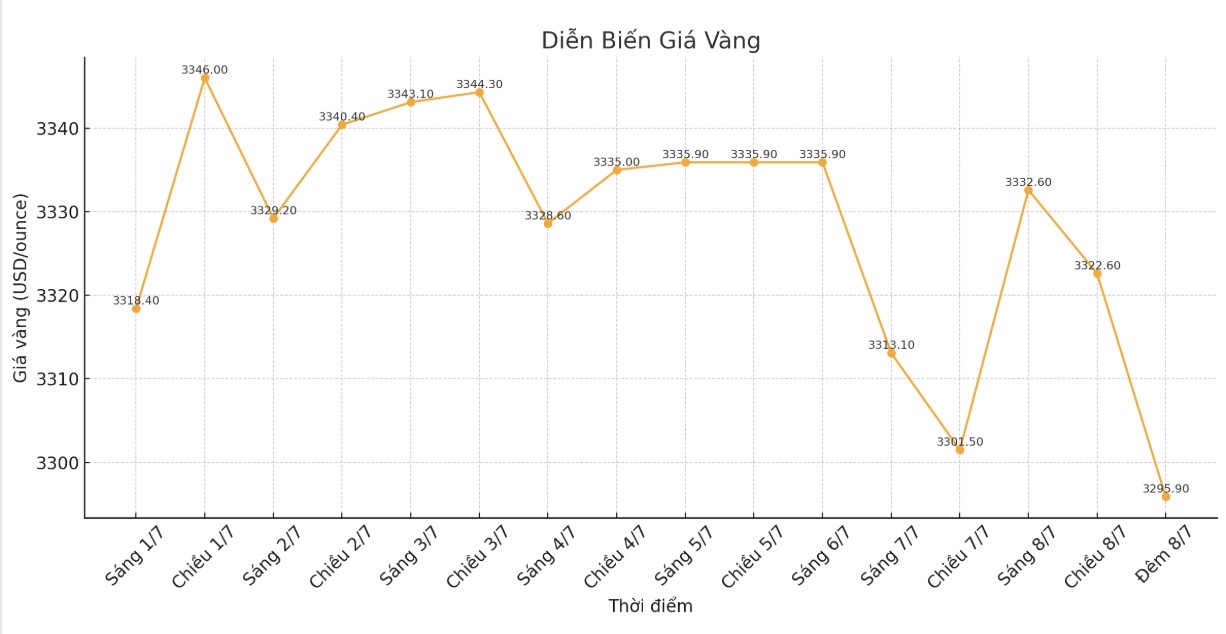

World gold price

Recorded at 6:15 p.m. on July 8, spot gold was listed at $3,295.9/ounce, down $29.2/ounce.

Gold price forecast

World gold prices fell as the market entered a quiet trading period typically seen in the summer. bulls are in need of a new push from the fundamentals to boost their rally. Otherwise, it is likely that the market will continue to fluctuate within a narrow range in the short term.

August gold price decreased by 7.9 USD, to 3,334.9 USD/ounce. September delivery silver price decreased by 0.094 USD, to 36.81 USD/ounce.

Asian and European stocks traded in opposite directions last night. US stock indexes are forecast to open slightly upward. Risk-off sentiment eased slightly after US President Donald Trump announced on July 7 to impose additional tariffs on goods from Japan and South Korea, and sent a letter of warning to more than 12 other countries about the possibility of 25-40% tariffs if they do not reach a trade deal with the US before August 1.

Technically, August gold still has a short-term technical advantage. The next upside target for buyers is to close above the resistance level of $3,400/ounce. On the contrary, the selling side needs to pull the price below the solid support level of 3,200 USD/ounce to create an active position.

The resistance level is close to 3,355.60 USD/ounce (played last night), then 3,376.9 USD/ounce (played last week). Support is close to a weekly low of $3,304.4 an ounce, followed by $3,300 an ounce.

In the outside market, the USD index decreased slightly, Nymex crude oil prices also decreased slightly and traded around 67.75 USD/barrel. The yield on the 10-year US Treasury note is at 4.40%.

Economic data to watch this week

Wednesday: Minutes of the Fed's June FOMC meeting.

Thursday: US weekly jobless claims.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...