Gold prices remained almost unchanged on Tuesday, fluctuating between safe-haven demand after US President Donald Trump proposed new tariffs on trading partners, including Japan and South Korea, and rising bond yields have held back their gains.

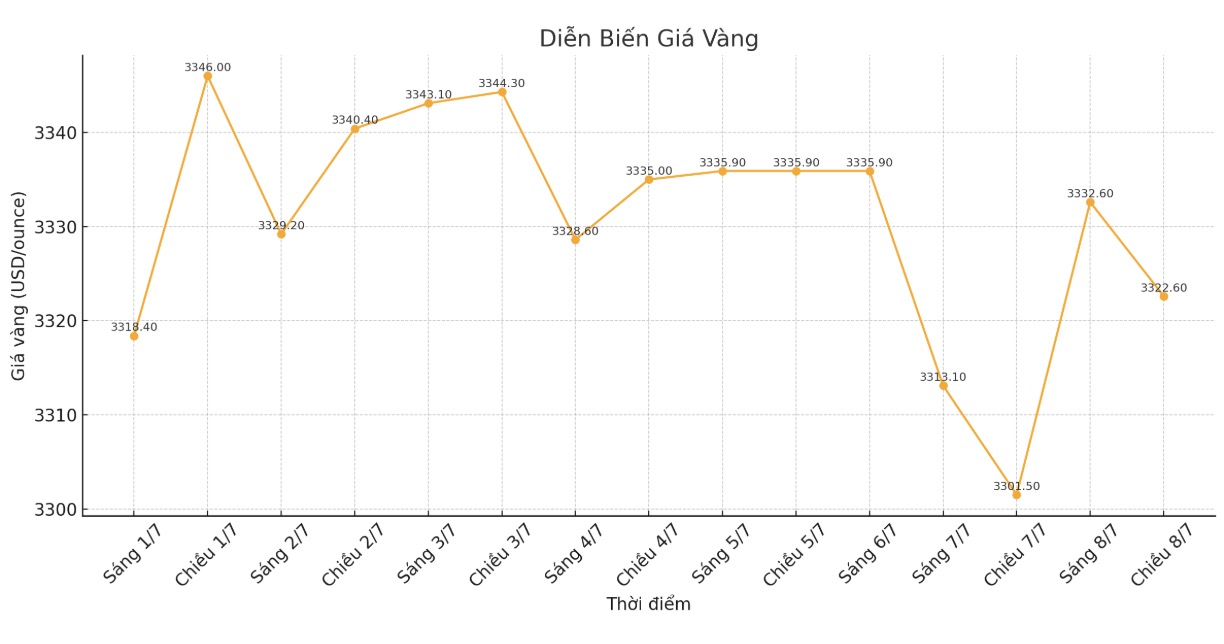

At 6:12 GMT, spot gold prices fell slightly by 0.1%, down to $3,331.85/ounce. US gold futures remained steady at $3,341.80/ounce.

President Donald Trump began notifying his trading partners on Monday that significantly higher US tariffs will begin on August 1, marking a new phase in the trade war he launched earlier this year. The tax rate for goods from Japan and South Korea is set at 25%.

Mr. Trump said the deadline for implementing the tax on August 1 is hard, but he could consider extending it if the countries make a proposal.

Mutual tariffs have been capped at 10% until July 9 to facilitate negotiations, but so far only a few countries have reached a deal.

Traders dont seem to be too concerned about Mr Trumps tariff letters, and with overall Asyl demand under control, gold is still waiting for an opportunity to break out.

Higher bond yields and the ability of the Asian market to cope well with tariff developments are holding back gold's short-term upside potential," said Mr. Waterer.

The yield on the 10-year US Treasury note has hovered near a two-week high. Rising yields make holding gold, a non-interest-bearing asset, less attractive.

Mr. Trump's tariffs have raised concerns about inflation, further complicating the interest rate cut roadmap of the US Federal Reserve (FED).

The minutes of the Fed's June meeting, due out on Wednesday, will provide further cluees on the agency's policy prospects.

Spot silver prices remained steady at 36.75 USD/ounce, platinum prices fell 0.1% to 1,368.93 USD/ounce and gold prices increased 0.2% to 1,112.88 USD/ounce.