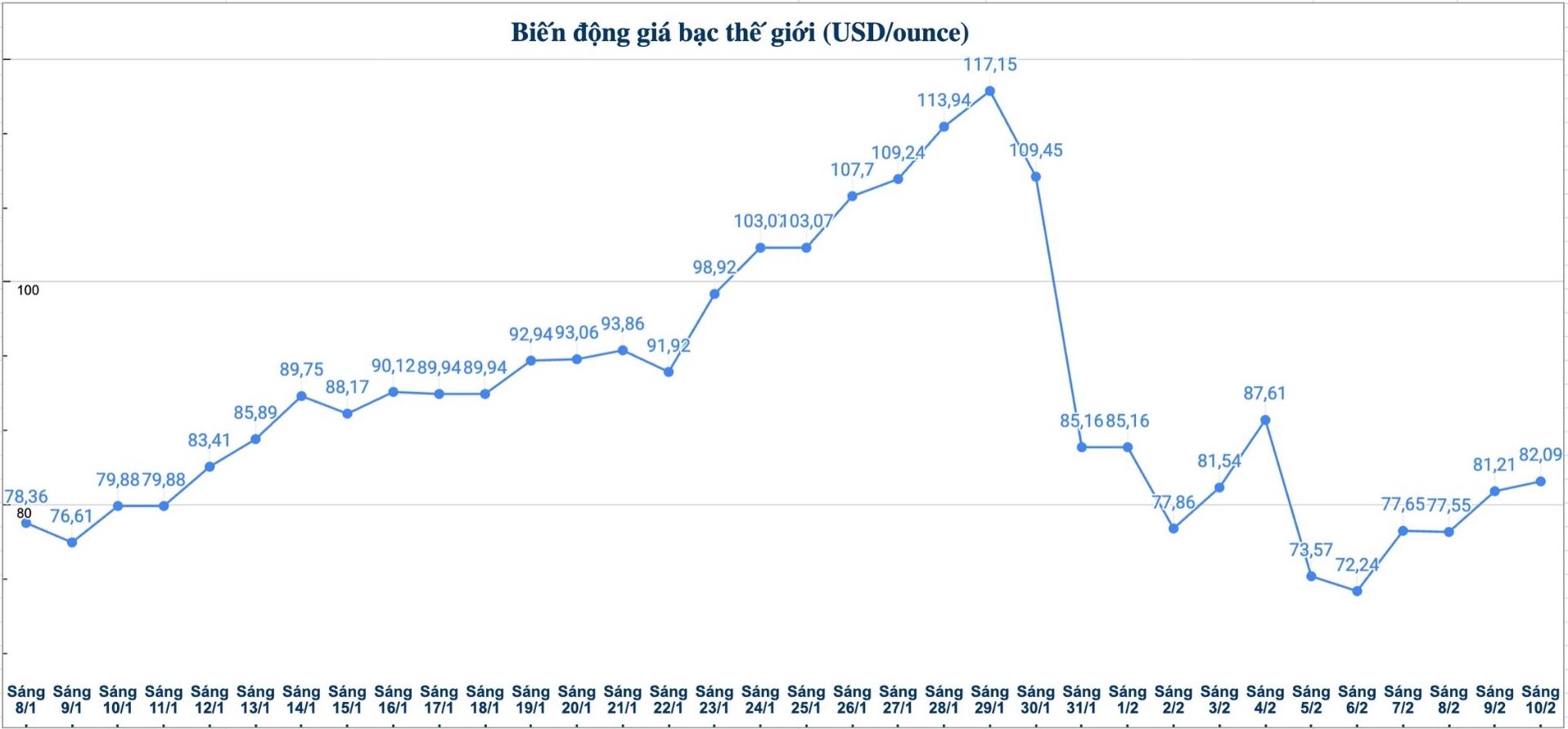

Fluctuations in the silver market are starting to cool down as the price of this precious metal moves into a high-value accumulation phase, around the threshold of 80 USD/ounce.

Although the market is still lower than the historical peak set last month, the long-term upward trend continues to be supported by solid fundamentals, according to the latest report by the Silver Institute (an international organization specializing in researching and providing information on the silver market).

In a recent research note, the Silver Institute said that the most important support for silver comes from the supply-demand imbalance, which is expected to last until the end of 2026, marking the sixth consecutive year the market has fallen into a deficit.

The foundational drivers supporting silver for most of 2025 are still present from the beginning of this year. Including tighter material supply in London, volatile geopolitical context, uncertainty in US policy and concerns about the independence of the US Federal Reserve (Fed)" - the analysis team noted.

As of February 9, silver prices have increased by 11% in 2026. Demand for silver bars and coins has increased sharply in recent months, while holdings in global ETP funds are estimated at 1.31 billion ounces.

According to the report, investment demand is expected to be the main driving force for silver prices to rise this year, as the slowdown in the economy puts pressure on industrial consumption. Conversely, the high price level is forecast to weaken jewelry demand.

Material investment is expected to increase by 20%, to the highest level in three years, reaching 227 million ounces (Moz). After three consecutive years of decline, material investment demand in the West is expected to recover in 2026, thanks to impressive silver prices and an unstable macroeconomic environment. Investment demand in India is also likely to continue to increase, extending the strong improvement momentum of the previous year" - Silver Institute said.

Meanwhile, demand for silver for industry is forecast to decrease by 2%, to a four-year low of about 650 million ounces. The biggest impact comes from the solar energy sector, as businesses continue to reduce silver content or seek alternatives in photovoltaic panel production.

However, despite reduced consumption in the solar energy industry, the electrification of the global economy is still seen as a factor supporting broader industrial demand for silver.

Many silver applications still benefit from favorable structural growth trends. In particular, the expansion of data centers, technology related to artificial intelligence (AI) and the automotive industry is expected to boost silver consumption in many segments, partly offsetting the decline from photovoltaic demand" - the report stated.

Demand for silver for jewelry - another important pillar of the market - is forecast to decrease by more than 9% in 2026, to 178 Moz, the lowest level since 2020.

Similar to 2025, record silver prices are expected to hinder consumption in most key markets, of which India is most clearly affected. China is an exception, as demand is expected to increase slightly, thanks to product innovation and the trend of favoring gold-plated silver jewelry" - Silver Institute said.

Although some segments recorded weakness, global silver demand is still forecast to exceed supply.

The Silver Institute said that total silver supply in 2026 is expected to increase by 1.5%, to a decade high, reaching 1.05 billion ounces.

Overall, the global silver market is forecast to continue to be in deficit in 2026. - for the sixth consecutive year - with a remarkable 67 Moz.

The Silver Institute's annual Silver Survey, conducted by Metals Focus, will be released next April.

Update on domestic silver prices

As of 4:25 PM on February 11, the price of 1 tael silver bars at Ancarat Jewelry Company is listed at 3.108 - 3.204 million VND/tael (buying - selling).

The price of 1kg silver ingot Ngan Long Quang Tien 999 at Ancarat Jewelry Company is listed at 82.880 - 85.440 million VND/kg (buying - selling); an increase of 96,000 VND/kg on the buying side and an increase of 106,000 VND/kg on the selling side compared to yesterday morning.

The price of Kim Phuc Loc 999 silver bars (1 tael) of Saigon Thuong Tin Commercial Joint Stock Company Limited (Sacombank-SBJ) is listed at the threshold of 3.399 - 3.507 million VND/tael (buying - selling).

At the same time, the price of 999 silver bars (1 tael) at Phu Quy Jewelry Group was listed at 3.118 - 3.214 million VND/tael (buying - selling).

The price of 999 silver ingots (1kg) at Phu Quy Jewelry Group is listed at 83.146-85.706 million VND/kg (buying - selling).