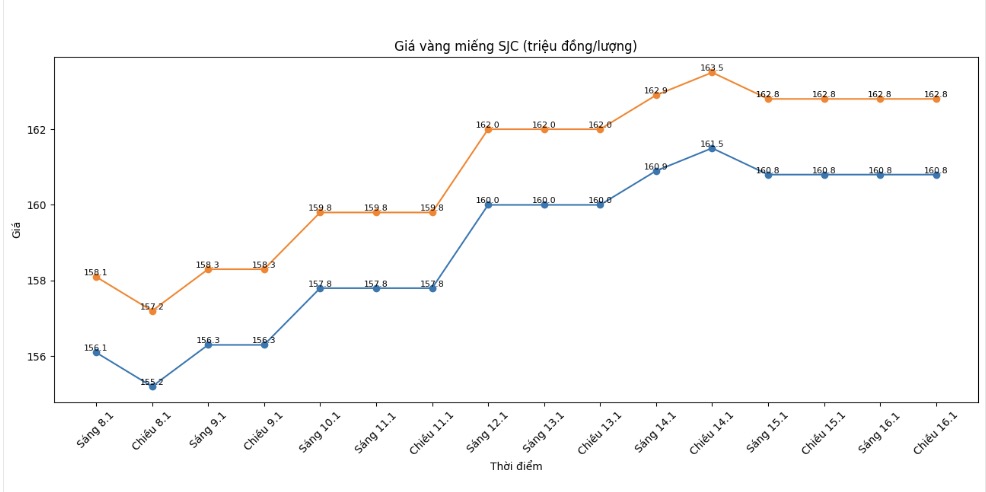

SJC gold bar price

As of 6:00 AM, SJC gold bar prices were listed by DOJI Group at the threshold of 160.8-162.8 million VND/tael (buying - selling), unchanged in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price is listed by Bao Tin Minh Chau at the threshold of 160.8-162.8 million VND/tael (buying - selling), unchanged in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed SJC gold bar prices at 160-162.8 million VND/tael (buying - selling), going sideways in both directions. The buying - selling price difference is at 2.8 million VND/tael.

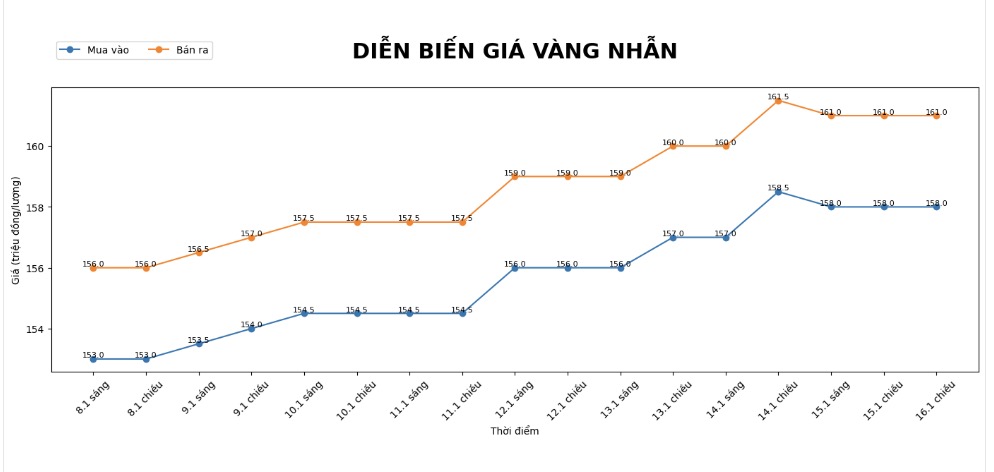

9999 gold ring price

As of 6:00 AM, DOJI Group listed the price of gold rings at the threshold of 158-161 million VND/tael (buying - selling), going sideways in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 1598.8-162.8 million VND/tael (buying - selling), going sideways in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at the threshold of 158-161 million VND/tael (buying - selling), unchanged in both directions. The buying - selling difference is at 3 million VND/tael.

Currently, the buying - selling price difference of gold rings is at a very high level, around 3 million VND/tael, posing a risk of losses for investors.

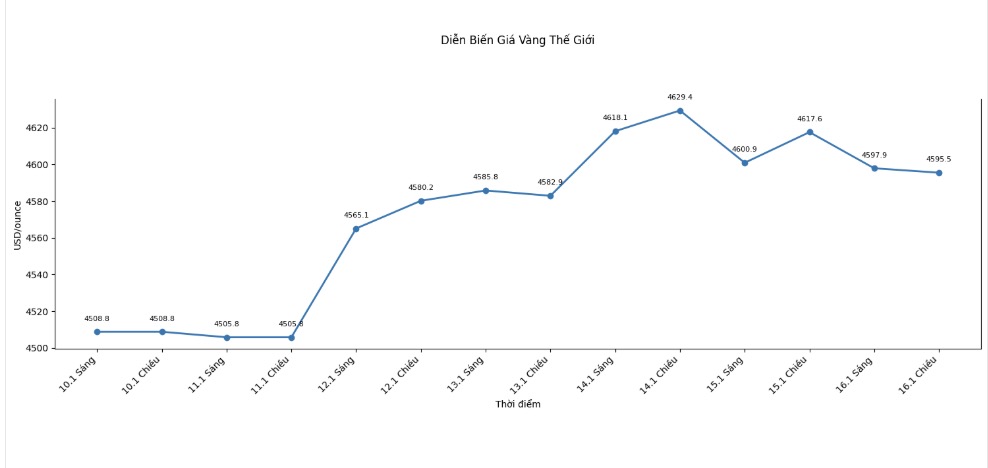

World gold price

At 6:00 AM, world gold prices were listed around the threshold of 4,596 USD/ounce, without much change compared to the previous day.

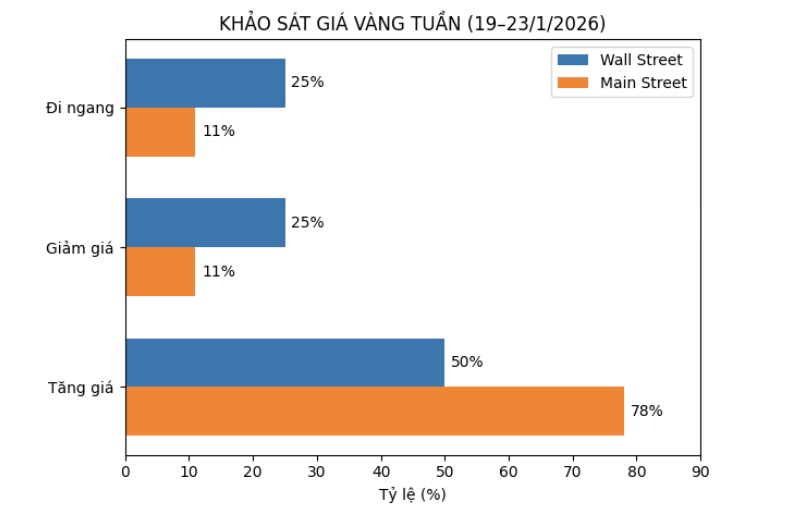

Gold price forecast

The latest weekly gold survey with Wall Street experts shows that analysts are having mixed views on the short-term outlook for gold prices, while individual investors continue to consolidate the optimistic trend.

This week, 16 experts participated in the gold survey. Among them, only half of Wall Street maintained a positive view of the short-term outlook for gold prices.

Accordingly, 8 experts, equivalent to 50%, predict that gold prices will continue to rise next week; 4 others, accounting for 25%, believe that gold prices will decrease. The remaining 4 analysts (25%) predict that this precious metal will continue to move sideways and accumulate next week.

Meanwhile, Kitco's online poll recorded a total of 247 votes, with the optimism of individual investors increasing after gold prices set new peaks. There are 192 small investors, equivalent to 78%, expecting gold prices to continue to rise next week.

Meanwhile, 27 people (11%) predicted gold prices would weaken. The remaining 28 investors, accounting for 11% of the total, believe that gold prices will remain unchanged in the near future.

According to analysts, the temporary "shutdown" of gold around the 4,550 - 4,600 USD/ounce range is not a negative sign, but reflects the need for rebalancing after a prolonged hot streak from the second half of 2025.

Mr. Neil Welsh - Head of Metals at Britannia Global Markets, said that the fact that prices are maintained at a high level today is more an accumulation than a weakening. “This is not a market without momentum, but a healthy correction phase to prepare for the next upward cycle” - he commented.

From a technical perspective, some indicators show that the risk of short-term correction is still present when the overbought state has not been completely resolved.

FXTM expert Lukman Otunuga warned that if gold prices fall sustainably below the $4,570/ounce mark, the market may witness a deeper correction to around $4,500 before buying power returns. However, he emphasized that the long-term trend of gold is still strengthened by buying demand from central banks and global economic instability that has not been thoroughly resolved.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...